How Travel Insurance for Domestic Vacations Works

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

You’ve probably heard of travel insurance, which promises to cover you if things go awry during your vacation. This perhaps seems obvious when you’re traveling overseas, but unexpected travel disruptions can happen when you travel domestically, too.

Let’s look at travel insurance for domestic vacations, what it covers and credit cards that’ll cover you during your trip.

Types of travel insurance

There’s more than one kind of travel insurance, including health coverage, trip interruption and rental car insurance. Depending on how you’re traveling, you likely won’t need every type of insurance, but here are the kinds you can generally expect to see:

Trip interruption insurance. This insurance will reimburse you for expenses incurred during a delay or interruption while traveling.

Trip cancellation insurance. This type of insurance will refund your costs if your trip is canceled for a covered reason.

Lost luggage insurance. This insurance will reimburse you for the items you have to repurchase when your bags are lost.

Rental car insurance. This type of insurance protects you while you're using a rental car.

Health insurance. Travel health insurance can differ but may include emergency medical and standard care coverage.

Cancel for Any Reason insurance. As the name suggests, this insurance allows you to cancel for any reason and receive a refund.

Accidental death insurance.

» Learn more: Common myths about travel insurance and what it covers

Can you buy domestic travel insurance?

So, is it possible to get travel insurance for a domestic U.S. trip? The short answer is: Yes, you can. The longer answer is: Yes, but not all types of coverage may be available to you, and you may need to meet certain requirements to qualify.

For example, the travel insurance offered by the Chase Sapphire Reserve® requires that you be at least 100 miles away from home before its emergency evacuation and transportation benefit kicks in. Your trip must also be at least five days long but no longer than 60 days total.

Meanwhile, some providers of travel health insurance indicate that their coverage doesn’t work within the U.S. Instead, your plan will only work once you’re traveling internationally. This is true for the health plans offered by GeoBlue; those plans are limited to countries outside the U.S. and available only to people who already have a qualifying insurance plan.

» Learn more: How much is travel insurance?

Domestic travel health insurance

It’s possible to get travel insurance within the U.S. whether you’re looking for comprehensive coverage or simply a medical care plan. Companies such as Squaremouth collect quotes from a variety of insurance providers and allow you to compare them.

For example, we put in a search for a 32-year-old from California traveling within the U.S. The total trip cost was $1,999 and took place over two weeks during the summer.

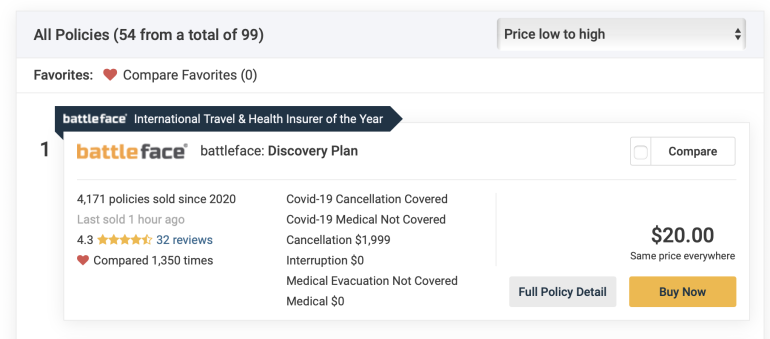

Squaremouth returned results from 54 providers, with the lowest charging $20 total.

However, this plan doesn’t include medical insurance. To find policies that offer this coverage, you’ll want to use the filters next to the search results.

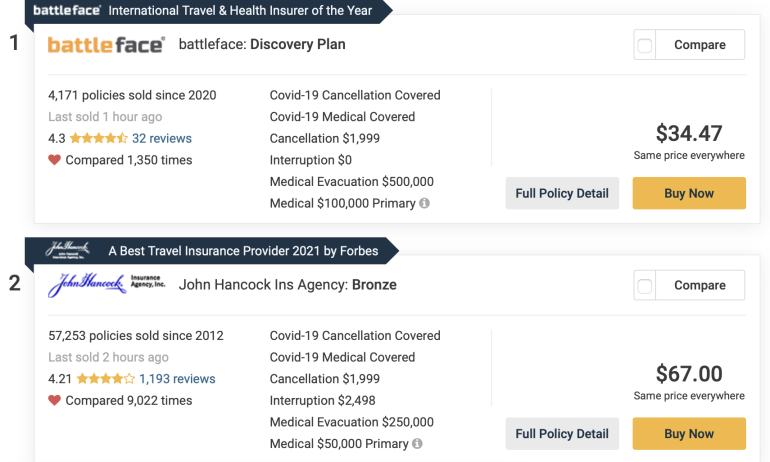

Including filters for domestic travel health insurance limits the total results, but pricing doesn’t change that significantly.

The policies shown will now include primary coverage, coverage for pre-existing conditions, medical evacuation and emergency medical. Even with all those options selected, the cheapest plan comes in at a relatively affordable $34.47.

For those unfamiliar with the terminology, primary insurance acts as the first payer for any claims you have. So if you visit a doctor during your trip, your primary policy will cover costs first. If that plan is exhausted and you also have secondary insurance, the secondary insurance can then pay off the rest.

It’s important to know the difference so you’ll be completely covered during your travels. Note, however, that if you don’t have primary insurance, any secondary insurance becomes primary.

Travel cards with domestic travel insurance

Interested in cheap domestic travel insurance? You won’t find anything cheaper than the complimentary travel insurance offered by many travel cards. We’ve already mentioned that the Chase Sapphire Reserve® has its own travel insurance benefits, but so do many other cards.

Generally, you don’t need to pay anything to be eligible for the travel insurance offered by these types of cards. Instead, you’ll simply need to charge the cost of the trip to your card and the insurance will be automatically activated. This is true whether you’re traveling domestically or internationally.

Here are a few cards that offer complimentary travel insurance:

Chase Sapphire Reserve®.

Terms apply.

» Learn more: The best travel credit cards right now

Travel insurance for domestic vacations recapped

Hopefully we’ve answered the question: “Do I need travel insurance for domestic travel?”

The truth is, whether or not you opt to obtain travel insurance for your trip is going to depend on you. Some travelers have a higher tolerance for risk and are willing to forgo insurance while hoping things go the way they should.

Others may be more interested in being covered for events such as trip delay, emergency medical and rental car insurance.

Whatever you choose, compare quotes from multiple insurance providers to be sure you’re getting a policy that suits your needs. Otherwise, check out the complimentary travel insurance offered by a variety of credit cards to see whether their coverage limits fit your travel budget.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-10x

Points60,000

Pointson Chase's website

1x-5x

Points60,000

Pointson Chase's website

1x-2x

Points50,000

Points