CrossCountry Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

3.0

CrossCountry offers programs that make homebuying more accessible, including grants for first-time home buyers, a credit toward future refinancing for current home buyers and temporary buydowns. However, the lender charges high rates and fees compared to competitors, and it does not post sample rates online.

Pros

- Offers a wide range of loan types, including loans for manufactured homes, jumbo loans, government loans (FHA, VA and USDA), home equity loans and HELOCs.

- Offers programs that make borrowing more accessible, including down payment grants.

- Offers a FastTrack Credit Approval program, which allows borrowers who have undergone the full preapproval process to close on a loan in as little as seven days once they’ve made an offer.

Cons

- Does not post rates online.

- Both mortgage rates and fees are higher than average.

- Doesn’t offer customer service via live chat.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about CrossCountry mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

CrossCountry receives a score of 737 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

CrossCountry receives a score of 646 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Servicer Satisfaction Study. The industry average for servicing is 601. (A mortgage servicer handles loan payments.)

CrossCountry receives a customer rating of 4.97 out of 5 on Zillow, as of the date of publication. The rating reflects more than 20,235 customer reviews.

CrossCountry’s mortgage loan options

5 of 5 stars

CrossCountry offers a relatively large number of loan options. For example, in addition to conventional and jumbo loans, the lender finances mortgages for manufactured homes.

Government-backed options include VA loans, FHA loans and USDA loans. These loans accounted for nearly a third of CrossCountry’s originations in 2022.

CrossCountry also offers a variety of ways to reduce the costs of homebuying and refinancing. These include:

A temporary buydown program, financed by the seller or builder, which reduces the interest rate between 1% and 3%.

Freddie Mac BorrowSmart Access, which provides up to $4,000 in down payment or closing cost assistance for borrowers who meet income requirements and other eligibility criteria.

CCM Smart Start, which provides up to $4,000 in down payment assistance for first-time borrowers who make no more than 80% of their county’s median income.

CCM Community Promise, which provides $6,500 in down payment assistance to borrowers moving from or within select communities in Atlanta, Baltimore, Chicago, Detroit, Memphis and Philadelphia.

A “buy now, refinance later” program, where borrowers can receive a credit of $1,500 toward refinancing to a lower mortgage rate down the line.

Borrowers planning on renovating a home have a choice of four loans: FHA 203(k), Fannie Mae HomeStyle, Freddie Mac CHOICERenovation and VA renovation loan.

CrossCountry HELOC and home equity loan

The lender also offers a home equity line of credit, or HELOC. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

CrossCountry offers both HELOCs and home equity loans, which the lender calls “closed end second loans.” These have a maximum loan-to-value ratio of 80% and are available to borrowers needing between $100,000 and $500,000. This minimum loan balance is higher than what most lenders require, and borrowers who need to borrow less should look elsewhere.

CrossCountry also offers a version of its home equity loan called CCM Equity Express, which the lender says can be closed within five minutes and funded within five days.

» MORE: Best HELOC lenders

What it’s like to apply for a CrossCountry mortgage

2.5 of 5 stars

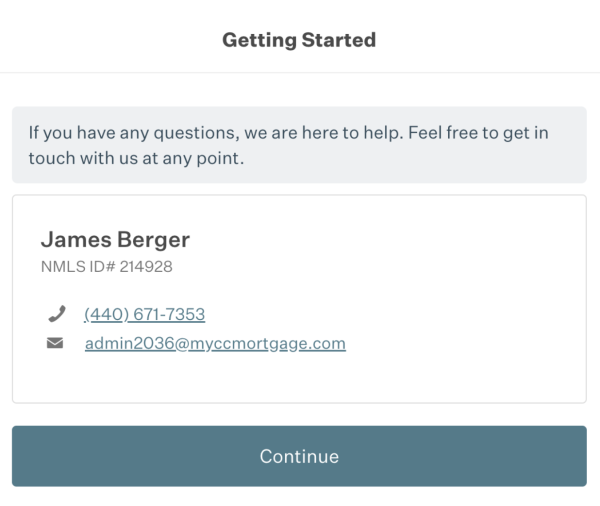

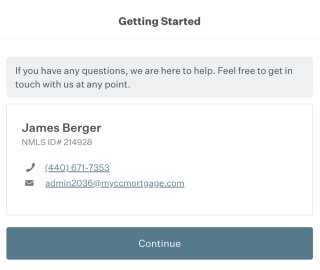

In order to fill out an application on CrossCountry’s site, borrowers have to fill out a contact form and create an account. Once they’ve been matched with a mortgage representative, borrowers can begin an application and upload supporting documents directly to the lender’s site for approval.

After being preapproved, borrowers could close on their loan within seven days after signing a purchase agreement through CrossCountry’s FastTrack Credit Approval program.

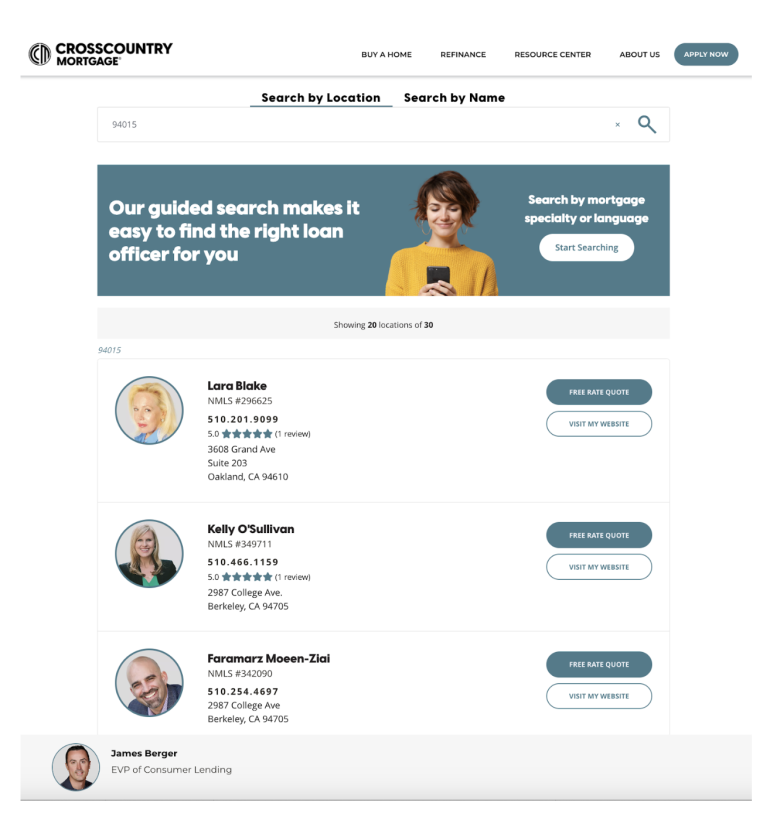

As an alternative to being matched with a representative upon starting an application, borrowers who are not ready to start the process yet can find a loan officer in their area using the lender’s search tool.

However, CrossCountry lost points in our review because it’s somewhat more difficult to communicate with them than other lenders. They don’t list hours of availability for any of the customer service numbers on their site, nor do they have a chat feature. When we tried their customer service line, we were disconnected twice and told that their phones were having problems. They offered to have a representative call us back, but this did not happen, and some of our questions ultimately went unanswered.

» MORE: How to apply for a mortgage

CrossCountry’s mortgage rates and fees

2 of 5 stars

CrossCountry earns 2 of 5 stars for average origination fee.

CrossCountry earns 2 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. CrossCountry’s average mortgage interest rates and origination fees are on the higher side compared to other lenders in the industry.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

CrossCountry’s mortgage rate transparency

1 of 5 stars

CrossCountry does not provide sample rates on their site, which makes it difficult for borrowers to compare offers without first reaching out for a rate quote or applying for preapproval.

Alternatives to a home loan from CrossCountry

First-time home buyers may be interested in a mortgage from PNC, while borrowers looking for a lender with dedicated programs for underserved communities could be drawn to New American Funding.

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).