Yes, as a property owner, you have the right to live in your investment property. However, transitioning from renting it out to living in it can be complex. Depending on your loan terms and other factors, you’ll likely need to notify both your lender and the Australian Taxation Office (ATO).

While investing in property helps build wealth through capital gains and rental income, changes in your personal or financial situation may lead you to move into the property instead. Here’s what you need to know before making that decision.

Converting your investment property to a primary residence

Converting your investment property into a primary residence means living in the property you once rented out, rather than generating rental income. Several factors may lead a property investor to consider this option, such as:

- Rising interest rates: If interest rates rise, repayments may surpass rental income, making it more financially sensible to live in your property instead of renting it out.

- Tenant vacancy: In certain markets, finding tenants for your rental property can be difficult. This could lead to periods without income, while you continue to pay for agency fees and advertising costs.

- Lifestyle: Your investment property may now be in a location that better aligns with new personal priorities. For example, it could be closer to work, family and the beach, offering a more convenient lifestyle.

- Financial goals: If you have already paid off your mortgage through rental income, you may now wish to move into an investment property you own outright, further reducing your ongoing expenses.

How to do it

Before moving into your investment property, consider the rights of the current tenants. Each state and territory has legislation that protects renters and landlords. As the owner, you have the legal right to move into your property, but you must give the tenants adequate notice. The amount of notice you need to give depends on your state or territory and the type of lease agreement. In Victoria, for example, if you are moving in, you need to give the tenants 60 days notice.

You also need to notify the ATO of the change as you will no longer be generating income from the property. You may also be eligible for a partial CGT exemption, where you have previously rented out the property, but subsequently move in and use it as your principal place of residence. Whether the exemption applies or not will depend on your individual circumstances.

What to consider first

Unfortunately, moving into your investment property means losing rental income. Additionally, you will no longer be able to claim tax deductions on related expenses, such as property management or maintenance costs. So, it is important to be transparent with the ATO. Consider speaking to a tax professional to ensure you are following the correct procedure.

Benefits

- A partial CGT exemption may apply.

- Savings on property management, maintenance, and advertising costs.

- An opportunity to improve the property through renovations.

Risks

- There may be a gap between tenants leaving and you moving in.

- You may be at risk of not being able to afford your repayments without the help of rental income, especially if interest rates rise.

- Your property could decrease in value while you live in it.

Switching your investment loan to owner occupied

In addition to notifying the ATO about the change in your primary residence, you’ll need to inform your lender, as your investment mortgage will likely need to be switched to an owner-occupied loan, which may involve refinancing.

The change to your loan type is because loan approval is based on your circumstances at the time of application. One factor is whether you plan to live in the property, as the interest rate your lender charges depends on whether you are an investor or an owner-occupier.

Moving into your investment property makes you an owner-occupier, potentially changing the nature of your loan and the interest rate you pay.

How to change your loan

The refinancing process varies by lender, so it’s best to speak with a lending professional from your bank or financial institution to understand your options. Generally, you will need to provide proof that you are indeed living in the property, such as an updated postal address.

Be sure to contact your lender as soon as possible to avoid delays in refinancing. Failing to disclose this change to your lender could expose you to legal risks, including occupancy fraud or mortgage fraud, as laws ensure borrowers do not mislead credit providers.

What to consider first

Transparency with your lender is crucial. Moving into your investment property is likely to benefit you financially, as owner-occupied loans generally have lower interest rates than investor loans due to their lower risk.

Benefits

- Lower interest rate.

- Potential to get ahead on your mortgage through features like offset or redraw.

- Potential to renovate using equity.

Risks

- Rising interest rates could see you fall behind on repayments with no tenants providing a second income.

- Losing money on untapped rent while switching to a new loan.

Other options for when your investment property isn’t making money

If you are not turning a profit from your investment property, there are other options available, such as:

- Renting out a room or a portion of your property to generate extra income while maintaining ownership

- Exploring tax-deducting strategies, such as negatively gearing.

- Selling the property.

DIVE EVEN DEEPER

Qantas American Express Ultimate Card: 2025 Overview

The Qantas American Express Ultimate Card is a premium tier credit card that earns Qantas Points.

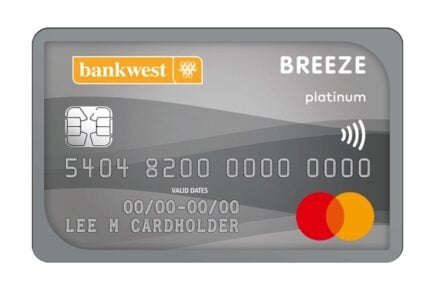

Bankwest Breeze Platinum Mastercard: 2025 Overview

The Bankwest Breeze Platinum Mastercard comes with 0% interest on balance transfers for 24 months (transfer fee applies), complimentary travel insurance and no foreign transaction fees.

What to Look for at a Rental Inspection: Checklist for Tenants

About to sign a lease? Make sure the place is right for you with this simple rental inspection checklist.

Westpac Lite Card: 2025 Overview

The Westpac Lite Card offers a lower-than-average interest rate, according to NerdWallet’s analysis, but costs $108 per year.