SoFi Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

3.5

SoFi offers an all-online application experience and a large array of perks for borrowers with an online account, and HELOC borrowers can access a higher percentage of their equity than is offered by many competitors. Interest rates are on the low side, according to the latest federal data.

Pros

- Has a highly rated mobile app that integrates with SoFi’s member rewards program.

- Home equity line of credit (HELOC) borrowers can access up to 90% of home’s value, a higher limit than most lenders’.

- Recently expanded mortgage offerings to include government-backed FHA and VA loans.

Cons

- Requires users to create an account to access some digital conveniences, including loan application and customer service chat.

- Displays only sample rates on its website. (Users with an online account can request a customized rate quote.)

- Doesn’t offer renovation or construction-to-permanent loans.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about SoFi mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from Zillow.

SoFi receives a customer rating of 4.86 out of 5 on Zillow, as of the date of publication. The rating reflects more than 1,665 customer reviews.

SoFi’s mortgage loan options

4 of 5 stars

SoFi offers mortgage options you might expect from an all-online lender, including fixed-rate conventional loans in varying term lengths, including 10-, 15-, 20- and 30-year terms. Adjustable-rate mortgages are also available.

For conventional loans, SoFi allows first-time home buyers to make a minimum down payment of 3%. For other buyers, the minimum down payment is 5%.

Unlike some of its competitors, SoFi also offers a wider range of mortgage options, including government-backed FHA and VA loans and jumbo loans up to $3 million. If you pre-qualify for a jumbo loan online, the lender requires a minimum down payment of 10%. However, SoFi doesn’t offer renovation or construction-to-permanent loans.

In our research, we found it easy to navigate the SoFi website to see which loan options are available.

SoFi also offers multiple ways to refinance your existing mortgage. Options include a rate-and-term refinance, cash-out refinance or government-backed streamline refinance. Purchase mortgages are available in all 50 states, but refinance loans are not available in New York.

If your purchase loan meets certain conditions — for example, it’s not a short sale — SoFi backs it up with a $5,000 close-on-time guarantee. You can apply the money toward closing costs or expenses caused by the delay.

SoFi HELOC

The lender also offers a home equity line of credit, or HELOC. These second mortgages are a way for homeowners to access existing home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

SoFi’s HELOC allows borrowers to access up to 90% of their home’s equity, up to $500,000. That’s higher than the typical limit set by HELOC lenders, which usually let you borrow up to 85% of your home’s value.

» MORE: Best HELOC lenders

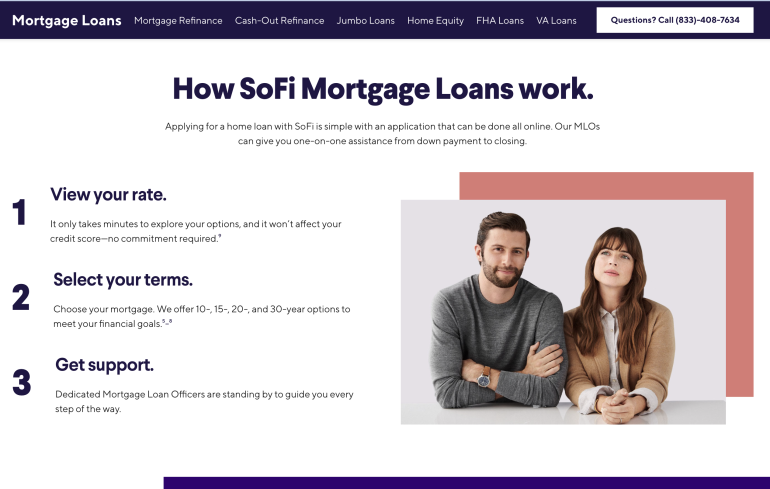

What it’s like to apply for a SoFi mortgage

3 of 5 stars

SoFi doesn’t have branches, so the mortgage experience unfolds online or through the lender’s highly rated mobile app. There, SoFi offers common conveniences including a self-service mortgage application, loan progress tracking and document upload.

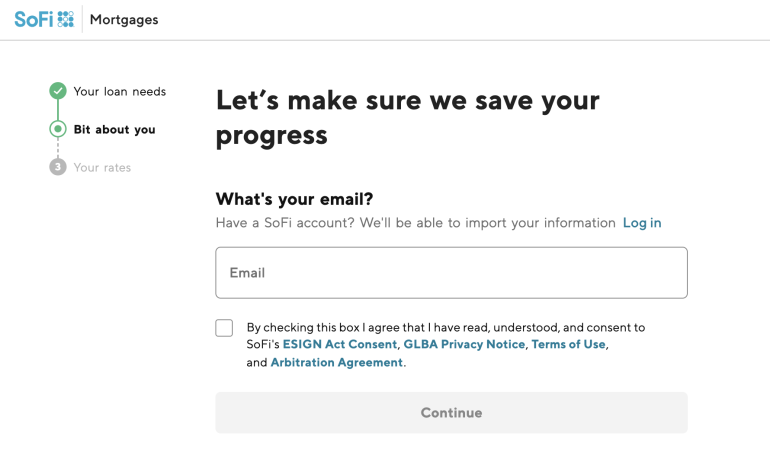

However, there’s one key requirement: You have to create an online account with SoFi to access all of these features. That’s not hard to do, but it’s worth noting that many other mortgage lenders let borrowers get preapproved or apply using contact information (without requiring another set of login credentials). NerdWallet recommends getting preapproved with at least three lenders to get the best rate. If you’re mortgage shopping, consider the effort you’re willing to spend just to apply.

SoFi offers numerous perks to those who create online accounts. SoFi members have access to complimentary financial planning, as well as members-only events and experiences in person and online. Members can also get rate discounts on other types of SoFi loans.

If you already have a student loan or personal loan with SoFi, home loans aren’t eligible for the member rate discount. However, SoFi members can earn rewards points — which can be redeemed for cash — for using the SoFi app to manage a mortgage.

» MORE: Our review of SoFi student loans

A mortgage loan officer follows your application from start to finish. A chatbot is available 24/7 to those with online accounts. Customer service agents are available via online chat or by phone on weekdays from 6:00 a.m. to 3:00 p.m. PST.

When we called the customer service line with questions, we found the menu options easy to navigate. In less than a minute, we connected with a real person who answered our questions efficiently. We didn’t experience a hold time, but if you want to hang up and receive a call back, SoFi makes that option available.

» MORE: How to apply for a mortgage

SoFi’s mortgage rates and fees

3.5 of 5 stars

SoFi earns 3 of 5 stars for average origination fee.

SoFi earns 4 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. SoFi’s origination fee is about average, and the lender’s interest rates are on the low side.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Borrowers with an eligible loan or investment account from SoFi may qualify for a $500 discount on mortgage fees.

SoFi’s mortgage rate transparency

3 of 5 stars

SoFi publishes a few general mortgage rates on its website. To get a customized rate quote, you'll need to create an online account. The rate customization tool asks you a few simple questions before requiring your email address.

NerdWallet’s transparency ratings are highest for sites with self-serve tools that allow shoppers to customize a rate estimate, making it easier to comparison shop.

Alternatives to SoFi mortgage

Here are some comparable lenders we review that borrowers can consider.

Guaranteed Rate offers similar digital conveniences for borrowers who prefer to manage their mortgage online. Northpointe has a wide range of conventional and government-backed mortgages for first-time buyers, but doesn’t offer home equity lines of credit.

» MORE: Best mortgage lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).