Breeze Airways Teases Credit Cards and New Loyalty Program

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

One of the newest airlines in the United States will soon have its own line of credit cards and a full-scale loyalty program.

Breeze Airways, which began operations in 2021, will partner with credit card issuer Barclays on a line of co-branded airline cards, the airline and bank recently announced. The credit cards are expected to launch with a new loyalty program sometime in early 2024.

The airline has yet to unveil specifics about the cards or future loyalty program; in fact, it’s only beginning to firm up details of both, a company executive tells NerdWallet.

However, the airline expects both will be directed at leisure travelers — the carrier’s biggest target market since inception.

» Learn more: The best airline credit cards right now

What is Breeze Airways?

Breeze launched just as travel was rebounding from the pandemic in May 2021. With a fast-growing network, the airline’s destinations skew heavily toward smaller-sized cities, including popular vacation markets like Savannah, Georgia.

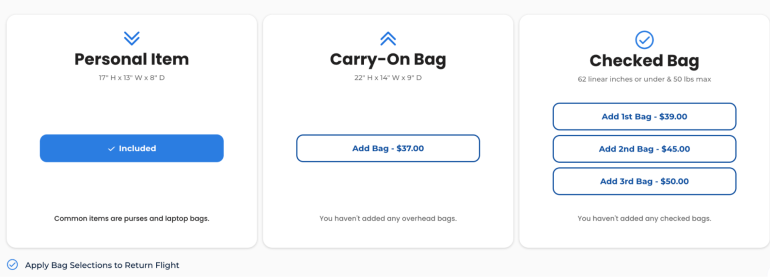

Branding itself as a “nice low-cost carrier,” Breeze shares some pricing model similarities with other low-cost carrier airlines, such as Spirit and Frontier, offering low base fares and add-on fees for other services.

The airline sells “Nice,” “Nicer” and “Nicest” airfares, and what’s included with your ticket depends on the fare class you book.

Amenities such as seat selection and checked baggage can be purchased a la carte or included as “extras” if a passenger books the more expensive, Nicer or Nicest ticket.

However, one significant difference from similar budget airlines is that Breeze does not charge change or cancellation fees. It also provides its version of a premium cabin in the form of its newly-branded “Ascent” seating at the front of the plane. And it has Wi-Fi on many of its aircraft.

Breeze also touts its free family seating policy. The airline allows families with children under 12 to select seats at no added cost. Children under age 12 can sit with at least one adult. Other airlines, including United Airlines, have established similar family seating policies this year.

“We’re not cramming people in and nickel and diming for everything. We are giving people the ability to select a fare bundle or create their own experience,” says Breeze vice president of marketing and communications Angela Vargo.

How might this all translate to a new loyalty program and line of credit cards?

Can you earn points on Breeze?

Despite not yet launching a full-scale loyalty program, Breeze already allows its customers to earn a loyalty currency called BreezePoints.

Passengers earn points for spending on fares and ancillary fees and can redeem them for future travel and services.

Travelers earn BreezePoints as a percentage of what is paid.

Nice fares: 2%.

Nicer fares: 4%.

Nicest fares: 6%.

Baggage fees: 4%.

Seat fees: 4%.

Flight cancellations on Breeze are also refunded in the form of BreezePoints, valid for two years.

Breeze’s upcoming loyalty program

While customers can currently earn BreezePoints, the airline has much bigger plans to build out its loyalty program.

Details of the program remain slim, but Vargo anticipates the eventual program will focus heavily on the practicality of earning points and redeeming them and less on elite status.

“I will never say never,” Vargo says of building a program with elite tiers. Instead, the new program will likely center on reachable cost-saving perks and rewards for the company’s leisure travel customers — some of whom may not fly frequently.

“People are asking for that personalization, so we’re just going to push ourselves to really think, ‘What does it mean to redefine airline loyalty?’” she says. “Getting people the opportunity to upgrade, for example, into Nicest or into Breeze Ascent are things we’re looking at.”

Breeze credit cards

The line of Breeze co-branded credit cards with Barclays is expected to launch at the same time as the full-scale loyalty program next year — a step Vargo hopes will make the two “a lot more symbiotic.”

The joint statement from the two companies announcing the long-term agreement signaled that customers can use the cards to earn redeemable points on Breeze when making a “wide range of everyday purchases.”

In recent years, numerous airlines have restructured their loyalty programs to allow their credit card members to earn cost-saving perks and elite status benefits based on flying and co-branded card spending.

Breeze Airways is becoming more valuable for frequent flyers

Breeze has grown significantly since launching just over two years ago, with more routes and an order for 80 new Airbus A220 aircraft in the coming years — with options to purchase 40 more.

Though you can already earn BreezePoints when traveling with the airline, the company is expected to roll out new credit cards and loyalty benefits in 2024 to give customers new opportunities to earn free flights and redeem points for in-flight benefits.

(Top photo courtesy of Breeze Airways)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles