The Guide to Bilt Transfer Partners

Transferring Bilt Rewards to a transfer partner generally offers the best value for your points.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

You'll often get the most value from your Bilt Rewards points by transferring them to one of the program’s many airline and hotel loyalty partners. Bilt has quickly become a top-tier rewards currency in part by adding unique transfer partners like Alaska Airlines and Japan Airlines — options you won't find with issuers like Chase or American Express.

With the launch of Bilt’s new cards in early 2026, the transfer partner network remains one of the program's strongest features. Here's what to know about your transfer options from Bilt Rewards.

Bilt airline and hotel transfer partners

Bilt members can transfer points to more than 20 airline and hotel loyalty programs at a rate of 1:1, meaning 1,000 Bilt points become 1,000 points in the loyalty program they’re transferred to. The only exception is the Accor Live Limitless program, which has a 3:2 ratio (1,000 Bilt points become 666 Accor points).

Complete list of Bilt transfer partners

- British Airways Club (Avios).

Additionally, for every 20,000 points transferred to Marriott in a single transaction, Bilt Rewards members will receive an additional 5,000 Marriott Bonvoy points.

How the cards compare

Annual fee

- $0

- $95

- $495

Bilt Points on rent/mortgage payments

Up to 1.25x points.

Up to 1.25x points.

Up to 1.25x points.

Bilt Points on other spending

- 1x points on everyday purchases. (You'll also earn 4% back in Bilt Cash on these purchases, if you choose that option.)

- 3x points on your choice of dining or grocery (on up to $25K in spending per year in the grocery category). Your choice category may be changed once a year.

- 2x points on travel.

- 1x points on everyday purchases.

- (You'll also earn 4% back in Bilt Cash on these purchases, if you choose that option.)

- 2x points on everyday purchases. (You'll also earn 4% back in Bilt Cash on these purchases, if you choose that option.)

Welcome offer

$100 of Bilt Cash when you apply and get approved.

$200 of Bilt Cash when you apply and get approved.

50,000 Bilt Points + Gold Status after spending $4,000 on everyday purchases in the first 3 months + $300 of Bilt Cash.

Anniversary bonus

None.

None.

Annual $200 Bilt Cash credit.

Additional perks

- Multiple transfer partners.

- Multiple transfer partners.

- $100 Bilt Travel portal hotel credit, split semi-annually, per calendar year. (Minimum two-night stay required.)

- Multiple transfer partners.

- $400 Bilt Travel portal hotel credit, split semi-annually, per calendar year. (Minimum two-night stay required.)

- Access to participating Priority Pass lounges and landings. (Two guests allowed on every visit.)

Authorized user fee

$0.

$50.

$95.

APR

The ongoing APR is 26.74%-34.74% Variable APR

The ongoing APR is 26.74%-34.74% Variable APR

The ongoing APR is 26.74%-34.74% Variable APR

Foreign transaction fee

- $0

- $0

- $0

Learn more

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Transfer limits and processing times

Rewards can be transferred to partners in 1,000-point increments. Blue tier members in the Bilt Rewards program must transfer a minimum of 2,000 points, while Silver, Gold, and Platinum members and above can transfer a minimum of 1,000 points.

According to Bilt, most transfers are immediate, but you should allow up to 48 hours for the transfer to be completed. Southwest Airlines transfers can take up to 72 hours.

» Learn more: The best travel credit cards right now

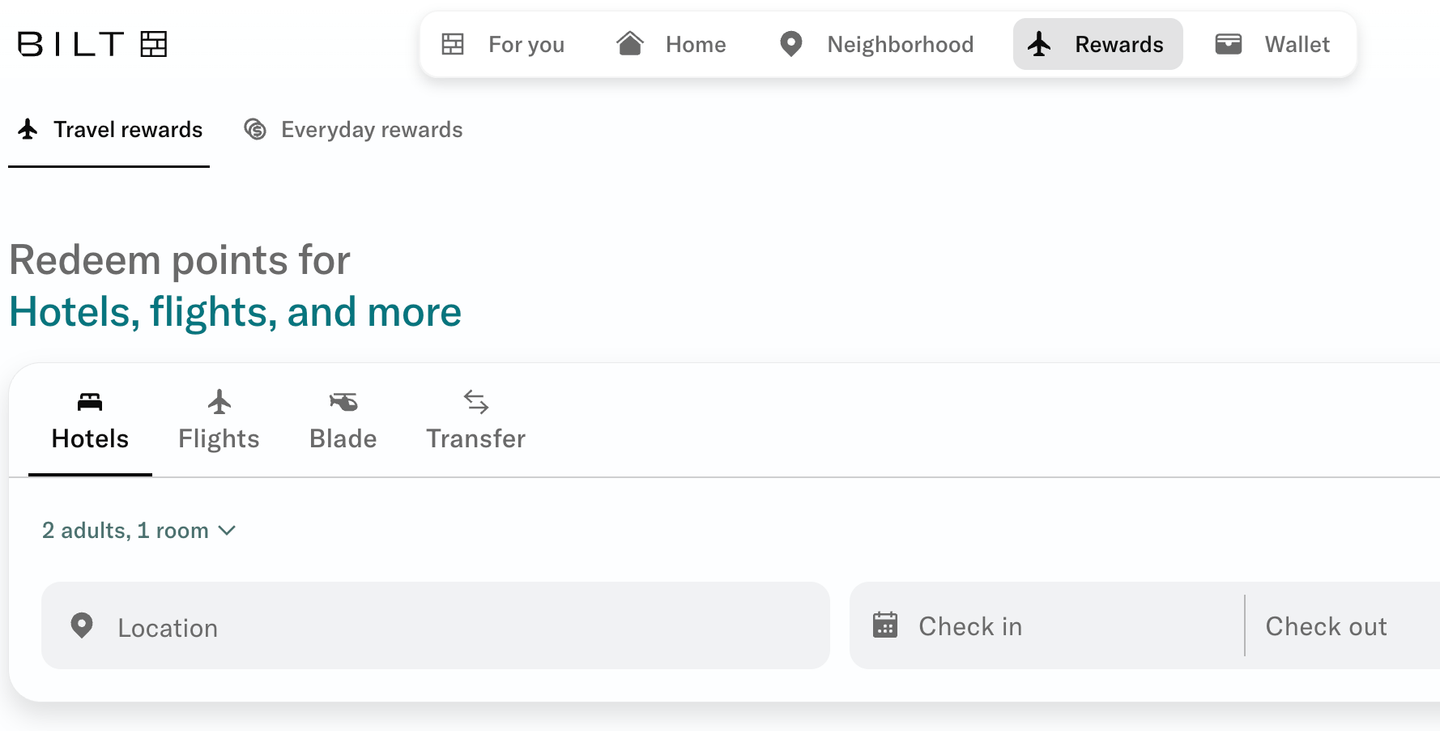

How to transfer Bilt Rewards

You can transfer Bilt points to partners either using Bilt’s mobile app or desktop. The process is the same for both.

First, navigate to the “Rewards” tab and select "Transfer."

Then select the hotel or airline loyalty program you want to link to your Bilt account.

Enter the number of points you intend to convert, and then confirm the transfer. Then you’ll be able to initiate a transfer.

Make sure your loyalty program account information is accurate before initiating a transfer. Transfers cannot be reversed once processed.

Which Bilt transfer partners are best?

World of Hyatt is the most valuable of Bilt's transfer partners, according to NerdWallet’s valuations. But that doesn’t mean you shouldn’t consider other options. The estimated point values below represent a median when redeeming these points for award stays or economy seats. You can often get better value (especially if you are booking business or first class seats), but this is the minimum value you should shoot for.

| Transfer partner | Estimated value |

|---|---|

| World of Hyatt | 1.8 cents. |

| Alaska Airlines | 1.2 cents. |

| Southwest Airlines | 1.3 cents. |

| British Airways Avios | 1.2 cents. |

| United MileagePlus | 1.2 cents. |

| Air Canada Aeroplan | 1.1 cents. |

World of Hyatt

World of Hyatt consistently ranks as the most valuable hotel loyalty program, making it Bilt's best hotel transfer partner. Hyatt points are worth the most of any hotel point currency. It also has an award chart, which makes it easier to predict how many points you'll need for an award stay, and an easy-to-use Points Calendar to find availability. Budget-friendly category 1 hotels start at 3,500 points per night for standard rooms, while ultra-luxury category 8 properties can go up to 45,000 points per night for standard rooms.

World of Hyatt also has several all-inclusive properties that you can book with points from brands such as Alila, Miraval, Ziva and Zilara.

Alaska Airlines

Alaska Airlines is an exclusive Bilt transfer partner. You can't transfer Chase, AmEx points, Citi ThankYou points or Capital One miles to Alaska’s Atmos Rewards loyalty program.

And redemptions through the Atmos Rewards program can be extremely valuable too — even for people who don't live in the Pacific Northwest, where Alaska tends to dominate. By leveraging Alaska's partners like Iberia or Aer Lingus, you could use Atmos Rewards points to book business class awards between the U.S. and Europe starting at 45,000 points for flight distances between 1,501 and 3,500 miles. Plus, Atmos' favorable stopover policy means you could potentially milk a couple flights out of one redemption if you're doing a multicity trip.

Should you transfer Bilt Rewards to partners?

Yes, in most cases. Bilt points are worth about 1.25 cents each when redeemed through Bilt’s travel portal, but transferring Bilt points to an airline or hotel partner program has the potential to give you even more value.

Here are various Bilt redemption options based on their redemption value:

| Redemption option | Estimated value per 10,000 Bilt points |

|---|---|

| Transfer to World of Hyatt | $180. |

| Redeem for home down payment | $150. |

| Book travel through the Bilt Travel portal | $125. |

| Lyft rides | $70. |

| Amazon purchases | $70. |

| Pay rent with points | $55. |

| Redeem for a statement credit | $55. |

Tips for maximizing value when transferring Bilt points

- Accumulate Bilt points in your Bilt account, rather than transferring immediately. Don't transfer speculatively unless you have a specific redemption in mind. Bilt points don't expire, so you have time to decide which hotel or airline program to transfer them to.

- Monitor Rent Day bonuses on the first of each month. Set a calendar reminder to check the Bilt app.

- Research partner award charts before transferring. Understanding sweet spots helps you maximize value.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles