Table of Contents

Your business credit card statement is a summary of everything that has happened on your business credit card account over the past month.

Understanding your business credit card statement and knowing what to check will help you get the most from your company credit card and ensure you don’t pay more charges or interest than necessary.

» MORE: Compare business credit cards

How and when do I get my business credit card statement?

Your business credit card provider will issue a statement once a month. How you get your credit card statement will depend on your account settings.

You will either receive a paper statement in the post, or it will be issued digitally.

If you have opted to go paperless, your statement will appear in your online account each month. You should also receive an email telling you it is ready to view.

What is on a business credit card statement?

If you are the primary cardholder and your employees have expense cards on your account, you will get an itemised credit card statement detailing the spending on each employee card.

This can help you monitor how and where your employees are spending money, which in turn should give you a better sense of your overall business spending. Your primary cardholder statement also details your business’s overall account position and any fees and charges owed by the business.

Each cardholder will also get their own statement so they can review their spending and check that everything is in order.

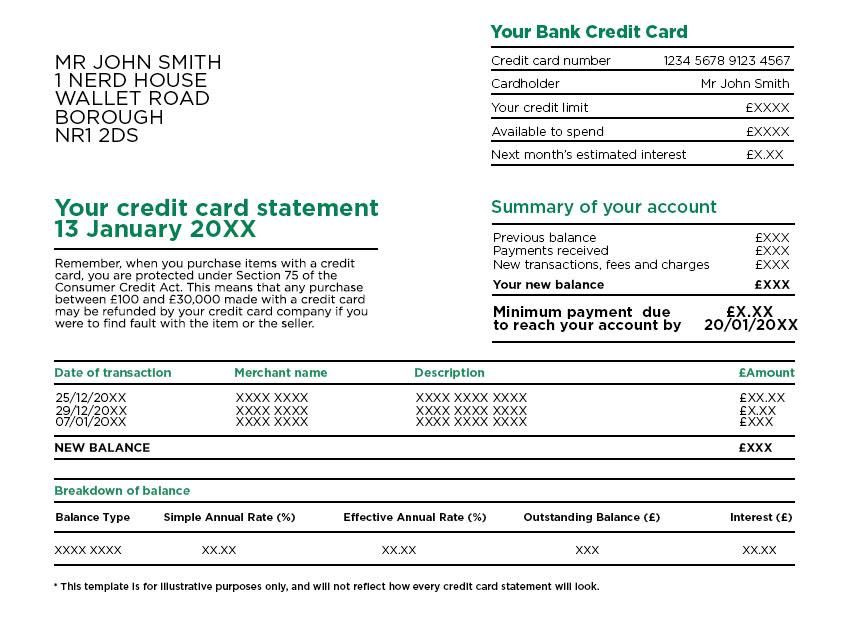

Generally speaking, credit card statements follow a similar pattern and may look something like this:

Your business credit card statement tells you:

- Your balance: This is how much you owed on your business credit card on the date the statement was created.

- Minimum payment due: This is the smallest amount you need to pay in order to avoid penalty charges.

- Payment due date: This is the date by which you need to make at least the minimum payment, otherwise you’ll be charged late fees.

- Balance breakdown: This shows what type of transactions have been made and their respective interest rates. For example, you may pay a different rate for overseas transactions and cash withdrawals.

- Outstanding balance: Here you can see where any balance that wasn’t paid off last month has been carried over onto this statement.

- Your credit limit: This is the maximum amount you are allowed to owe on your credit card at any time.

- Transactions: There will be a list of any transactions on your credit card since your last statement. This should show the date the transaction occurred and a brief description, such as the name of the retailer and how much was spent. You will also see any payments you made towards what you owe in this list.

- Summary box: This contains key information related to your business credit card, such as any upcoming changes to your interest rates.

In addition to these monthly statements, you will also get an annual statement summarising the activity on your account over the past year.

What to look for on your business credit card statement

You must check your business credit card statement each month. This way, you can spot any mistakes or suspicious activity on your business credit card account.

Regularly checking your statement also makes it easier to keep on top of repayments.

Paying back what you owe on time is essential for building your business credit score. If you fail to make at least the minimum business credit card repayment on time, your business credit score will suffer.

Here’s what to watch out for on your business credit card statement:

Fees and charges

Check your credit card statement to see if you were charged any fees last month. If there are any, check to see if they were charged correctly. Did you go over your credit limit, were you late paying the minimum payment last month, or did you forget to pay?

Remember that unless you have a business credit card designed for overseas spending, you could be charged extra for transactions in foreign currencies. Business credit card cash advances (where you use your business credit card to withdraw money at an ATM) also tend to come with extra fees.

If you think any of the fees have been charged in error, query them with your credit card provider. If, on the other hand, they were charged correctly, think about how you can avoid these fees in the future.

To avoid missing a payment or making late payments, consider setting up a direct debit to pay off at least the minimum amount on your business credit card each month. That way, you’ll never pay a late penalty again – and you won’t need to worry about your business credit score suffering because you failed to pay your credit card debts on time.

(If you’re able, you should always try to pay more than your minimum monthly payment. This will reduce the amount of interest you pay and help you clear your debt faster. And ideally, you should aim to pay off your balance in full each month, which means you’ll avoid interest charges altogether.)

Suspicious payments

Read over your transactions and highlight any you don’t recognise. Do the same for any charges where the amount is more than you expected.

If you don’t recognise a retailer, try doing a quick internet search, as some businesses will appear on your statement with a name you may not be familiar with. If you still don’t recognise the transaction, get in touch with your credit card issuer immediately.

Your balance

If you aren’t clearing your credit card in full each month, keep an eye on your balance. Monitoring the amount you owe will help you avoid building up more debt than your business can afford to repay.

If you worry that your balance is getting too high, try to limit your card use, rein in employee spending, and make an effort to pay off some, or all, of your business’s debt.

If you provided a personal guarantee as part of your business credit card application, then remember that you will be personally liable for any debts your business can’t afford to pay. Your personal credit score could also be impacted if your business struggles to repay what it owes.

Interest rates

Check what interest rates you are paying on your outstanding debt. Has a promotional deal, like an initial 0% purchase period, run out? You may be able to apply for another credit card with a lower interest rate if you think your business is paying over the odds.

And remember that you can avoid paying interest on your business credit card altogether if you clear your balance in full and on time each month.

Employee spending

If your employees have their own expense cards tied to your business credit card account, then it’s on you to keep on top of employee spending.

Set clear guidelines so your employees know what they can and can’t use the card for, and take advantage of your card’s expense management tools to monitor how business credit cards are being used.

You will also be able to see a breakdown of employee spending on your monthly card statement. This is your chance to make sure spending lines up with your expectations so you can nip any issues in the bud.

Image Source: Getty Images