Is Expedia Legit? Can It Get Me a Good Deal?

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Expedia is an online travel agency (OTA) that might come up in your search when you’re searching for travel deals, including flights, hotels, rental cars, cruises, vacation packages and activities. In 2023, Expedia launched a loyalty program called One Key, allowing travelers to earn and redeem rewards across its three most popular brands: Expedia, Hotels.com and Vrbo.

Let’s take a look at how Expedia works and whether it’ll save you money.

How does Expedia work?

Because Expedia is a travel agency, its website or app's travel search features will return you results from multiple companies. For instance, if you search for a hotel in Miami, Expedia will display options from brands like Marriott, IHG, Hilton and Hyatt, and even boutique hotels.

Booking on Expedia is much faster than going to each company’s individual website, since it can be a good way to compare prices from multiple options at once.

How to find and book travel on Expedia

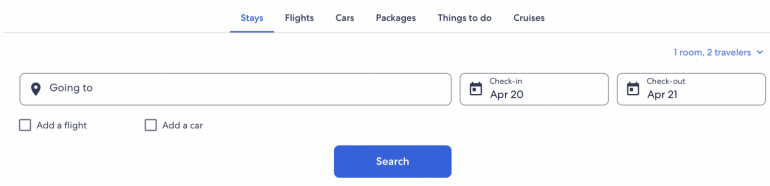

Like other OTAs, you’ll book travel using Expedia’s website or app.

If you’re on a computer, once you’re on the site’s homepage, you can enter your search details. Expedia allows you to book hotels, flights, rental cars, cruises, vacation packages and even things to do.

Once you’ve completed your searching, you’ll be taken through the booking process. As an OTA, Expedia acts as the intermediary between you and the actual travel operators.

Many hotels and rental car agencies have restricted the ability to earn points or elite status credits when using an online travel agency for bookings. This does not generally apply to airlines, so you can usually still earn miles for flights booked through OTAs.

This means that if you were looking for a stay and chose to book a Marriott hotel through Expedia, Expedia would take your booking, head on over to Marriott to confirm availability, then process your reservation. It’ll then pass on those reservation details to the Marriott hotel.

Is Expedia reliable?

You might be cautious of go-betweens or third-party booking sites, but Expedia is a legitimate, well-known online travel agency that’s been around for years. Microsoft originally launched the Expedia website in 1996. These days, Expedia is part of the larger Expedia Group, which includes brands such as Hotels.com, Orbitz, Hotwire, Travelocity, Vrbo and CarRentals.com.

All this is to say that Expedia is a reliable company. This isn’t some shady, fly-by-night operation.

However, you’ll always want to be careful when booking with a third party. It may be harder to change or cancel your reservation, and it might be wise to confirm any reservations directly with the travel operator. You’ll want to be sure that the details of your travel are correct and the reservation was actually made.

Ways to get a good deal on Expedia

Expedia can offer cheap travel deals across the spectrum, but it doesn’t just stop at your booking. There are a few other ways to help pump up the savings on your vacations.

1. Use a travel credit card to get rewards

If you aren’t already using a credit card to book your travel, you ought to be. In addition to earning bonus points on your purchases, some credit cards provide travel insurance free of charge as long as you use the card to purchase the trip.

When booking your trips, use a credit card that maximizes earnings on travel. This includes options such as the Chase Sapphire Reserve®, which earns 3 Chase Ultimate Rewards® points per dollar spent on all travel.

NerdWallet values Chase points at 2.2 cents each if you take advantage of transfer partners. That means you’ll be getting a 7.8% return when using this card to book travel, including bookings made on Expedia.

• 5 points per dollar spent on travel (including flights) booked through Chase's travel portal.

• 2 points per dollar on other travel (including flights).

Annual fee: $95.

• 10 points per dollar on hotel stays and car rentals purchased through Chase's travel portal.

• 5 points per dollar on air travel purchased through Chase's travel portal.

• 3 points per dollar spent on travel and dining not booked with Chase.

Annual fee: $550.

• 3 points per dollar on travel including airfare, hotels, cruises, tours, car rentals, campgrounds, and vacation rentals.

Terms apply.

Annual fee: $150.

• 10 ThankYou® points per $1 spent on hotels, car rentals and attractions booked through the Citi Travel site.

• 3 points per $1 spent on air travel and other hotel purchases.

Annual fee: $95.

» Learn more: The best travel credit cards right now

2. Sign up for One Key Rewards

If you book any travel with Expedia, it’s worth it to sign up for One Key, the site’s free member rewards program. As a member, you’ll receive 2% OneKeyCash for each $1 you spend on travel as well as elite status based on each travel segment booked. One Key is a unified program for Expedia, Hotels.com and Vrbo, so the loyalty perks can be earned and redeemed across all three programs.

By signing up for One Key, you become a Blue member, which — according to Expedia — allows you to save at least 10% on more than 100,000 hotels globally. As you move up the tiers in status, your savings and benefits increase with higher discounts.

Triple-dip your reward earnings by stacking your credit card bonus points and One Key rewards by using a shopping portal when booking.

You can also opt to get an Expedia credit card if you really want to pledge your loyalty to the brand.

» Learn more: The One Key Rewards guide

3. Take advantage of Expedia’s best price guarantee

Expedia has its own best price guarantee when booking hotels, which will refund you the difference in cost if you find a cheaper price elsewhere. There are restrictions for this process — the cheaper option must be identical to Expedia’s offering, and you must be able to provide proof. If you’ve found a lower price, submitting a claim for a price match can be a good way to save money on your hotel bookings.

However, before you go ahead with your Expedia booking, you’ll want to check the prices for hotels when booking directly. This is because major hotel chains such as Hilton, Hyatt and Marriott often not only match a lower price you found elsewhere, but they’ll also provide up to a 20% to 25% discount on the entire stay or bonus points.

» Learn more: The pros and cons of Expedia

4. Skip rental car insurance if you already have coverage

As we mentioned above, Expedia offers the ability to rent cars. Along with the booking, you can also opt to include extras, such as additional drivers and rental car insurance.

But is Expedia car rental insurance a good deal? Not usually — rather than paying extra for this benefit, use a travel card that offers complimentary rental car insurance. This includes options such as the Chase Sapphire Preferred® Card and The Platinum Card® from American Express, among many other cards. Terms apply.

» Learn more: Best credit cards for online travel booking websites

Expedia is legit

Expedia has grown to become one of many large travel brands under the Expedia Group designation. While booking travel via an OTA can save you money, you’ll always want to double check your reservations with the travel provider and only book reservations that you are fairly confident that you’ll keep. Canceling can be a huge headache.

However, when stacked together with multiple ways to earn rewards, Expedia can be a great way to save some money on your travels.

Insurance Benefit: Car Rental Loss & Damage Insurance

Car Rental Loss and Damage Insurance can provide coverage up to $75,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-5%

CashbackUp to $300

2x-5x

Miles75,000

Miles