IHG Hotels: Pay With Points, Cash or Both?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

IHG offers its IHG One Rewards program members the option to book stays with cash, points or a combination of cash and points. Whether you’ve been amassing millions of IHG points through business travel or are considering applying for an IHG credit card, you’ll want to understand the advantages of these different options.

Here’s how to decide whether you should pay with cash, pay with points or pay with cash and points.

» Learn more: The guide to IHG One Rewards

Paying with points

If you have enough IHG rewards points to cover your stay, your first choice might be to book with points.

IHG’s only reasonable point redemption option is for stays within its family of brands, so you might as well use up your points before parting with cash. You won’t earn additional points on your stay, but reward nights booked with points count toward elite status qualification, so there’s little downside to booking with points.

Perhaps the biggest advantage of booking with points is that, if you are an IHG cardholder, you can get a fourth night free on your stay.

Fourth night free as an IHG cardholder

One of the perks of being an IHG co-branded credit cardholder is that you can get your fourth night free when you book a standard room stay of four nights or more using points. When you take advantage of the fourth-night free perk, the fourth night of your stay will be priced at 0 points.

As you can see from the screenshot below, the fourth-night free pricing applies only to reservations booked entirely with points — it doesn't apply to cash and points rates.

The bottom line on paying with points is that it’s usually a good option if you have enough points to cover your entire stay. If you’re a credit cardholder and can take advantage of the fourth-night free benefit, points bookings are a phenomenal value.

» Learn more: The best IHG redemptions

Paying with cash and points

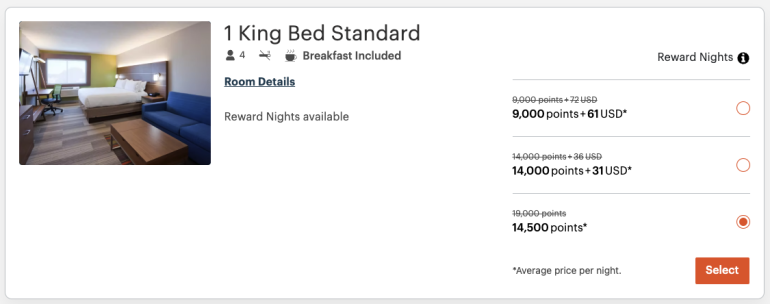

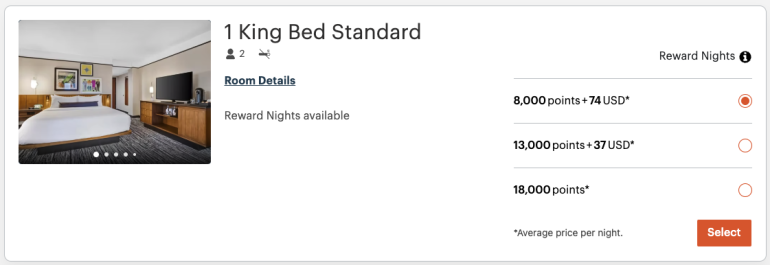

In many cases, IHG gives you the option to book your room with a combination of cash and points. When you opt to view hotel room prices in terms of points, you’ll see a list of options to select how much of your stay you want to pay with cash and how much you want to pay with points.

When you book a room with cash and points, you’re effectively buying rewards points at a set rate. In the example below, we can effectively buy 5,000 to 10,000 points toward our booking at a rate of 0.74 cents per point. This is less than NerdWallet’s valuation, which pegs IHG points at 0.8 cent a point. In this case, you’re approximately breaking even with buying points for this booking.

This price to “buy” points is fairly stable for normal bookings. Unlike Marriott’s cash and points prices, which can vary widely, the cash copays offered by IHG offer relatively consistent value.

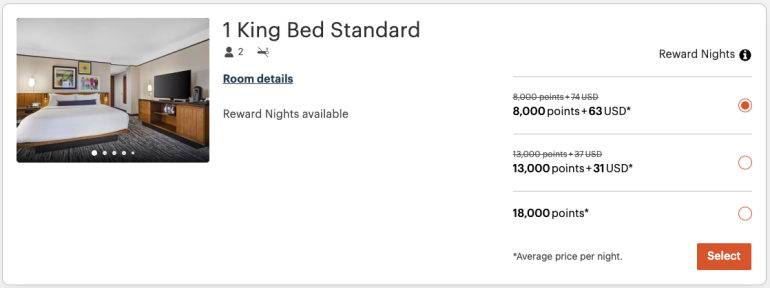

But that’s not the end of the story when booking with cash and points. A stated benefit of IHG Platinum and Diamond elite status is reward night promotional discounts. When logged in as an IHG Platinum member, I see the following pricing for this same stay.

With the above rates, I’m effectively buying IHG points for 0.62 cent per point. That discount represents a measurable difference between NerdWallet’s valuation and the cash cost.

If you don’t have enough points to cover your entire stay, the cash and points prices you are offered are likely to be a reasonable value — close to the NerdWallet valuations of IHG points. But if you are targeted for a promotional discount on the cash copay of cash and points bookings, it could make sense to book with cash and points, even when you have excess IHG points.

» Learn more: The best hotel credit cards right now

Paying with cash

You might think that the decision to pay with cash is simple. If you have points, pay with points; if you have cash, pay with cash. But sometimes paying with cash can offer a better deal, depending on which channel you book through and how many deals you can stack.

Paying cash when booking direct

When you pay a cash rate for an IHG stay and book directly with the property, you’ll enjoy your elite benefits, earn points for your stay and earn additional points when you use an IHG credit card to pay. If you’re trying to accumulate as many IHG points as possible for a future stay, booking directly and paying with cash might be your best option.

But booking direct doesn’t mean that you need to settle for only earning IHG points. You can stack additional rewards by shopping through a cash-back portal or using a browser extension like Capital One Shopping.

Capital One Shopping has been known to offer targeted rewards for bookings directly on IHG’s website. Checking to see what cash-back portals offer or if you are targeted through a browser extension like Capital One Shopping can give you a few extra dollars of rewards on top of your IHG points.

Paying cash through a third-party booking site

You can book your IHG stay through a third-party booking site like Expedia or Orbitz, but you’ll give up earning IHG points and enjoying elite benefits during your stay. For most people who aren’t interested in IHG status or points, booking through a bank’s travel portal might be a better option.

Premium travel cards like the Capital One Venture X Rewards Credit Card, Chase Sapphire Reserve® and The Platinum Card® from American Express offer additional rewards when you book a prepaid hotel through their portals. Terms apply.

The Capital One Venture X Rewards Credit Card and Chase Sapphire Reserve® offer 10 points per dollar when you book a prepaid hotel through their portals.

The Platinum Card® from American Express will give you 5 points per dollar. Terms apply. Booking your IHG hotel through Capital One’s travel portal can also be a good way to use the $300 annual travel credit you get with the Capital One Venture X Rewards Credit Card.

The bottom line

You can find good value with IHG by booking with cash, cash and points, or with points. Be sure to log in if you’re an IHG elite member to see if you qualify for promotional pricing. If you're booking a four-night stay with points as a credit cardholder, don’t overlook your card’s fourth-night free benefit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-26x

Points140,000

Pointson Chase's website

1x-9x

Points30,000

Pointson Chase's website

2x-17x

Points150,000

Points