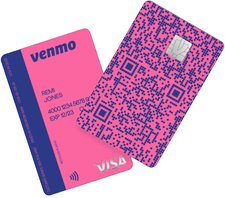

Venmo Credit Card

Venmo Credit Card

Venmo Credit Card

Card details

Earn up to 3% cash back on your top spend category, 2% on the next, and 1% on the rest.

No annual fee.

Your card comes with your own unique QR code on the front, so it’s a snap to Venmo friends. When they scan your code, up pops your Venmo profile to pay or get paid.

Keep tabs on card activity in the app, right with all your Venmo spending.

Use the Venmo app to disable a lost or stolen physical card.

Rates, fees & offers

Annual fee

$0

Rewards rate

1%-3%

Bonus offer

None

Intro APR

N/A

Ongoing APR

APR: 15.24%-24.24%, Variable

Cash Advance APR: 24.24%, Variable

Foreign transaction fee

None

Recommended credit score

Compare to other cards

| Learn more | Learn more | Learn more |

Annual fee$0 | Annual fee$99 | Annual fee$199 |

Regular APR15.24%-24.24% Variable APR | Regular APRSee Terms | |

Intro APRN/A | Intro APR0% intro APR for 15 months on balance transfers made within 45 days of account opening. After that, a variable APR will apply, 21.24%-29.99%. | Intro APRN/A |

Recommended Credit Score |

Recommended Credit Score |

Recommended Credit Score |

NerdWallet review

By Sara Rathner

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Rating details

3.4

Editor's overall rating

Pros and cons

Pros

No annual fee

Bonus categories

Cons

No 0% intro APR

Requires good/excellent credit

The Venmo Credit Card breaks away from one-size-fits-all rewards cards, offering extra cash back where you spend the most each month with no need to strategize. Just use the card as you normally would to make purchases, and you’ll automatically earn a higher cash-back rate on your top two spending categories.

The Venmo Credit Card stays true to Venmo’s roots as an app that makes it easy to split costs between friends. The card’s design features a QR code others can scan with their phones, so when you front the cost of dinner out with your card, you won’t need to chase anyone down to get paid back.

The card does have some limitations. There’s no sign-up bonus and extra cash-back earnings are capped after the first year. Still, this card could be compelling if you already use Venmo and you’re seeking a straightforward way to earn and redeem rewards.