Earn Cash Back, Pay Down Debt, or Rake In the Miles — These Nerd-Approved Cards Have Something for Everyone

From huge sign-up bonuses to generous rewards, we've picked credit cards that stand out from the crowd. Compare these deals, some of which are from our partners, to find the right one for you.

Show summary

NerdWallet's Earn Cash Back, Pay Down Debt, or Rake In the Miles — These Nerd-Approved Cards Have Something for Everyone

Chase Freedom Unlimited®: Best for Cash-Back Pairing with Chase Sapphire Preferred®

Capital One SavorOne Cash Rewards Credit Card: Best for Dining and Groceries + No Annual Fee

Chase Sapphire Preferred® Card: Best for Airline Miles and a Large Bonus

Discover it® Cash Back: Best for High Rewards Rate in Rotating Categories and First Year Cashback Match

Wells Fargo Active Cash® Card: Best for Cash Back — High Flat Rate + Incentives

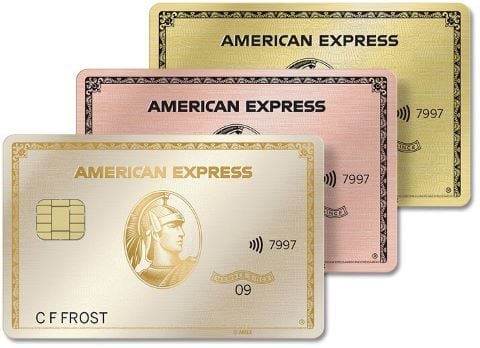

American Express® Gold Card: Best for Big Rewards on Everyday Spending

Earn Cash Back, Pay Down Debt, or Rake In the Miles — These Nerd-Approved Cards Have Something for Everyone From Our Partners

Credit card | NerdWallet rating | Annual fee | Rewards rate | Intro offer | Learn more |

|---|---|---|---|---|---|

| Excellent for Cash-Back Pairing with Chase Sapphire Preferred® | $0 | 1.5%-5% | Up to $300 | Apply Now on Chase's website on Chase's website | |

Capital One SavorOne Cash Rewards Credit Card Apply Now on Capital One's website on Capital One's website | Excellent for Dining and Groceries + No Annual Fee | $0 | 1%-10% | $200 | Apply Now on Capital One's website on Capital One's website |

| Excellent for Airline Miles and a Large Bonus | $95 | 1x-5x | 60,000 | Apply Now on Chase's website on Chase's website | |

| Excellent for High Rewards Rate in Rotating Categories and First Year Cashback Match | $0 | 1%-5% | Cashback Match™ | Apply Now on Discover's website, on Discover's website, or call 800-347-0264 | |

| Excellent for Cash Back — High Flat Rate + Incentives | $0 | 2% | $200 | Apply Now on Wells Fargo's website on Wells Fargo's website | |

| Excellent for Big Rewards on Everyday Spending | $325 | 1x-4x | 60,000 | Apply Now on American Express' website on American Express' website |

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

Cash back on travel purchased through Chase Travel℠.

Cash back on drugstore purchases.

Cash back on dining at restaurants, including takeout and eligible delivery services.

Cash back on all other purchases.

1.5%-5%

$0

Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

1.5%-5%

$0

- INTRO OFFER: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year) - worth up to $300 cash back!

- Enjoy 6.5% cash back on travel purchased through Chase Travel℠, our premier rewards program that lets you redeem rewards for cash back, travel, gift cards and more; 4.5% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and 3% on all other purchases (on up to $20,000 spent in the first year).

- After your first year or $20,000 spent, enjoy 5% cash back on travel purchased through Chase Travel℠, 3% cash back on drugstore purchases and dining at restaurants, including takeout and eligible delivery service, and unlimited 1.5% cash back on all other purchases.

- No minimum to redeem for cash back. You can choose to receive a statement credit or direct deposit into most U.S. checking and savings accounts. Cash Back rewards do not expire as long as your account is open!

- Enjoy 0% Intro APR for 15 months from account opening on purchases and balance transfers, then a variable APR of 20.49% - 29.24%.

- No annual fee – You won't have to pay an annual fee for all the great features that come with your Freedom Unlimited® card

- Keep tabs on your credit health, Chase Credit Journey helps you monitor your credit with free access to your latest score, alerts, and more.

- Member FDIC

- No annual fee

- Intro APR period

- High rewards rate

- No minimum redemption amount

- Requires good/excellent credit

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

Cash back on purchases made through Uber & Uber Eats.

Cash back on Capital One Entertainment purchases.

Cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options.

Cash back on dining.

Cash back on entertainment.

Cash back on popular streaming services.

Cash back at grocery stores (excluding superstores like Walmart® and Target®).

Cash back on all other purchases.

1%-10%

$0

Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening.

1%-10%

$0

- Earn a one-time $200 cash bonus after you spend $500 on purchases within the first 3 months from account opening

- Earn unlimited 3% cash back on dining, entertainment, popular streaming services and at grocery stores (excluding superstores like Walmart® and Target®), plus 1% on all other purchases

- Earn 10% cash back on purchases made through Uber & Uber Eats, plus complimentary Uber One membership statement credits through 11/14/2024

- Earn 8% cash back on Capital One Entertainment purchases

- Earn unlimited 5% cash back on hotels and rental cars booked through Capital One Travel, where you'll get Capital One's best prices on thousands of trip options. Terms apply

- No rotating categories or sign-ups needed to earn cash rewards; plus cash back won't expire for the life of the account and there's no limit to how much you can earn

- 0% intro APR on purchases and balance transfers for 15 months; 19.99% - 29.99% variable APR after that; balance transfer fee applies

- No foreign transaction fee

- No annual fee

- View Rates & Fees

- No annual fee

- Intro APR period

- Bonus categories

- No foreign transaction fees

- Requires good/excellent credit

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

Points on travel purchased through Chase Travel℠.

Points on dining.

Points on select streaming services.

Points on online groceries.

Points on all other travel purchases.

Point on all other purchases.

1x-5x

$95

Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

1x-5x

$95

- Earn 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. That's $750 when you redeem through Chase Travel℠.

- Enjoy benefits such as 5x on travel purchased through Chase Travel℠, 3x on dining, select streaming services and online groceries, 2x on all other travel purchases, 1x on all other purchases, $50 Annual Chase Travel Hotel Credit, plus more.

- Get 25% more value when you redeem for airfare, hotels, car rentals and cruises through Chase Travel℠. For example, 60,000 points are worth $750 toward travel.

- Count on Trip Cancellation/Interruption Insurance, Auto Rental Collision Damage Waiver, Lost Luggage Insurance and more.

- Get complimentary access to DashPass which unlocks $0 delivery fees and lower service fees for a minimum of one year when you activate by December 31, 2024.

- Member FDIC

- New cardholder bonus offer

- Bonus categories

- Primary rental car coverage

- Flexible rewards redemption

- Transfer partners

- Has annual fee

- Requires good/excellent credit

- Complicated rewards

INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

Cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate.

Cash back on all other purchases.

1%-5%

$0

INTRO OFFER: Unlimited Cashback Match for all new cardmembers – only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

1%-5%

$0

- INTRO OFFER: Unlimited Cashback Match for all new cardmembers–only from Discover. Discover will automatically match all the cash back you’ve earned at the end of your first year! There’s no minimum spending or maximum rewards. You could turn $150 cash back into $300.

- Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases—automatically.

- Redeem your rewards for cash at any time.

- Discover could help you reduce exposure of your personal information online by helping you remove it from select people-search sites that could sell your data. It’s free, activate with the mobile app.

- Get a 0% intro APR for 15 months on purchases. Then 18.24% to 28.24% Standard Variable Purchase APR applies, based on credit worthiness.

- No annual fee.

- Terms and conditions apply.

- View Rates & Fees

- No annual fee

- Intro APR period

- Bonus categories

- Cash rewards

- Complicated rewards

- Spending caps on bonus rewards

- Lower acceptance abroad

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

Unlimited Cash rewards on purchases.

2%

$0

Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

2%

$0

- Select “Apply Now” to take advantage of this specific offer and learn more about product features, terms and conditions.

- Earn a $200 cash rewards bonus after spending $500 in purchases in the first 3 months.

- Earn unlimited 2% cash rewards on purchases.

- 0% intro APR for 15 months from account opening on purchases and qualifying balance transfers. 20.24%, 25.24%, or 29.99% Variable APR thereafter; balance transfers made within 120 days qualify for the intro rate and fee of 3% then a BT fee of up to 5%, min: $5.

- $0 annual fee.

- No categories to track or remember and cash rewards don’t expire as long as your account remains open.

- Find tickets to top sports and entertainment events, book travel, make dinner reservations and more with your complimentary 24/7 Visa Signature® Concierge.

- Up to $600 of cell phone protection against damage or theft. Subject to a $25 deductible.

- View Rates & Fees

- High rewards rate

- No annual fee

- Intro APR period

- No bonus categories

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24. Terms Apply.

Points when you dine at restaurants worldwide.

Points at U.S. supermarkets (on up to $25,000 per year in purchases, then 1X).

Points on flights booked directly with airlines or on amextravel.com.

Point on all other eligible purchases.

1x-4x

$325

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24. Terms Apply.

1x-4x

$325

- Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership. Plus, receive 20% back in statement credits on eligible purchases made at restaurants worldwide within the first 6 months of Card Membership, up to $100 back. Limited time offer. Offer ends 11/6/24.

- Get the American Express® Gold Card in either the Gold, Rose Gold or Limited-Edition White Gold metal design. White Gold design is only available while supplies last.

- Earn 4X Membership Rewards® points per dollar spent on purchases at restaurants worldwide, on up to $50,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 4X Membership Rewards® points per dollar spent at US supermarkets, on up to $25,000 in purchases per calendar year, then 1X points for the rest of the year.

- Earn 3X Membership Rewards® points per dollar spent on flights booked directly with airlines or on AmexTravel.com.

- Earn 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- Earn 1X Membership Rewards® point per dollar spent on all other eligible purchases.

- $120 Uber Cash on Gold: Add your Gold Card to your Uber account and each month automatically get $10 in Uber Cash for Uber Eats orders or Uber rides in the U.S., totaling up to $120 per year.

- $84 Dunkin' Credit: With the $84 Dunkin' Credit, you can earn up to $7 in monthly statement credits after you enroll and pay with the American Express® Gold Card at Dunkin' locations.

- $100 Resy Credit: Get up to $100 in statement credits each calendar year after you pay with the American Express® Gold Card to dine at U.S. Resy restaurants or make other eligible Resy purchases. That's up to $50 in statement credits semi-annually. Enrollment required.

- $120 Dining Credit: Satisfy your cravings, sweet or savory, with the $120 Dining Credit. Earn up to $10 in statement credits monthly when you pay with the American Express® Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, and Five Guys. Enrollment required.

- Explore over 1,000 upscale hotels worldwide with The Hotel Collection and receive a $100 credit to use towards eligible charges, which may include food and beverage, spa, or other on-property charges with every booking of two nights or more through AmexTravel.com. Credit use varies by property.

- No Foreign Transaction Fees.

- Annual Fee is $325.

- Terms Apply.

- View Rates & Fees

- Bonus categories

- Transfer partners

- Flexible rewards redemption

- Has annual fee

- Complicated rewards

- Requires good/excellent credit