A Guide to Capital One Premier Collection Hotels

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Capital One credit card holders are eligible for extra benefits when booking a hotel stay through this exclusive new hotel reservations platform.

Launched in late 2022, the Capital One Premier Collection includes hotels around the world, including The Ned NoMad and Pendry Manhattan West in New York and the Conservatorium Hotel in Amsterdam.

Like the American Express Fine Hotels and Resorts program, this platform is similar to a travel agency but open only to those with a Capital One card. Making a reservation through this portal has extra perks like daily breakfast and a welcome gift.

Most of the hotels in the program represent high-end brands and boutique collections. These include The Leading Hotels of the World, Preferred Hotels & Resorts, Design Hotels and Small Luxury Hotels of the World.

Here’s what you need to know about Capital One Premier Collection hotels and how to benefit from the program.

Which credit cards have Capital One Premier Collection access?

The only cards with access to the Capital One Premier Collection are the Capital One Venture X Rewards Credit Card and the Capital One Venture X Business Card. This makes it an exclusive perk reserved for those paying the $395 annual fee.

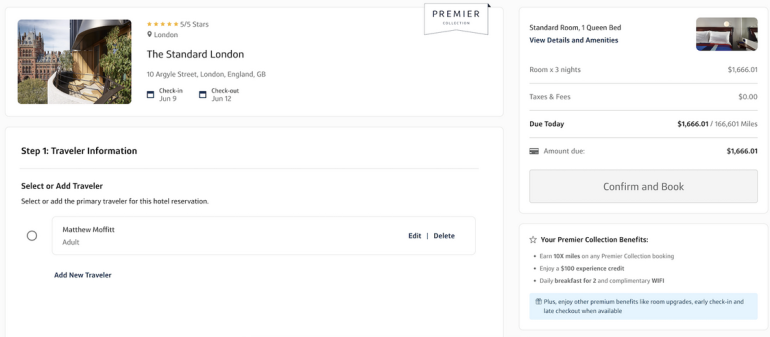

To be eligible for the extra hotel amenities, you have to use this card and book directly through the Capital One Premier Collection hotel portal.

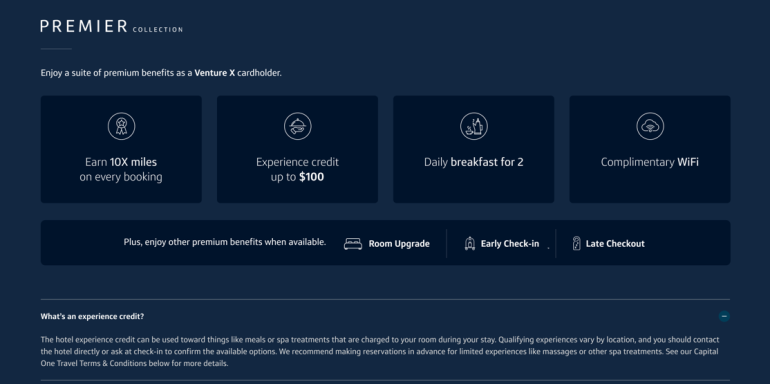

Capital One Premier Collection benefits

If you want to boost your mileage balance with the credit card, one of the best benefits is the ability to earn 10x Capital One miles per dollar spent on a hotel reservation made through this portal.

Because the portal is considered a third party, you likely won’t earn hotel elite status perks in a hotel loyalty program, but you will get many of those same benefits from the Capital One Premier Collection, including:

Daily breakfast for two.

Space-available room upgrade.

Early check-in and late checkout, if available.

$100 experience credit to use during the stay.

Free Wi-Fi.

10x Capital One miles.

Upgrades can look different at each property, ranging from an improved view to a larger room or suite. Either way, it’s a welcome perk.

It's nice not to pay extra for Wi-Fi, and in many hotels, the free breakfast for two can add up to quite a bit of savings. A more sizable amenity is the $100 credit for an experience, which could mean a food and beverage credit, spa credit or another on-property experience.

Benefits vary depending on the property, and they are not displayed on the website’s booking portal. To eliminate the mystery, you can contact the hotel in advance and ask (indicating you are booking through the Capital One Premier Collection program).

It's wise to compare prices because many hotel companies have best rate guarantees or member-only discounts on their websites. However, these would not include the host of benefits that come with Capital One’s Premier Collection hotels.

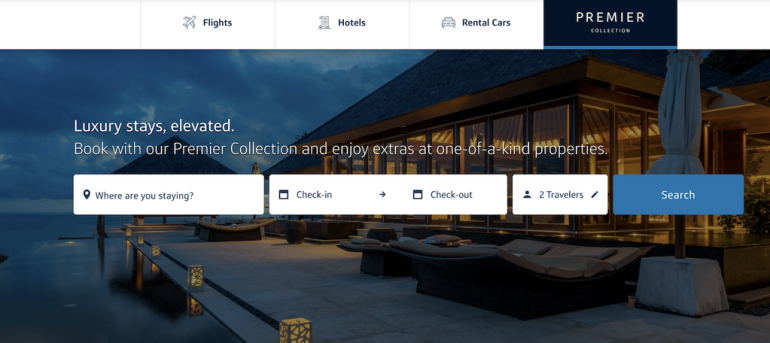

How do you make a Capital One Premier Collection reservation?

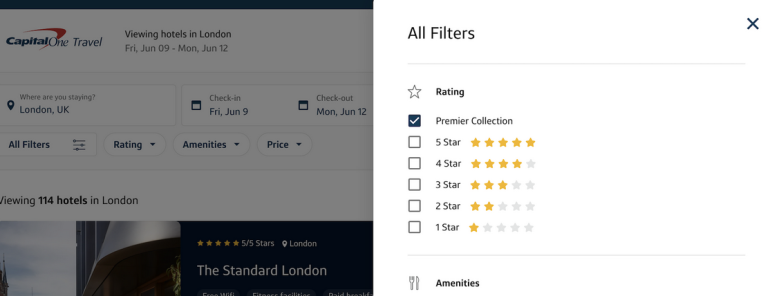

To make a reservation, log in to the Capital One Travel website and click on the Premier Collection tab to see participating hotels. Enter your destination details and dates to see a list and map display of available hotels. Filters are available for specific price points and hotel types.

You can read more about the hotel’s amenities, location and benefits for booking via this portal. Another feature allows you to pay in cash or choose to pay with Capital One miles (at a ratio of 10 miles per dollar spent) to cover the cost of the stay. Either way, you will receive the same benefits when making the reservation via this website.

It is important to read through the cancellation details before confirming because the policies vary by hotel. And it’s important to note that as many as four rooms can be booked through this program and receive the benefits, but the cardmember must stay in one of the rooms.

What if I already have elite status with a loyalty program?

This is where things get a bit tricky. Many people value having hotel loyalty program elite status because it can deliver substantial perks. If you're booking with a boutique hotel where you might not be able to use loyalty program benefits, this portal can provide extra perks.

But if you're booking with a brand hotel, it is not always clear whether you will receive the loyalty points in the program when booking through Capital One. Because this is a third-party service, some hotel brands may not supply points for every dollar you spend.

They also may not honor elite status benefits. You’ll want to weigh the perks you receive with a hotel elite status versus the perks with Capital One before booking with a hotel where you have elite status. If you have elite status with a hotel brand, you may be able to double dip, but this is not a guarantee.

When to book with Capital One Premier Collection hotels

The Capital One Premier Collection portal can provide substantial value, so it makes sense to compare the cost of the hotel on its own website with the cost via Capital One. If you have elite status with a brand, factor those perks into the equation to decide where you will get the most value.

It’s not always a guarantee you will get hotel loyalty points when booking through the Capital One Premier Collection portal. Use the portal to book with independent or boutique hotels where you may otherwise not get elite status perks. After a little homework on your part, this portal can be a valuable way to improve your stay on your next trip.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

2x-5x

Miles75,000

Miles1%-10%

Cashback$200

2x-10x

Miles75,000

Miles