Ultimate Guide to Your Credit Score and Credit Score Ranges

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Your credit score is a three-digit number from 300 to 850 that is calculated using information from your credit reports.

The two most prominent credit scores are from FICO and VantageScore. Each scoring company weights credit scoring factors differently, producing slightly different scores.

The factors that make the biggest impact on your score are paying on time and credit utilization, or the amount of available credit you're using.

Checking your credit score is free and easy to do.

Credit scores influence many aspects of your life: whether you get a loan or credit card, what interest rate you pay, or whether you get an apartment you want.

A higher credit score can give you access to more credit products — and at lower interest rates. Borrowers with scores above 750 or so frequently have many options, including the ability to qualify for 0% financing on cars and for credit cards with 0% introductory interest rates.

It pays to know how credit scores work and what the credit score ranges are.

What is a credit score?

A credit score is a three-digit number, usually on a scale of 300 to 850, that estimates how likely you are to repay borrowed money and pay bills.

Credit scores are calculated from information about your credit accounts. That data is gathered by credit-reporting agencies, also called credit bureaus, and compiled into your credit reports. The three largest bureaus are Equifax, Experian and TransUnion.

You don't have a single credit score — you have a few, and they probably vary slightly. That's because two major companies calculate scores; more on that below.

The highest credit score you can get is 850, although there's not much difference between a "perfect" score and an excellent score when it comes to the rates and products you can qualify for. In other words: Don't stress over trying to achieve an 850 score, especially because scores tend to fluctuate frequently.

What is the difference between FICO score and VantageScore?

Two companies dominate credit scoring. The FICO score is the most widely known score. Its main competitor is the VantageScore. Generally, they both use a credit score range of 300 to 850.

Each company has several different versions of its scoring formula, too. The scoring models used most often are VantageScore 3.0 and FICO 8.

FICO and VantageScore pull from the same data, weighting the information slightly differently. They tend to move in tandem: If you have an excellent VantageScore, your FICO is likely to be high as well.

Why are my FICO and VantageScore credit scores different?

A score is a snapshot, and the number can vary each time you check it. Your score can vary depending on which credit bureau supplied the credit report data used to generate it, or even when the bureau supplied it. Not every creditor sends account activity to all three bureaus, so your credit report from each one is unique.

What are the credit score ranges?

Creditors set their own standards for what scores they'll accept, but these are general guidelines:

A score of 720 or higher is generally considered excellent credit.

A score of 690 to 719 is considered good credit.

Scores of 630 to 689 are fair credit.

And scores of 629 or below are bad credit.

In addition to your credit score, factors like your income and other debts may play a role in creditors' decisions about whether to approve your application.

FICO score ranges

Here’s how FICO breaks down credit scores:

Below 580: poor.

580 to 669: fair.

670 to 739: good.

740 to 799: very good.

800 and above: exceptional.

VantageScore ranges

VantageScore has slightly different credit score tiers:

300 to 600: subprime.

601 to 660: near prime.

661 to 780: prime.

781 to 850: superprime.

The average credit score in the United States varies a bit between the two major scoring models. The average FICO 8 score was 717 as of October 2023, up one point from a year earlier. The VantageScore 3.0 average was 700 as of October 2023, up six points from a year earlier.

What factors impact your credit scores?

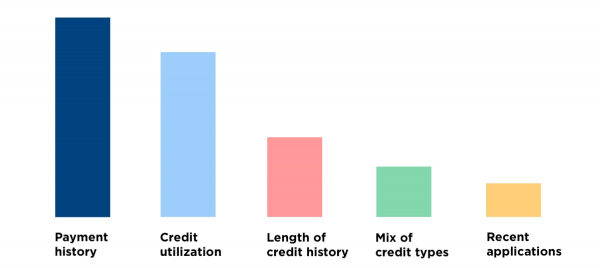

The two main credit scoring models, FICO and VantageScore, consider many of the same factors but weight them somewhat differently.

For both scoring models, the two things that matter most are:

Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or more past the due date stays on your credit history for years.

Credit utilization. This term describes how much of your credit limits you are using. It's good to use less than 30% of your credit limits — lower is better. You can take several steps to lower your credit utilization.

Much less weight goes to these factors, but they're still worth watching:

Credit mix: Scores reward having more than one type of credit — a traditional loan and a credit card, for example.

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

Factors that don’t affect your credit scores

There are some things that are not included in credit score calculations, and these mostly have to do with demographic characteristics.

For example, your race or ethnicity, sex, marital status or age aren’t part of the calculation. Neither is your employment history — which can include things like your salary, title or employer — nor where you live.

How to improve your credit

What does your credit score measure? In one word: creditworthiness. But what does this actually mean? Your credit score is an attempt to predict your financial behaviors. That's why factors that go into your score also point out reliable ways you can build up your score:

Pay all bills on time.

Keep credit card balances under 30% of their limits, and ideally much lower.

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans.

Space out credit applications instead of applying for a lot in a short time. Typically, lenders will initiate a "hard pull" on your credit when you apply, which temporarily dings your score. Too many applications too close together can cause more serious damage.

There are several ways to build credit when you're just starting out and ways to bump up your score once it's established. Doing things like making payments to your credit card balances a few times throughout the month, disputing errors on your credit reports, or asking for higher credit limits can elevate your score.

How can I check and monitor my credit?

You can check your own credit — it's free and doesn't hurt your score — and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0. Many personal banking apps also offer free credit scores, so you can make a habit of checking in when you log in to pay bills.

Remember that scores fluctuate. As long as you keep it in a healthy range, those variations won’t have an impact on your financial well-being.

You can help protect your credit by freezing your credit with each credit bureau. You can still use credit cards, but no one can apply for credit using your personal data because access is blocked when your credit is frozen. Freezing your credit takes only a few minutes, but it goes a long way in protecting your finances.