How to Maximize Chase Ultimate Rewards

Transferring points to an airline or hotel program is the best way to get outsized value for your rewards.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The Chase Ultimate Rewards® program offers travelers and points collectors excellent opportunities to earn rewards and redeem them for flights, hotel stays and more.

You'll generally find the best value by transferring your rewards to travel partners. But select bookings through Chase's travel portal, especially hotels, can also provide solid value.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Use Chase Ultimate Rewards® transfer partners

Transferring Chase Ultimate Rewards® to one of Chase's travel partners will generally get you the best value for your points.

Full list of Chase transfer partners

Airlines

- Aer Lingus (1:1 ratio).

- Air Canada (1:1 ratio).

- Air France-KLM (1:1 ratio).

- British Airways (1:1 ratio).

- Iberia (1:1 ratio).

- JetBlue (1:1 ratio).

- Singapore (1:1 ratio).

- Southwest (1:1 ratio).

- United (1:1 ratio).

- Virgin Atlantic (1:1 ratio).

Hotels

- Hyatt (1:1 ratio).

- IHG (1:1 ratio).

- Marriott (1:1 ratio).

NerdWallet values Hyatt points at 1.8 cents each — higher than any other Chase transfer partner. That means, on average, you'll find the best value by transferring Chase Ultimate Rewards® points to World of Hyatt.

By comparison, points are only worth 1 cent each when redeemed for a statement credit and through many redemptions in Chase's travel portal (more on that below).

Airline transfer partners also offer a great opportunity for outsized value. My favorite airline partners are United Airlines, Air Canada and Air France-KLM.

Recently, I transferred 111,000 Chase Ultimate Rewards to partners for over $6,600 in travel, which included a swanky hotel stay with Hyatt and an Air France-KLM Flying Blue business class flight between Washington D.C. and Stockholm with a free stopover in Amsterdam. And over the last 10 years, I've transferred over three million points to Chase partners for nicer stays and flights than I'd typically pay for. The best value for my Ultimate Rewards® points nearly always comes from transfer partners.

🤓 Nerdy Tip

To see what your points could be worth if transferred to a travel partner, check out NerdWallet's miles and points valuations. » Learn more: Helpful tips for earning Chase Ultimate Rewards®

Find a Points Boost booking in Chase's travel portal

Ultimate Rewards® have a baseline value of 1 cent each when you book reservations through Chase's travel portal. However, Chase's premium travel cards have access to cheaper redemptions through Points Boost pricing found on some travel bookings.

You can find Points Boost pricing on these cards:

- Chase Sapphire Reserve®: up to 2 cents per point.

- Sapphire Reserve for Business℠: up to 2 cents per point.

- Chase Sapphire Preferred® Card: up to 1.75 cents per point.

- Ink Business Preferred® Credit Card: up to 1.75 cents per point.

🤓 Nerdy Tip

Chase Ultimate Rewards® earned across multiple cards can be combined on the card that provides the best redemption value. Booking Points Boost flights

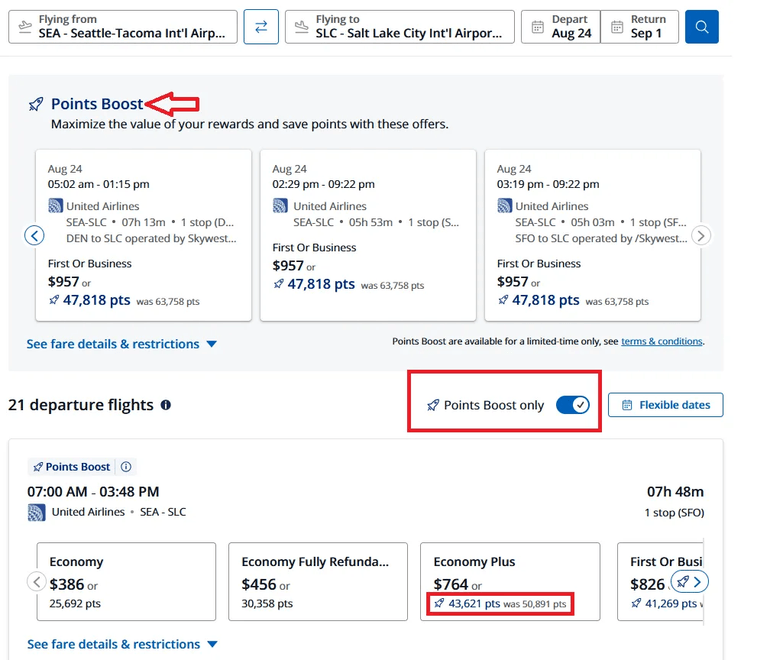

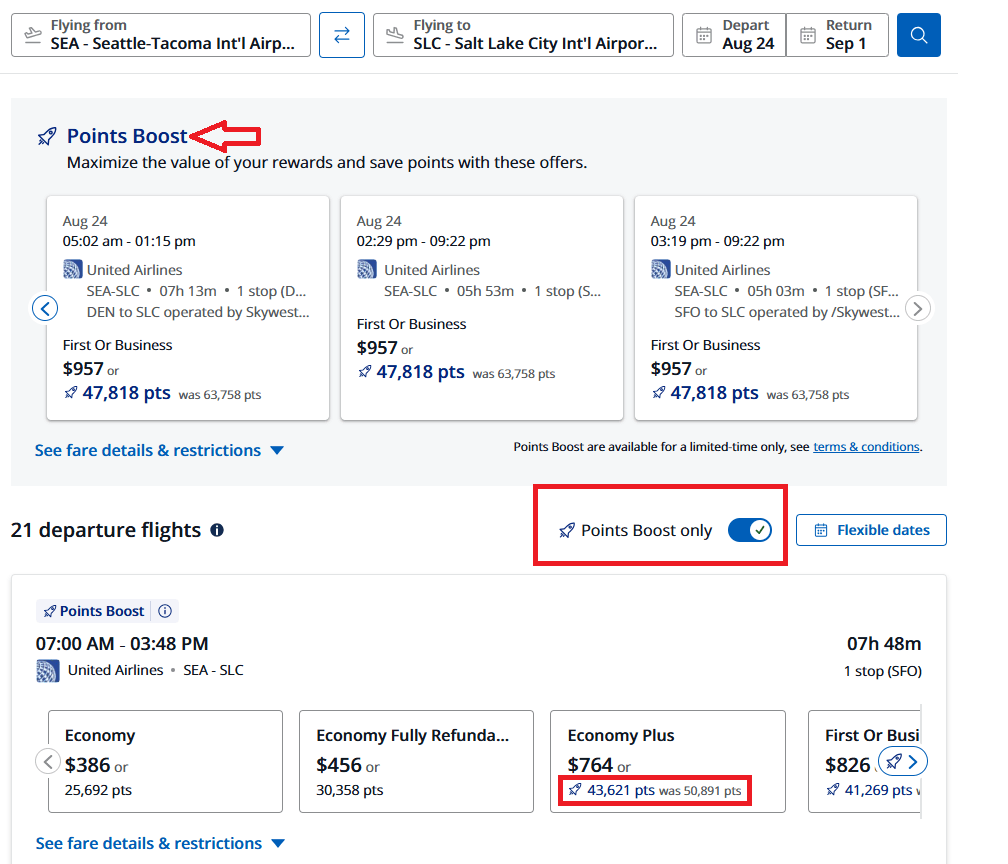

To find flights that offer Points Boost pricing, navigate to Chase's travel portal and input your travel details. Flights with Points Boost pricing are shown at the top of the screen. You can also toggle the Points Boost slider bar to see only Points Boost results.

In the example below, an Economy Plus ticket with United would cost $764 or 43,621 points, for a redemption value of 1.75 cents each. Note that the Economy and Economy Fully Refundable tickets would not qualify for Points Boost, and your points would receive a value of only 1 cent each.

While economy tickets with Points Boost pricing do exist, a study by NerdWallet in June 2025 found fewer than 10% of flights in Chase's travel portal qualified for Points Boost pricing, and of those flights, 97% of the Points Boost tickets were in a premium cabin. If you want to redeem your points for economy flights, you'll usually do better transferring your rewards to the airline.

Booking Points Boost hotels

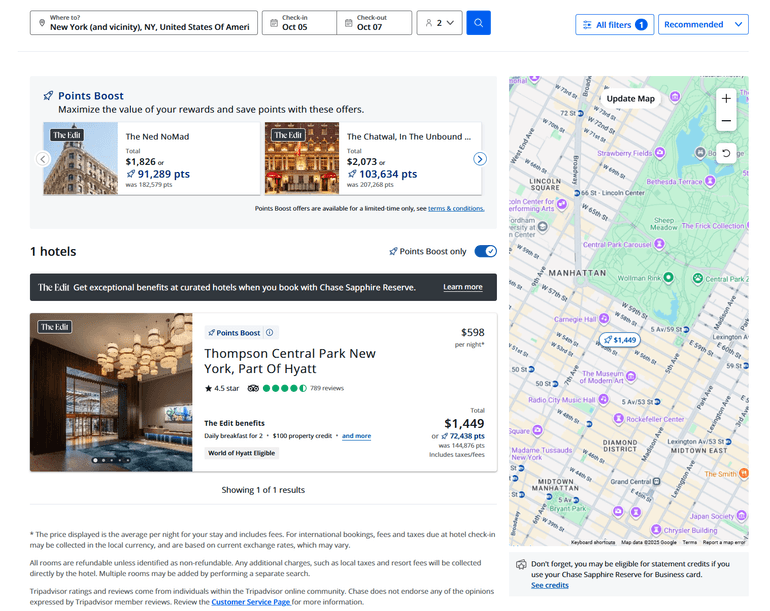

Hotels booked through Chase's travel portal offer a lot more ways to maximize value with Points Boost.

To find a qualifying hotel, head to Chase's travel portal and enter your search details. Properties with Points Boost pricing will be shown on top.

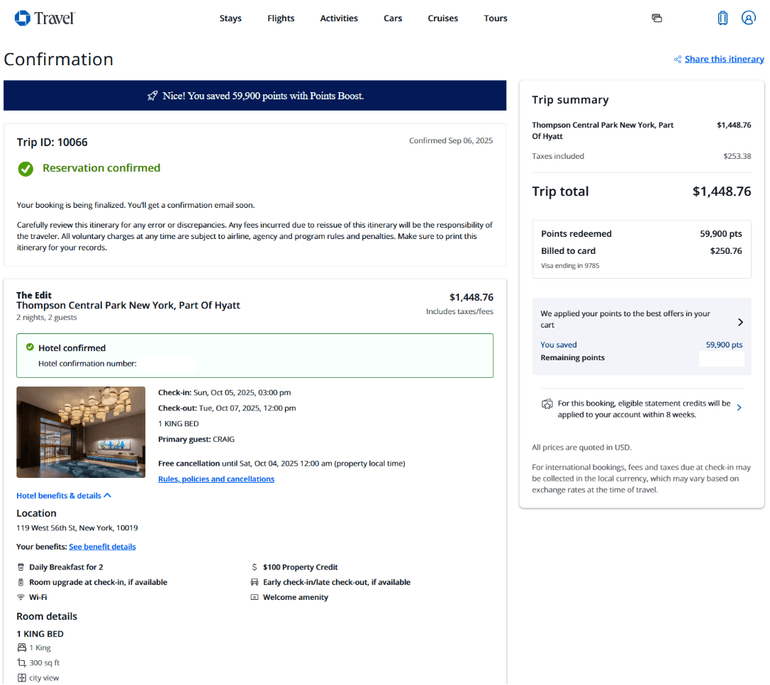

I recently booked a two-night stay in New York City at the Thompson Central Park by Hyatt for 72,438 points. The cash cost was $1,449, giving a redemption value of 2 cents per point with my Chase Sapphire Reserve® using Points Boost.

But I did even better than that.

This property is part of Chase's The Edit collection, which qualifies for a slew of benefits with my Chase Sapphire Reserve®, including a semi-annual $250 credit on prepaid stays of two nights or more booked through Chase, daily breakfast for two, a room upgrade (when available) and a $100 property credit.

Since Chase lets you book through the portal with cash and points, I paid 59,900 points and charged $250 to my card to maximize that $250 credit. Within three days, I received the $250 back as a statement credit on my card. This same stay would have cost 58,000 points if I had transferred points to World of Hyatt. But instead, booking through Chase for roughly the same number of points gives me complimentary breakfast and the rest of the benefits offered through The Edit. This type of booking also lets me earn World of Hyatt points and elite qualifying nights for the stay, even though it was booked through a third party.

Redemptions to avoid

There are several suboptimal redemption options for your Chase Ultimate Rewards®. That doesn't mean you're wrong for redeeming your points in these ways, but they won't get you maximum value.

- Cash back or gift cards. Chase lets you redeem points for cash back or retail gift cards at 1 cent each. That can be an OK redemption if you don't have plans to travel. But you'll usually get better than 1 cent each with select partner transfers and Points Boost reservations through Chase's travel portal.

- Purchases at Amazon. You're able to connect your Chase Ultimate Rewards® account to your Amazon profile and use points at checkout, but only at a value of 0.8 cents per point. If you want to use points for Amazon purchases, it would be better to make the purchase with your card, then redeem points as a statement credit at 1 cent each.

- Purchases at Apple. You can get 1 cent per point by redeeming your rewards for Apple products. But again, that doesn't offer the best value. If you want to use points for a new set of AirPods, you'd do better making the purchase with your card and earning credit card points, then redeeming points for a statement credit at 1 cent each.

If you want to maximize your Chase Ultimate Rewards® ...

There are two ways to get outsized value from your Chase Ultimate Rewards® — transferring points to travel partners or finding Points Boost redemptions through Chase's travel portal. Over the years, most of the value I've received for my points has been through transfer partners to book nicer hotel rooms or flights than I'd ever pay cash for. Chase's travel portal also offers the opportunity to get better than 1 cent each for your points, but you'll have a lot more options by booking hotels instead of flights.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles