The Pros and Cons of Expedia

You can sometimes score great last-minute deals on Expedia, but the cancellation policies are more stringent.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Frequent travelers likely know that there’s something better than a dream trip: a dream trip that you booked on a bargain.

The ways to save money on travel are plentiful. You can redeem hotels and airline points, or take advantage of last-minute travel deals, to name a few. And booking through third-party online travel agencies like Expedia can sometimes yield especially big savings.

Beyond just deals, Expedia has robust search filters that make finding your perfect vacation easy. It streamlines purchasing trip insurance, which can be especially important for travel these days. Plus, the Expedia Rewards program earns you points to pay for future bookings.

But booking through an OTA like Expedia is not without its drawbacks. Here's a look at some of those to help you weigh the pros and cons of booking travel through Expedia.

When it comes to Expedia prices

Pro: Expedia has frequent sales, last-minute travel deals and bundle discounts

Expedia deals are aplenty, whether it’s a bundling discount or a sale.

Bundling: A major component of booking travel on Expedia is the practice of bundling, where you can expect additional savings for booking more than one product (e.g., flight and hotel, or hotel and attraction ticket) in one transaction. For example, when we searched for a hotel and rental car in Miami, one five-day booking option included up to three free rental car days while another offered one free night.

🤓 Nerdy Tip

A perk of booking travel through Expedia is that you select your hotel, airfare and car rental in separate steps in the process. This makes it easy to bookmark the page and compare the cost of these items on Expedia versus the cost on the company’s direct website. Expedia payment plans: If you don’t want to pay for your whole trip at the time of booking, Expedia allows you to make smaller payments through Affirm, which is a service that offers short-term loans for online purchases. If approved by Affirm, you’ll be able to pay for your trip in monthly installments.

You can also check Expedia’s Deals page and Expedia’s Last-Minute Deals page. Both tend to offer an eclectic mix of travel deals, ranging from cheap motels in tiny towns to lavish resorts in major tourist destinations. We’ve spotted deals as high as 70% off.

» Learn more: How to find cheaper last-minute flights

Con: Booking direct is sometimes still cheaper than Expedia

Sure, Expedia sales and last-minute deals are nice, but that’s not to say that you can’t find other (sometimes better) deals for booking directly with the travel provider. Many offer their own exclusive deals — and they might save you even more than booking with online travel agencies. Compare prices across both Expedia and the specific company to ensure you’re getting the best price.

And sometimes the savings go beyond just the sticker price. For example, boutique hotel chain Ovolo Hotels offers generous amenities including free laundry, happy hour refreshments and a daily breakfast buffet — but only if you book directly with them.

» Learn more: Is Expedia legit? Can it get me a good deal?

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

When it comes to Expedia travel insurance

Pro: You can purchase an Expedia travel insurance policy

Expedia partners with various insurance providers, depending on your individual booking, to offer trip protection.

- For flights: Expedia offers travel insurance protection options that cover flight cancellation, medical emergencies and other covered circumstances.

- For hotels: Choose hotel booking protection to reimburse your stay in the case of cancellation.

- For car rentals: You can add car rental damage protection for an extra per-day fee.

Coverage varies by plan, but you can typically expect reimbursement for some (or all) trip costs if your trip is impacted by covered reasons. Covered reasons typically include delays, loss, theft or damage to one’s baggage and personal belongings. You’re also typically reimbursed for covered medical expenses, including emergency evacuation if you get sick or injured during your trip.

But there are many limitations and exclusions, so read your policy’s fine print to understand what’s covered.

Expedia 24-hour cancellation

When you book a flight on Expedia, you can cancel for a full refund as long as you do so within 24 hours of booking. The U.S. Department of Transportation requires airlines to allow you to cancel a flight for a full refund if canceled within 24 hours of booking and it was booked seven days before departure.

Con: Outside travel insurance might be more comprehensive or cheaper (and sometimes free)

You can opt out of Expedia’s travel insurance and either be completely uninsured — or simply acquire your insurance elsewhere. And there are better travel insurance policies out there.

After a comprehensive review of dozens of plans that assessed factors including price and COVID-19 coverage, here are the best travel insurance policies.

What’s more, you might not even need to pay for travel insurance at all. Many credit cards offer travel insurance benefits if you paid for your trip with that card.

When it comes to the Expedia cancellation policy

Pro: Expedia offers some fully refundable options

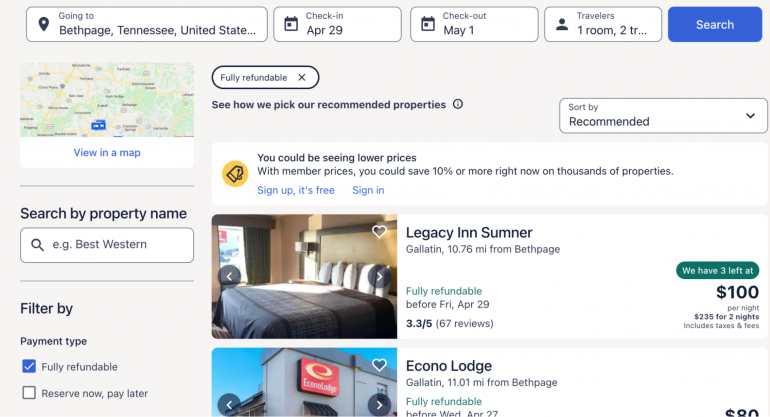

Because airlines, hotels and other travel services set their own individual policies on Expedia, change and cancellation policies can vary significantly. While it can be tricky to parse the policies for each individual property, use Expedia’s “fully refundable” search filter to limit potential bookings to those with flexible policies.

For straightforward requests, use the Expedia service page to make changes and get a refund. If you’re unable to get help through Expedia’s self-service tools, other ways to get in touch with Expedia include live chat, a dedicated Twitter account (@expediahelp) and a phone line.

Con: Most cancellation policies are bad, confusing or both

Because airlines are required to give full refunds if you cancel within 24 hours of booking, Expedia lets you change or cancel your flight reservation without fees within the same time period.

For everything else, good luck. Because each travel provider sets its own policies, navigating them can be a headache. In some cases, canceling through Expedia means you’ll have to chase after the hotel or activity provider to recoup the costs.

Additionally, prepare for cancellation fees (both Expedia’s own fees as well as fees from the service provider). That’s if you’re able to cancel at all. Some bookings through Expedia are nonrefundable altogether.

When it comes to the Expedia loyalty program

Pro: It’s great for commitment-phobes

The new Expedia Rewards program, One Key Rewards, lets you earn OneKeyCash for every booking you make on the platform (plus on Vrbo and Hotels.com), which can then be used like cash toward future trips. Not only that, but Expedia users can earn status, which includes benefits like exclusive members-only discounts and extra benefits at VIP Access properties (such as free breakfast or late checkout).

For travelers who don’t like to commit to one airline or hotel company, don’t travel that frequently, or who book travel that otherwise doesn’t have its own loyalty program (like a tour or vacation rental), Expedia makes it possible to still get rewarded.

» Learn more: The guide to One Key Rewards

Con: Most hotel and airline loyalty programs are far more rewarding

While the One Key Rewards program is fine, most travel loyalty programs tied to specific hotels or airlines are almost always more rewarding. For individual point values, most other currencies of airline and hotel points are worth far more than OneKeyCash, which nets you 2% back on cruise, hotel, activity and rental car bookings but only .2% on flights. Once it's in your account, you can use it to pay for bookings just like you would cash — though you’ll need enough OneKeyCash in your account to pay for an entire flight, not just part of it.

Additionally, holding specific airline or hotel elite status is typically more lucrative than the value of elite status on One Key Rewards as most perks extend to Expedia VIP Access properties only. That said, some elite members can enjoy up to 20% discounts on hotels and free price drop protection on flights, which is a plus.

As for how to use Expedia points, OneKeyCash can be redeemed on “pay now” bookings for participating purchases priced in U.S. dollars. You can use it to pay for part of a hotel booking, but you’ll have to have enough to pay for the full cost of a flight (including taxes and fees). And while you can’t transfer rewards, you can use your OneKeyCash to book travel for others.

But depending what status you’re able to reach with individual brand loyalty programs, you can likely expect better perks. So if you’re fine committing to one brand, you’re almost always better off striving to earn its status versus with One Key Rewards. But if you only stay for a night here or there or prefer to book based on location or price, it’s a way to earn a few more rewards.

When it comes to maximizing credit card points

Pro: Expedia counts as a travel purchase

Many travel rewards credit cards give you a higher rewards rate on travel purchases, and booking sites like Expedia typically count as travel spending. For example, the Chase Sapphire Preferred® Card earns 2 points per dollar on travel spending, compared with 1 point per dollar on most purchases.

Con: Travel credit cards are usually better for earning and redeeming rewards

If you’re loyal to a specific hotel or airline brand — or are open to pledging allegiance — credit cards aligned with those brands typically pay more on purchases directly from the brand partner. For example:

Rewards when booking directly

• 2 miles per $1 spent on Delta purchases.

Terms apply.

• 2 miles per $1 spent on United purchases.

• 12 points per $1 spent on eligible Hilton purchases.

Terms apply.

• 6 points per $1 spent at participating Marriott Bonvoy hotels.

Rewards when booking via Expedia

• 1 mile per $1 spent.

• 1 mile per $1 spent.

• 3 points per $1 spent.

• 2 points per $1 spent.

Learn more

Even general-purpose travel rewards cards that aren't tied to a specific airline or hotel chain will often reward you more handsomely for booking through their own portals than they would for going through a site like Expedia. Going back to the Chase Sapphire Preferred® Card: As mentioned, it earns 2 points per dollar on most travel purchases — but 5 points per dollar on travel booked through the Chase portal. Among general-purpose travel cards:

Popular travel cards

Rewards when booking through issuer

• 5 miles per $1 on hotels, vacation rentals and car rentals booked through Capital One Travel.

• 2 miles per $1 on other purchases.

• 5 points per $1 spent on travel booked through Chase.

• 5 points per $1 spent on flights booked directly with airlines or with American Express Travel, on up to $500,000 spent per year.

• 5 points per $1 on prepaid hotels booked with American Express Travel.

Terms apply.

Rewards when booking via Expedia

• 2 miles per $1 spent.

• 2 points per $1 spent.

• 1 point per $1 spent.

Learn more

If you're considering booking with other online travel agencies like Priceline or Hotels.com, here are the best credit cards for online travel booking websites.

The pros and cons of Expedia recapped

With the right deal, booking travel — including flights, hotels, cruises or car rentals — on Expedia could be worth it. It makes searching for travel relatively easy given the massive array of available listings, coupled with thoughtful search functionality to actually help you create your ideal itinerary.

But don’t automatically assume it’s a cheap way to book travel. Especially given the complicated cancellation policies, it might become among the most expensive, should an uninsured trip need to be canceled.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles