Better Mortgage Review 2024

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners and here's how we make money.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

4.5

Better provides an easy-to-navigate application process and generally offers lower mortgage rates than average. But its fees are on the higher end, and it doesn't offer harder-to-find mortgages, such as construction and renovation loans.

Pros

- Offers a one-day mortgage that lets eligible borrowers apply, lock in a rate and get a loan commitment within 24 hours.

- Average interest rates are on the low end compared with other lenders, according to the latest federal data.

- Offers a HELOC and a home equity loan; both can be used for a primary, second or investment home.

Cons

- Doesn't offer harder-to-find loans, such as construction loans, renovation loans, or USDA mortgages.

- Finding descriptions of all of the loan offerings on the website requires some digging, and the lender does not have a mobile app.

- Average lender fees are on the high end compared with other lenders, according to the latest federal data.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 0% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Better at Better | |

580 | 3.5% | Visit Lenderat Rocket Mortgage, LLC at Rocket Mortgage, LLC | |

620 | 0% | Visit Lenderat Veterans United at Veterans United | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate |

Full Review

Better Mortgage's loan options

4 of 5 stars

Better offers relatively common types of fixed- and adjustable-rate purchase and refinance loans, including conventional loans, jumbo loans and government-backed FHA and VA mortgages. Eligible properties include homes with two to four units, townhouses and condominiums, homes in planned unit developments and manufactured homes.

The lender's primary focus is on conventional mortgages. In 2022, 97% of its loans by volume were conventional loans, 2% were jumbo and 1% were FHA loans, according to the latest federal data.

Better doesn't offer harder-to-find mortgages, such as USDA loans, construction and renovation loans, or mortgages for modular homes, multifamily homes with five or more units, co-ops and mixed-use properties.

Finding all of Better's loan options on the website is difficult. On the day we checked, three fixed-rate conventional mortgages and one fixed-rate FHA mortgage were listed on the rates page.

We had to dig through an FAQ page to learn that the lender offered VA loans and click on the terms and conditions for Better's one-day mortgage to see that it offered jumbo loans.

Better Mortgage home equity loan and HELOC

The lender also offers home equity loans and home equity lines of credit (HELOCs). These second mortgages are one way for homeowners to access home equity without refinancing or selling their home. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Better’s “digital HELOC” and home equity loan allow borrowers to access up to 90% of a home’s value — higher than the common 85% threshold of many lenders — and can be used to tap into equity from a primary residence, a second home or an investment property.

The HELOC has variable interest rates while the home equity loan has a fixed annual percentage rate.

When it launched the home equity loan in April 2024, Better said it anticipated offering the product nationwide as it met licensing requirements. As of April 23, the home equity loan was available in 30 states.

» MORE: Best HELOC lenders

What it's like to apply for a Better Mortgage home loan

4 of 5 stars

Better promotes a "One Day Mortgage" that lets you apply and lock in a rate online. Eligible customers must provide the required financial documentation within four hours of locking in a rate to get a "commitment letter" within the next 24 hours. The commitment letter is a step beyond a mortgage preapproval, which Better says can be accomplished in minutes. But even if you have a commitment letter, your loan will still have to go through some final checks before closing and may require additional documentation.

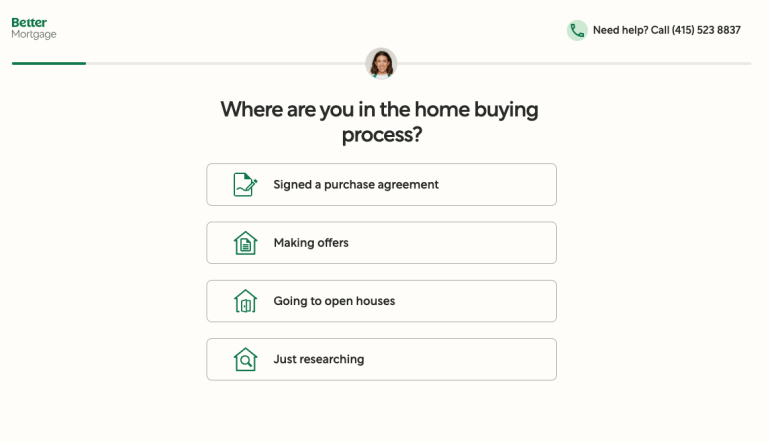

Better offers a fully digital application. The process begins online by clicking a button on the Better homepage. Choosing the "get pre-approved" or "buy a home" option brings up a page with various scenarios, such as "Just researching" and "Making offers." For refinancing, you'll enter some brief information about the property, then submit your email address before continuing.

The phone number is available on most pages of the website. When we called, it took less than a minute to navigate an automated phone menu and reach a human being. The sales development associate was able to answer our questions.

The website features an online chat, but associates aren’t always available. We typed in a question and then finally closed the window after two hours of getting no response. If you don't mind providing your contact information, the chat feature gives the option of leaving your email address so the lender can contact you directly.

Unlike many mortgage lenders, Better does not have a mobile app.

» MORE: How to apply for a mortgage

Better Mortgage's rates and fees

3.5 of 5 stars

Better earns 2 of 5 stars for average origination fee.

Better earns 5 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by the lenders. Better's rates are lower than average compared with other lenders, but its fees are on the higher end.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Better says it will give qualifying loan borrowers a $2,000 closing cost credit if they choose to work with a Better-referred real estate agent.

Better Mortgage's rate transparency

4 of 5 stars

You can find sample interest rates and APRs for four types of fixed-rate mortgages on Better's website, but you can't get customized quotes without providing contact information. On the day we looked, the rates were based on a 20% down payment and assumed a borrower with a credit score of 760 or higher and a debt-to-income ratio below 35%. It's not unusual for lenders to post sample rates based on an exceptionally strong financial profile, but keep in mind that you may be quoted a higher rate.

What borrowers say about Better Mortgage

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Better Mortgage receives a score of 715 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Better Mortgage receives a customer rating of 4.39 out of 5 on Zillow, as of the date of publication. The score reflects nearly 870 customer reviews.

Alternatives to Better Mortgage

Here are some comparable lenders we review that borrowers can consider.

Guaranteed Rate offers a strong digital experience, and PNC Bank offers options for first-time home buyers.

» MORE: Best online lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

John Buzbee contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).