Fidelity Crypto: Pros, Cons and How it Compares

It's an easy entry point for Fidelity customers, but serious crypto enthusiasts might find the product lacking.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Crypto isn't for everyone — it's risky, volatile and can be hard to navigate. Fidelity's product has simplified the process, largely by starting investors with just a few crypto options.

Fidelity Crypto could be appealing for investors who are curious about cryptocurrency and already know and trust Fidelity with their investments. Or, if you're only interested in gaining exposure to some of the most established cryptocurrencies (Fidelity offers access to Bitcoin, Ethereum, Litecoin, Solana and Fidelity Digital Dollar) through a traditional broker, Fidelity could be a decent option.

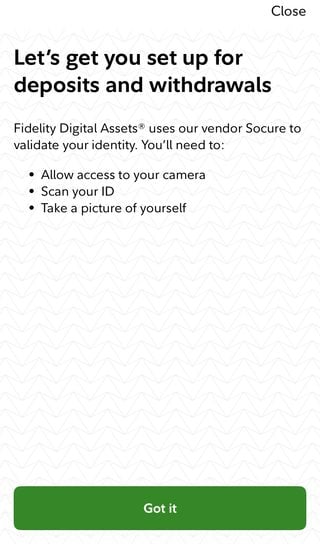

Perhaps one of the most enticing aspects of Fidelity's crypto offering is that users can move cryptocurrency into and out of their Fidelity account via the app. Previously, the inability to transfer assets was a major drag on Fidelity Crypto.

You'll have to set up your Fidelity account to allow this feature, which requires taking a photo of both yourself and a form of identification. This may feel intrusive, but it's very common in the crypto world, and is a part of KYC (Know Your Customer) regulations, so don't be alarmed by this.

Still, if you’re already an advanced crypto investor, chances are you’re not going to be interested in switching for these new offerings alone. While Fidelity’s low trading costs are competitive with some of the leading crypto exchanges, the selection and crypto functionality are not yet up to par.

Advertisement

Fees $0per trade | Fees 2%-5.5% |

Account minimum $0 | Account minimum $1 |

Promotion Up to 4% match (up to $2M)when you open and fund an account with Webull | Promotion Noneno promotion available at this time |

Why you might want to sign up

Here are a few factors to consider as you evaluate Fidelity's crypto offerings.

Crypto trading fees

Fidelity is offering customers what it describes as “commission-free” crypto trading. That doesn’t necessarily mean trading is free. The company says it takes a spread of up to 1% on crypto trades.

Still, that’s relatively good compared with other crypto services reviewed by NerdWallet. Coinbase, the largest U.S.-based exchange focused solely on crypto, has a confusing fee structure that may result in fees anywhere between 1% and 4%, depending on the method of payment.

Funding and minimums

Funding a Fidelity Crypto account could be easy if you already have a brokerage or cash management account with the company. You’ll be able to move money from Fidelity accounts into Fidelity Crypto.

There’s no minimum deposit to open a crypto trading account. And the minimum crypto purchase is $1, Fidelity says. These factors put the company on even footing with most other leading exchanges.

If you don’t have a Fidelity account, making purchases will require you to create and fund an account such as a brokerage or cash management account.

Why you might want to use another exchange

Availability

Some of Fidelity Crypto services aren't available in every state . If you can’t access the service in your state, you’ll have to go with another option.

Crypto selection

Fidelity Crypto’s offerings are on the low end among cryptocurrency platforms reviewed by NerdWallet. Granted, Bitcoin and Ethereum are the two most valuable cryptocurrencies (and Litecoin is one of the original altcoins), which means they are widely used and relatively well-established in this emerging sector.

However, cryptocurrency traders often look at more options when they are buying and selling. Crypto.com, another major cryptocurrency exchange, has around 400 cryptocurrencies for sale. Other brokerages also have more crypto options.

It may turn out that Fidelity follows the path of other brokerages, such as Robinhood, which started with limited crypto offerings, then expanded over time.

Functionality

Fidelity Crypto does not offer some of the advanced features available on competing exchanges. It doesn't allow staking, a process that allows owners of some cryptocurrencies to earn rewards similar to interest. And while you can trade crypto 24/7, most trades will actually take place during a particular window.

The bottom line

Though Fidelity’s consumer crypto product isn't the most robust on the market, the firm’s brand name and track record may give some customers a level of comfort moving into an asset class like crypto. And the company has left the door open to expand its features and capabilities later on.

» Learn more: Read our review of Fidelity's brokerage.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. Fidelity. Availability by state. Accessed Feb 27, 2026.

More like this

Related articles