What money problems are people in the UK struggling with the most, and where?

Jump to

- What money problems are people in the UK struggling with the most, and where?

- Cost of living: Who is searching the most?

- Common cost of living questions answered by our Personal Finance expert, Adam French

- Scams – which cities are the most concerned?

- Common scams questions answered by our Personal Finance expert, Rhiannon Philps

- Inflation – which cities are the most concerned?

- Common inflation questions answered by our Personal Finance expert, Adam French

- Credit score – which cities are the most concerned?

- Common credit score questions answered by our Personal Finance expert, Rhiannon Philps

- Debt – which cities are the most concerned?

- Common debt questions answered by our Personal Finance expert, Rhiannon Philps

- Mortgages – which cities are the most concerned?

- Common mortgage questions answered by our Personal Finance expert, Tim Leonard

- Loans – which cities are the most concerned?

- Common loans questions answered by our Personal Finance expert, Rhiannon Philps

- Methodology and data sources:

Money worries can be daunting and very personal. Many of us will do our own online research, before choosing to discuss our financial problems with family members, friends or even debt help services.

A recent report from Citizens Advice revealed that in the last quarter of 2022, one in two people it helped with debt advice were in a ‘negative budget’, meaning the cost of essentials was more than their income.

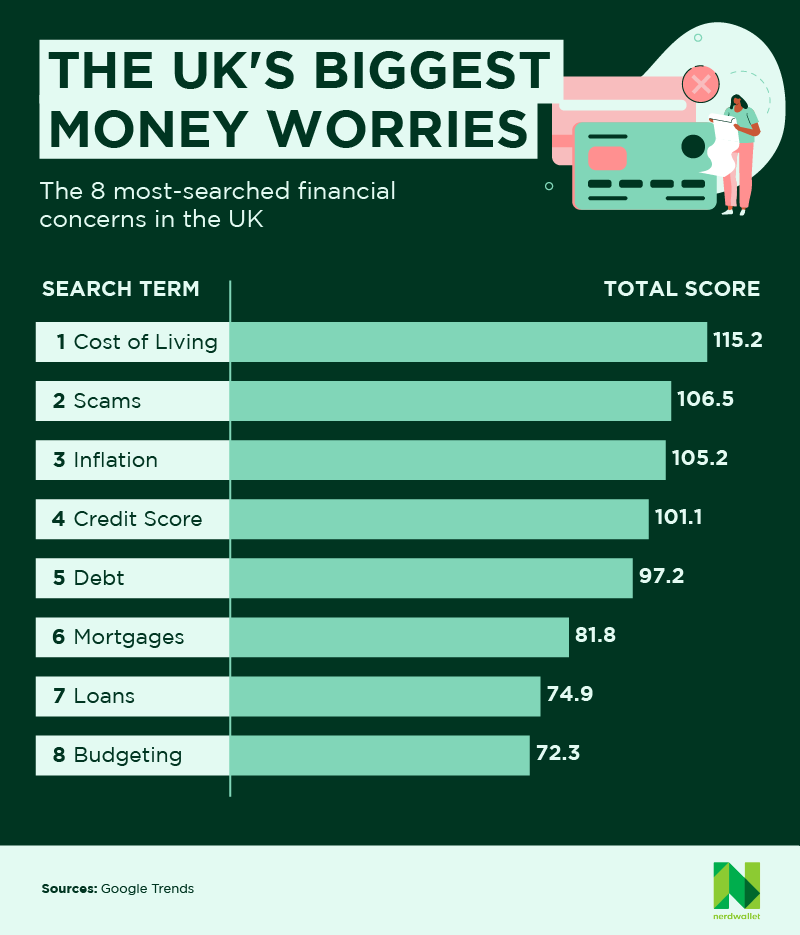

With this in mind, at NerdWallet, our team of experts has looked into what financial struggles are the most pressing across the UK, using Google Trends data to determine the most searched-for concerns in 25 major cities.

Each keyword has been scored across each city by using a ranking function to score the Google trend figures out of 10 and then to determine the most worrying factor for individuals across the UK as a whole these scores were added up to reveal a score out of 250.

Unsurprisingly, as a result of the current financial climate and inflation, the ‘cost of living’ (total score of 115.2) arose as the biggest financial concern for Brits, followed in second by ‘Scams’ (total score of 106.5).

Every year the Financial Ombudsman Service, which settles complaints between consumers and financial services providers, sees thousands of complaints involving fraud and scams. These range from disputed card transactions and cash-machine withdrawals to online banking fraud and identity theft, all of which can cause financial and emotional damage.

Cost of living: Who is searching the most?

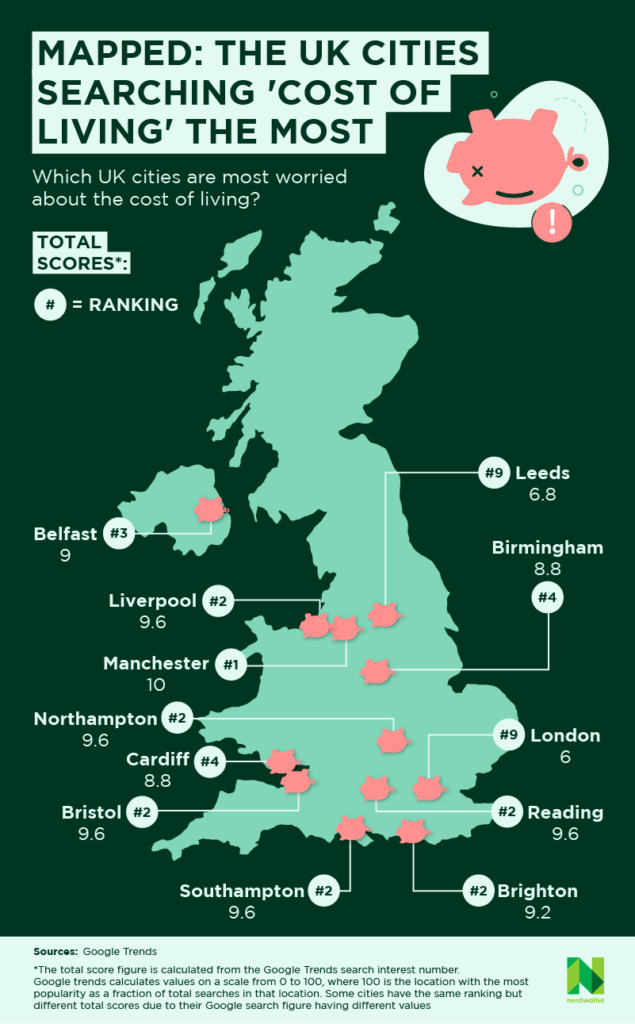

With rising prices squeezing household budgets the cost of living is a concern at the forefront of many people’s minds. However, some cities are more troubled by it than others.

It has been revealed that the ‘cost of living’ is the most-searched-for money worry in Manchester scoring 10/10.

The cost of living emerged as the second most-searched money worry for a number of cities, including Liverpool, Bristol, Southampton, Northampton, Reading (scoring 9.6/10) and Brighton (scoring 9.2/10).

Interestingly, the least concerned cities were Leeds and London, where it was the ninth most searched, Edinburgh the 13th and Glasgow the 16th.

Common cost of living questions answered by our Personal Finance expert, Adam French

What cost of living help can I get?

“There are a few options available to help ease the impact of the cost of living in the UK, including Cost of Living Payments designed to support those on a low income.

“People eligible for the cost of living payment will be receiving certain benefits or tax credits, including universal credit, income-based jobseeker’s allowance (JSA), income-related employment and support allowance (ESA), income support, pension credit, child tax credit and working tax credit.”

Are cost of living payments still being made?

“Around 8 million families will receive the cost of living payments over the next year until spring 2024, which will be made in three instalments of £301, £300 and £299, totalling £900. There will also be a separate disability payment of £150 in the summer of 2023 and a pensioner payment of £300 in the winter of 2023/24.”

Can the cost of living decrease?

“The cost of living will fall when wages increase at a faster rate than inflation, meaning households have more disposable income. Inflation is expected to fall this year, but prices will still rise – just at a slower pace. Households may not see a real term increase in income until 2024.”

Why is the cost of living so high in the UK?

“The cost of living has been impacted by a number of factors, including the financial strain of Covid-19, a shortage of goods, materials and workers as the UK navigates through Brexit, and increased energy and food costs as a result of the war in Ukraine.”

Scams – which cities are the most concerned?

Scams are becoming more advanced and believable, getting access to us through text, emails, social media and phone calls.

According to UK Finance data, in the first half of 2022 alone, criminals stole a total of £609.8 million through scams.

Citizens Advice has warned that more than three quarters of UK adults had been targeted by a scam in 2022 – a 14% increase compared with 2021.

From a missed parcel redelivery scam to a council tax repayment scam, which cities are the most concerned?

‘Scams’ were the most alarming money worry for those living in London, Birmingham, Derby and Brighton, all scoring 10/10.

For Glasgow, scams were the second most searched (scoring 9.2/10), with Northampton third (scoring 9.2/10), and Nottingham fourth (scoring 8.8/10).

Leicester and Edinburgh were the least concerned about scams, with searches coming 12th and 13th in these cities.

» MORE: Cost of living scams

Common scams questions answered by our Personal Finance expert, Rhiannon Philps

Are scams increasing?

“Scammers are working hard to exploit the cost of living crisis and take advantage of our growing financial vulnerability.

“In June last year, Citizens Advice warned that more than three quarters of UK adults were targeted by a scam in 2022, a 14% increase on the previous year.”

How do you know if you’re being scammed?

“Look out for spelling mistakes and inconsistencies, an urgent tone or message that requires urgent action, requests for personal or sensitive information or being contacted by someone you don’t know unexpectedly are all hallmarks of a scam.”

What are the most common scams to be aware of?

“A report by Citizens Advice found the most common scams include postal, delivery or courier scams (55%), pretending to be from the government or HMRC (41%) fake investments or ‘get rich quick’ schemes (29%), rebates and refunds (28%), banking (27%), online shopping (24%), health or medical (13%), and energy scams (12%).”

Inflation – which cities are the most concerned?

Inflation is hurting households across the UK, with the latest figure at 10.1% in March, meaning products are almost the most expensive they have been for the last 40 years.

‘Inflation’ tops the table as the most concerning financial worry for those living in Glasgow, Edinburgh, Cardiff and Belfast, with all five cities scoring 10/10.

The topic also emerged as the second biggest financial concern in Derby and Portsmouth, with both scoring 9.6/10.

In Birmingham, worries surrounding inflation were the eighth highest, suggesting that Brummies’ financial worries may lie elsewhere.

Common inflation questions answered by our Personal Finance expert, Adam French

What inflation is and how it affects consumers?

“Inflation is a term used to describe the rate at which prices of products and services have increased, given as a percentage change over the past 12 months. Rising prices hit the purchasing power of many of us because our money is buying less than it did before.

“The government has set the Bank of England a target of keeping inflation at 2% so it can deliver sustainable growth and employment.”

Are inflation rates rising?

“The annual rate of inflation reached 11.1% in October 2022, a 41-year high, but the inflation rate is expected to fall in 2023. In March 2023 it fell slightly to 10.1%, down from 10.4% in February.”

Can inflation cause a recession?

“A recession can be caused by multiple different factors such as high-interest rates, a fall in confidence, a fall in bank lending and a decline in investment as well as natural disasters or armed conflict.

“Central banks raise interest rates to combat rising inflation aiming to slow the economy, reducing consumer and business demand and allowing prices to stabilise. But it can increase the likelihood of a recession.”

Why is inflation so high?

“It is in part due to the increasing costs and demand of consumer goods alongside the supply chain disruption the UK is facing, plus the ongoing uncertainty around our energy supply.

“Food costs are also rising sharply, reaching a 45-year high in February 2023, with prices 18% higher compared to the year before.”

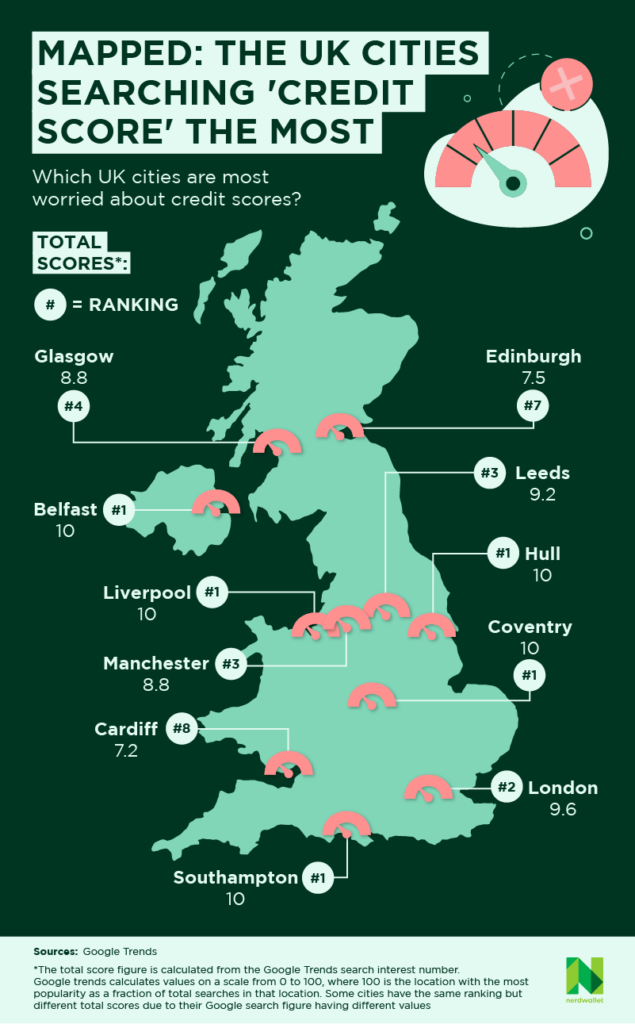

Credit score – which cities are the most concerned?

A bad credit score can be concerning for many reasons, and it can mean you’re unable to qualify for credit cards, loans and even mortgages.

‘Credit score’ emerged as the most searched-for financial concern of people living in Liverpool, Coventry, Belfast, Hull, and Southampton with all five cities scoring 10/10.

While other cities had other financial worries that came before their credit score, Londoners still had it as their second biggest financial concern, scoring 9.6/10.

For those living in Leeds (scoring 9.2/10) and Manchester (scoring 8.8/10), it was their third most searched worry. Residents in Glasgow had a score of 8.8/10, making credit scores their fourth most searched financial concern.

Common credit score questions answered by our Personal Finance expert, Rhiannon Philps

Are credit scores important?

“The higher your credit score, the more likely it is you’ll get the best credit card, loan and mortgage deals because you look like less of a risk to potential lenders.

“Having a good credit score increases your chances of qualifying for the best interest rates, meaning you can borrow money for less. You can easily check your credit score for free, and if it isn’t in the best shape there are steps you can take to help improve it.”

Does your credit score affect your mortgage offer?

“The chances of securing a mortgage will be affected by your credit score. If your credit score is poor, you may find it harder to get a mortgage.

“Some lenders do offer mortgages designed for people with a bad credit history, but these usually include higher interest rates and fees.”

Does your credit score affect car insurance?

“Having a bad credit score can mean that you can pay more for your car insurance, as providers might assume that those with bad credit are unreliable at making payments and, therefore, are higher-risk customers.”

Debt – which cities are the most concerned?

With the average total of debt per household in the UK at £65,434 in January 2023, it’s unsurprising that debt is a worrying burden on many individuals’ minds.

With fewer people able to save money for a rainy day, many households may have concerns about managing or falling into debt.

According to findings from our Household Debt Report last year, almost three quarters (74%) of consumers in debt feared becoming trapped by debt in the future.

So, which cities are the most concerned about their debt?

‘Debt’ is the biggest financial worry for residents in Sheffield, with those living in the ‘Steel City’ scoring 10/10.

For Liverpool, Southampton and Bradford (scoring 8.8/10) debt was their fourth most searched-for concern, and while it isn’t their biggest financial worry, it’s still on their priority list.

The cities of Northampton and Nottingham were also less consumed by debt worries, with debt being the fifth most searched-for topic, scoring 8.4/10.

Common debt questions answered by our Personal Finance expert, Rhiannon Philps

Can debt collectors add fees?

“It is unlikely a debt collector will add interest to your debt, however, in some cases a debt collector may continue adding interest and charges, such as if the debt is still owned by the original creditor, but only amounts that were agreed in the original contract can be added.”

What are debt consolidation loans?

“Getting a debt consolidation loan is a way of paying off your existing debt with one new loan and can enable you to reduce the interest rate, monthly payment amount or number of companies you owe money to. But missing a payment on a debt consolidation loan can cause even more significant damage to your credit score.

“It isn’t the right option for everyone, and it may not be an option at all if you have a poor credit history. It’s important you seek impartial advice before heading down this path.”

Will debt collectors take you to court?

“If you can’t reach an agreement with a debt collector or your original creditors to repay a debt, they can take you to court. But they do have to follow strict procedures to do this and it’s usually a last resort.”

Mortgages – which cities are the most concerned?

Mortgages and their repayments are not the number one worry for any city, with the 25 cities we researched deeming other financial products more important.

Those living in Nottingham, Bradford (both scoring 9.6/10) and Brighton (scoring 9.2/10) were the most concerned about their mortgage payments, with it being their second most searched financial worry.

Mortgages are slightly less of a worry, but still on the high priority list for those living in Hull (scoring 8.8/10) and Glasgow (scoring 8/10), as it emerges as the fourth most searched financial worry.

Alternatively, some cities have far more pressing financial concerns than their mortgages, but are still searching for it online with Leicester (seventh), Manchester and Belfast (eighth), and Birmingham and Bristol (ninth).

Common mortgage questions answered by our Personal Finance expert, Tim Leonard

How do mortgages work?

“A mortgage is a loan that helps you purchase a property. Usually, you’ll need to have a deposit of at least 5% of the property value, and the rest of the money towards the purchase can be borrowed from a mortgage lender and repaid over an agreed amount of years.

“However the bigger the deposit you can put down, the better. A higher percentage deposit will usually unlock cheaper deals, lower monthly repayments and potentially improve the chances of your application being accepted by improving the affordability of the mortgage. Although saving the money for a deposit in the first place isn’t an easy task for many first-time buyers.”

Can mortgages be paid off early?

“You can pay a mortgage off early by making larger payments than you agreed, however, it’s important your lender agrees to these overpayments as sometimes it can result in a fee.

“Overpaying a mortgage is one of the most common ways of paying back your mortgage early.”

Are mortgages fixed or variable?

“Mortgages can be fixed or variable rate. A fixed-rate mortgage means that the interest you are charged will not change for a set number of years – this is usually between two and five years, but can be longer. In contrast, a variable rate mortgage means that the interest rate you pay can change frequently, depending on the base rate it is tracking.”

Are mortgages secured or unsecured?

A mortgage is a secured loan, which means that the property itself can be used as collateral. This means that if you cannot afford to repay your monthly amount it can repossessed by the lender to claim back the money they are owed.

Loans – which cities are the most concerned?

Similarly to mortgages, loans didn’t qualify as the biggest financial concern for any city, with credit cards, scams, cost of living and inflation being deemed far more concerning.

Worries about loans and being able to afford the payments were, however, the second most searched financial worry in Coventry (scoring 9.6/10) and the third most searched in Cardiff (scoring 9.2/10).

For Liverpool, Leeds, and Southampton (all scoring 8.4/10) loans were the fifth highest financial worry, while Manchester was sixth, and Birmingham and Bristol seventh.

Common loans questions answered by our Personal Finance expert, Rhiannon Philps

Can loans affect your credit?

“Getting a personal loan can affect your credit score, just like any other type of credit. Not making payments or regularly making late payments can cause significant damage to your credit score. Alternatively, if you make all of your payments on time, you can build up your credit score.”

Can loans affect mortgages?

“A loan can affect your ability to get a mortgage if the lender thinks that the size of your loan will mean you cannot afford your mortgage repayments. It can also be detrimental if you have missed any payments on your loan and, therefore, have a bad credit score.”

Which loans can I get with bad credit?

“There are a range of loans that you can still apply for with bad credit, and these usually include unsecured personal loans, guarantor loans and secured loans. But these loans usually come with more restrictions and higher interest rates than others.

“Be aware that if you apply for loans you are unlikely to get an unsuccessful application will have a negative effect on your credit score. You could use a loans eligibility service to conduct a soft search across multiple lenders and provide you with results of your likelihood of a successful application against several different loans, without affecting your credit score.

“But always check the details of the service you use, to make sure it only uses soft searches and to see how many lenders it checks.”

What’s an unsecured loan?

“An unsecured loan means that you can borrow money from a lender without having to offer any of your personal assets as financial security for the loan.”

How secured loans work?

“By contrast, a secured loan means borrowing money against an asset you own. This is usually a high-value asset such as your house that can be used as repayment if you fail to pay back your loan.”

Methodology and data sources:

The ‘Money Worries’ Report, conducted by the personal finance experts at award-winning comparison website NerdWallet, compiled a list of 25 major UK cities and a seed list of financial keywords. These were then analysed using Google Trends, to discover which of the 25 cities are searching each term the most during a specific time period (1 September 2021 to 21 February 2023).

The team then used a ranking function to score each financial keyword for each of the 25 cities, to score the locations out of 10 on who is searching the keywords the most.

Sources:

- https://trends.google.com/trends/?geo=GB

- https://www.investmentmonitor.ai/features/largest-cities-uk-investment-strengths/

- https://answerthepublic.com/

- https://app.ahrefs.com/

Dive even deeper

How Will the Laws and Policies Announced in the King’s Speech Affect Your Money?

Labour has set out its plans for the year ahead in the King’s Speech. How will the new government’s agenda affect your money?

Get a Free Credit Report: Equifax vs Experian vs TransUnion

You can get a free credit report from any of the credit reference agencies in the UK – Equifax, Experian and TransUnion.

How to Protect Your Credit Score When Using an Overdraft

You’re borrowing money from your bank when you go into your overdraft. This makes an overdraft a type of credit and it can affect your credit score positively or negatively depending on how you use it.