No Credit vs. Bad Credit: What’s the Difference and How to Fix It

Learn the difference between having no credit and having bad credit, why it matters to lenders, and simple steps you can take to build — or rebuild — your credit score.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

If you have no credit, it means creditors don’t have a good way to predict how likely you are to pay your bills as agreed. Bad credit, on the other hand, means you have a credit history but have made mistakes — like missed payments, taking on too much debt or having an account go to collections — that have tanked your score.

No credit vs. bad credit: What’s the difference?

While both bad credit and no credit come with their unique challenges, having no credit is considered better because it’s more of a blank slate and can be fixed by getting roughly six months of credit usage recorded by the three major credit bureaus. From there, FICO and VantageScore can generate a credit score.

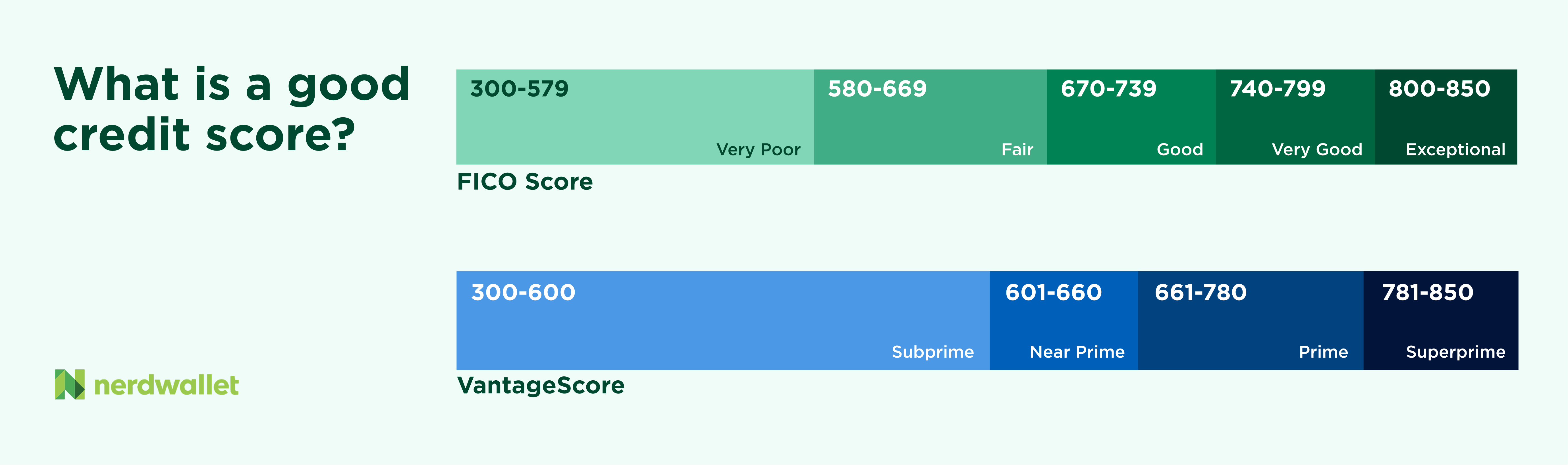

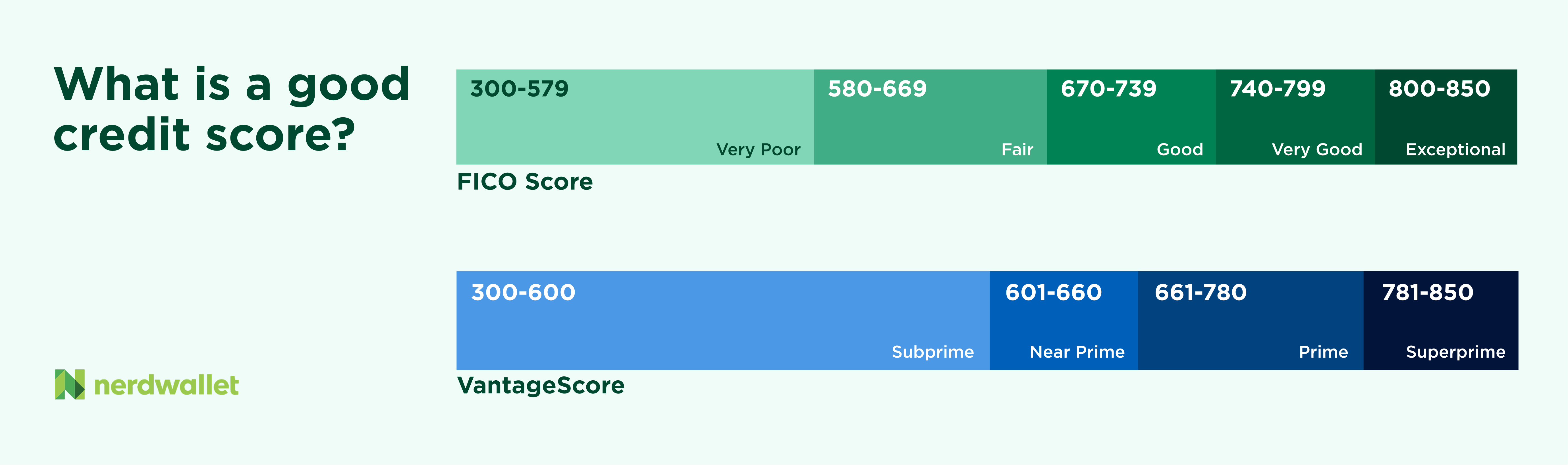

What is a bad credit score?

What counts as a bad credit score differs based on the scoring formula. A score of 669 or lower is "fair" according to FICO's model, while 600 or lower is "subprime" in VantageScore's model.

Either way, a score in these ranges makes lenders reluctant to extend credit because you've made some major credit mistakes in the past, possibly including:

- Making one or more late payments.

- Using more than 30% of your credit limit.

- Letting an account go to collections.

- A past bankruptcy.

If you have either no credit or bad credit, it’s smart to find ways to improve it. Focusing on the most important credit scoring factors is one way to narrow in and build positive financial habits.

Why is having no credit considered a bad thing?

Even if you have a reliable income but you have no credit history, you will be seen as a risk to lenders because you don’t yet have a credit history, or a track record they can review before making a decision. A lack of credit can also result in:

- Trouble finding a place to live.

- Having to pay higher utility deposits.

- Fewer options, like credit cards, in case of emergency expenses.

- Higher interest rates (or getting turned down) if you want to take out a loan for a car or other major purchases.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

5 ways to turn no credit into good credit

If you have no credit score, the good news is you’re starting with a clean slate. Your best options to start building toward a good credit score are:

- Secured credit cards. These cards are backed by a security deposit, and that amount becomes your credit limit. On-time payments are reported to the credit bureaus, which helps build credit.

- College student credit cards. Such cards are relatively easy to qualify for if you have no credit.

- Credit-builder loans can also help you establish credit and do not require upfront cash as secured cards do. Instead, you make monthly payments and that money is held in a locked account. Once you've made all your payments, you get the money and the record of on-time payments, too. This is a great way to build an emergency fund.

- Authorized user status. Becoming an authorized user on a trusted person's credit card with a good payment record and long credit history can help put you on the credit map. You are not responsible for payments, though, and its effect is limited.

- Getting a co-signer. This is risky for the co-signer, because he or she is fully responsible for paying off the loan. Failure to pay on your part could hurt the co-signer's credit and jeopardize your relationship.

Have bad credit? Start with your credit reports

If you have bad credit, you have a different problem with a similar solution. Instead of trying to build credit, you are trying to rebuild it.

Start first by checking your credit reports. Here's what to do:

- Use annualcreditreport.com to get free copies of your reports from each of the three major credit reporting agencies: Equifax, Experian and TransUnion. You are entitled to one per week from each bureau.

- Check your reports for errors, particularly for addresses where you’ve never lived, accounts you don’t recognize or payment amounts that seem off.

- Check to make sure any derogatory marks, or negative marks, have fallen off your credit reports after the designated time (usually between seven to 10 years).

- You can dispute errors online (the fastest way) or by phone or mail. Be sure to file a separate dispute with each bureau where the error appeared. While it might seem like a hassle, it's worth your time because incorrect information can significantly damage your scores.

Building or rebuilding credit takes time and consistency, but it’s completely doable. Whether you’re starting from scratch or bouncing back from past mistakes, every on-time payment and smart credit move helps you move closer to your financial goals. With patience and good habits, you can turn no credit or bad credit into a solid foundation for your future.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles