Missed Tax Day? File as soon as possible to limit penalties. Try our fast, hassle-free tax filing. It's just $50.

Missed Tax Day? Try our fast, hassle-free tax filing. It's just $50.

Learn more2024 Tax Brackets and Federal Income Tax Rates

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

In 2023 and 2024, there are seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Taxable income and filing status determine which federal tax rates apply to you and how much in taxes you'll owe that year.

Federal tax rates will remain the same until 2025 as a result of the Tax Cuts and Jobs Act of 2017. However, the IRS can adjust income thresholds for tax brackets each year to reflect inflation.

» Ready to crunch the numbers? Estimate your refund or bill with NerdWallet's tax calculator

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

2024 tax brackets and income tax rates

There are seven income tax rates for the 2024 tax year, ranging from 10% to 37%. The 2024 tax brackets apply to income earned this year, which is reported on tax returns filed in 2025.

Tax brackets 2024 (taxes due April 2025)

Tax rate | Single | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

10% | $0 to $11,600 | $0 to $23,200 | $0 to $11,600 | $0 to $16,550 |

12% | $11,601 to $47,150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

37% | $609,351 or more | $731,201 or more | $365,601 or more | $609,350 or more |

2023 tax brackets and income tax rates

The tax tables below show the rates and brackets that apply to income earned in 2023. Tax returns for 2023 were due on April 15, 2024, for most filers. If you secured an extension by tax day, your new federal filing deadline is Oct. 15, 2024, but if you have a tax bill, that should be paid as soon as possible to reduce penalties and interest.

Tax brackets 2023

Tax rate | Single | Married filing jointly | Married filing separately | Head of household |

|---|---|---|---|---|

10% | $0 to $11,000 | $0 to $22,000 | $0 to $11,000 | $0 to $15,700 |

12% | $11,001 to $44,725 | $22,001 to $89,450 | $11,001 to $44,725 | $15,701 to $59,850 |

22% | $44,726 to $95,375 | $89,451 to $190,750 | $44,726 to $95,375 | $59,851 to $95,350 |

24% | $95,376 to $182,100 | $190,751 to $364,200 | $95,376 to $182,100 | $95,351 to $182,100 |

32% | $182,101 to $231,250 | $364,201 to $462,500 | $182,101 to $231,250 | $182,101 to $231,250 |

35% | $231,251 to $578,125 | $462,501 to $693,750 | $231,251 to $346,875 | $231,251 to $578,100 |

37% | $578,126 or more | $693,751 or more | $346,876 or more | $578,101 or more |

» Learn more: How to track the status of your refund

How tax brackets and tax rates work

1. What are income tax brackets?

The U.S. has a progressive tax system, which means that people with higher incomes are subject to higher federal tax rates, and people with lower incomes are subject to lower income tax rates.

The government decides how much tax you owe by dividing your taxable income into chunks — also known as tax brackets — and each individual chunk gets taxed at a corresponding tax rate. Tax rates can range from 10% to 37%.

The beauty of tax brackets is that no matter which bracket(s) you’re in, you generally won’t pay that tax rate on your entire income. The highest tax rate you pay — the marginal rate — applies to only a portion of your income.

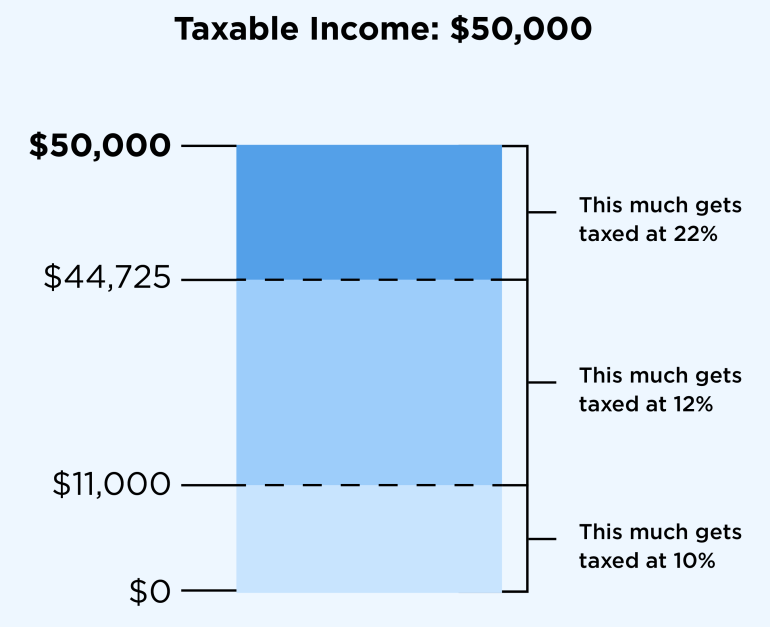

Federal tax brackets example: If you had $50,000 of taxable income in 2023 as a single filer, you’d pay 10% on that first $11,000 and 12% on the chunk of income between $11,001 and $44,725. Then you’d pay 22% on the rest because some of your $50,000 of taxable income falls into the 22% tax bracket. The total bill would be about $6,300 — about 13% of your taxable income — even though your highest bracket is 22%. That 13% is your effective tax rate.

2. How do tax brackets and rates work on the state level?

States may handle taxes differently than the federal government. Your state might have different brackets, or it might altogether use a different system. Colorado, for example, has a flat tax rate of 4.4% on taxable income, and some states, such as Wyoming, don't have a state income tax.

3. Are income tax brackets adjusted?

Each year, all the federal income tax brackets — the window of income where a certain tax rate ends and begins — are updated to reflect the current rate of inflation. These tweaks, formally known as inflation adjustments, are a critical part of the tax code.

Bracket adjustments can help prevent taxpayers from ending up in a higher tax bracket as their cost of living rises, a scenario called “bracket creep." They can also lower taxes for those whose compensation has not kept up with inflation.

Tax inflation adjustment example

In 2023, a single filer making $45,000 of taxable income pays a 10% tax rate on $11,000 of their earnings, a 12% tax rate on the portion of the earnings between $11,001 and $44,725, and a 22% tax rate on the remaining $275 that falls into that final tax bracket.

Assuming this taxpayer's income does not change in 2024, they will now pay 10% on earnings up to $11,600 and 12% on the rest. In other words, they will no longer pay 22% on any part of their income. This is because the upper end of the 12% tax bracket has been updated from $44,725 to $47,150, which allows this taxpayer to shelter more of their income from a higher tax rate.

What is a marginal tax rate?

The marginal tax rate is the tax rate paid on the last dollar of taxable income. It typically equates to your highest tax bracket.

For example, if you're a single filer in 2023 with $35,000 of taxable income, portions of your income would be taxed at 10% and 12%. If your taxable income went up by $1, you would pay 12% on that extra dollar, too.

What is an effective tax rate?

Your effective tax rate is the percentage of your taxable income that you pay in taxes. To determine your effective tax rate, divide your total tax owed (line 24) on Form 1040 by your total taxable income (line 15).

How to reduce taxes owed

Two common ways of reducing your tax bill are credits and deductions.

Tax credits can reduce your tax bill on a dollar-for-dollar basis; they don't affect what bracket you're in.

Tax deductions, on the other hand, reduce how much of your income is subject to taxes. Generally, deductions lower your taxable income by the percentage of your highest federal income tax bracket. So, if you fall into the 22% tax bracket, a $1,000 deduction could save you $220.

In other words, take all the tax deductions you can claim. Deductions can reduce your taxable income and could kick you to a lower bracket, which means you pay a lower tax rate.

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Tax tools

More tax articles