The Ultimate Guide to Chase’s Travel Portal

Chase’s travel portal lets you book flights, hotels, cruises and more with points, or pay in cash to earn bonus rewards.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Chase Ultimate Rewards® are one of the most valuable and flexible rewards currencies out there. Many credit cards earn them, and if you have the right card, you can access Chase’s travel portal and get good value from your points when you want to redeem them.

There are numerous ways to redeem these points, from sending them to hotel and airline transfer partners to booking hotels, flights, cars, cruises and activities directly through Chase. You can redeem points to pay for an entire trip, combine points and cash or use all cash to earn bonus rewards for your next adventure.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

What is Chase’s travel portal?

Chase’s travel portal lets cardholders redeem Chase Ultimate Rewards® and transfer points to travel partners (eligible cards only). The user interface is relatively simple and operates like other online travel agencies, such as Expedia.

What credit cards can access Chase’s travel portal?

Credit cards that earn Chase Ultimate Rewards® can access Chase’s travel portal and earn bonus rewards when booking travel and paying cash through the portal. But some cards offer a much better value when you redeem points for travel.

These cards earn Chase Ultimate Rewards® and have the following value when you redeem points through Chase's travel portal:

- Chase Sapphire Reserve®: 1 to 2 cents per point.

- Sapphire Reserve for Business℠: 1 to 2 cents per point.

- Chase Sapphire Preferred® Card: 1 to 1.75 cents per point.

- Ink Business Preferred® Credit Card: 1 to 1.75 cents per point.

- Chase Freedom Unlimited®: 1 cent per point.

- Chase Freedom Flex®: 1 cent per point.

- Chase Freedom Rise®: 1 cent per point.

- Ink Business Cash® Credit Card: 1 cent per point.

- Ink Business Unlimited® Credit Card: 1 cent per point.

Ultimate Rewards® have a baseline value of 1 cent each when you book through the travel portal. However, the premium travel cards have access to discounted redemptions through Chase’s Points Boost feature, making points on those cards potentially more valuable (more on that below).

If you have multiple cards that earn Chase Ultimate Rewards®, your rewards can be combined on the card that provides the best redemption value. That can really amplify the value of your points stash.

For example, rewards on the Chase Freedom cards have the same value when redeemed for a statement credit as they do when redeemed through Chase’s travel portal (1 cent per point). In that case, you’d be better off directly paying for your travels on the card to earn rewards, then redeem your points to offset the expense. But if you have the Chase Sapphire Reserve®, you can transfer points to that card and potentially receive up to twice the value when you make a Points Boost booking through Chase’s travel portal.

» Learn more: The best travel credit cards right now

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Should you use Chase’s travel portal?

Only those with the Chase Sapphire Reserve®, Chase Sapphire Preferred® Card and Ink Business Preferred® Credit Card should consider using points to book through Chase’s travel portal. Those cards can potentially find added value through Points Boost pricing. The points on the other cards that earn Chase Ultimate Rewards® are worth 1 cent each, so 1,000 points are equal to $10. In this case, you’d be better off redeeming your points for a statement credit and booking travel directly through the airline or hotel.

You can also use cash to book through Chase’s travel portal and earn 5 to 8 points per dollar spent with most of the cards listed above by booking through the portal and paying in cash. However, there are drawbacks.

The customer service experience with Chase's travel portal can be lackluster, especially if things go wrong. Since the start of 2025, I've had two hotel reservation issues arise when I was standing in a hotel lobby trying to check in. In one instance, Chase never contacted the hotel to confirm the online booking I made days prior. The second time, Chase booked me in a smoking room that was conspicuously marked non-smoking on the website. Because the hotel had no control over third-party bookings, I had to wait on hold for almost two hours while Chase resolved the issue.

🤓 Nerdy Tip

When you book a flight with points through Chase, your reservation is booked as a revenue ticket that’s likely to earn frequent flyer miles with the airline. However, hotel bookings made through Chase are not likely to earn elite night credits or hotel points with the hotel loyalty program.

Nerdy Perspective

How do you use Chase Ultimate Rewards® points?

How to access Chase's travel portal

From the Chase website

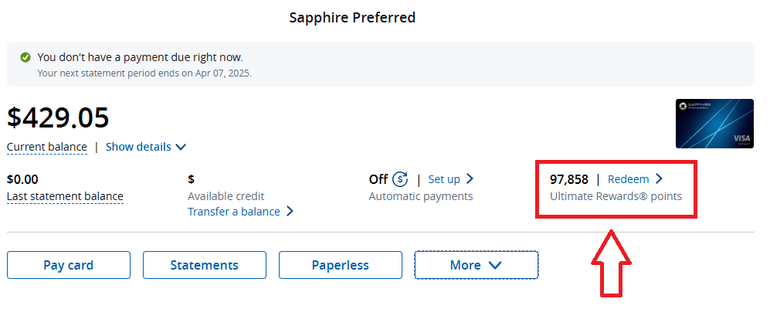

If you’re on a computer, log in to your account and select your Ultimate Rewards® card from the list of accounts. From your card’s account page, select the “redeem” link located next to your rewards balance.

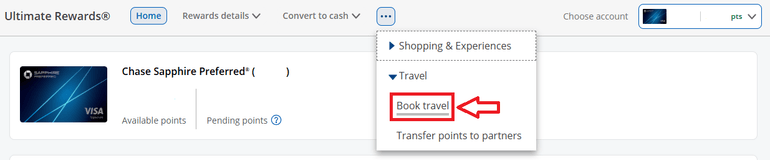

Once you’re in the travel portal, click the three dots at the top of the screen, then “book travel” in the dropdown menu. If you’d rather transfer points to a travel partner, click the link below that.

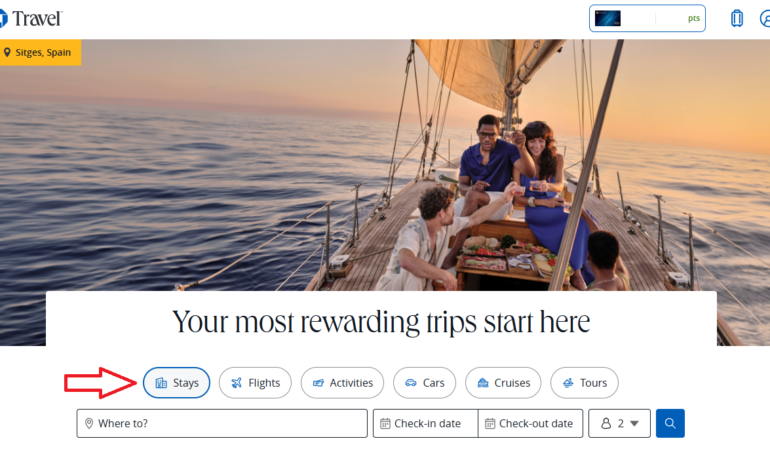

Once you see the travel portal search bar, select what type of travel you’re interested in and additional details, including the dates of travel and number of people.

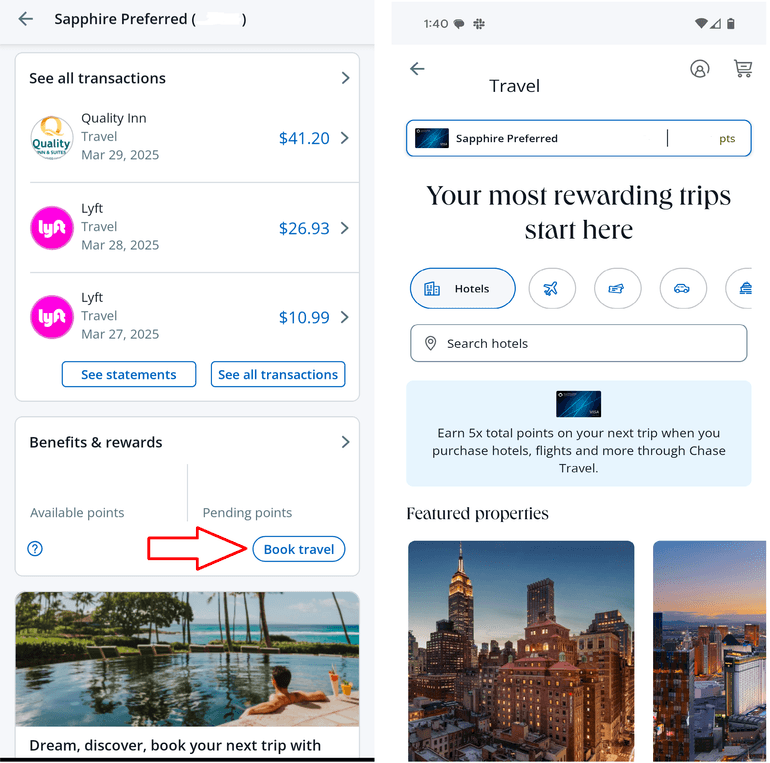

From the Chase mobile app

You can also access Chase’s travel portal through the Chase mobile app. Log in to the app and select your card. Once on the card’s account page, look for the “Benefits and rewards” section directly below your transactions. Click “Book travel,” then select details about the trip you’re trying to book.

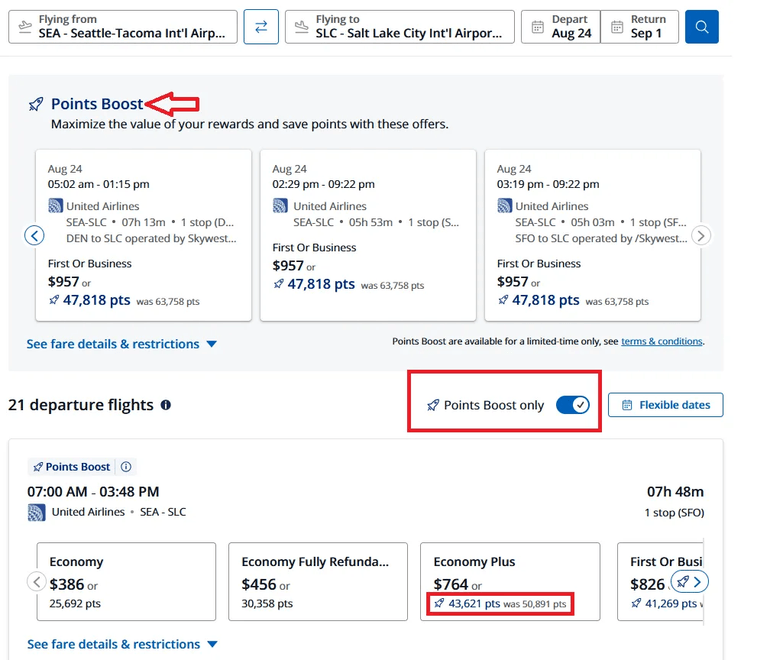

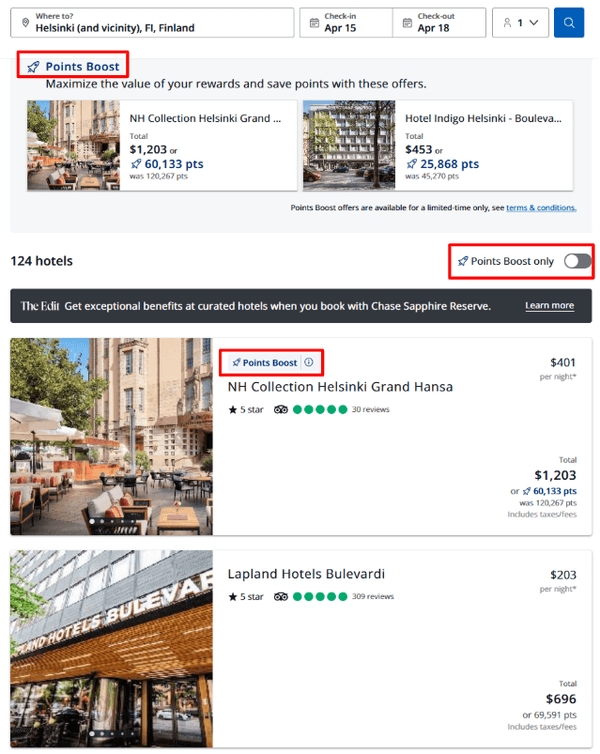

How to find Points Boost bookings

To find a qualifying Points Boost booking, access the travel portal and complete a search. Points Boost options will appear at the top of the results screen. You can also toggle the slider bar for “Points Boost only” to show only redemptions that qualify for Points Boost pricing.

The following cards are eligible for discounted Points Boost bookings through Chase’s travel portal:

If you don’t hold one of those cards, or if you can’t find a Points Boost option for your travel plans, you may want to reconsider using Chase’s travel portal and instead transfer points to travel partners. To find the best transfer partner redemptions for your Ultimate Rewards®, use an award travel search tool like PointsYeah. You can also redeem points for a statement credit, then use that credit to offset the travel costs when you book directly through the airline or hotel.

» Learn more: Chase’s Points Boost on Flights Is a Massive Points Bust

How to book flights through Chase

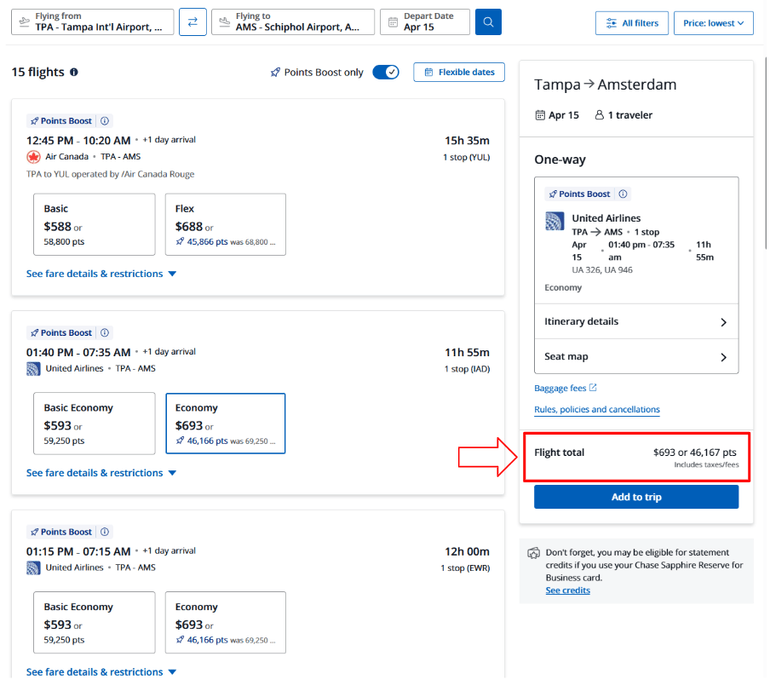

To book a flight through Chase, log in to Chase’s travel portal and click the “Flights” icon above the search bar. Enter your departure and arrival cities and choose between one-way and round-trip flights, the class of your ticket, number of travelers and your travel dates.

A nice thing about Chase’s travel portal is how obvious it makes basic economy flight bookings. This fare class is sometimes obscured by other online travel agencies. Select your outbound and return flights, if applicable. At the bottom, you’ll see your flight cost in both cash and points.

Along the right side of the screen, you can also see specific details about the itinerary you select, including a seat map and layover duration. If you’re happy with those details, select “Add to trip.”

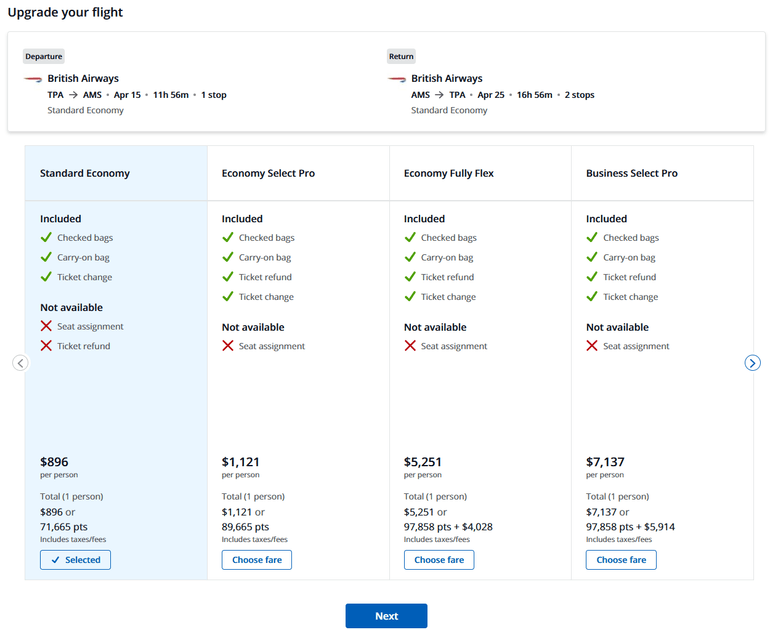

Next, you’ll be taken to a screen that shows the benefits of the ticket you selected in addition to a comparison of the cost and benefits to other available fare classes. Select the fare class you want and select “Next.”

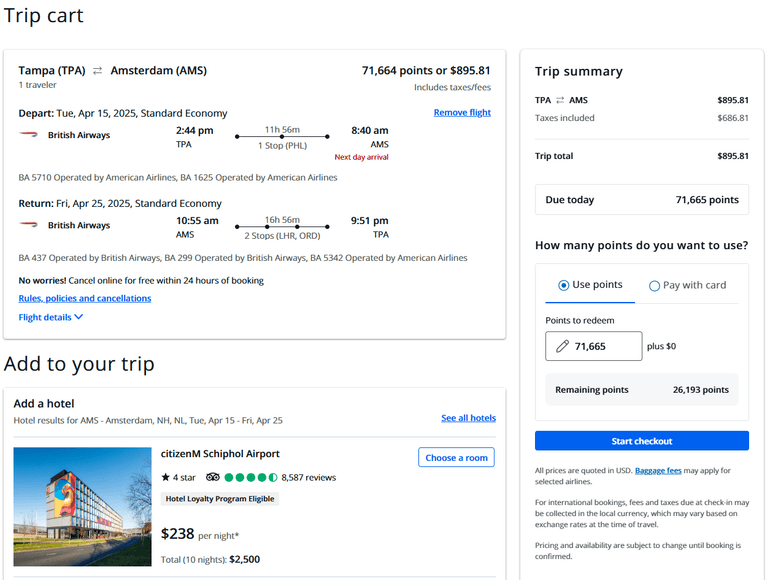

Then you’ll see the details about your itinerary including the final price. From there you can select to redeem points, pay with your card (and earn additional Chase Ultimate Rewards®) or book with both points and card. Hit “Start checkout,” and from there you’ll enter your personal traveler information, including your Known Traveler Number for any TSA PreCheck or Global Entry benefits.

How to book hotels through Chase

To book a hotel stay through Chase, navigate to the Chase Travel homepage and select the “Stays” icon. Then enter your destination, check-in and checkout dates. You’ll be taken to a list of available properties, along with a map of hotel locations and costs. Options with Points Boost pricing will appear at the top of the page and with a label further below. Similar to airline searches, you can toggle the slider bar to show only Points Boost options.

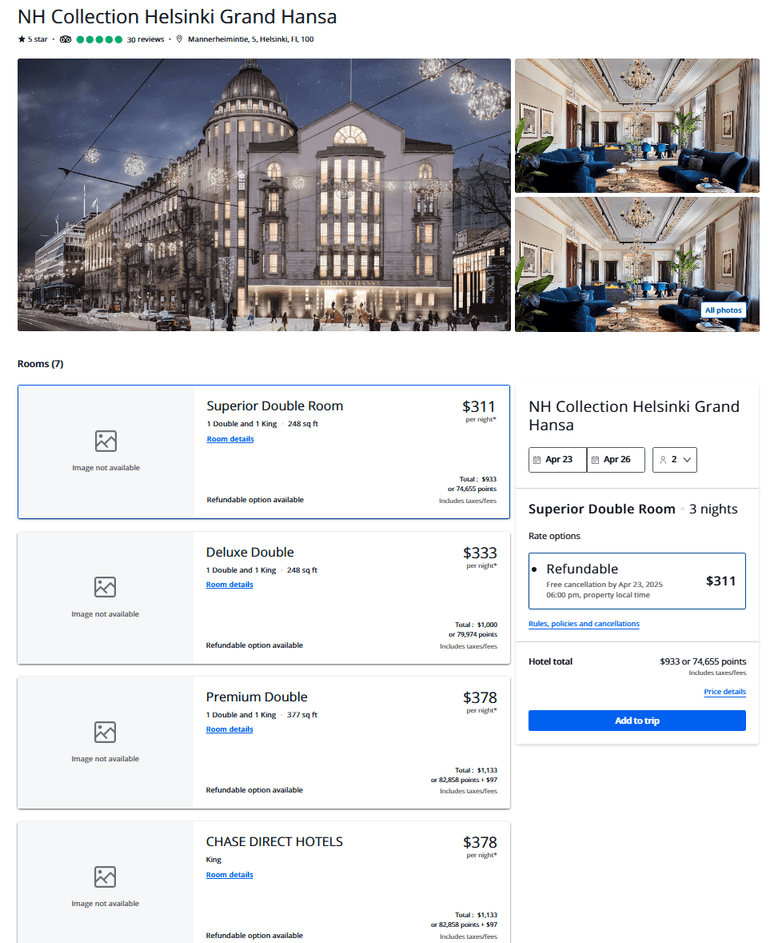

Select the property you’re interested in and it will take you to a choice of available rooms and prices, details about the cancellation policy and photos of the hotel.

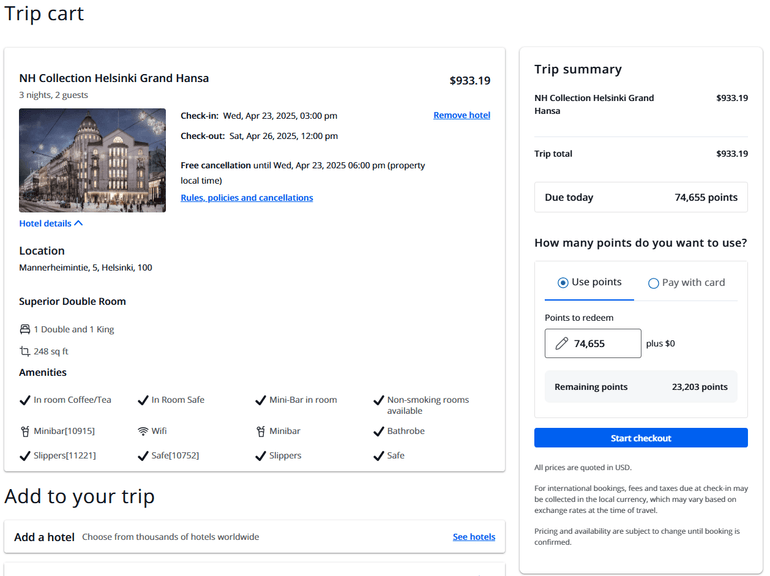

Once you select a room, click “Add to trip” and you’ll be taken to the final summary page before checkout. Here you can review your reservation details and any included amenities.

How to book cruises through Chase

Chase just made a quiet but meaningful update to its travel portal, and it’s a big win for cruise lovers — especially those sitting on a stash of Chase Ultimate Rewards® points.

As of April 22, 2025, you can now browse cruises online directly through Chase's travel portal. That’s a major upgrade from the old system, which required calling a dedicated agent just to see available options. While you’ll still need to pick up the phone to complete your cruise booking, the ability to now compare itineraries, prices and cruise lines online makes planning far more convenient.

Cruises can be found under a new section called Voyages by Chase Travel, where eligible cardholders can browse sailings from major brands like Royal Caribbean, MSC Cruises, and even luxury lines like Silversea Cruises and Regent Seven Seas Cruises. Some sailings may include special perks like onboard credit, unlimited Starbucks packages or fine dining upgrades — depending on the cruise.

To finish the booking, you’ll still need to call 855-234-2542, but being able to search online is a huge time-saver.

However, we weren’t able to find any cruises with Points Boost pricing, meaning your points will generally be worth 1 cent each when you book through Chase.

How to contact support

To contact customer service for Chase's travel portal, call 866-331-0773. This will give you access to a travel specialist who can assist you 24/7 with any inquiries about your trip.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

On this page

- What is Chase’s travel portal?

- What credit cards can access Chase’s travel portal?

- Should you use Chase’s travel portal?

- How to access Chase's travel portal

- How to find Points Boost bookings

- How to book flights through Chase

- How to book hotels through Chase

- How to book cruises through Chase

- How to contact support

More like this

Related articles