First American Home Warranty Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

First American Home Warranty is a smart choice for homeowners who want flexibility. It offers unlimited coverage for certain systems, a high-value basic plan and service with decent customer reviews.

The company has three plans, with the most basic one covering appliances and systems, such as air conditioning and electrical. Instead of the usual coverage caps on every item, it only limits coverage on certain items and in some cases with certain plans. It also covers damage due to technicians cutting into walls and concrete, which many competitors don’t offer. But some customer reviews highlight issues with technicians and long repair times.

Deciding factors | |

|---|---|

Monthly cost | $42 and up monthly. |

Service fees | $75, $100 or $125 per call. |

Annual coverage cap* | No limit for electricity, plumbing and HVAC; cap for appliances depends on the plan. |

Average customer service rating† | 3.36 out of 5. |

Technician choice | You must use the company’s technicians. |

*Annual coverage cap assumes a 12-month plan. †Average customer service rating is based on three sources: Trustpilot, ConsumerAffairs (both consumer review sites) and the Better Business Bureau. | |

» MORE: What is a home warranty?

How does First American Home Warranty work?

Like many of its competitors, First American Home Warranty limits its coverage to items that malfunction because of normal wear and tear. This means items that have cosmetic damage or are damaged because of missing parts or natural disaster are not covered.

You can submit claims through the company’s online portal and by phone with a representative. Once you’ve submitted a claim, a technician will usually call you within 48 hours to schedule an appointment. After the technician has looked at your appliance or system, they will repair it or notify the company that it needs to be replaced.

The company has three plans that offer different levels of coverage:

The Starter Plan covers appliances including your dishwasher, refrigerator, range hood, built-in microwave and oven/range/cooktop, plumbing including stoppages and toilets, basic electrical systems and heating systems including ductwork.

The Essential Plan covers the same as the Starter Plan and adds coverage for your clothes washer and dryer, trash compactor, water heater, all fans including exhaust, garage door opener, and air conditioning systems. It also increases the coverage caps on some items.

The Premium Plan adds several items on top of the Essential Plan, including your garbage disposal, several plumbing fixtures, additional HVAC components, window units and central vacuum system.

The Essential and Premium plans also include additional coverage and services, which the company calls First American Advantage. This feature will pay for:

Someone to fix code violations that affect repairs or replacements.

The repair or replacement of covered items that malfunction because of improper repair, installation or modification.

A company to remove an appliance or system that is being replaced by your home warranty.

The combined limit that the company will pay toward First American Advantage services is generally $500. That amount is for all of those services combined, not individually. So if you hit the $500 mark when the company replaces an incorrectly installed dishwasher, First American Home Warranty won’t pay for a company to haul off your old dishwasher as well. That limit increases to $1,500 with the Premium Plan.

» MORE: What does a home warranty cover?

First American Home Warranty has additional coverage available for optional items that customers can add to their plans. This coverage comes with an extra fee and can include:

Pool or spa equipment.

Well pump.

Septic tank pump and system.

Water softener.

Reverse osmosis filtration system.

Additional refrigerator.

HVAC tuneup (includes one in every six-month period).

Limited roof leaks.

Unlike competitors, First American offers unlimited coverage on certain systems, and with certain plans. This means that, as long as the work is approved by the company on the covered item, your home warranty will pay for a repair or replacement regardless of price. Other home warranty companies tend to put a coverage cap on all items.

Keep in mind, though, that unlimited coverage doesn't necessarily mean your broken appliance or system will be replaced with a new one that costs as much as you paid for the original.

System or appliance | Starter Plan cap | Essential Plan cap | Premium Plan cap |

|---|---|---|---|

Each major kitchen appliance, including dishwasher, refrigerator, range hood, built-in microwave and oven/range/cooktop | $3,500. | $3,500. | $7,000. |

Clothes washer and dryer | Not covered. | $3,500. | No limit. |

Trash compactor | Not covered. | $3,500. | $7,000. |

Water heater | Not covered. | $1,000. | No limit. |

Plumbing | No limit. | No limit. | No limit. |

Electrical | No limit. | No limit. | No limit. |

Heating | No limit. | No limit. | No limit. |

Ductwork | No limit. | No limit. | No limit. |

Air conditioning | No limit. | No limit. | No limit. |

» MORE: Are home warranties worth it?

How much does a First American Home Warranty cost?

First American Home Warranty’s plans start at $42 a month. Customers can save $24 per year if they pay annually instead of monthly. Quotes are based on your location and chosen plan.

Like its competitors, First American Home Warranty requires customers to pay a service fee whenever a technician responds to a claim. When they sign up for a home warranty, customers choose if they want to pay service fees of $75, $100 or $125, and the service fee they choose affects their monthly premium. Customers who choose higher service fees will pay less in monthly premiums, and those who choose the lower service fees will pay more in monthly premiums.

First American Home Warranty guarantees their technicians’ work for 30 days, so you won’t pay a service fee if a technician has to return to look at an appliance or system again during that time frame.

Themes from customer reviews

NerdWallet considered customer reviews from three review websites to get a wider perspective of customer experiences. We’ve highlighted the types of experiences that we’ve found to be most common, keeping in mind that online reviews tend to lean toward negative experiences. NerdWallet hasn't independently verified the claims made in these consumer reviews.

Trustpilot: 4.1 out of 5.0. Consumer Affairs: 4.1 out of 5.0. Better Business Bureau: 1.77 out of 5.0.

Negative customer reviews of First American Home Warranty report that the company hires unreliable technicians who don’t repair the issue or show up for appointments. Some customers also complain that the company tends to deny claims that the customers believe should be covered and doesn’t respond quickly to technician problems, which causes repairs to take longer than necessary.

First American Home Warranty’s positive reviews note that the company makes it easy to submit claims for repairs. Customers also note that contract technicians are professional and respond quickly to claims.

Some customers report that over several years of filing claims with First American Home Warranty, they’ve had a mix of good and bad experiences, especially with getting claims approved and technicians scheduled.

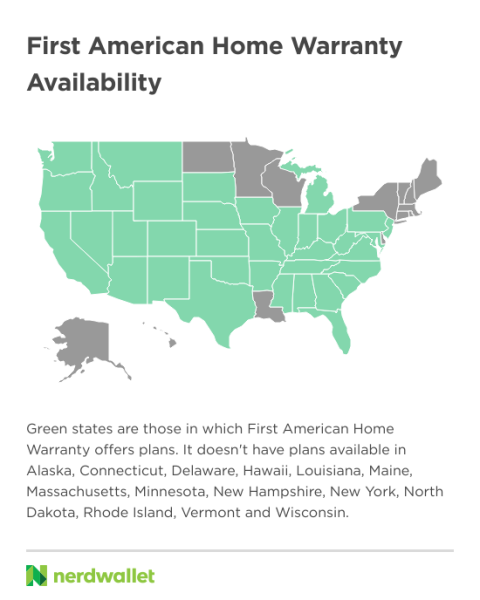

Where is First American Home Warranty available?

First American Home Warranty provides plans in 36 states and Washington, D.C.

Pros of First American Home Warranty

First American Home Warranty has several benefits for homeowners, including:

High coverage caps. The company is unique in that it offers unlimited coverage for certain systems and appliances. This means it might be willing to pay out much more than competitors for certain approved claims.

Flexible service fee options. First American Home Warranty lets customers choose how much they want to pay each time a technician responds to a claim. The lower the service fee, the higher the monthly premium.

Pays for access repair. If a contractor has to cut through a wall or concrete to repair certain systems, First American Home Warranty will pay to repair the surface. For walls and floors, it’ll repair to a rough finish; for concrete, the company caps access repair at $500 for the Essential Plan and $1,000 for the Premium Plan.

Decent customer satisfaction. Customer reviews say the company’s contract technicians are hit or miss when it comes to being professional and that it can take a long time to have something repaired. However, some reviews say technicians are friendly and professional and repairs are fixed quickly.

Cons of First American Home Warranty

There are two drawbacks to First American Home Warranty's plans:

Have to use the company's technicians. You’ll have to use the technician that the company assigns to your claim. You can’t hire your own contractor and be reimbursed.

Coverage limited to 36 states. The company doesn’t provide home warranties in every state, so some potential customers won’t be able to sign up for coverage.

Alternatives to First American Home Warranty

American Home Shield Home Warranty

on American Home Shield's website

Liberty Home Guard

on Liberty Home Guard's website

Choice Home Warranty

on Choice Home Warranty's website

Select Home Warranty

on Select Home Warranty's website

Methodology

NerdWallet's Home Services team evaluated home warranties across several factors, including cost, covered items, coverage limits, customer ratings, ability to choose your own technician and warranty on work completed. Because costs can vary by location, it's best to get quotes from multiple companies before making a decision. Read more about how NerdWallet rates home warranties.