How to Compare Medicare Advantage Plans

Medicare Advantage plans are an alternative to Original Medicare, offered by private insurers. Here's how to shop.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Medicare Advantage plans can bundle Medicare Part A (hospital coverage), Medicare Part B (outpatient medical coverage) and Medicare Part D (prescription drug coverage).

That makes them a convenient way to get most of your coverage from a single source. But that also makes it important to choose the right plan to meet your needs.

And because plans change from year to year, it’s a good idea to compare your Medicare Advantage options during Medicare open enrollment: Oct. 15 to Dec. 7.

NerdWallet's best Medicare Advantage companies in 2025-2026

Step by step: How to compare Medicare Advantage plans

Here’s how we recommend comparing Medicare Advantage plans to find your best fit.

1. Check star ratings

The government rates Medicare Advantage plans on up to 40 measures of quality and performance. Those measures factor into an overall star rating, which can be an easy way to get a general sense of plan quality.

Star ratings use a 5-star scale where 5 is the best score. 5-star plans aren’t available everywhere, but it’s a good idea to shop around for the best options in your area.

The map below shows the highest star ratings for each state. Click on a state to see the best Medicare Advantage plans available there.

2. Compare costs

About three quarters of Medicare Advantage members are in plans with $0 premiums, according to health policy nonprofit KFF. (So they don’t owe anything in addition to the Part B premium of $202.90 per month in 2026.)

Premiums aren’t the only costs. You should also look at:

Medicare Advantage out-of-pocket costs

3. Keep your meds in mind

Most Medicare Advantage plans include prescription drug coverage. If you take medications, it’s important to check whether and how a plan covers your drugs.

Keep an eye on pharmacies, too. Plans might have certain pharmacies in their networks where you pay less. Your drugs might cost more or might not be covered at out-of-network pharmacies.

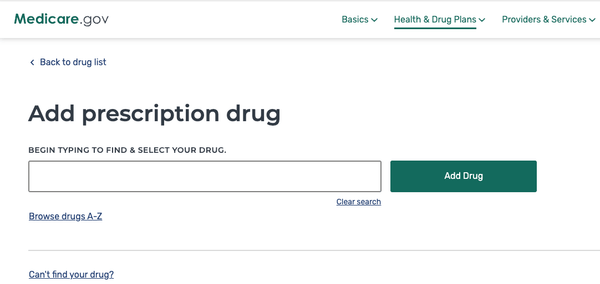

The plan finding tool on Medicare.gov and many insurance companies’ and brokers’ websites let you enter your medications and pharmacies to see what you’d pay with different plans. Compare carefully to keep your costs low.

Source: Medicare.gov

4. Look for your doctors

Many Medicare Advantage plans have networks of providers and facilities. You might pay more or not be covered at all if you go out of network.

Look for plans whose networks include providers who are important to you. You can ask your doctors what Medicare plans they accept. Some online shopping tools also allow you to enter your medical providers to show whether they’re in network.

5. Consider the plan type

Medicare Advantage plan types can determine which doctors or facilities you’re allowed to use and whether you need prior authorization for certain kinds of care.

Here are the major types of Medicare Advantage plans:

Health maintenance organization (HMO) plans: Require you to see an in-network provider unless it’s an emergency situation, and most require a referral to see a specialist.

Preferred provider organization (PPO) plans: Allow you to see both in-network and out-of-network health care providers, although it’s usually more expensive to go out of network. PPOs are generally networked in a local area or may expand to a wider region.

Private fee-for-service (PFFS) plans: Allow you to see any Medicare-approved health care provider as long as they accept the plan’s payment terms and agree to see you. You may also have access to a network of providers. You can see doctors that don’t accept the plan’s payment terms, but you might pay more.

Special needs plans (SNPs): Created to improve the management of care for Medicare beneficiaries who are either dually eligible for Medicare and Medicaid, require an institutional level of care or have certain chronic or disabling conditions, such as diabetes, chronic heart failure or dementia.

Medical savings account (MSA) plans: Combine a high-deductible insurance plan with a medical savings account that can be used for health care costs.

Shopping for Medicare Advantage plans? We have you covered.

MEDICARE ADVANTAGE is an alternative to traditional Medicare offered by private health insurers. Compare options from our Medicare Advantage roundup. | |

Best for size of network

| Best for Part B Giveback

|

Best for ratings

| Best for low-cost plan availability

|

Star ratings from CMS and on a 5-★ scale. | |

When can you sign up for Medicare Advantage (or change plans)?

If you’re signing up for Medicare for the first time, you can enroll in a Medicare Advantage plan during the following windows:

During your initial enrollment period (IEP).

During a special enrollment period (SEP), which you might qualify for if you experience a specific life event, such as retiring and leaving your employer-sponsored health coverage.

During Medicare’s general enrollment period from Jan. 1 to March 31, if you miss your initial enrollment period and don’t qualify for a SEP.

If you already have a Medicare Advantage plan, you can change Medicare Advantage plans at following times:

Each year during Medicare's open enrollment from Oct. 15 to Dec. 7. (You can also join a Medicare Advantage plan during this time if you want to switch from Original Medicare.)

Each year during Medicare Advantage open enrollment from Jan. 1 to March 31. (You can only change plans during this time if you already have a Medicare Advantage plan.)

During a SEP, which you might qualify for if you move out of your plan’s service area or move into a nursing home, among other life events.

If you're switching plans, you’ll be automatically unenrolled from your old plan once your new one starts.

If you have any questions about the process, you can reach the folks at Medicare at 800-MEDICARE (800-633-4227), or you can find information at Medicare.gov.

Medicare Advantage companies

Get more information below about some of the major Medicare Advantage companies. These insurance companies offer plans in most states. The plans you can choose from will depend on your ZIP code and county.

What are the pros and cons of Medicare Advantage plans?

Simplicity of bundled coverage.

Often low or $0 premiums.

Limits on maximum out-of-pocket costs.

Additional benefits such as some coverage for hearing, dental or vision care.

Denied claims can be an issue.

Provider networks can limit choice of doctors and hospitals.

Out-of-pocket costs can be high.

Might be difficult and/or expensive to switch back to Original Medicare with Medigap.

What's the difference between Medicare and Medicare Advantage?

Original Medicare includes Medicare Part A (hospital insurance) and Part B (medical insurance), and if you want drug coverage, you’ll need Medicare Part D as well. You can buy Medicare Supplement Insurance (Medigap) to help pay for your out-of-pocket costs, and you can use any health care provider in the U.S. that accepts Medicare.

Medicare Advantage is a bundled plan that includes the same coverage as Medicare Part A, Part B, and usually Part D. Out-of-pocket costs may be lower, and plans usually offer extra benefits like vision and dental coverage. With a Medicare Advantage plan, you’ll be limited to health care providers within the plan’s network, and you'll generally need prior authorization before seeing any specialists.

ON THIS PAGE

ON THIS PAGE