How to Get the Most from Alaska’s Atmos Rewards Ascent Credit Card

You can more than offset the annual fee by maximizing your award flight redemptions and the Companion Fare.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Alaska Airlines' Atmos™ Rewards Ascent Visa Signature® credit card is popular among West Coast flyers and credit card maximizers alike for good reason: Its reasonable annual fee ($95) can be easily offset by its solid combination of benefits.

But what if you want to do more than just "offset" the annual fee? Here are all the ways to get the most from your Atmos™ Rewards Ascent Visa Signature® credit card, including earning and redeeming points and optimizing the useful-but-complex Companion Fare.

Taking advantage of this card requires a bit of homework, but the effort is well worth it.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Maximizing the Companion Fare

For many, the annual Companion Fare that comes with the card each anniversary (as long as you spend $6,000 on the card annually) is worth more than the other benefits combined. The trick is using it to maximum effect.

Here’s how the Companion Fare works: You can buy two main cabin round-trip airfares on the same Alaska-flown itinerary for the price of one ticket plus $99 plus taxes and fees.

Let’s say you’re buying a ticket that costs $500 total, $150 of which is taxes and fees. If you use the Companion Fare to add another traveler to this itinerary you would pay:

- $500 for the full-priced regular ticket.

- $99 for the Companion Fare.

- $150 for the taxes and fees on the Companion Fare.

Which comes to $749 total for two tickets. In other words, it would cut the price of the second ticket in half.

As you may notice, the trick to getting the most value from this benefit is to use it for high-priced tickets, especially ones without high taxes and fees. This could be great to use for family travel during the holidays, when even normal domestic flights can be pricey.

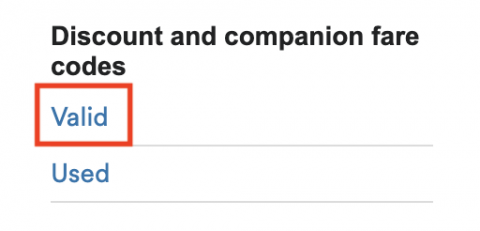

To use the Companion Fare, log into your Atmos Rewards account on the website (not the app) and look for the "Discount and Companion Fare codes" section in the left column:

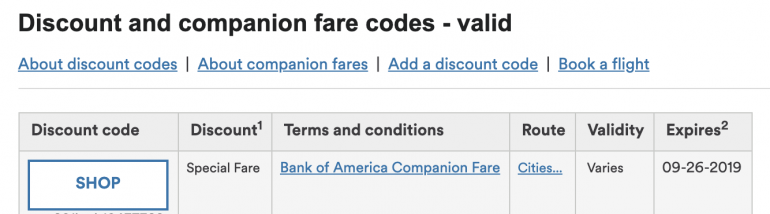

Look for the "shop" button to the left of your active code:

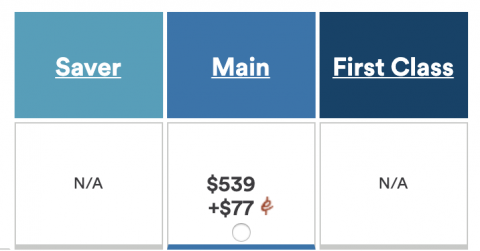

Then, do your flight search as normal. In the flight selection screen, you’ll see the Companion Fare price next to the weird red symbol:

Those are the basics of how to use this valuable fare. For an in-depth guide to squeezing the most value from it, check out our comprehensive guide to maximizing the Alaska Companion Fare.

Save on bag fees

When you book with the card, you and up to six companions on the same itinerary get one free checked bag each. This is one of the simplest benefits of the Atmos™ Rewards Ascent Visa Signature® credit card and one of the easiest ways to make the annual fee worth it.

The first bag usually costs $35 each way, so using this benefit on a single round-trip flight can nearly offset the annual fee. Doing so with a companion (or gaggle of companions) can save even more.

Keep in mind that this benefit is effectively nullified for Atmos elite status holders, who already get two free checked bags. That is, the free bag benefit of the credit card doesn't allow elite status holders to get an extra checked bag for a total of three.

» Learn more: Guide to Alaska Airlines Baggage and Other Fees

Earn points through the card

This card offers two ways to earn points through Atmos Rewards, Alaska and Hawaiian Airlines' joint loyalty program: Through the sign-up bonus and through other spending.

Note: Points earned through your card don't count toward earning Alaska’s MVP elite status. In other words, you can’t earn elite status by spending on the Alaska card.

Sign-up bonus

Here’s the current signup bonus: Get 70,000 bonus points and a $99 Companion Fare (plus taxes and fees from $23) with this offer. To qualify, spend $3,000 or more on purchases within the first 90 days of opening your account.

Note that minimum spending requirement, and make sure to hit it within the timeframe. This bonus is all-or-nothing, meaning you won’t get any of it if you spend even $5 less than this threshold amount.

Spending on the card

The earning structure on the Atmos™ Rewards Ascent Visa Signature® credit card is straightforward. You’ll earn:

- 3 points per dollar spent on eligible Alaska Airlines purchases.

- 2 points per dollar spent on eligible gas, EV charging station, cable, streaming services and local transit including ride share purchases.

- 1 point per dollar spent on all other purchases.

Since NerdWallet values Alaska points at 1.2 cents apiece, this 3x multiplier on Alaska purchases is a decent return on spending.

Also, if you have an eligible Bank of America® account, you'll earn a 10% bonus on all points earned from card purchases. That means if you spent enough to earn 1,000 points on the card, you would actually receive 1,100 points with the bonus.

Redeem points

While earning points through this card may be relatively straightforward, putting them to good use is the tricky part. Unlike some other airline loyalty programs like Delta (which offers a relatively narrow band of value), Atmos Rewards offers plenty of "sweet spots" and high-value redemptions. They just require a little work and patience to find.

Although Alaska offers plenty of interesting ways to redeem points, the best value almost always comes the old-fashioned way: using them to book flights. To search for these award fares, check the "use points" box in the Alaska flight search tool.

The best value is often found in three types of fares (or combinations of all three, as described below:

- Partner flights.

- Premium cabin flights.

- Free stopovers.

Partner flights

Alaska is a member of the Oneworld Alliance, bringing its total partner count to 23 global airlines. Using Alaska points to book flights with these partners is one of the best ways to get the most bang for your award buck.

However, not all Alaska partners are created equal, and some have far better award charts than others. Here are some airlines to target for partner redemptions:

- American Airlines.

- Cathay Pacific.

- Japan Airlines.

(Note: Cathay awards aren't searchable on the Alaska website. You’ll have to call an Alaska representative to book these awards.)

And here are some partners you can generally avoid:

- British Airways.

- Singapore Airlines.

Why? British Airways flights often carry outrageous fuel surcharges, and Singapore’s partnership with Alaska, while decent, doesn’t offer great overall value compared with Alaska’s other partnerships with Asian airlines.

» Learn more: Making sense of Alaska Airlines partners

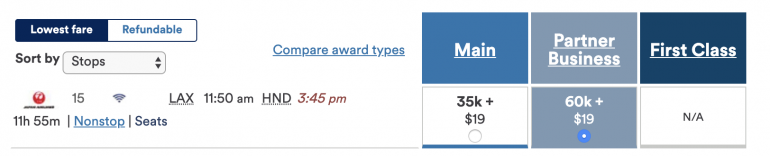

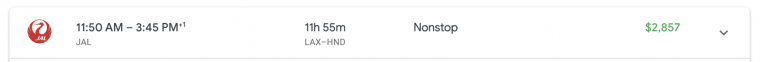

If you’re looking to get the absolute best return on your Atmos points in terms of pure dollar value, you can’t beat first and business class redemptions, especially on partner flights. For example, you can get from North America to Japan in JAL business class for only 60k points one way:

Compared with $2,857 for the same flight paying cash:

That works out to 4.7 cents per point in value, well above our 1.2 cents baseline. That said, it’s important to ask yourself whether you would ever conceivably spend that much cash on a premium cabin ticket. If not, it might not make sense to book an equivalent award flight, even if the value is excellent.

Free stopovers

While other airlines devalue and restrict their award programs, Alaska has kept one of its most valuable policies: free stopovers on award flights.

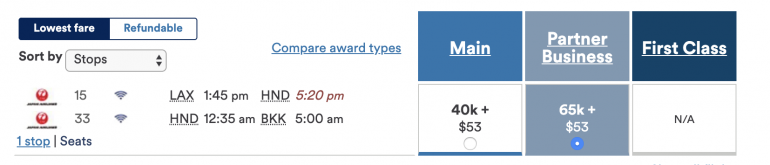

A "stopover" is a long layover in a connecting city — we’re talking up to weeks or months long, so you can effectively get two trips for the price of one. For example, a business class flight from Los Angeles to Bangkok with a two-week stop in Tokyo on JAL costs the same amount (65,000 points) as a flight from Los Angeles to Bangkok.

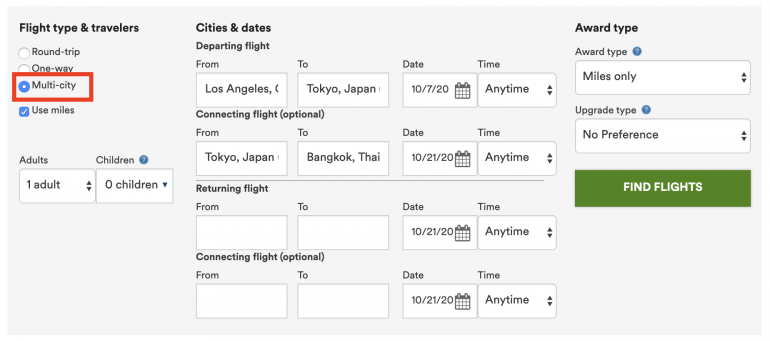

To search for stopovers, use the “multi-city” search option on the Alaska flight tool.

Keep in mind that the stopover must be in a hub city for that airline. So if you’re looking to fly through Tokyo, you can only book a stopover award with JAL.

In-flight purchases

Finally, the Atmos™ Rewards Ascent Visa Signature® credit card offers 20% back on in-flight purchases made with the card. This is hardly a huge perk (unless you’re a cheese plate addict), but it offers a good reason to keep the card in your wallet while traveling.

Discount on lounge membership

If you're a frequent Alaska flyer and you usually purchase the Alaska Lounge+ membership anyway, this card will save you $100 on the membership fee. Membership is usually $795. Alaska Lounge+ includes access to the nine Alaska lounges, plus 90 other partner lounges.

The bottom line

The Atmos™ Rewards Ascent Visa Signature® credit card often ranks as one of our favorite airline credit cards for good reason. It offers valuable perks like free bags and the Companion Fare without a budget-busting annual fee. That said, with a little research and dedication, you can get far more than average value from this card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles