What Is Form 1099-DIV for Dividends and Distributions?

Form 1099-DIV is an IRS tax document that reports dividend income. Here's what it means and what to do with it.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you were paid dividends during the year, you might receive a form 1099-DIV (or more than one) sometime in February. You need to hang on to it because it can have a big impact on your tax life.

NerdWallet Wealth Partners can create a personalized plan that evolves with you, from this tax season to the next chapter. Start by answering a few questions.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

What is a 1099-DIV form?

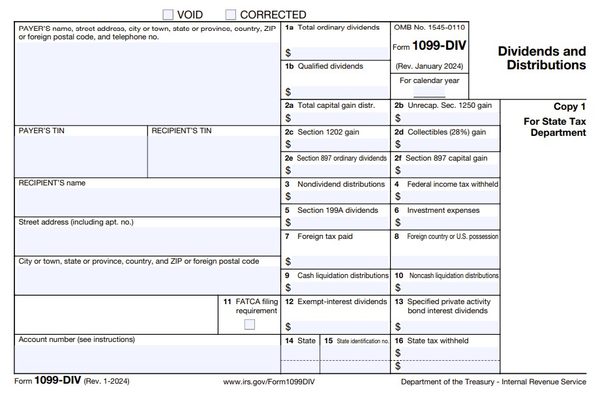

A Form 1099-DIV is a record that a company or person who is not your employer paid you at least $10 in dividends.

You might receive a 1099-DIV tax form from your brokerage firm because you earned dividends on your investments.

The sender also provides a copy to the IRS and the state. A Form 1099-DIV will have your Social Security number or taxpayer identification number on it, which means the IRS will know you’ve received dividends — and it will know if you don’t report that income on your tax return.

Dividends are taxable income, but simply receiving a 1099-DIV tax form doesn’t necessarily mean you owe taxes on that money. You might have deductions that offset the income, for example, or some or all of it might be sheltered based on characteristics of the asset that generated it.

1099-DIV

What do I do with a 1099-DIV form?

You use your Form 1099-DIV to prepare your tax return. It helps you figure out how much income you received during the year. You’ll report that income in different places on your tax return, depending on what kind of income it was.

If you need help estimating how dividend income on a Form 1099-DIV could affect your tax bill, check out our free tax calculator.

What does my 1099 tax form mean for my tax situation?

If you received a Form 1099-DIV from a brokerage firm or other entity because you have investments or accounts that earned dividends, you might also get a few other 1099 tax forms in the mail.

1099-INT

If you earned $10 or more in interest from a bank, brokerage or other financial institution, you might receive a 1099-INT.

1099-OID

You might receive Form 1099-OID if you bought bonds, notes or other financial instruments at a discount to the face value or redemption value at maturity. Typically, the instrument must have a maturity of more than one year.

1099-PATR

If you belong to a co-op and received at least $10 in patronage dividends, expect to see Form 1099-PATR in your mailbox.

1099-R

If you got distributions from a pension, retirement plan, profit-sharing program, an IRA or an annuity, you might receive a 1099-R. (Remember, many retirement plans are tax-advantaged, so this form might be simple record-keeping on behalf of the IRS.) If you took a loan from your retirement plan, you might have to treat it as a distribution, which means it might be on this form, too, as well as permanent and total disability payments under life insurance contracts.

1099-CAP

You might receive a 1099-CAP if you hold shares of a corporation that was acquired or underwent a big change in capital structure and you got cash, stock or other property as a result.

The more you earn, the more complex your taxes become. Learn the 10 traps to dodge.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.