Guaranteed Rate Mortgage Review 2024

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

- 50+ mortgage lenders reviewed and rated by our team of experts.

- 40+ years of combined experience covering mortgages and financial topics.

- Objective, comprehensive star rating system assessing 120+ categories and 5,000+ data points.

- Governed by NerdWallet's strict guidelines for editorial integrity.

Our Take

5.0

Guaranteed Rate offers a wider selection of mortgages than many lenders and a home equity line of credit that can be funded in as few as five business days. It also offers a one-day mortgage approval process.

Pros

- Offers a one-day mortgage approval process.

- Offers a generous selection of loans, including government-backed, interest-only, ITIN, jumbo and renovation loans.

- Advertises a HELOC that can be funded in as few as five business days.

Cons

- Origination fees are higher than average, according to the latest federal data.

- HELOC has a relatively short draw period, which may not provide flexibility for someone who wants the option of accessing home equity over a longer period.

Lender | Min. credit score | Min. down payment | |

|---|---|---|---|

620 | 3.5% | Visit Lenderat NBKC at NBKC | |

620 | 3% | Visit Lenderat Guaranteed Rate at Guaranteed Rate | |

620 | 5% | ||

620 | 3% | ||

620 | 3% |

Full Review

What borrowers say about Guaranteed Rate mortgages

NerdWallet’s lender star ratings assess objective qualities, including rates, fees and loan offerings. To assess borrowers’ subjective experiences with lenders, NerdWallet has gathered customer satisfaction ratings from J.D. Power and Zillow.

Guaranteed Rate receives a score of 704 out of 1,000 in J.D. Power’s 2023 U.S. Mortgage Origination Satisfaction Study. The industry average for origination is 730. (Mortgage origination covers the initial application through closing day.)

Guaranteed Rate receives a customer rating of 4.96 out of 5 on Zillow, as of the date of publication. The score reflects nearly 21,150 customer reviews.

Guaranteed Rate's mortgage loan options

5 of 5 stars

Guaranteed Rate offers a full lineup of conventional and government-backed purchase and refinance mortgages, as well as some hard-to-find choices, such as interest-only, construction-to-permanent and ITIN loans. Conventional loans for manufactured homes are also available.

It's easy to find Guaranteed Rate's mortgages menu. Just select "loan options" at the top of the homepage to see a list of categories. Selecting a category will take you to a page explaining the mortgage type. You'll find details about borrower requirements, benefits and drawbacks, comparisons to other loans and more.

Besides 15- and 30-year fixed-rate mortgages, Guaranteed Rate offers 5-, 7- and 10-year adjustable-rate loans.

Guaranteed Rate also offers FHA, VA and USDA mortgages, including FHA and VA renovation loans and FHA's reverse mortgage, known as a Home Equity Conversion Mortgage (HECM). And there are a variety of options for high-cost properties, including jumbo loans for vacation homes and investment properties.

Guaranteed Rate's home equity loan and HELOC

The lender also offers home equity loans and a home equity line of credit (HELOC). These first or second mortgages are a way for homeowners to access home equity without refinancing or selling their homes. Funds obtained with a second mortgage can be used for expenses such as home improvements, education costs or debt consolidation.

Guaranteed Rate's home equity loans are available with terms of five, 10, 15, 20, 25 and 30 years. The lender's HELOC has a fixed or adjustable rate and a draw period of two to five years. The relatively short draw period — a typical period is 10 years — makes this HELOC a good option for immediate needs.

Applying online takes five to 10 minutes, and Guaranteed Rate says it can fund a home equity loan or HELOC in as few as five business days, faster than what's typical in the industry.

» MORE: Best HELOC lenders

What it's like to apply for a Guaranteed Rate mortgage

4.5 of 5 stars

Guaranteed Rate offers a digital application process. Selecting the "apply" or "get started" button opens a window to begin an application and includes a sidebar with the name and contact information of a local loan officer. If you select "share screen," you can get a code to share with the loan officer once you're working together.

There's also a general phone number at the top of the homepage. We had to call the number multiple times to reach a human. The other times, we received an automated prompt to leave a voicemail for a loan officer or send a text to get a callback.

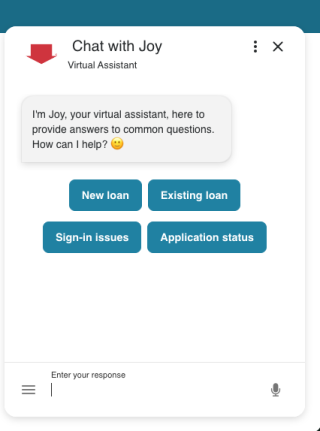

The website features a chatbot, which we could access by selecting a red arrow at the bottom of the homepage. The chatbot took us through a series of questions when we indicated that we were interested in a new loan and then gave us options to call a loan officer, have the loan officer call us, schedule a call or apply online. It didn't provide any other information.

Guaranteed Rate has branches in all 50 states. However, the locations may not be obvious on a quick visit to the website. On the day we checked, we found branch locations by selecting the search icon on the homepage and typing in "branches." From there, we could find the addresses, phone numbers and hours of nearby branches and could select individual branches to get contact information and bios for loan officers.

With its "same day mortgage," Guaranteed Rate says a borrower can get approved within one business day and earn a $250 credit toward closing costs if they provide all the required documentation within eight business hours of signing the application. The offer isn't available in Kentucky or West Virginia, nor is it available for New York co-op or Consolidation, Extension and Modification Agreement (CEMA) loans or Texas refinance loans.

» MORE: How to apply for a mortgage

Guaranteed Rate's mortgage rates and fees

2.5 of 5 stars

Guaranteed Rate earns 2 of 5 stars for average origination fee.

Guaranteed Rate earns 3 of 5 stars for average mortgage interest rates.

NerdWallet analyzes federal data to compare mortgage lenders’ origination fees and offered mortgage rates. We measure annual averages across all loan types, as reported by lenders. Guaranteed Rate’s origination fees tend to be higher than average for the industry, while its mortgage rates are average.

Borrowers should consider the balance between lender fees and mortgage rates. While it's not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

Guaranteed Rate's mortgage rate transparency

5 of 5 stars

Guaranteed Rate lets you see current interest rates and Annual Percentage Rates (APRs) for many of its products. And its rates page lets you enter different values for purchase price, down payment and credit score to see customized rates, without giving your name and contact information.

Alternatives to a Guaranteed Rate mortgage

Here are some comparable lenders we review that borrowers can consider.

Bank of America offers a similar digital experience, and NBKC Bank offers a similar variety of loan types.

» MORE: Best mortgage lenders

Explore mortgages today and get started on your homeownership goals

Get personalized rates. Your lender matches are just a few questions away.

Bella Angelos contributed to this review.

More from NerdWallet

NerdWallet’s overall ratings for mortgage lenders are evaluated based on four major categories: variety of loan types (purchase, refinance, fixed and adjustable, for example), ease of application, rates and fees and rate transparency. Among the factors we consider when scoring these categories are options to apply for and track loans online, the level of detail about mortgage rates on lender websites and our analysis of the rates and fees lenders reported in the latest available Home Mortgage Disclosure Act data. These scores generate ratings from 1 star (poor) to 5 stars (excellent).