Bilt Rewards: What It Is, Why Travelers Should Pay Attention

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The cost of housing is one of the biggest expenses for most households. But, whether you're paying rent or a mortgage, it can be difficult or costly to earn credit card rewards on these payments. With its innovative credit card, Bilt Rewards seeks to change that for renters.

In this article, you'll learn what Bilt Rewards is, how to earn and redeem Bilt Points in this unique rewards program, and how to pay your rent with the Bilt Rewards credit card.

What is Bilt Rewards?

Bilt Rewards is the first loyalty program that lets you earn points when paying your rent, with no transaction fees. Through the Bilt Rewards Alliance, tenants can earn rewards at more than four million rental homes nationwide. Additionally, they can earn extra points on their daily purchases with the Bilt Rewards credit card.

Points earned through this rental rewards program can be used to cover your rent, contribute to a down payment on a home, transfer to airline and hotel loyalty programs, and more.

Additionally, your rent payments are reported to the credit bureaus, which can help build your credit. This is a valuable perk since most landlords only report negative information, such as collections or judgments for unpaid rent or damage to the rental. This benefit is only available to Bilt Alliance tenants. Tenants must opt in.

Elite status tiers with Bilt Rewards

There are four elite status tiers in the Bilt Rewards program: Blue, Silver, Gold and Platinum. As you progress through the levels, benefits include bonus points on lease incentives, interest on points earned and 1:1 points transfers with travel partners.

In 2024, Bilt made several positive updates to its program, and there are now two ways to earn elite status:

Earn Bilt points in a variety of ways, including using the Bilt World Elite Mastercard® Credit Card.

Spend money on eligible purchases (excluding rent) with any linked debit or credit card, including spending on Bilt Dining, Lyft, the Bilt Travel portal and more.

The fact that you can earn elite status with Bilt by spending on any linked debit or credit card makes progressing through Bilt's elite status levels easier.

Bilt Rewards Elite Status Tiers

Blue | Silver | Gold | Platinum | |

|---|---|---|---|---|

Earn status (pts/year) or fast-track through spending | All members. | 50,000 points or $10,000. | 125,000 points or $25,000. | 200,000 points or $50,000. |

Bonus on lease incentives | 0%. | 10%. | 25%. | 50%. |

1:1 transfer to airlines and hotels | Yes. | Yes. | Yes. | Yes. |

Access to the Bilt Collection | Yes. | Yes. | Yes. | Yes. |

Build credit history | Yes. | Yes. | Yes. | Yes. |

Earn interest on points | No. | Yes. | Yes. | Yes. |

Homeownership concierge | No. | No. | Yes. | Yes. |

Receive a gift from the Bilt Collection | No. | No. | No. | Yes. |

Flying Blue Gold status | No. | No. | No. | Yes. |

As part of the new update, for every 25,000 Bilt points earned, you'll receive “milestone rewards” in the form of accelerated points-earning opportunities, additional points on Bilt Dining and points toward the Bilt Collection.

One of the most significant benefits of moving up the rewards program tiers is the larger bonus on lease incentives. For members with larger balances, earning interest on your points is also a nice perk once you reach Silver status.

Once you earn elite status, you keep it all the way through to the end of the following calendar year. For example, if you earn elite status in August 2024, your status will remain active until Dec. 31, 2025. So, the sooner you earn status in a given year, the better.

8 ways to earn Bilt Rewards points

Here are eight ways you can earn Bilt Rewards points, from paying rent to referring friends.

1. Earn Bilt Rewards points by paying rent

Tenants can earn and redeem points through this rental rewards program in multiple ways.

Properties in the Bilt Rewards Alliance

If you live in a Bilt Rewards Alliance residence, you can earn points by paying your rent in the Bilt Rewards app, even if you don't have the Bilt World Elite Mastercard® Credit Card. Individuals living in the Bilt Rewards Alliance residences earn a flat 250 points per month just for paying rent. You can also earn bonus points for select activities, such as signing a new lease or renewing your existing lease.

More than four million rental units across the U.S. currently participate in the Bilt Rewards Alliance. Some of the participating real estate companies include:

Camden.

Equity Residential.

Highmark Residential.

Starwood Capital Group.

Willow Bridge.

GID-Windsor Communities.

To find out if your rental company participates in the Bilt Alliance, ask your property manager.

Properties that don’t belong to Bilt’s alliance

If your landlord isn't part of the Bilt Rewards Alliance, you can still pay your rent and earn points using the Bilt World Elite Mastercard® Credit Card. Bilt will mail a check to your landlord when you initiate a payment through the Bilt app.

You can also use the app to pay rent directly through your property’s online payment portal; learn how to set that up on Bilt’s website.

You’ll earn 1 point per $1 on rent paid through the app or website using your Bilt World Elite Mastercard® Credit Card, as long as you have at least five transactions total in a statement period. (You can earn a maximum of 100,000 points in a calendar year.)

» Learn more: How paying rent with Bilt can net you a free Disney trip

2. Earn Bilt points using the Bilt World Elite Mastercard® Credit Card

With the Bilt World Elite Mastercard® Credit Card, you can pay your monthly rent without fees, while earning valuable rewards anywhere Mastercard is accepted. The Bilt World Elite Mastercard® Credit Card is also suitable for people who don't rent because it earns points on daily purchases, with some attractive bonus categories:

3x points on dining.

2x points on travel (direct bookings with airlines, hotels, car rentals and cruises).

1x points on rent, with no transaction fees (up to 100,000 Bilt points in a calendar year).

1x points on other purchases.

Note: You must use the card at least five times per statement period to earn points.

Another strong benefit of having this card is the ability to pay your rent even if your landlord isn't part of the Bilt Rewards Alliance. If your landlord accepts ACH payments, you can pay your rent through your Rent Rewards Account using the Bilt app. Bilt will give you a routing number and account number to pay rent, and you'll still earn points.

There is no annual fee, so you don't need to earn enough rewards to offset its cost. When you use the card, you also get these valuable benefits:

Trip Cancellation and Interruption Protection.

Auto Rental Collision Damage Waiver.

Cellular Telephone Protection (up to $800 per claim).

Purchase security (theft and damage protection up to $1,000 within 90 days).

Up to $60 worth of Lyft Credits per year ($5 credit each month that you take at least three rides).

No foreign transaction fees.

Five transaction minimum

Those who hold the Bilt World Elite Mastercard® Credit Card need to use the card at least five times in a statement cycle to earn points during that cycle. Paying rent with your card counts as one of the five necessary transactions.

Until you reach the five transactions, points will show as pending on your statement. Once you’ve achieved five transactions, the points will become available.

» Learn more: The best travel credit cards right now

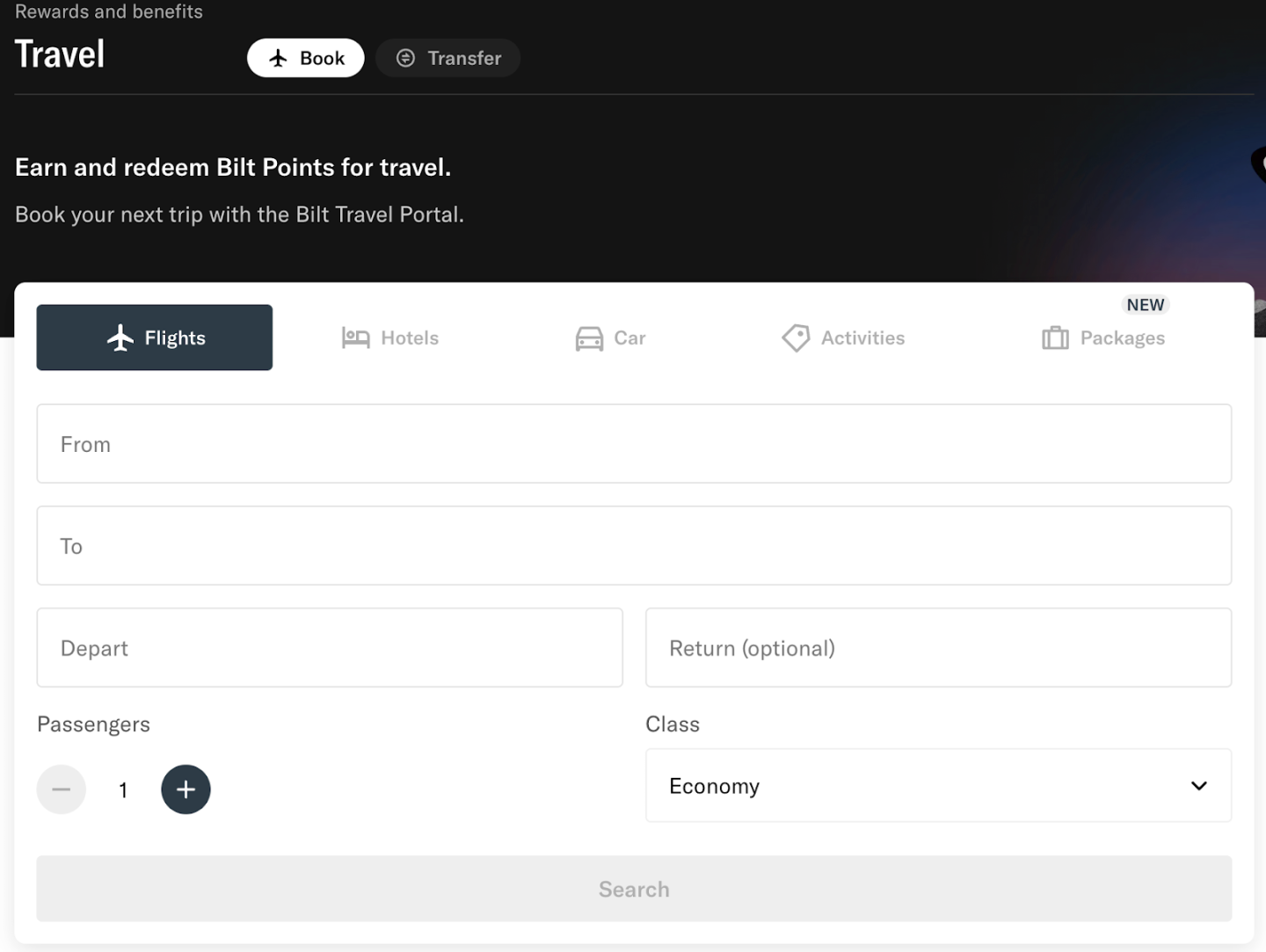

3. Earn Bilt points through the Bilt Travel Portal

Bilt has a travel portal that allows you to earn points on flights, hotels, car rentals, activities and vacation packages. Bilt World Elite Mastercard® Credit Card holders will earn 2 Bilt points per $1 when booking travel through the portal. And for travel purchases, excluding flights, you do not need to meet the five transaction minimum per statement period to earn the points.

Bilt rewards members without the credit card will earn 1 Bilt point per $1 spent on bookings through the travel portal.

4. Earn Bilt points on Lyft rides

If you have the Bilt World Elite Mastercard® Credit Card, you can earn 3 points per $1 on Lyft purchases, including rideshares, bikes and scooters. Once you link your Bilt Rewards and Lyft accounts and select Bilt as your earning partner, you earn an additional 2 points per $1 on Lyft rideshare purchases (scooters and bikes are excluded).

In total, you can earn up to 5 points per $1 on Lyft rides, which is a solid way to earn Bilt points if you’re a frequent Lyft user. Notably, you can only earn points on Lyft rides in the U.S.

» Learn more: Best credit cards for Uber and Lyft

5. Earn Bilt points on Bilt Dining

You can earn up to 10 Bilt points per $1 when spending money at restaurants that participate in the Bilt Dining rewards program. Bilt Dining is available in over 20 cities, including Denver, Las Vegas, Miami and New York. The rewards earning rate varies by restaurant.

Bilt Dining works similarly to other dining rewards programs. To set it up, you'll need to log in to your Bilt account on the website or in the app and link an eligible card. Then, when you make a purchase with that card at one of the restaurants that participates in the program, you'll earn points.

The Bilt World Elite Mastercard® Credit Card earns 3 points per $1 on dining, so if you link this card to your Bilt Dining profile and use the card to pay for your meal at a participating restaurant, you’ll earn these points in addition to what you earn for dining at a participating restaurant.

6. Earn Bilt points on fitness classes

You can earn Bilt points when taking classes with a participating fitness studio. Currently, Bilt points can be earned with SoulCycle, Rumble Boxing, Pure Barre, Y7, CycleBar, Row House, AKT, BFT and YogaSix.

7. Earn Bilt points for linking your airline and hotel loyalty programs

Bilt partners with several airlines and hotels. When you link your Bilt Rewards account to any of these programs, you will earn 100 points for every loyalty program linked, up to 500 points.

» Learn more: Best airline and hotel rewards programs

8. Earn Bilt points for referring friends

If you refer a friend to the Bilt World Elite Mastercard® Credit Card and the friend gets approved, you'll earn 2,500 points. Once you make your fifth referral, you'll earn a 10,000-point bonus.

5 ways to redeem Bilt rewards points

You have five options for redeeming Bilt rewards points — you can transfer them to travel partners, use them for rent-related expenses, take fitness classes, buy art or shop.

1. Transfer points to airline and hotel partners

This redemption option is what makes the program shine for travelers.

As a Bilt Rewards member, you can transfer your points on a 1:1 basis to numerous airline and hotel loyalty programs. In addition, you won't be charged for transferring your points.

» Learn more: The guide to Bilt transfer partners

2. Pay rent with your points or save up for a down payment

Points can be redeemed toward paying your monthly rent. Additionally, you can save your points and use them toward a down payment on your own home.

When paying your rent with points, the value of your points depends on your landlord, as each property sets its rates. The Bilt Rewards app shows you how much your points are worth before you redeem them for rent.

For members saving up for a down payment, your points are worth up to 1.5 cents each.

3. Take fitness classes

Bilt has partnered with some of the nation's top group fitness class providers, including Soul Cycle, Y7 and Solidcore. Classes start at just 1,600 points each.

» Learn more: Best credit cards for fitness perks

4. Buy art and more via the Bilt Collection

Bilt curates a collection of art, decor, and apparel inspired by a different artist each quarter.

5. Shop on Amazon

You can use Bilt points to pay for all or a portion of your Amazon purchase. This option is only available if you hold the Bilt World Elite Mastercard® Credit Card.

Why the Bilt Rewards credit card could be a smart option for travelers

As a traveler, the Bilt World Elite Mastercard® Credit Card offers numerous perks. You'll earn 2x points on travel booked directly with the airline, hotel, car rental agency or cruise company.

Plus, the card earns 3x points on dining, whether you're at home or on vacation. Points can transfer to several airlines and hotels on a 1:1 basis, saving you cash for other expenses.

There are no foreign transaction fees when making international purchases. You're insured for trip delays or cancellations, and your rental car is insured for damage or theft.

Given that points transfer at a 1:1 value to popular airlines and hotels, you can easily turn the points you earn paying rent into your next award booking.

Bilt's partnership with Blade

Another noteworthy travel perk of being a Bilt Rewards member (whether you hold the credit card or not) is access to benefits with Blade, the commuter helicopter service offering flights between Manhattan and New York City area airports, the Hamptons and Montauk, as well as service between select international destinations.

Bilt Rewards members who pay for Blade rides with a Bilt-connected card will earn 2x points. Bilt status holders also get discounts on flights:

Bilt Silver: 10% off Blade airport flights booked in the Bilt app or on the Bilt website.

Bilt Gold: 10% off Blade airport flights, plus access to Blade lounges, even when not flying.

Bilt Platinum: All of the above benefits plus one free Blade flight per year between Manhattan and either JFK or Newark airports; or a free Blade flight between Monaco and Nice.

» Learn more: NerdWallet's quick start guide to points and miles

Final thoughts on Bilt Rewards

The Bilt World Elite Mastercard® Credit Card allows tenants to earn rewards and build credit when paying their rent. It earns up to 3x points on bonus categories and provides travel benefits like trip cancellation protection and insurance for rental cars and cell phones. In addition, there is no annual fee for the card.

If you're not ready for a new credit card, tenants at participating properties can earn points for paying their rent each month. The points can be used to pay rent, put toward a down payment on a home, book travel and more.

Bilt’s recent changes to its loyalty program make it easier to earn status simply by spending money on any linked debit or credit card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024, including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Chase's website

1x-5x

Points75,000

Pointson Chase's website

1.5%-5%

CashbackUp to $300

2x-5x

Miles75,000

Miles