JetBlue Sweet Spots

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When it comes time to cash in all your hard-earned points and miles on award travel with your favorite airline, the goal is generally to get the most bang for your buck — or, rather, the most bang for your points. But how do you do that? What’s the best way to maximize those points so they can take your farther, faster?

Because JetBlue tends to tie the cost to book in points to the dollar cost of airfare, finding a way to maximize your TrueBlue points can be tricky. But we’ll help break it down for you in this guide to JetBlue sweet spots.

How TrueBlue works

We broke down the ins and out of booking flights with TrueBlue points, but suffice it to say that the airline doesn’t publish an award chart. Essentially, JetBlue utilizes a dynamic price structure, which means each award flight is based on the airfare’s cash price.

During peak times when cash prices are higher, award prices also rise. During off-peak travel seasons when cash costs for airfare are lower, TrueBlue costs are also lower which brings us to our first sweet spot.

Nerd Tip: JetBlue is also one of the few airlines that allows you to book with a combination of cash and points — a useful feature if you want to use up points, but don’t have enough to cover the entire cost of your flight.

Sweet Spot #1: Off-peak travel

Plan your travel during the off-season. The definition of off-season can vary by destination, but generally fall and spring are shoulder seasons, while winter (aside from holidays) is often a less popular travel time.

Opt to travel during less popular times of the year for the best deal on award travel.

Sweet Spot #2: Alternate days or times

If you can’t travel in an off-peak season, you may still be able to maximize your points by booking on an “off-peak” time of day or week just by being a bit more flexible with your travel schedule. Keep an eye on the mini-calendar at the top of your flight search screen when browsing for flights to make sure you don’t miss the opportunity to save thousands of TrueBlue points, simply by selecting a different day of the week.

» Learn more: Is the JetBlue Plus card worth its annual fee?

Sweet Spot #3: Book on Hawaiian Airlines using TrueBlue points

Another way to put your TrueBlue points to good use is on a Hawaiian vacation. Hawaiian Airlines is the only partner airline on which you can use TrueBlue points to book, no HawaiianMiles required.

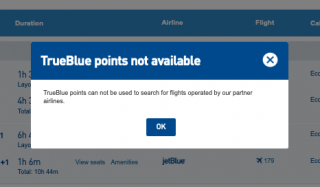

To book with TrueBlue points on Hawaiian, you have to call JetBlue’s reservation line, as booking online with partner airlines using miles results in this error message:

JetBlue doesn’t have an award chart, but Hawaiian does, even if you’re using TrueBlue points. Flights between Hawaiian islands start at 6,000 TrueBlue points per one-way flight, while travel from the West Coast of the U.S. starts at 22,000.

In comparison, that’s actually fewer TrueBlue points than HawaiianMiles for inter-island travel, but slightly more than the lowest-priced HawaiianMiles flight for travel to and from the West Coast.

This type of TrueBlue booking is even sweeter in peak travel months when higher-priced airfare won’t affect how many points you need for travel because you're booking on Hawaiian, not JetBlue.

How to know if you’re getting a good deal

The best way to see if you’re getting an optimal return on the value of your TrueBlue points is to search for the same flight at a different time of the month or year. That will give you an idea of how point prices fluctuate and when might be best to fly.

You can even search using just cash prices since point prices are intrinsically linked to the cash value of the fare (though point values seem to vary between 1.1 cents and 1.5 cents per point in the examples we found). So do a little searching to check and see if you’re getting a good deal.

» Learn More: How much are my JetBlue TrueBlue points worth?

The bottom line

Since JetBlue doesn’t publish an award chart and TrueBlue point prices are based on the cash fare of the same flight, it’s hard to nail down specific JetBlue sweet spots when seeking the best deals and destinations for award travel. But if you’re willing to be flexible with your booking dates, travel during less popular seasons and use your TrueBlue points on Hawaiian Airlines, you can still definitely find a few award travel sweet spots.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2024:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-5%

CashbackUp to $300

2x-5x

Miles75,000

Miles