Missed Tax Day? File as soon as possible to limit penalties. Try our fast, hassle-free tax filing. It's just $50.

Missed Tax Day? Try our fast, hassle-free tax filing. It's just $50.

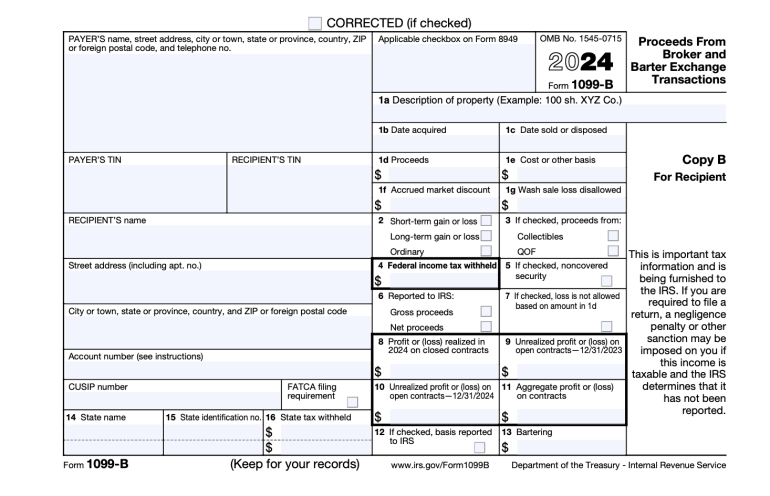

Learn moreForm 1099-B: Proceeds From Broker and Barter Exchanges

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is a 1099-B?

A 1099-B is an informational document brokers send to people who have sold securities, such as stocks or bonds, through a brokerage during the year. It outlines which securities were sold and categorizes them based on tax type to help investors make sense of their capital gains or losses.

Tax filers need to reference their 1099-B forms when filling out their tax returns and other forms investors typically need to deal with at tax time, such as Schedule D and Form 8949.

A 1099-B reports on transactions made in non-retirement brokerage accounts. It doesn’t report on or include information about any investments held in a 401(k), an IRA or other retirement savings vehicles.

» Dive deeper: How taxes on different types of investments work

Who receives a 1099-B?

If you sold any of the following throughout the tax year through a broker or brokerage, you can expect a 1099-B in your inbox or in the mail:

Stocks.

Bonds and other debt instruments.

Short sales.

Commodities.

Regulated futures contracts.

Foreign currency contracts.

Forward contracts.

Options.

Securities futures contracts for cash.

Other instances that could result in a 1099-B landing on your doorstep:

You participated in bartering or a barter exchange network, where you traded your services or products for value instead of cash. A simplified example is exchanging your services as a freelance photographer in return for construction services completed on your home. The IRS considers the value of the trade as earned income that is reportable and taxable.

You received cash, stock or another type of property from a corporation that your broker knows or “has reason to know.” This can be a little complicated, but the instructions for Form 1099-B have more details.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

How a 1099-B form works

A 1099-B lists your investment sales activity and what type of transactions they were tax-wise. It also typically notes:

When you acquired a security and how much you paid for it.

When you sold the security and for how much.

Whether the brokerage withheld any state or federal taxes on your behalf.

All of this information is intended to help you determine your net capital gain (profit) or loss from your transactions, which will help you figure out how your investments will be taxed.

Generally, here's how that works:

Capital gains: When you sell a security for more than you originally paid for it, you may have to pay either long-term or short-term capital gains tax on your profit. Which tax rate applies to your sale depends on how long you held the asset before deciding to sell.

Capital losses: If you sell something for less than it was worth when you purchased it, that’s called a capital loss. Because the IRS taxes you on your net capital gains (your total gains minus your total losses), capital losses can potentially help to reduce your capital gains and even ordinary income.

Keep in mind that even though your investment gains are taxable income, many things, such as tax credits and deductions, can offset or influence your final tax bill.

» Ready to crunch the numbers? Try our capital gains tax calculator.

What if there’s more information on my 1099-B?

If you do a lot of business with a brokerage, you may receive what’s called a composite substitute 1099. When this happens, your brokerage has rolled a bunch of different 1099s into one document rather than sending them out individually. Depending on what income you generate through the brokerage, you may see information about your dividends (1099-DIV), interest (1099-INT), stock sales (1099-B), or even miscellaneous payments (1099-MISC) on a single form.

There are many types of 1099 forms. The easiest way to tell them apart is to look at the abbreviations that follow the “1099” — they are typically shorthand for the type of taxable income. A 1099-INT, for example, summarizes any taxable interest you earned throughout the year from a source like a high-yield savings account. A 1099-DIV summarizes your taxable dividend income.

When will I get a 1099-B form?

Brokers are required to send a 1099-B and composite 1099s by February 15. Depending on the type of investing you do, some 1099-Bs could also need to be corrected by the broker after February 15, so keep that in mind when filing your return.

If you file with incomplete or incorrect information, you may need to file an amended return later. You can also opt to request a tax extension using Form 4868 if you think you’ll need more time to get the correct information, but keep in mind your tax payment is still due on the regular filing deadline in mid-April.

» Need to call in a professional? How to find a CPA near you

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account