Chubb Travel Insurance Review: Is It Worth the Cost?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Chubb is a property and casualty insurance company that operates in 54 countries and territories. Its executive offices are in France, Singapore, Switzerland, the United Kingdom and the United States.

Besides property and casualty insurance, the company also offers personal coverage and supplemental health insurance, life insurance and travel insurance. Chubb travel insurance is underwritten by ACE Property and Casualty Insurance Co.

What does Chubb travel insurance cover?

Depending on what type of coverage you’re looking for, Chubb offers several different travel insurance options. It offers annual policies as well as single-trip plans for trips to domestic and international destinations.

Coverage ranges across:

» Learn more: The best travel insurance companies

Chubb travel insurance plans

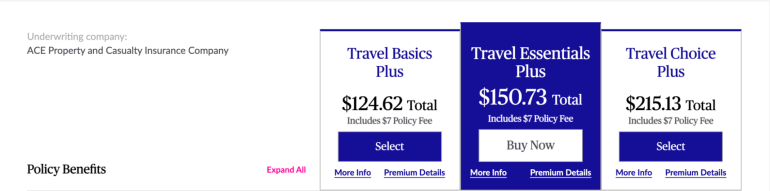

Three single-trip travel insurance plan options are available: Travel Basics Plus, Travel Essentials Plus and Travel Choice Plus.

These are comprehensive travel insurance plans that include medical coverage as well as trip protections, such as trip delay, baggage delay and baggage loss.

Here's how coverage varies across the plans.

Coverage | Travel Basics Plus | Travel Essentials Plus | Travel Choice Plus |

|---|---|---|---|

Trip cancellation | 100% of the trip cost (with a $100,000 limit). | 100% of the trip cost (with a $100,000 limit). | 100% of the trip cost (with a $100,000 limit). |

Trip interruption | 100% of the trip cost (with a $100,000 limit). | 150% of the trip cost (with a $150,000 limit). | 150% of the trip cost (with a $150,000 limit). |

Trip interruption – return air only | $500. | $750. | $1,000. |

Trip delay | $100 per day, with a $500 maximum. | $150 per day, with a $750 maximum. | $200 per day, with a $1,000 maximum. |

Missed connection | N/A. | $250. | $500. |

Baggage delay | $200. | $300. | $500. |

Baggage loss | $750 (with a $50 deductible). | $1,000. | $2,500. |

Emergency medical | $15,000 (with a $50 deductible). | $50,000. | $100,000. |

Emergency evacuation and repatriation | $150,000. | $500,000. | $1 million. |

Accidental death and dismemberment | N/A. | $10,000. | $50,000. |

Preexisting medical conditions waiver | Must be purchased within 21 days after your initial trip payment. | Must be purchased within 21 days after your initial trip payment. | Must be purchased within 21 days after your initial trip payment. |

All three plans offer an optional car rental collision coverage add-on that covers up to $35,000 (with a $250 deductible). This add-on includes damage caused by collision, vandalism or weather and does not include theft.

» Learn more: When to buy travel insurance

Chubb single-trip plan cost

Below is how much a 35-year-old traveler from Utah would pay for travel insurance for a 10-day trip to Argentina valued at $2,500.

The least expensive of the options, the Travel Basics Plus plan will set you back $124.62. The Travel Essentials Plus policy comes in at $150.73 and provides more coverage. The most expensive plan, Travel Choice Plus, costs $215.13 and includes the most coverage with higher limits.

All plans include a $7 policy fee.

» Learn more: The best travel credit cards right now

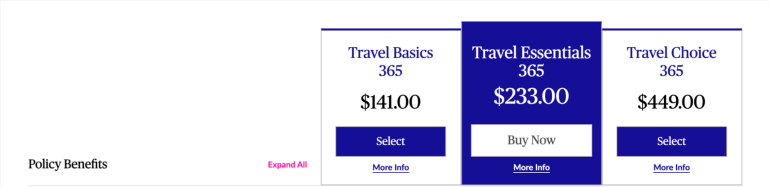

Chubb multi-trip/annual travel insurance

Chubb also offers multi-trip or annual travel insurance plans to those who take multiple trips per year. Three policies are available: Travel Basics 365, Travel Essentials 365 and Travel Choice 365.

Below are the coverage limits for annual travel insurance plans offered by Chubb.

Coverage | Travel Basics 365 | Travel Essentials 365 | Travel Choice 365 |

|---|---|---|---|

Trip cancellation | N/A. | $2,500. | $5,000. |

Trip interruption | $1,000. | $2,500. | $5,000. |

Trip delay | $150 per day, with a $750 maximum (kicks in after five hours). | $150 per day, with a $1,000 maximum (kicks in after five hours). | $150 per day, with a $1,500 maximum (kicks in after five hours). |

Missed connection | N/A. | $500 (kicks in after three hours). | $1,000 (kicks in after three hours). |

Baggage delay | $150 per day, with a $300 maximum (kicks in after 12 hours). | $250 per day, with a $500 maximum (kicks in after 12 hours). | $250 per day, with a $1,000 maximum (kicks in after 12 hours). |

Baggage loss | $1,500. | $2,000. | $2,500. |

Emergency medical | $25,000. | $50,000. | $100,000. |

Emergency evacuation and repatriation | $250,000. | $500,000. | $1 million. |

Accidental death and dismemberment | $10,000. | $50,000. | $100,000. |

Car rental collision damage waiver | N/A. | $35,000 (with a $250 deductible). | $35,000 (with a $250 deductible). |

Security evacuation | $25,000. | $50,000. | $100,000. |

Chubb annual plan cost

Below is how much a 35-year-old traveler from Utah would pay for an annual travel insurance policy from Chubb.

The most affordable option of the three, the Travel Basics 365 plan, will set you back $141. The Travel Essentials 365 policy will set you back $233, and the Travel Choice 365 policy costs $449.

Which Chubb travel insurance plan is for me?

If you’re seeking coverage for one trip: Look into the single-trip travel insurance plans, such as Travel Basics Plus, Travel Essentials Plus and Travel Choice Plus.

If you’re traveling extensively: For travelers who take multiple trips per year or who are constantly on the road, an annual plan, such as Travel Basics 365, Travel Essentials 365 and Travel Choice 365, will provide a more economical solution.

If you hold a travel rewards credit card: Take a look at your card’s benefits guide and determine what kind of trip protections, if any, are offered by your credit card. Pick a travel insurance plan with perks that don’t overlap with what is already covered.

» Learn more: 10 credit cards with travel insurance

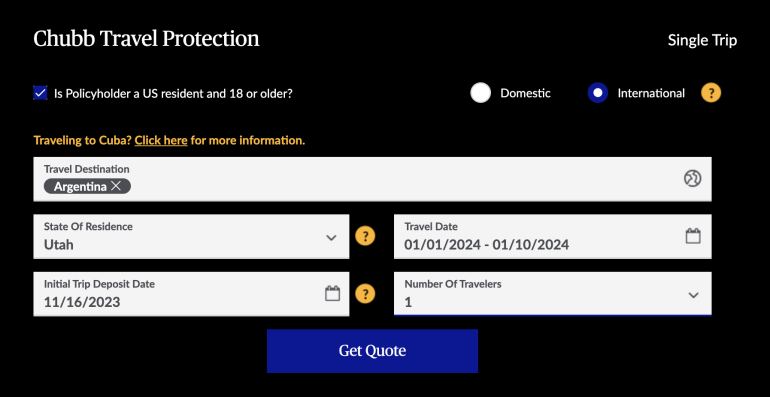

How to get a quote from Chubb

To get a quote from Chubb for an individual or family travel policy, start on it's website. Decide whether you need a single-trip plan or an annual plan, and click on “Get a quote.”

Select between a domestic or an international policy and confirm that you’re a U.S. resident and at least 18 years old by checking the respective box. Enter your travel destination, state of residence, travel dates, the initial trip deposit date and the number of travelers.

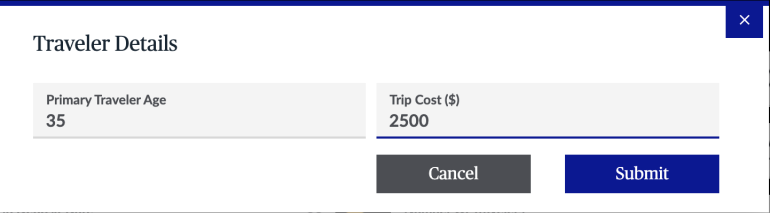

Then provide a couple of more details, such as the primary traveler’s age and the cost of the trip.

The quotes for each plan will be displayed on the next page.

For an annual policy, select your state of residence from the dropdown menu, pick a coverage start date, enter the traveler’s age and click “Get quote.”

What isn’t covered by Chubb travel insurance?

Like most insurance providers, Chubb publishes a list of exclusions to its coverage. Below are some of the situations not covered by Chubb travel insurance:

Intentional self-inflicted injuries or suicide.

Normal pregnancy or elective abortion.

Participation in professional athletic events.

Mountaineering.

War, acts of war or participating in a civil disorder, riot or resurrection.

Operating or learning to operate an aircraft.

Being under the influence of drugs or narcotics.

Traveling for the purpose of securing medical treatment.

Traveling against a physician’s recommendation.

» Learn more: Can you get a refund on travel insurance?

Is Chubb travel insurance worth it?

If you look online, Chubb travel insurance reviews are mixed, but they also include car, home and business insurance, not the company’s travel insurance branch specifically.

In any case, before you purchase a plan, we recommend not only comparing prices but also reading policy terms to make sure you understand what's covered so your claim will be accepted should you need to file one.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points