What Is a Credit Score and Why Is It Important?

A credit score is a number between 300 and 850 that is calculated using information from your credit reports. Your credit score is used by lenders to determine the kinds of financial products and rates you are eligible for.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Your credit score is more than just a number — it’s a snapshot of your creditworthiness that lenders use to make decisions. Because of its impact, it’s important to know your score and understand how your financial choices can influence it.

Credit score definition

Your credit score, a number between 300 and 850, is calculated using information from your credit reports. Lenders use it to judge how likely you are to repay money you borrow, which affects the financial products available to you.

Higher credit scores can open the door to more financial products that often have better rates and terms. Lower scores, on the other hand, can make it harder to qualify for things like credit cards and loans. Fewer choices often leads to higher borrowing costs, like higher interest rates.

Your credit score affects a lot more than just loans and credit cards. For example, insurers may use credit scores to set auto or homeowners policies. Landlords may check your credit score when deciding who to rent to. Even utility providers look at your score to determine who gets the best cell phone plans and who has to make bigger deposits to get utilities like electricity and water.

The good news: Checking your score is free — and it won't hurt your credit.

» Get your free credit score with NerdWallet today.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

How is your credit score calculated?

Credit scores are based on the information in your credit reports from the three major credit bureaus: Experian, Equifax and TransUnion. Since each major credit bureau maintains its own credit report, you have more than one score — and those numbers fluctuate all the time.

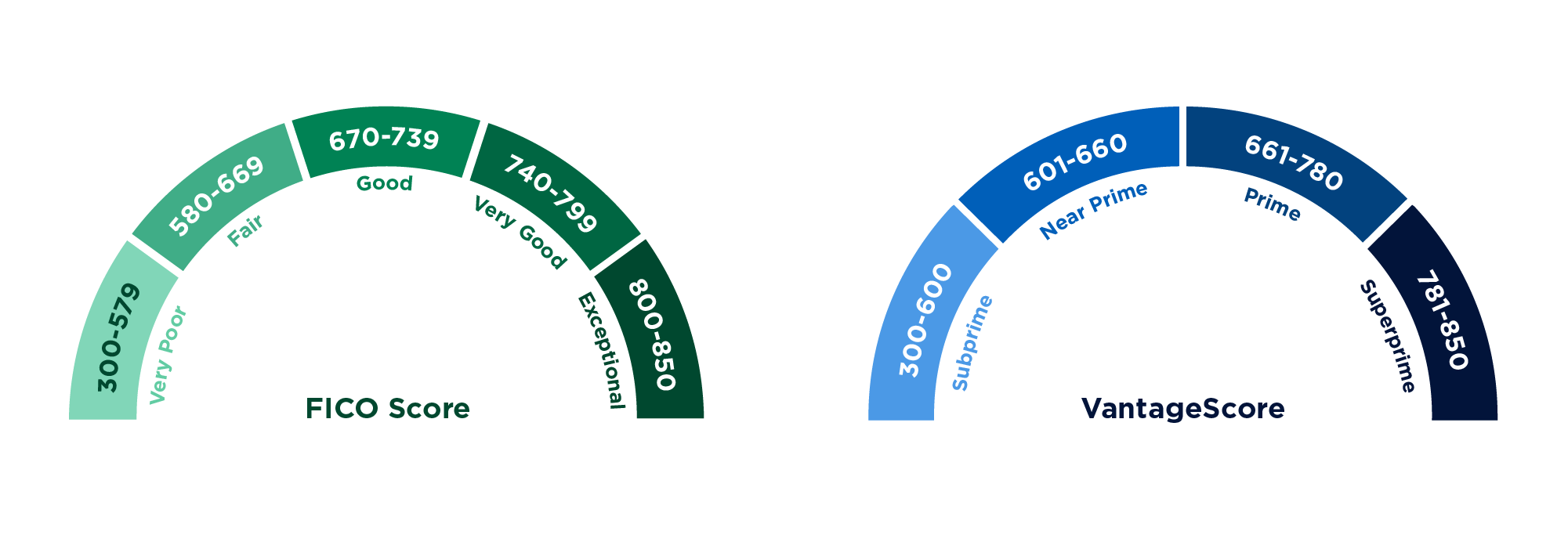

Your scores are then categorized within ranges, outlined by the two major credit scoring companies FICO and VantageScore. These credit score ranges generally determine whether your score is seen as excellent, good, fair or poor by lenders. FICO and VantageScore have their own distinct ranges, which means a “good” credit score at VantageScore might not quite make the cut at FICO.

Score calculations consider the following factors:

- Payment history is your record of paying your bills on time every month.

- Credit utilization is the amount of available credit you're using at a given moment. Ideally, you only want to be using 30% or less at one time.

- Length of credit history is how long you’ve had credit. A longer history gives lenders a better look at how you’ve borrowed and paid money back over time.

- Credit mix is the types of credit in your portfolio. While not a huge factor, having a variety of credit types shows lenders how you manage revolving credit (credit cards) and installment loans (car, student and personal loans).

FICO and VantageScore each use their own formulas to weigh these factors. The end result is your credit score.

Your score can vary depending on the scoring model and which credit bureau’s report was used. It’s also important to know that not all lenders report to all three credit bureaus, so some information might not be on every report

» Learn more: Which factors affect your credit score?

How to build your credit

Credit scores might feel mysterious, but there are some ways to elevate them. If you’re looking to build credit, try these:

- Pay your bills on time. Payment history is the most influential credit scoring factor, so automate your bills or set calendar alerts so you don't miss a due date.

- Know your credit limits and stay well beneath them. Using your credit cards is important because it helps build your payment history, but it’s a good rule of thumb to try to spend no more than 30% of your available credit limit to keep your credit utilization low.

- Pay balances in full if you can. There’s no need to carry debt when your goal is growing your credit scores. If you do carry balances, try to pay them down as quickly as possible.

- Avoid closing your oldest accounts, even if you don’t use them much. Your “credit age” is a piece of the credit scoring puzzle. Consider keeping older cards active by putting a small, recurring charge on it each month and setting up autopay.

- Space out your applications. When you apply for a credit card or loan, the lender usually does a hard inquiry on your credit report. Too many inquiries in a short time can lower your score, so it’s best to space out applications — ideally waiting at least six weeks between them.

- If you’re new to credit, start small: Consider a secured credit card or becoming an authorized user on a trusted adult’s credit card.

» Want a “good” credit score? Here are tips for how to get there

Why your credit score matters

You can leverage great scores into great deals — on loans, credit cards, insurance premiums, apartments and cell phone plans. Bad scores can hammer you into missing out or paying more.

Having good or excellent credit can provide significant savings over your lifetime by paying less in interest on a home or car loan, for example.

Consistently monitoring your score can also help you spot identity theft or other mistakes on your credit report. Major drops in your score could signal a problem and being on top of things means you can take steps to dispute credit report errors and get your score back on track faster.

» Next up: What is a credit report and how do you read one?

» Next up: What is a credit report and how do you read one?

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles