The Guide to Booking Award Nights With Hilton Honors

Although the Hilton Honors points redemption chart is no longer in use, you can still easily use points for free stays.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Once upon a time there was a Hilton award chart. That made it quite clear how many Hilton Honors points you needed to book an award night, allowing you to save your cash for you and to cover your hotel room with points. There's now no longer a published Hilton Honors points redemption chart, but you can still book award nights using Hilton Honors points. Now, points generally correspond a bit more closely with the cash price to book a room — but that's not always the case.

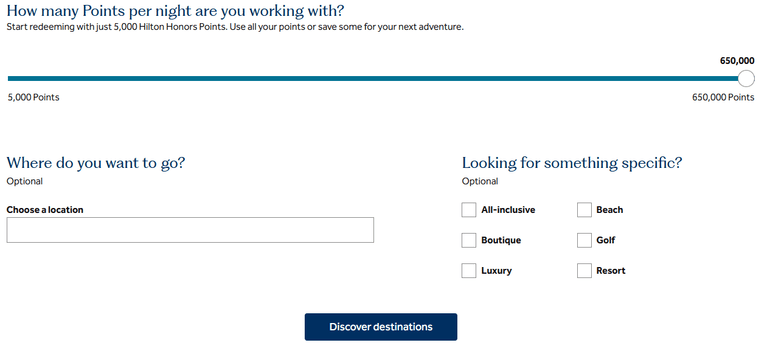

Luckily, Hilton doesn't leave you totally in the dark in terms of how much it costs to book a room on points. Instead, Hilton has what it calls the Points Explorer tool, giving you a better gauge of how many points you'll need to book a specific Hilton reward. You can even filter results by the number of points you actually have.

How many Hilton points for a free night?

The minimum amount of Hilton points that you’ll need to book a standard room is 5,000 points, and the cost can reach upward of 120,000 points for high-end properties. For a step-by-step guide on how to use points to book an award stay, check out this resource: The complete guide to using Hilton Honors points.

Since Hilton doesn’t offer an award chart, the number of points needed for any given stay will vary based on hotel, room, booking and stay date. Although this can make pricing your award night more uncertain, Hilton does put both a minimum and a cap on the number of points needed for stays at each property. Use the Points Explorer tool to check the maximum price.

Use points and money

Hilton also allows you to pay with a mixture of points and cash for hotel stays. Although this can be a helpful feature if you don’t have enough Hilton points to book a full stay, if you’re looking to maximize the value of your points, this isn't usually the best option.

You’ll still need to pay resort fees for bookings made with Points & Money (notably, resort fees are waived for award bookings paid entirely with points). Additionally, by using the strategies in this article, you’ll often be able to get a better redemption rate for your points than is offered through Points & Money.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Best strategies for booking Hilton award nights

Here are some strategies that can help you maximize the value of your Hilton Honors points:

1. Use the Hilton 5th night free benefit

One of the best ways to get the most value out of your Hilton points is using Hilton’s fifth night free benefit. Whenever you book a standard room reward for five or more nights with Hilton, the fifth night is free.

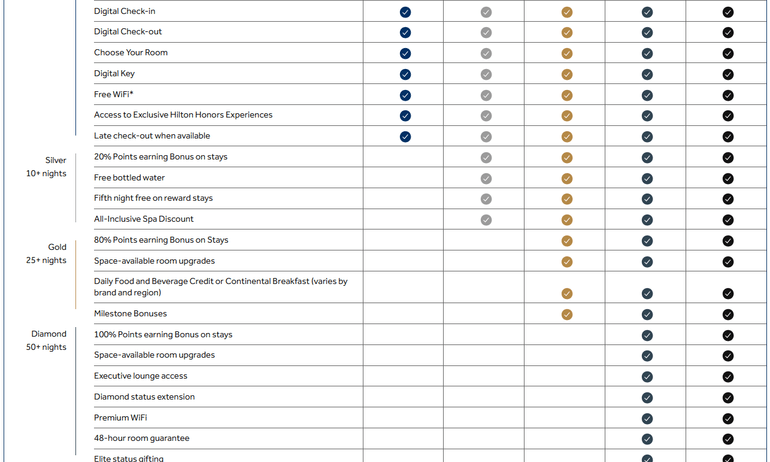

This benefit is available to any Hilton Honors™ elite (Silver level and above) — and don’t worry, elite status is really easy to get with Hilton (more on that below).

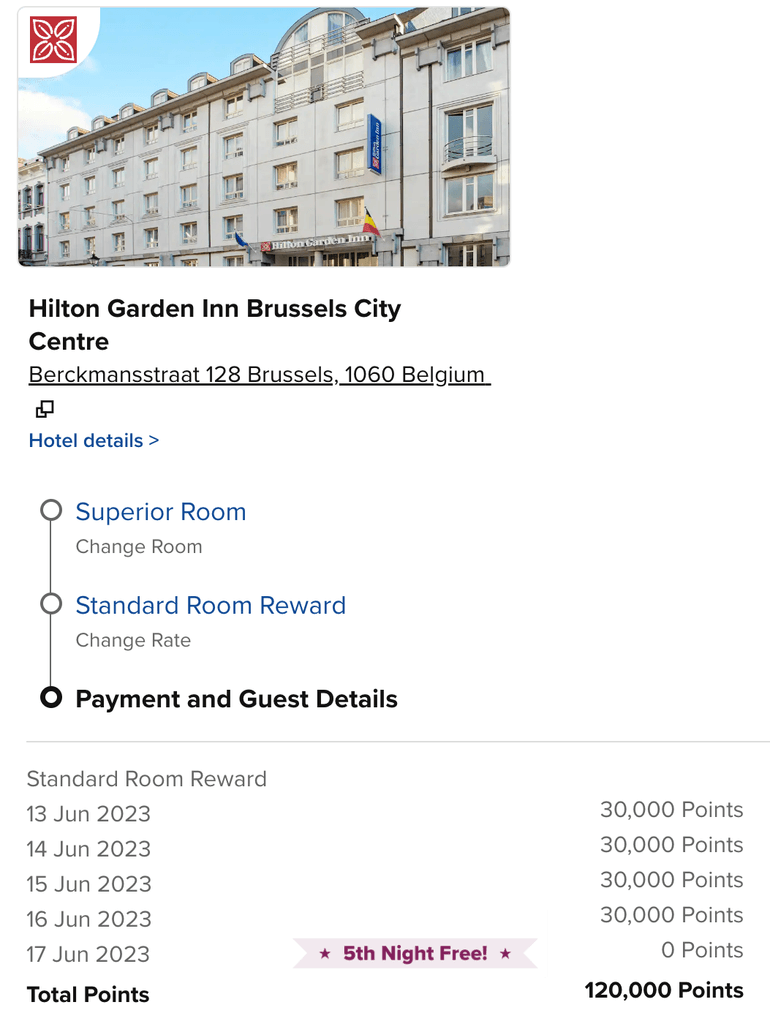

By taking advantage of the fifth night free perk, you are spending 20% less points on an award stay. For example, if an award night costs 30,000 points, a four-night stay and a five-night stay will both cost 120,000 points. By taking advantage of the fifth night free, you’re effectively paying 24,000 points per night instead of 30,000.

For example, take a look at this five-night hotel stay at the Hilton Garden Inn Brussels City Centre.

Although each night is priced at 30,000 points, when you book five nights, the last night is free — so the entire stay will cost only 120,000 points. Those points used for the stay are worth around $600 given NerdWallet's valuation of 0.4 cent per point.

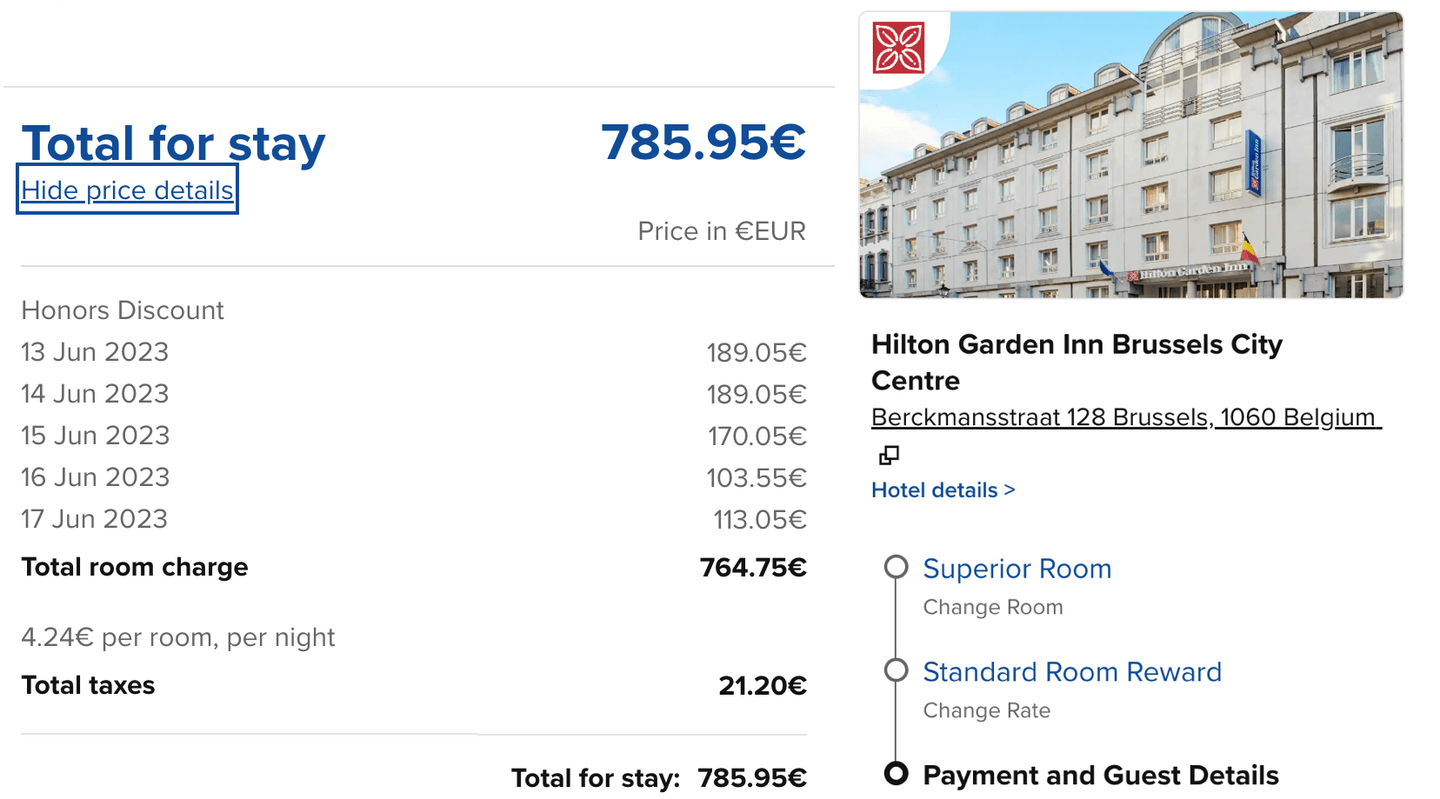

Now, if you look at the hotel price in cash, you will see that you’re being charged for the fifth night. That's because the fifth night free perk is not available on stays paid in cash.

This five-night stay will set you back about $800 based on the current exchange rate. By using points, you’re getting a value in excess of 0.75 cent per point, which is above what the points are worth based on our valuation.

By using points on a five night stay, you’re not only spending fewer points but also saving more cash. As long as you book a five-night stay, this perk will let you meaningfully increase the value of your points.

As mentioned before, to take advantage of this benefit, you’ll need to at least have Hilton Honors™ Silver status. Luckily, Hilton makes it pretty simple to reach Silver.

2. Get Hilton Silver status

Hilton has four elite status levels: Hilton Honors™ Silver, Hilton Honors™ Gold, Hilton Honors™ Diamond and Hilton Honors™ Reserve. Once you sign up for a loyalty account and get a Hilton Honors account number, you reach the Member level. As a Member, you still get some perks like no resort fees on award stays and free Wi-Fi.

To get the fifth night free award, you’ll need to reach Hilton Honors™ Silver elite status, which can be achieved by staying 10 nights at Hilton properties. However, a much faster way to attain Silver status is to get approved for a Hilton credit card (even one without a fee).

For example, the Hilton Honors American Express Card does not charge an annual fee ( see rates and fees). In addition to Silver status, the card offers the following perks:

- 7 points per $1 spent on eligible purchases at Hilton hotels or resorts.

- 5 points per $1 spent on eligible purchases at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

- 3 points per $1 spent on all other eligible purchases.

- No foreign transaction fees. Terms apply.

Unlike many other cards without annual fees, this card does not charge foreign transaction fees. If you’re a Hilton loyalist and you’re looking to add a hotel card to your portfolio, this is a solid option. Not only can you use it when traveling internationally, but you can also earn 7x Hilton points when you swipe the card at Hilton properties. Most importantly though, you get Silver status, which gets you the fifth night free on award bookings.

» Learn more: The best hotel credit cards

3. Use a Hilton free night certificate

While the fifth night award is great, the free night certificate is also a great perk and provides you with a lot more flexibility for shorter stays. These certificates can only be earned by those who have Hilton co-branded credit cards that charge an annual fee.

The certificate can be used at almost any Hilton property as long as there is a standard room available. Hilton hotels are priced from as low as 5,000 points per night to upwards of 120,000 for a standard room — generally, you’d be extracting the most value from a certificate by using it at a higher-end property.

To learn all about the different ways to maximize the certificate, how to earn, and the best ways to redeem it, check out our guide: How to Earn and Redeem Hilton Free Night Certificates.

These are the Hilton cards that either offer a free night certificate outright or provide a path to earning one.

4. Focus on Hilton luxury hotels

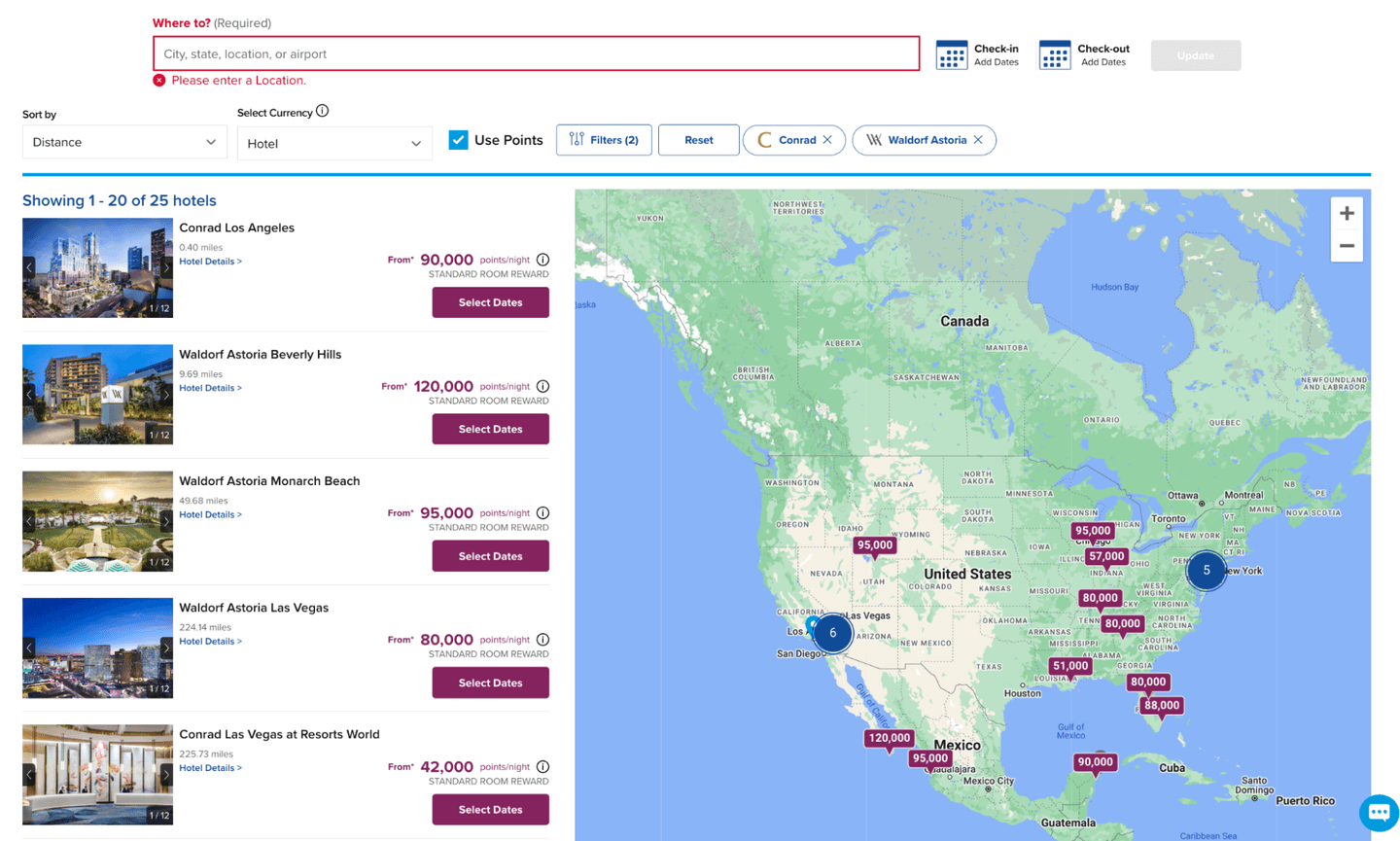

Luxury properties generally offer the best opportunity to maximize the value of your Hilton points. One way to find a luxury stay is to use Hilton’s Points Explorer tool, which allows you to select the nightly price and filter by location and/or other criteria.

You’ll then see a map, which will allow you to zoom in by location and also let you filter by specific hotel brands. You may be prompted to enter a location.

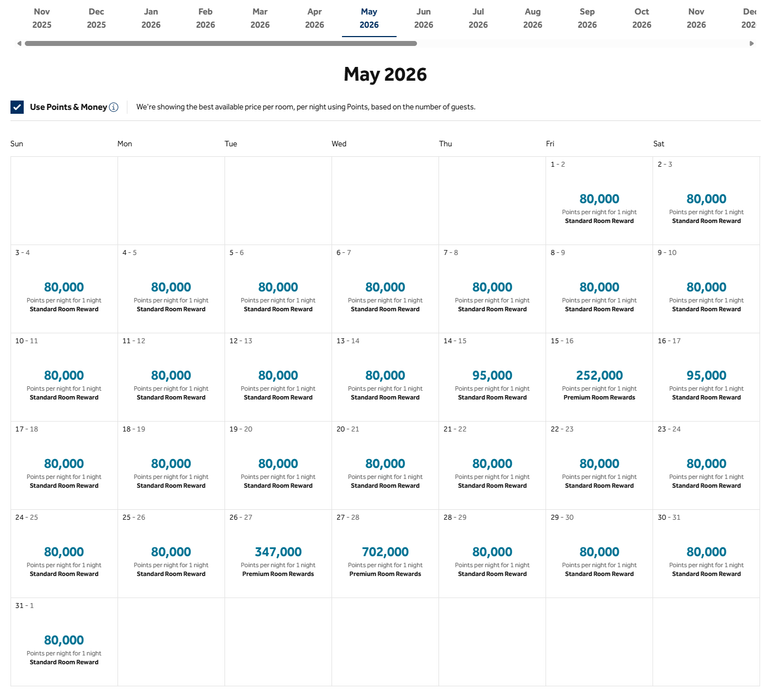

Let’s say for example, you’ve decided to check out the Conrad Los Angeles, which starts at 80,000 points per night. A scan of the calendar over the year shows plenty of availability at 80,000 points per night, even during the holidays in December.

🤓 Nerdy Tip

Whenever possible, book your award stays entirely with points to avoid paying resort fees. Where you can use your Hilton Honors points

Hilton is one of the largest hotel companies with 24 brands, more than 8,000 hotels in 139 countries. Its Hilton Honors loyalty program can be richly rewarding for members and includes the following brands:

- Canopy by Hilton.

- Conrad Hotels & Resorts.

- Curio Collection by Hilton.

- Doubletree by Hilton.

- Embassy Suites by Hilton.

- Hampton by Hilton.

- Hilton Garden Inn.

- Hilton Grand Vacations.

- Hilton Hotels & Resorts.

- Home2 Suites by Hilton.

- Homewood Suites by Hilton.

- Tapestry Collection by Hilton.

- Tru by Hilton.

- Waldorf Astoria Hotels & Resorts.

You can also use Hilton points at properties that aren't exactly Hilton, but are affiliated with Hilton. That includes Evermore Orlando Resort, a vacation rental resort that operates more like a hotel, and that is located near Walt Disney World.

Top-tier Hilton hotels where you can use your points

If you’re looking for some suggestions on where you can put your points or free night certificates, check out our guides:

How else can you use Hilton Honors points?

As a Hilton Honors member you can redeem points toward travel in other ways.

NerdWallet values Hilton points at 0.4 cent each. This is a baseline value, drawn from real-world data, not a maximized value. In other words, you should aim for award redemptions that offer 0.4 cent or more in value from your Hilton points.

- Airline and Amtrak points. For example, 10,000 Hilton Honors points can be redeemed for 1,500 Amtrak Guest Rewards points, while the same number of points equals 1,000 Delta or United miles.

- Hilton Experiences. Hilton also lets you redeem points for experiences and events. Some of these "once-in-a-lifetime experiences" can be booked outright, while others require bidding. For example, bidding for tickets to a Jim Gaffigan comedy show in New York topped out at 90,000 points — or you could get The Ultimate Mezcal Tasting Experience in Cancun for just 25,000 points.

- Non-travel awards. You can also use points to shop for non-travel awards. Some options including shopping and purchasing items through Hilton’s partnership with Amazon.com — link your Hilton account to Amazon and you can use your points through the Shop with Points program. On Amazon, 500 points equals $1. You can also pool your points with other Hilton Honors members free of charge and redeem for free night awards. If you're feeling charitable, members can donate points through Point Worthy to a number of nonprofit organizations, such as the Red Cross. Redeem at least 10,000 points for a $25 donation.

Other Hilton points tips

How many Hilton Honors points will I earn on hotel stays?

Hilton Honors members earn 10 points for every $1 spent at most Hilton properties. Home2 Suites and Tru hotels earn 5 points per $1.

Hilton Honors™ elite members earn additional bonuses on top of the 10 points per $1:

- Silver: 20% bonus points.

- Gold: 80% bonus points.

- Diamond: 100% bonus points.

Additionally, meeting planners can earn 1 point for every $1 spent when booking guest rooms, meeting rooms and other event space.

Earn more points with the Hilton credit cards

Hilton offers four credit card options that come with welcome bonuses and elite status, among other benefits.

Annual fee

$0.

$150.

$550.

$195.

Earning rates

• 7 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 5 points per $1 at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

• 3 points per $1 on all other eligible purchases.

Terms apply.

• 12 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 6 points per $1 at U.S. restaurants, U.S. supermarkets and U.S. gas stations.

• 4 points per $1 on U.S. online retail purchases.

• 3 points per $1 on all other eligible purchases.

Terms apply.

• 14 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 7 points per $1 on flights booked directly with airlines or AmexTravel.com and car rentals booked directly with select car rental companies.

• 7 points per $1 at U.S. restaurants.

• 3 points per $1 on all other eligible purchases.

Terms apply.

• 12 points per $1 on eligible purchases with a hotel or resort within the Hilton portfolio.

• 5 points per $1 on other purchases made using the Hilton Honors Business Card on the first $100,000 in purchases each calendar year, 3 points per $1 thereafter.

Terms apply.

Other noteworthy benefits (see reviews for full rundown)

• Hilton Honors™ Silver status, which gives you a 20% bonus on Hilton Honors base points as well as a fifth night free whenever you use points to book five or more nights at a Hilton property.

• Path to Gold status. Get an upgrade to Gold if you spend $20,000 or more on the card in a calendar year.

Terms apply.

Learn more about elite status levels with our guide to the Hilton Honors program.

• Hilton Honors™ Gold status, which gives you an 80% points bonus, as well as complimentary breakfasts at select hotels and room upgrades at select properties where available.

• Path to Diamond status. Get an upgrade to Diamond if you spend $40,000 or more on the card in a calendar year.

• $200 annual statement credit for eligible Hilton purchases on your card (doled out in $50 statement credits per quarter).

• Potential free night. Earn a free night award after you spend $15,000 on purchases on your card in a calendar year.

Terms apply.

• Hilton Honors™ Diamond status, which gives you such perks, such as double bonus points on all base points you earn, room upgrades when available, premium Wi-Fi, late checkout and more.

• Free nights. Get one free night reward with the card each year. Earn an additional night after you spend $30,000 on purchases in a calendar year and another after you spend $60,000 in a calendar year.

• Flight credit. Get up to $50 in credit each quarter on flight purchases made directly with an airline or through American Express.

• $200 annual resort credit. Get up to $200 in statement credits semi-annually for eligible purchases at participating Hilton Resorts.

Terms apply.

• Hilton Honors™ Gold status, which gives you an 80% points bonus, as well as complimentary breakfasts at select hotels and room upgrades at select properties where available.

• Path to Diamond status. Get an upgrade to Diamond if you spend $40,000 or more on the card in a calendar year.

Welcome offer

Earn 70,000 Bonus Points plus a Free Night Reward after you spend $2,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

Earn 130,000 Bonus Points plus a Free Night Reward after you spend $3,000 in purchases on the Card in the first 6 months of Card Membership. Offer Ends 4/15/2026. Terms Apply.

Earn 150,000 Hilton Honors Bonus Points after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. Terms Apply.

Earn 175,000 Hilton Honors Bonus Points plus a Free Night Reward after you spend $8,000 in purchases on the Hilton Honors Business Card in the first six months of Card Membership. Offer ends 4/15/2026. Terms Apply.

Learn more

Using Hilton points for free nights recapped

Even without a points chart, Hilton Honors has a really great award program if you’re savvy and willing to invest the time to find the best redemptions. To maximize the value of your points, try to save enough so that you can book your entire stay using the points, ideally at luxury properties and for at least five nights.

All information about the Hilton Honors American Express Aspire Card has been collected independently by NerdWallet. The Hilton Honors American Express Aspire Card is no longer available through NerdWallet.

To view rates and fees of the Hilton Honors American Express Surpass® Card, see this page.

To view rates and fees of The Hilton Honors American Express Business Card, see this page.

To view rates and fees of the Hilton Honors American Express Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles