Veterans United Home Loans Review 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.0

Veterans United, the largest VA lender in the U.S., specializes in working with military borrowers and offers customer support tailored for this market. VA borrowers can check their eligibility and apply for preapproval on the lender’s website.

Pros

- Offers a wide menu of VA purchase and refinance loan options.

- Borrowers can access 24/7 customer service over the phone.

- Offers a free credit counseling service.

Cons

- Parent company’s mortgage rates are on the higher side, according to the latest federal data.

- Does not offer second mortgage options like home equity loans or HELOCs.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 0% | Visit Lenderat Veterans United at Veterans United | |

620 | 0% | Visit Lenderat NBKC at NBKC | |

580 | 0% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

580 | 0% | Visit Lenderat Rocket Mortgage, LLC at Rocket Mortgage, LLC | |

600 | 0% |

Full Review

What borrowers say about Veterans United mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Veterans United receives a score of 777 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Veterans United receives a customer rating of 4.78 out of 5 on Zillow, as of the date of publication. The rating reflects more than 5,360 customer reviews.

Veterans United’s mortgage loan options

4 of 5 stars

Veterans United specializes in VA loans for purchase and refinancing. Other loan types, including conventional loans, are available, but make up a small percentage of the lender’s overall business.

This focus on VA home loans is notable, even compared with other specialist lenders. Veterans United Home Loans originates the most VA home loans in the industry by far, according to the latest federal data. This makes it an especially strong choice for VA borrowers who want to work with a lender experienced with their needs. This lender can also be a good match for VA borrowers who want to finance improvements that will make their homes more energy efficient.

The lender’s website clearly outlines VA loan options, which are available only to borrowers who meet the qualifications prescribed by the Department of Veterans Affairs.

Veterans United is included in NerdWallet’s roundup of the best VA mortgage lenders.

Given the specific qualifications required for homes purchased with VA loans, customers may be interested in taking advantage of Veterans United’s real estate agent match program, as these knowledgeable agents can guide clients toward homes that meet the VA’s standards.

One call center representative we spoke to believed Veterans United makes only VA loans, but the lender confirmed via email that it offers conventional mortgages, FHA loans and USDA loans. Home equity loans and home equity lines of credit (HELOCs) are not available.

What it’s like to apply for a Veterans United mortgage

4 of 5 stars

Borrowers can either apply entirely over the phone, or they can begin an application online to verify their eligibility and have a representative call them with additional questions. According to the agent we spoke with, Veterans United primarily serves customers online and by phone. While a borrower may be able to apply in person if they live near a branch location, this would be unusual.

Veterans United also has a highly rated mobile app, which promises convenient document upload, loan status tracking and e-signature.

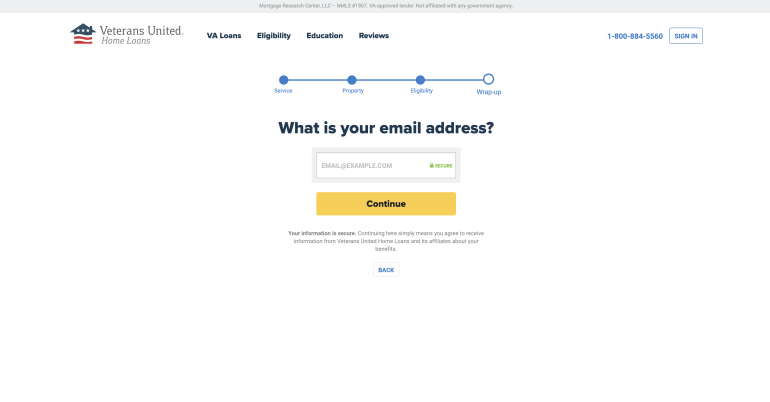

When we clicked the easy-to-find “Check Your Eligibility” button online, we were prompted to answer some straightforward questions, including: buy a home or refinance; military affiliation; marital status; credit score; estimated price range; and annual income before taxes.

At the end of this portal, we were met with a contact form. Anyone who enters their email address can choose to set up an account and then apply for pre-qualification or preapproval online. Most applicants will get a phone call from a loan specialist, too.

Veterans United offers 24/7 customer phone support, which can be especially useful for borrowers stationed overseas in various time zones.

Whenever we called the lender, it took us an average of one minute to connect with a live agent. In every instance, we were transferred within minutes to a specialist who was able to answer all of our questions.

There is no live online chat feature. Instead, customers can fill out a form to send a message to the help desk and have an agent get back to them with a response later. Borrowers can find specialist contact information in the FAQ section on the lender’s website.

» MORE: How to apply for a mortgage

Veterans United’s mortgage rates and fees

2.5 of 5 stars

Veterans United, reporting as Mortgage Research Center LLC, earns 3 of 5 stars for average origination fee.

Veterans United, reporting as Mortgage Research Center LLC, earns 2 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Relative to other lenders, Veterans United’s parent company, which does business as Veterans United and Paddio, reported average rates that were on the higher end and origination fees that were typical.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Veterans United’s mortgage rate transparency

4 of 5 stars

Veterans United provides sample VA mortgage rates for all of its loan options, including refinances and jumbo loans, based on credit score ranges and points purchased. Borrowers can fill in their own information on the website — including their email address — and receive a personalized rate offer.

Note that these kinds of offers are only estimates. When you’re ready, applying for preapproval will give you a more solid idea of the rate you can expect.

Alternatives to a home loan from Veterans United

Here are some comparable lenders we review that borrowers can consider.

VA borrowers who like the idea of working with an experienced lender for military borrowers may be interested in Navy Federal Credit Union, which has home equity products, adjustable-rate mortgages and a loan option for military borrowers who have exhausted their VA loan benefit, among other offerings.

Meanwhile, PenFed can be a strong choice for VA borrowers who want to take advantage of low origination fees.

» MORE: Best mortgage lenders

John Buzbee contributed to this review.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).