What Is Adjusted Gross Income (AGI)? Definition, How to Calculate

Adjusted gross income is your gross income minus certain payments you’ve made during the year.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Key takeaways

Your AGI plays a role in calculating your taxable income.

To calculate your AGI, you reduce your gross income by subtracting certain qualified payments, such as student loan interest.

Adjusted gross income can help to determine your eligibility for certain tax credits.

Adjusted gross income (AGI) is a term you're likely to come across when working with tax documents or when filing your annual tax return. It refers generally to your annual gross income after certain adjustments, such as retirement plan contributions, have been subtracted from it.

Outside of the tax world, adjusted gross income can be used by government agencies, banks, and even private companies to check if someone meets the criteria for a certain program, benefit, or application. For example, certain income-driven student loan repayment programs may use AGI to help determine if someone qualifies.

Here's a quick guide to what adjusted gross income means, how it's calculated, and why knowing yours is important.

on Priority Tax Relief's website

on Alleviate Tax's website

What is adjusted gross income?

Adjusted gross income is a number that the IRS uses as a basis to help calculate how much you owe in taxes. The IRS defines AGI as gross income, minus adjustments to that income.

You can determine your AGI by calculating your annual income from wages and other income sources (gross income), then subtracting certain types of payments, such as student loan interest, alimony, retirement contributions, or health savings account contributions, you've made during the year.

Once you have your adjusted gross income, you can use that number to determine your taxable income by taking either the standard deduction or itemizing to further reduce your liability. Your AGI can also help you figure out which tax credits might be able to save you money.

How to calculate adjusted gross income

Put simply, your adjusted gross income = gross income - certain qualified payments. To determine your gross income and see which payments should be subtracted to find your AGI, follow these two steps.

Step 1: Determine your gross income

In general, the formula for calculating AGI starts with determining your gross income. Gross income includes money earned from most sources:

Jobs.

Investments.

Social Security.

Retirement income.

Pensions.

Businesses.

Real estate.

Farms.

Unemployment.

Step 2: Subtract certain qualified payments

You can then subtract the following from your gross income:

Educator expenses (books, supplies, equipment).

Certain business expenses.

Deductible HSA contributions.

Moving expenses for military members.

Deductible self-employment taxes.

Contributions to retirement plans (e.g., SEP, SIMPLE) or health insurance for self-employed people.

Penalties on early withdrawals of savings.

Alimony paid.

Deductible IRA contributions.

Student loan interest.

If you file taxes online, your software will calculate your AGI. If you use a tax pro, they will calculate your AGI as they prepare your tax return.

» Ready to file? See NerdWallet's picks for the best tax software

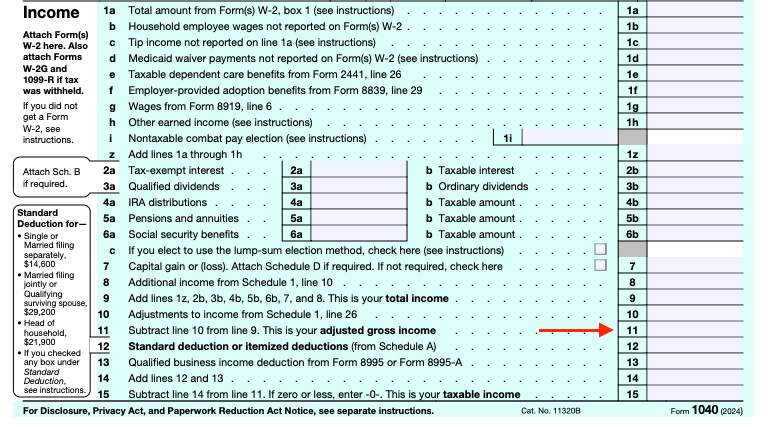

Where to find your AGI on your 1040

You can find your adjusted gross income right on line 11 of your tax return, also known as the IRS Form 1040.

» Need to back up? How federal income tax returns work

The significance of adjusted gross income

Your AGI is often the starting point for calculating your tax bill. From there, you’ll make various adjustments and subtract your allowable deductions to find the amount on which you’ll pay tax: That's your taxable income. You’ll see the term “adjusted gross income (AGI)” repeated throughout your tax forms.

AGI is also the basis on which you might qualify for many deductions and credits. For example, you may be able to deduct unreimbursed medical expenses, but only when they're more than 7.5% of your AGI. So the lower your AGI, the greater the deduction. The earned income tax credit, a refundable tax break for certain low-income people, also uses earned income and AGI to determine eligibility.

Your state tax return might also use your federal AGI as a starting point for calculating your state tax.

on Priority Tax Relief's website

on Alleviate Tax's website

What is your modified adjusted gross income (MAGI)?

If you’re filing Form 1040 and itemizing so that you can take certain deductions, you may have to calculate your modified adjusted gross income (MAGI). Your MAGI may also be a baseline for the phaseout level of some credits and tax-saving strategies, including:

Determining whether you qualify for tax breaks.

Determining whether you can contribute to a Roth IRA or deduct traditional IRA contributions.

According to the IRS, for most taxpayers, modified adjusted gross income is simply adjusted gross income before subtracting deductible student loan interest, but the formula for MAGI can depend on the type of tax benefit it applies to. For example, calculating MAGI can also include adding back in the deduction for half of the self-employment tax paid or any non-taxable Social Security benefits.

» Dive deeper: How to calculate modified adjusted gross income

ON THIS PAGE

ON THIS PAGE