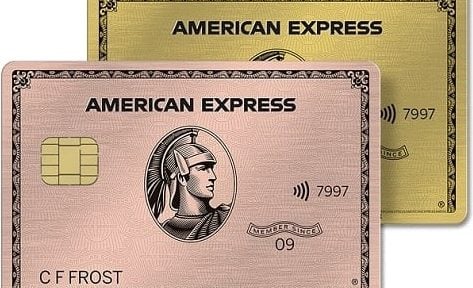

Is the American Express Gold Card Worth Its Annual Fee?

This card's annual fee makes it cheaper than many premium cards and has more rewards than basic travel cards.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

With lots of no-annual-fee credit cards out there, the $325 annual fee on a card like the American Express® Gold Card can be hard to justify. Plus, with the pandemic leaving so many travelers grounded, the card’s emphasis on travel rewards may be less appealing. So is the American Express® Gold Card worth the annual fee?

Well, there’s more to this card than just travel benefits. The American Express® Gold Card has an attractive 4 points per $1 dollar rewards earning structure for people who spend a lot of money at U.S. supermarkets and restaurants worldwide, in addition to some valuable dining statement credits each month. Terms apply (see rates and fees).

So even for users who aren’t traveling much these days, the benefits could prove worth more than the annual fee. Below is a quick overview of the benefits, followed by some points to consider when deciding whether the American Express® Gold Card is worth it for you.

Perks of the American Express® Gold Card

The American Express® Gold Card can be a great option during "normal times," offering the following welcome bonus: You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Cardholders earn 4 American Express Membership Rewards points per dollar spent on restaurants worldwide (up to $50,000 per calendar year) as well as on the first $25,000 spent at U.S. supermarkets annually. Plus, earn 3 points per dollar on flights booked directly with airlines and amextravel.com, 2 points per dollar on prepaid hotels booked through amextravel.com and 1 point per dollar on all other spending. Terms apply.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

The American Express® Gold Card annual fee is worth it if you...

Spend a lot of money at restaurants and U.S. supermarkets

The 4 points per dollar you earn for spending on groceries at restaurants worldwide and U.S. supermarkets is much higher than many rewards cards. Keep in mind the 4x on U.S. supermarket spending applies to up to $25,000 per calendar year in purchases, then it reverts to 1x. The elevated earn rate cap on restaurants is $50,000. Others only offer 1 point per dollar on the same spend, so this card can provide a hefty boost for your points accrual. Terms apply.

Use the $10 monthly Uber Cash and $10 monthly credits for select dining services

The American Express® Gold Card comes with several hundred dollars in credits, including up to $120 annually in dining (up to $10 per month at specific delivery services including Grubhub, Goldbelly and a few restaurants).

American Express also added a new benefit to the American Express® Gold Card in 2021 that includes an additional $10 per month (up to $120 per year) in the form of Uber Cash, which can be used for either U.S. rides or Uber Eats orders. You have to add the card to your Uber account and pay with it (or another AmEx card) to collect the benefit. Terms apply.

You can likewise get an $84 annual credit for spending at U.S. Dunkin' locations and another $100 credit for spending at U.S. Resy restaurants.

If you make use of the full amount of all these credits, you'll pick up $424 worth of value, completely covering the annual fee.

Enrollment required. Terms apply.

Shop abroad

This card carries no foreign transaction fees. Foreign transaction fees on other cards can add up to 3% on every transaction made outside of the states — a hefty expense for frequent international travelers. Terms apply.

🤓 Nerdy Tip

AmEx is not accepted everywhere internationally, so it’s a good idea to also carry a Visa or Mastercard as a backup. Can earn the welcome offer

Aim to hit the spending minimum without carrying over a balance or paying interest charges. You don't want to miss out on tens of thousands of points, especially on a card with a significant annual fee.

» Learn more: The best AmEx transfer partners — and ones to avoid

The American Express® Gold Card annual fee is not worth it if you...

- Prefer cash back. Redeeming AmEx Membership Rewards points for maximum value can be complicated since points vary in value based on how you redeem them. Trading points for flights or other rewards can be limiting if you’re someone who prefers the simplicity of cash back or statement credits.

- Cannot use the aforementioned dining and related credits.

The bottom line

The American Express® Gold Card is great for some, but a money-losing proposition for others. If you’re a regular traveler who spends a lot on dining and at U.S. supermarkets, you can easily get more value out of this card than you pay in annual fees.

To view rates and fees of the American Express® Gold Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles