Your Financial Health

Understand where you are in your journey so you know what steps to take next.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Financial health simply measures your ability to handle financial stressors and reach your long-term goals. The areas of financial health typically considered are:

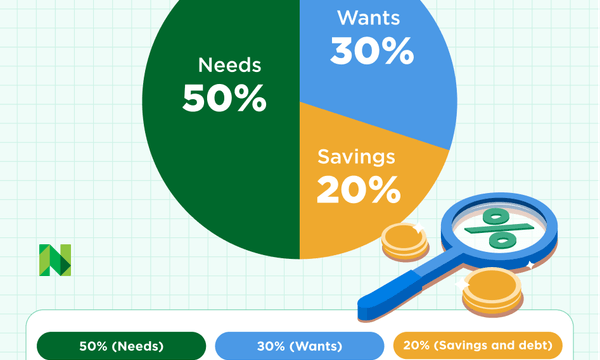

- Savings and debt paydown: Are you able to cover your needs, your wants and still have enough to build savings and pay down debt over time? The 50/30/20 budget is a good measure.

- Debt-to-income ratio: This comparison of your monthly debt payments to your monthly gross income gives you a good idea of how manageable your debt load is. It's also a common measure used by creditors in making approval decisions.

- Credit score: Even if you don't plan to apply for more credit, a good or excellent score can play a role in things like apartment applications, insurance costs, utility deposits and more.

- Emergency fund: Having enough in the bank to weather financial shocks protects you from debt spirals and the credit score damage that comes from missing bill payments.

- Insurance: This protects assets — such as vehicles, personal possessions and your home — and it also protects dependents in case you're unable to work.

- Financial planning: Staying financially healthy means saving toward retirement, working on estate planning and more.

Meet MoneyNerd, your weekly news decoder

So much news. So little time. NerdWallet's new weekly newsletter makes sense of the headlines that affect your wallet.

How to improve your financial health

For most people, attaining financial health is a journey — one that lasts a lifetime. Very few people are lucky enough to have instant security from generational wealth or a massive lottery jackpot.

Instead, the progression tends to look like this: build a foundation, stack up wins and make the most of your money,

Build a foundation

Strengthening foundations includes creating an emergency fund, building your credit score and balancing spending and expenses. It's never too early — or late — to start planning for retirement, so that your savings have time to take advantage of the magic of compound interest.

These guides can help you handle basics, like choosing a bank, getting some savings going and learning how to manage money:

- Emergency Fund: What It Is and How to Build One: Research shows that even a few hundred dollars in reserve can mean budget shocks don’t derail your life.

- How to Build a Budget: A plan for maximizing your money doesn’t have to be complex.

- What You Need to Know About Building Credit: Building your score can save you money and let you borrow at better rates.

» MORE: Get your free credit score with NerdWallet

Setbacks can hit anyone, at any time. If you're having trouble keeping up with your bills and don’t have a financial cushion, explore these resources that may help you and lay the groundwork for greater financial security:

- How to Pay Bills When You Can’t Pay Your Bills: If you can't cover everything, check out these sources of help and strategies to minimize the fallout.

- 6 Ways to Get Free Money From the Government: Programs include help with utility costs, child care, college — even help with a down payment on a house.

- Beware of Predatory Lenders: Know the warning signs of a toxic loan.

Stack up wins

As you gain momentum, continue to grow your financial stability. This could mean things like paying down debt balances and knowing what your needs will be in retirement. Paying bills on time and keeping track of your credit score can help push it higher, which gives you more financial choice.

You may be thriving in some areas but not yet on top of others. Here are ways to address possible financial pain points and shore up your security.

Manage debt

- Tools and Tips to Pay Off Debt: Learn strategies to speed up debt payoff.

- Understanding Debt Relief: Struggling with debt? Learn options for help, plus their pros and cons.

Build your credit score

- How to Build Credit Fast: Adding more points to your score saves you money and unlocks access to things you want.

- How to Rebuild Your Credit: If you’ve made some missteps, you can recover — these strategies will help.

Work toward financial goals

- How to Manage Your Money: These strategies help you make sure each dollar does the most for you.

- Intro to Retirement Planning: Start where you are and with what you have. Every bit helps.

- Beginner Guide to Investing: What to know about goals, timelines and the amount of risk that makes sense for you.

- College Savings Strategies: Explore the ways you can set aside money over time and find the best plan.

Save for a home

- First-Time Home Buyer Guide: Those new to the housing market have some key help.

- Buying a Home With Bad Credit: It is possible — here’s what to know.

- How to Save for a Down Payment: You might not need as much as you think.

- Down Payment Assistance: Getting Help Buying a House: These programs can help, even if you’re not new to the housing market.

- How Much House Can I Afford? Enter your income, monthly debt payments, and down payment to get your answer.

Make the most of your money

Those who are financially healthy are successfully managing all aspects of their financial life. They have good to excellent credit, a handle on debt, an emergency fund and a retirement fund. The goal for you, if you fall in this category, is staying the course and reaching your financial goals.

Here are some resources to maximize your efforts and ensure you’re getting the most out of the optimal position you’re in.

Maintain financial health

- The Benefits of Diversification: Why financial pros suggest you spread investment dollars across a range of assets to reduce investment risk.

- Choosing a Financial Advisor: Find a professional to help you meet your goals.

Save and invest for retirement

- The Best Retirement Investments: It’s all about how you account for savings in your budget.

- IRAs vs. 401(k): How to Choose: How to weigh what account is best for you.

- How to Invest in Stocks: Get started with an online brokerage account — it’s easier than you might think.

- Best Investments for Any Age or Income: Fine-tune your approach, depending on your circumstances.

- Choosing the Best Index Funds: It all starts with deciding a goal for your money.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles