Citi Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.0

Borrowers report high satisfaction with Citi’s mortgage offerings, and the lender’s low average interest rates make it a standout choice for buyers or refinancers shopping for the best deal. Citi also offers a proprietary loan for qualified borrowers, which requires just 3% down and has no mortgage insurance requirements. However, the website lacks some useful features, and borrowers will have to contact the lender for customized mortgage rates.

Pros

- Average interest rates are among the lowest compared to other lenders’, according to the latest federal data.

- Receives high marks for customer satisfaction, according to J.D. Power and Zillow.

- Borrowers with existing Citi accounts may receive discounts.

Cons

- Customized mortgage rates are not available without contacting the lender.

- HELOCs and home equity loans are not currently available.

- No live chat feature on the lender’s site.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Citi mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Citi receives a score of 756 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Citi receives a customer rating of 4.84 out of 5 on Zillow, as of the date of publication. The rating reflects 3,785 customer reviews.

Citi’s mortgage loan options

3 of 5 stars

Citi offers 30-year and 15-year conventional mortgages, as well as FHA loans, VA loans and jumbo loans. Citi also offers a proprietary loan called a HomeRun Mortgage for borrowers who meet income and property requirements, among other criteria. This loan has a minimum down payment of 3% (or 5% in high-cost areas), flexible credit requirements and no mortgage insurance. We found the lender’s website to be fairly straightforward to navigate, and the page that outlines its loan offerings also has helpful information about loan terms and choosing a fixed vs. adjustable interest rate.

Citi does not offer home equity products, renovation loans or construction loans.

What it’s like to apply for a Citi mortgage

3 of 5 stars

Borrowers may have a difficult time navigating Citi’s website compared with those of other lenders. The lender does not have a live chat feature, and borrowers have to click through the “Contact Us” link at the bottom of the page to find a phone number. Citi lists specific numbers based on borrower needs (including one for new mortgage loans), but they do not provide hours of availability.

Borrowers have the option to schedule a call. When we called the lender, we were put on hold briefly before being put through to an agent. Once connected, the representatives we spoke with were able to answer all of our questions.

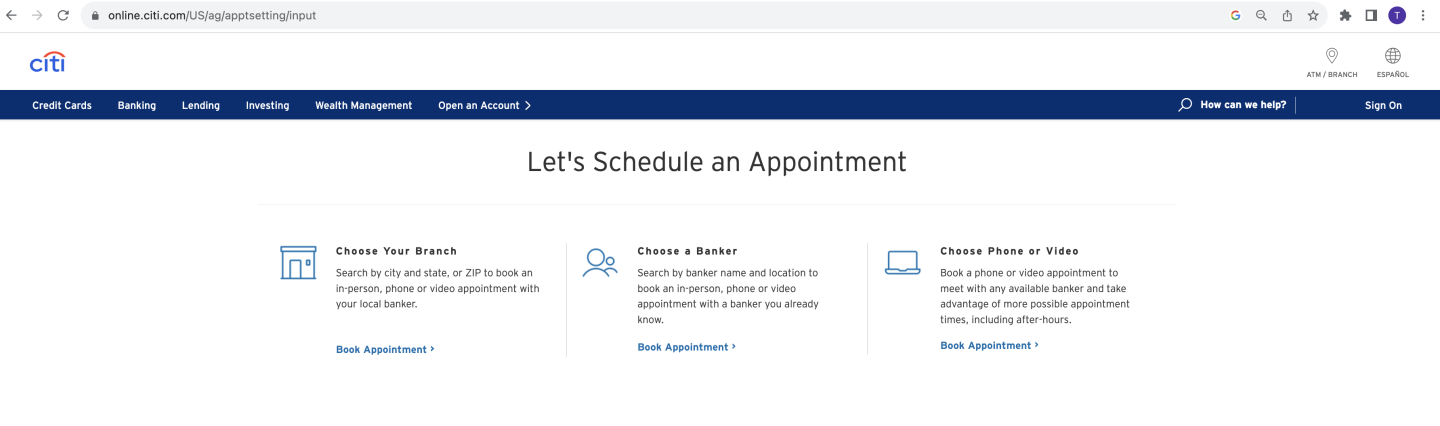

Borrowers can apply online, over the phone, via video call or in person. Those who apply online are required to create an account first before accessing the application. Borrowers who choose to apply in person can schedule an appointment with a loan officer.

Citi’s website also has a help center with frequently asked questions, including specific mortgage-related information such as “what is an escrow account” and “what is the FHA loan limit.”

» MORE: How to apply for a mortgage

Citi’s mortgage rates and fees

4 of 5 stars

Citi earns 3 of 5 stars for average origination fee.

Citi earns 5 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Citi had average origination fees and exceptionally low interest rates.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Citi’s mortgage rate transparency

4 of 5 stars

Citi publishes sample rates and APRs for 30-year and 15-year conventional mortgages; all other rates (including customized rate) can only be accessed by contacting the lender.

Borrowers with existing Citi accounts can receive rate or closing cost discounts. Borrowers with $49,999 or less in their accounts may be eligible for $500 off of their closing costs, while borrowers with larger balances may receive interest rate discounts of a fraction of a percentage point. This discount is on a sliding scale: borrowers with larger balances will receive a greater discount (up to 5/8 percentage point off for borrowers with balances of $2 million or more).

NerdWallet’s transparency ratings are higher for lenders that post sample rates on their sites, making it easier for home buyers to comparison shop, and highest for sites with self-serve tools that allow shoppers to see what rates might be like for their particular loan.

Alternatives to a home loan from Citi

Here are some comparable lenders we review that borrowers can consider.

Borrowers who prioritize high customer satisfaction may be interested in Bank of America, while borrowers looking for low rates and fees could be a good fit for PenFed.

» MORE: Best mortgage lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

Bella Angelos contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).