Best Travel Insurance for Parents Visiting USA

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Visitors to the United States can and should buy travel medical insurance.

U.S. health care costs are the highest in the world, therefore it’s imperative you invest in a travel medical insurance policy to protect you from financial ruin should a medical emergency occur while your parents are traveling to the United States.

Best visitor insurance for parents visiting USA

If your parents are visiting you in the United States, we recommend you get visitor insurance for parents.

You never know when you might need it. A parent could fall and break her hand or maybe experience an acute onset of a pre-existing condition. In that case, you’ll want to be prepared.

Consider the following providers for the best travel insurance for parents visiting the USA.

» Learn more: What to know before buying travel insurance

Atlas America

Atlas America provides comprehensive insurance for non-U.S. citizens traveling outside their country, and it’s a good option to consider when searching for visitor insurance for parents visiting the USA. Trips between five and 364 days long are covered.

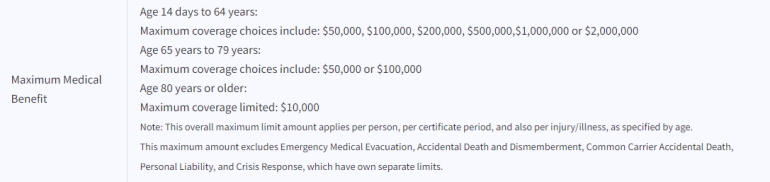

When shopping for coverage, you must select a policy maximum (the amount of money an insurance provider will pay for covered medical expenses) ranging from $50,000 to $2 million.

Depending on the age of your parents, the maximum gets capped. For example, if your parents are in their 70s, the maximum amount available for policy maximum is $100,000. For parents older than 80, it’s reduced to $10,000.

You also have to choose a deductible, which ranges from $0 to $5,000 and affects the total cost of a policy. After you deplete your deductible, the plan covers 100% of the bill up to the policy maximum (as long as you visit in-network providers).

An Atlas America policy includes the following medical expenses:

Optional coverages include (for an upcharge):

Accidental death and dismemberment.

Crisis response with natural disaster evacuation.

Personal liability.

So, let’s consider a sample 30-day trip for a 60-year-old parent visiting you in the United States. The plan includes a $100,000 lifetime maximum and a $500 deductible.

This Atlas America plan prices out at $195.30. The quote doesn’t include any optional coverages.

Atlas America participates in the UnitedHealthcare PPO network, meaning you'll be covered if you find a health provider on the UnitedHealthcare network search.

If you search for coverage through WorldTrips, you’ll find the same Atlas travel medical insurance plan.

» Learn more: The best travel insurance companies

Beacon America

Beacon America provides another option for travel insurance for parents visiting the USA. It covers trips between five and 364 days in length.

Similar to the Atlas America plan, you must select a policy maximum when shopping for coverage, but the range is lower — from $25,000 to $1,100,000. The maximum policy amount is capped at $50,000 for those older than 70 and at $12,000 for those who are older than 80.

Beacon America deductibles range from $0 to $2,500. The plan covers 100% up to the policy maximum after you use up the deductible (for in-network providers). Beacon America also participates in the UnitedHealthcare PPO network.

A Beacon America policy includes the following medical expenses:

You can add an optional sports rider that will provide up to $50,000 maximum coverage for extreme sports, such as mountain biking, horseback riding, white water rafting, snowmobiling or zip-lining.

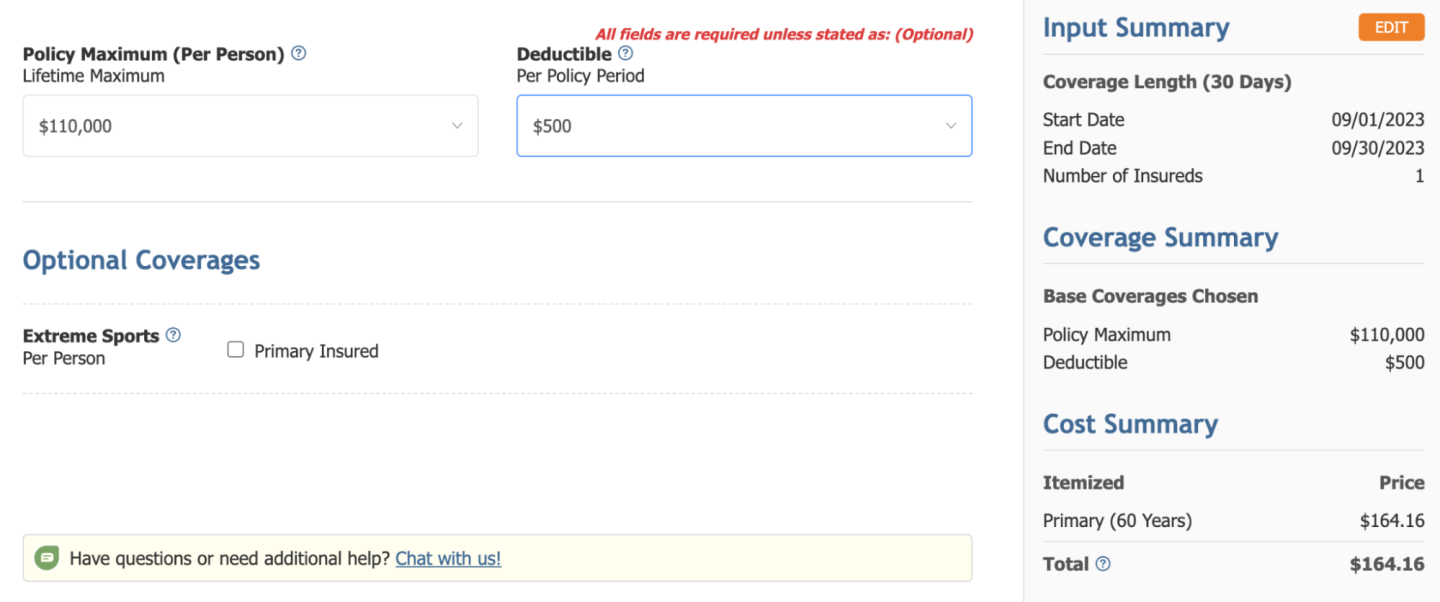

So, let’s search for a plan with the same parameters for visitors insurance for parents as before: a 30-day trip for a 60-year-old parent traveling to the United States. The plan includes a $110,000 lifetime maximum and a $500 deductible.

This Beacon America plan comes out to $164.16, $31 cheaper than the plan offered by Atlas America.

» Learn more: Best travel insurance for seniors

Patriot America Plus

Patriot America Plus from IMG is another option for health insurance for parents visiting the USA. It’s available for trips up to 12 months in length (with an option to extend to 36 months, depending on the plan). Three plans are available under the Patriot America Travel Series: Patriot Lite, Patriot Plus and Patriot Platinum.

You can expect the following coverage with each plan type.

Patriot Lite | Patriot Plus | Patriot Platinum | |

|---|---|---|---|

Policy maximum | Up to $1 million. | Up to $1 million. | Up to $8 million. |

Deductible | $0 to $2,500. | $0 to $2,500. | $0 to $25,000. |

Emergency medical evacuation | $1 million. | $1 million. | Up to policy maximum limit. |

In-network coverage | 100%. | 100%. | 100%. |

Out-of-network coverage | 80% up to $5,000, then 100%. | 80% up to $5,000, then 100%. | 90% up to $5,000, then 100%. |

COVID-19 coverage | No. | Yes. | Yes. |

Acute onset of pre-existing conditions (for travelers under the age of 70) | No. | Yes. | Yes. |

Telehealth | No. | No. | Yes. |

Evacuation Plus | No. | No. | Yes. |

The Patriot plans include the following:

Once again, Patriot plans from IMG provide U.S. travelers with access to the UnitedHealthcare network.

Patriot plans provide some travel protections, such as lost luggage and terrorism, as well. With a Patriot America Plus plan, you can also add an optional device protection rider to cover your cell phone and a supplemental adventure sports rider.

A 30-day Patriot Plus plan with a $100,000 policy maximum and a $500 deductible comes out to $165.78 for a 60-year-old female resident of Mexico traveling to the United States.

» Learn more: Best long-term travel insurance

Safe Travels USA

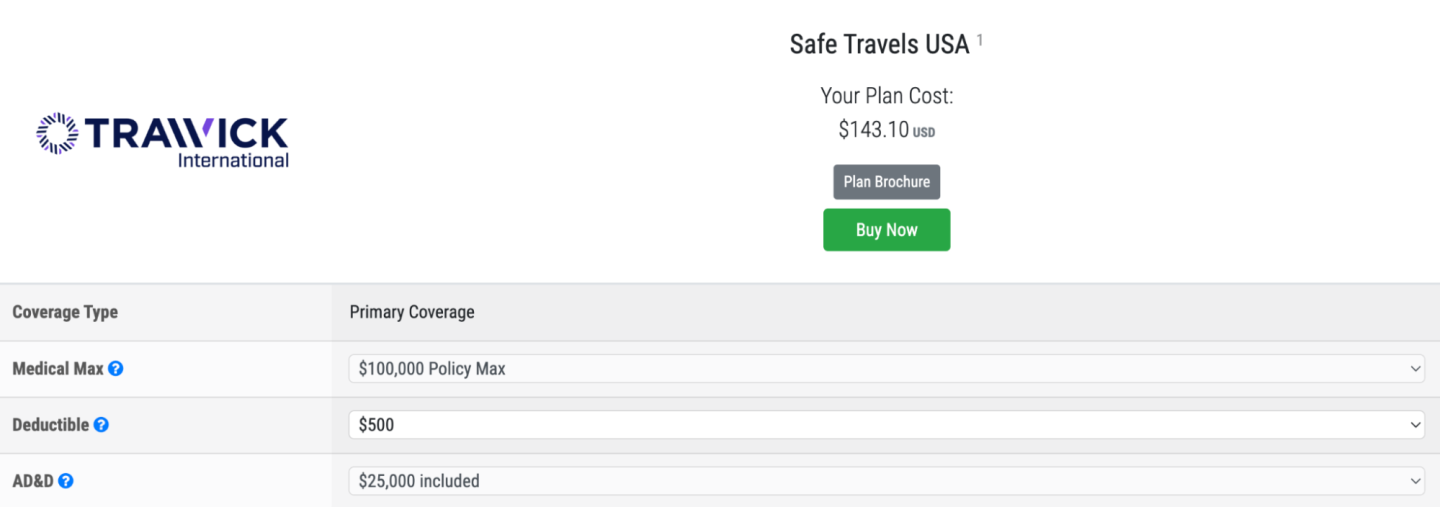

Safe Travels USA from Trawick International covers non-U.S. citizens traveling to other countries, including the United States. In fact, this plan isn’t available to U.S. residents and Green Card holders. The coverage duration is between five days and 364 days.

Policy maximum amounts range from $50,000 to $1 million, and deductibles vary between $0 and $5,000. Safe Travels USA plans are in the First Health network.

A Safe Travels USA plan includes the following medical expenses:

Safe Travels USA considers COVID-19 to be any other illness, meaning the medical coverage includes sicknesses related to the virus. Also, trip protection benefits, such as trip interruption, lost baggage, and accidental death and dismemberment, are included.

You can add a supplementary sports activity coverage for injuries sustained during archery, tennis, swimming, golf, basketball and other sports listed in the policy. Return to home country coverage is also optional (if your trip is longer than 30 days).

The Safe Travels USA plan with a maximum limit of $100,000 and a $500 deductible will cost $143.10 for a 60-year-old parent from Mexico.

CoverAmerica-Gold

CoverAmerica-Gold is a comprehensive travel medical insurance plan from Sirius Specialty Insurance Corporation for non-U.S. residents visiting the United States. Like other insurance providers, you can purchase coverage for at least five days and, at most, 365 days (with an option to extend by another 365 days). The CoverAmerica-Gold plan is available to parents up to 79 years old.

Maximum policy coverage ranges from $50,000 to $250,000, and the deductible ranges from $100 to $5,000, so there’s no option to pick a $0 deductible like with other plans mentioned above. CoverAmerica-Gold participates in the UnitedHealthcare PPO network.

A CoverAmerica-Gold policy includes the following medical expenses:

Physician visits.

COVID-19 expenses.

Diagnostic X-rays and lab services.

Inpatient surgical treatment.

Hospital room and board.

Acute onset for pre-existing conditions (for visitors younger than 70 years old, coverage up to $3,000 for ages 70 to 79).

Emergency dental treatment (up to $250).

Urgent care consultations incur a $15 copay.

The CoverAmerica-Gold insurance plan also offers travel benefits, such as trip interruption, emergency medical evacuation and return of mortal remains. An adventure sports rider is also available as an optional add-on.

The CoverAmerica-Gold policy with the same maximum limit of $100,000 and a $500 deductible will set a 60-year-old visitor from Mexico back $191.10.

» Learn more: The best travel credit cards right now

Visitors insurance for parents recapped

Getting reunited with family is a great feeling, especially when you live far away and the visits are rare. However, you don’t want your parents’ stay in the United States to be overshadowed by huge medical bills should an accident or a medical emergency occur.

If you want COVID-19 coverage to be included, go with Patriot America’s Plus and Platinum plans. Safe Travels USA and CoverAmerica-Gold also provide COVID-19 medical coverage.

If you're familiar with the UnitedHealthcare PPO network, Atlas America, Beacon America, CoverAmerica-Gold and Patriot America Plus are all on that network.

For those looking for extra travel protections, Patriot America Plus, Safe Travels USA and CoverAmerica-Gold are safe choices for parents’ insurance visiting the USA.

And remember to shop around and compare options as the length of the visit, policy maximums and deductibles will determine the final plan cost.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points