Is the Frontier GoWild Pass Worth It?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Unlimited air travel sounds like a dream — and airlines have long recognized this, whether that was American Airlines’ $250,000 AAirpass or Alaska Airlines’ Flight Pass subscription.

Frontier Airlines has since joined the ranks with its GoWild All-You-Can-Fly Pass, which allows eligible customers to board as many flights as they’d like.

However, it’s not all free flights whenever you’d like with Frontier’s pass. There are limitations and additional costs involved, which begs the question of whether it’s worth investing in.

Let’s take a look at the Frontier GoWild Pass, its cost and whether it’s something you should purchase.

What is Frontier’s GoWild Pass?

At first look, the Frontier GoWild All-You-Can Fly Pass seems like an incredible deal. By purchasing the pass, you’ll be able to fly as much as you like on Frontier’s entire route network.

What does the GoWild Pass cost?

Costs for the GoWild pass vary based on whether you’re paying monthly or annually:

Monthly: $0 for the first month plus a $49 enrollment fee; $149 per month thereafter.

Annually: $1,999 for the year (with travel beginning in April 2024).

» Learn more: The guide to Frontier miles

How the Frontier GoWild Pass works

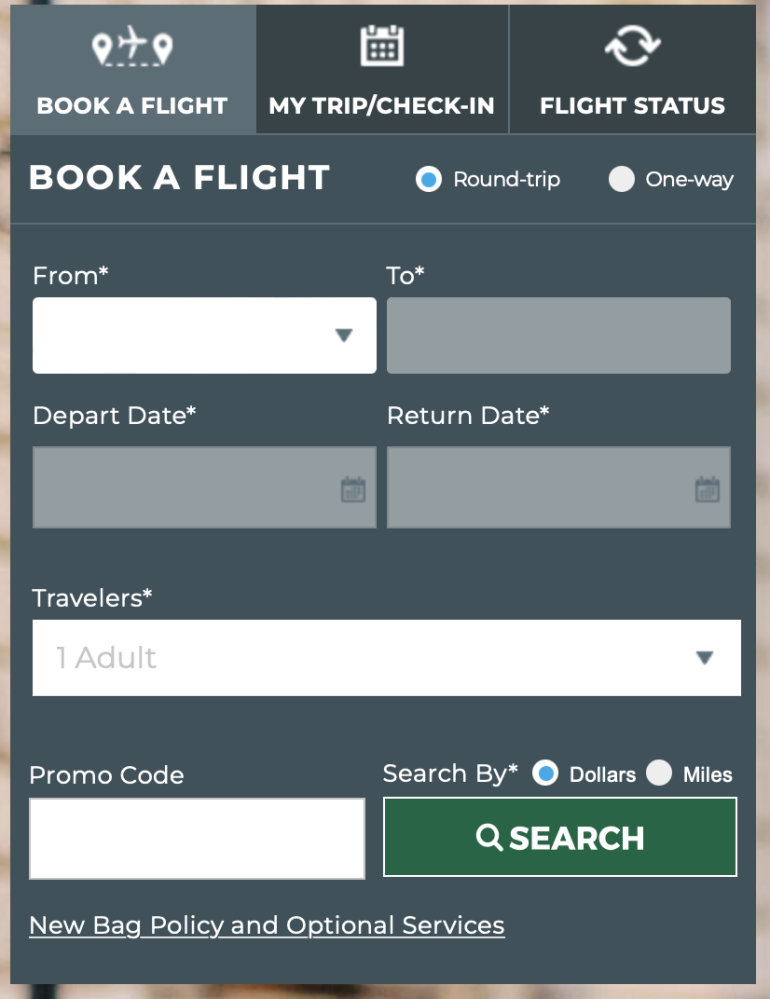

After you’ve signed up for the pass, you’ll immediately be able to begin booking tickets. To do so, you’ll simply need to navigate to Frontier’s website. On the homepage, you’ll be able to input your flight information, including your departure airport and dates of travel.

Once the search results are loaded, you’ll be able to select the GoWild fare if it’s available.

As a passholder, you’ll pay just 1 cent in airfare plus applicable taxes and fees.

» Learn more: Frontier vs. Spirit: The battle of the budget airlines

Limitations of the Frontier GoWild Pass

The Frontier GoWild Pass sounds like a great value, especially if you’re a frequent flyer. However, there are strings attached to the pass that significantly diminish its worth.

The first, and probably the biggest one for most people, is that you’re barely able to book in advance. On domestic flights, you can book and confirm your seat the day before departure. For international travel, you can do so starting 10 days in advance.

Already, you can see how this would disqualify most travelers. It’s nearly impossible to plan a vacation around a flight with almost no notice, especially if you have limited time off.

However, if you are extraordinarily flexible and able to make the flights, there’s still the issue of cost. You’re paying either $149 per month or $1,999 per year for flights to drop your airfare down to a penny. Beyond this, though, you still need to pay taxes, charges and fees. These may be assessed by airports, governments or the airline itself, and you’ll need to shell out for them. This means, in reality, your “free flights” never end up being free.

Finally, Frontier is a low-cost airline, which means that, although you won’t be paying airfare, you will need to pay for seat selection, carry-on luggage, checked bags and even snacks. It’s possible that you will end up paying more in fees than you would have spent on airfare with another airline.

» Learn more: Your guide to earning miles with Frontier Airlines

Is the Frontier GoWild Pass worth it?

To put it baldly: Probably not. There are some limited situations in which someone may be able to put the pass to good use. A remote worker or a freelancer who only needs to bring a spare outfit for the weekend will have the flexibility to make their flights.

Those who have Frontier elite status may also be able to maximize their flights since they receive free seat selection and a carry-on as perks, though they’d still need to have a lot of flexibility for last-minute bookings.

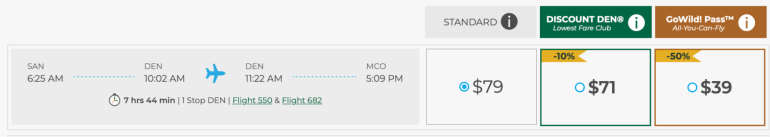

But this is ignoring the fact that — a lot of the time — Frontier’s airfare costs are already minimal. This is exemplified by its frequent sales, in which you can buy tickets for less than $20 one-way.

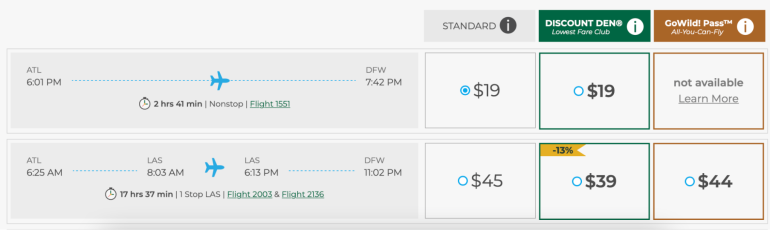

Here’s a look at a one-way flight from Atlanta (ATL) to Dallas-Fort Worth (DFW) in November.

It’s not possible to use the GoWild Pass on the nonstop flight, which costs just $19. Instead, if you’re wanting to book, you’ll have to pay $44 and spend nearly 18 hours on a flight that should take less than three.

Consider a Discount Den membership instead

In the screenshots above, you can see that there are three possible tickets to purchase: Standard, Discount Den and GoWild Pass. At $59.99 per year ($99 for the first year), the Discount Den membership is significantly cheaper than the GoWild Pass and provides significant savings on flights.

Not only that, Discount Den members are able to apply their savings to up to nine members on the same reservation. They’re also able to take advantage of Frontier’s Kids Fly Free promotions, which allow children under 15 to fly free with adults on eligible dates.

Discount Den memberships may also be eligible for reimbursement using airline fee credits provided by certain credit cards.

» Learn more: The best airline credit cards right now

If you’re thinking about buying Frontier’s GoWild Pass …

Like all airline flight passes, Frontier’s GoWild Pass seems almost too good to be true. That’s because it is. Although it technically allows passengers to fly for “free” as much as they’d like, the copious amounts of red tape and limited booking windows make this a poor option for most.

If you’re interested in saving money on Frontier flights, consider purchasing a Discount Den membership instead. It’s much cheaper, provides discounts on airfare and allows you to share the benefits with up to eight others. We call that a win.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points60,000

Pointson Chase's website

1.5%-6.5%

Cashback$300

2x-5x

Miles75,000

Miles