Capital One VentureOne with Miles Boost: Value Sooner Rather Than Later

The Bottom Line

4.1

Weigh the rewards against the offerings of other no-annual-fee travel cards before committing. You might even get more value from the regular Venture card, which charges a fee.

Rates, fees and offers

Rates, fees and offers

Annual fee

$0

Rewards rate

1.25x-5x

Bonus offer

Earn a bonus of 40,000 miles once you spend $1,000 on purchases within 3 months from account opening, equal to $400 in travel.

Intro APR

N/A

Ongoing APR

APR: 18.49%-28.49% Variable APR

Cash Advance APR: 28.49%, Variable

Balance transfer fee

4% of the amount of each transferred balance that posts to your account at a promotional APR that Capital One may offer to you

Foreign transaction fee

None

More details from Capital One

More details from Capital One

- Earn a bonus of 40,000 miles once you spend $1,000 on purchases within 3 months from account opening, equal to $400 in travel

- 18.49% - 28.49% variable APR; this product does not have an introductory APR period, 4% fee on amounts transferred at a promotional APR that Capital One may offer you

- $0 annual fee and no foreign transaction fees

- Earn unlimited 1.25X miles on every purchase, every day

- Miles won't expire for the life of the account and there's no limit to how many you can earn

- Earn 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- Use your miles to get reimbursed for any travel purchase—or redeem by booking a trip through Capital One Travel

- Transfer your miles to your choice of 15+ travel loyalty programs

- Top rated mobile app

Pros and Cons

Pros

No annual fee

Flexible rewards redemption

Cons

Rewards have limited flexibility

Requires good/excellent credit

Detailed Review

If you’re not a heavy spender, the annual fee for a top travel credit card could cost you more than the rewards you’d earn. With the Capital One VentureOne Rewards Credit Card - Miles Boost, a $0-annual-fee version of Capital One's popular travel card, you can earn rewards without worrying about a fee eating into their value (see rates and fees).

On the plus side, the Capital One VentureOne Rewards Credit Card - Miles Boost offers a stronger sign-up bonus than its primary competitors among general-purpose travel rewards credit cards with no annual fee, so new cardholders will realize more value upfront. On the flip side, its ongoing rate is generally lower than what those competitors offer, so its advantage shrinks as time wears on. It's a balancing act.

Capital One VentureOne Rewards Credit Card - Miles Boost: Basics

Card type: Travel.

Annual fee: $0.

Sign-up bonus: Earn a bonus of 40,000 miles once you spend $1,000 on purchases within 3 months from account opening, equal to $400 in travel.. Note that this bonus offer may be different from the VentureOne offer available directly from Capital One or on other websites.

Rewards:

1.25 miles per dollar spent on purchases.

5 miles per dollar spent on hotels, vacation rentals and rental cars booked through Capital One Travel.

Options for redeeming miles:

Redeem for statement credit against travel purchases.

Use to book travel through Capital One.

Transfer to more than 15 partner airline and hotel programs. Per-mile value depends on the transfer partner and how you redeem the transferred miles.

Redeem for gift cards.

Redeem for purchases on Amazon or through PayPal.

How much are Capital One miles worth? NerdWallet's analysis of Capital One miles determines that they are worth:

Exactly 1 cent apiece when redeemed for statement credit or used to book travel through Capital One.

An average of 1.2 cents apiece when transferred to partner programs and redeemed there.

Between 0.8 cents and 1 cent when redeemed for gift cards.

0.8 cents apiece when redeemed for purchases on Amazon.

Interest rate: The ongoing APR is 18.49%-28.49% Variable APR.

Foreign transaction fees: None.

Credit score requirement: The Capital One VentureOne Rewards Credit Card - Miles Boost is available to applicants with good to excellent credit. However, some applicants with less-than-excellent credit may be offered a different version of this card, one that has the same cash back rewards but not the sign-up bonus. If this is the case, you'll be told during the application process and given the chance to accept or decline.

Compare to Other Cards

Vacation more, spend less. Subscribe to our free newsletter for inspiration, tips, and money-saving strategies – delivered straight to your inbox.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Benefits and Perks

Light on fees

If you’re not a frequent flyer and you pay with credit only occasionally, the $0 annual fee is a strong selling point (see rates and fees). You'll earn rewards while paying nothing to carry the card, assuming you pay your balance in full each month to avoid interest. The Capital One VentureOne Rewards Credit Card - Miles Boost also travels well internationally; it charges no foreign transaction fees, and it's a Mastercard (and therefore widely accepted).

Strong sign-up bonus

Bonus offers on no-annual-fee travel cards tend to top out in the $250 to $300 range. The Capital One VentureOne Rewards Credit Card - Miles Boost tops them by a comfortable margin with this offer:Earn a bonus of 40,000 miles once you spend $1,000 on purchases within 3 months from account opening, equal to $400 in travel. Note that this bonus offer may be different from what's available on VentureOne when applying directly through Capital One or on other websites.

Redemption flexibility

The redemption process on the Capital One VentureOne Rewards Credit Card - Miles Boost is as flexible as it gets for travel cards. You can use them for travel in three ways:

Use your miles to book travel through Capital One's travel platform.

Use your card to pay for travel, and then redeem your miles for statement credit against the expense.

Transfer your miles to leading travel loyalty programs.

Full list of Capital One transfer partners

Airlines

Aeromexico (1:1 ratio).

Air Canada (1:1 ratio).

Air France-KLM (1:1 ratio).

Avianca (1:1 ratio).

British Airways (1:1 ratio).

Cathay Pacific (1:1 ratio).

Emirates (1:1 ratio).

Etihad (1:1 ratio).

EVA (2:1.5 ratio).

Finnair (1:1 ratio).

Japan Airlines (2:1.5 ratio).

JetBlue (5:3 ratio).

Qantas (1:1 ratio).

Qatar Airways (1:1 ratio).

Singapore Airlines (1:1 ratio).

TAP Air Portugal (1:1 ratio).

Turkish Airlines (1:1 ratio).

Virgin Red (1:1 ratio).

Hotels

Accor (2:1 ratio).

Choice Privileges Hotels (1:1 ratio).

I Prefer Hotel Rewards (1:2 ratio).

Wyndham Rewards (1:1 ratio).

MORE NERDY PERSPECTIVES

| For a no-annual-fee card, it has a generous sign-up bonus. But on an ongoing basis, you earn just 1.25 miles per dollar. I downgraded to this card when I no longer wanted to pay an annual fee on a Venture card, but I still had miles to redeem. Otherwise, I'm willing to pay the annual fee for the Venture X because the annual travel credit mostly wipes it out, it offers a bunch of other perks, and you earn at least 2 miles per dollar. Sara Rathner, writer/spokesperson, credit cards |

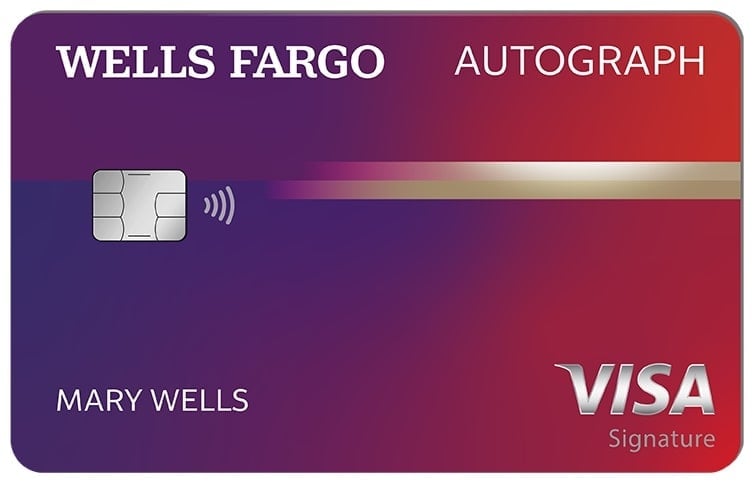

| Despite its low rewards rate, the VentureOne had one unique perk that might have made it worthwhile for someone: You could transfer rewards to a transfer partner without paying an annual fee. This is still an option, but now other no-annual-fee cards with better rewards also have this perk. If transferring rewards is important to you and you also don’t want to pay an annual fee, consider the Wells Fargo Autograph or the Bilt Rewards Mastercard instead. Caitlin Mims, editor, credit cards and travel rewards |

| Other no-annual-fee travel credit cards can offer more valuable rewards and the same easy introduction into the world of points and miles. What gives this card an edge is that it has a longer list of transfer partners. Melissa Lambarena, writer, credit cards |

Drawbacks and Considerations

Relatively low rewards rate

This card's 1.25% base rewards rate is underwhelming when you consider that you can find no-fee rewards cards that give the equivalent of 1.5% back or more. Compare it with these options:

The Wells Fargo Autograph® Card has a $0 annual fee and earns 3 points per dollar on restaurants, travel and transit, gas and EV stations, popular streaming services, and select phone plans. All other purchases earn 1 point. Points are worth 1 cent each.

The $0-annual-fee Bank of America® Travel Rewards credit card earns 1.5 points per dollar on spending, with points worth 1 cent apiece when redeemed toward travel.

The Discover it® Miles also has a $0 annual fee and earns 1.5 miles per dollar spent on everything. Miles are worth 1 cent apiece whether redeemed for travel or cash back.

Not ideal for bigger spenders

If you plan to put more than $12,750 a year on your card — about $1,060 a month — you'd get more value from the regular Capital One Venture Rewards Credit Card, even taking into account that card's annual fee of $95 (see rates and fees). That's because it gives you 2 miles per dollar spent on most purchases. Plus, this card has a much bigger sign-up bonus: LIMITED-TIME OFFER: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel. You'll also get an application fee credit for Global Entry or TSA Precheck. Use our calculator to compare your estimated rewards with each card:

A cash-back card gives more flexibility

When it comes to travel credit cards, redemption is understandably geared toward travel. If you want to use your rewards for anything else, you typically get less value. Such is the case with the Capital One VentureOne Rewards Credit Card - Miles Boost, where NerdWallet values miles at 1 cent apiece when you redeem them for travel, but about half that when you use them to get cash back. Consider the Citi Double Cash® Card instead. It pays you 2% cash back on every purchase: 1% when you buy something and 1% when you pay it off. The annual fee is $0.

Visit NerdWallet's best credit cards roundup for more potential alternatives.

For Capital One products listed on this page, some of the benefits may be provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

How To Decide If It's Right For You

If you’re looking for a low-cost travel card with terrific upfront value, the Capital One VentureOne Rewards Credit Card - Miles Boost is a good choice. But other no-annual-fee cards can offer more value over the long haul.

And if you're OK with paying an annual fee in exchange for greater benefits and perks, check out our best travel credit cards page for even more options.

Nothing's more flexible than cash

For higher rewards, consider this card, which gives you 2% cash back on every purchase (1% when you buy something + 1% when you pay it off). You can use your cash back for travel — or for anything else. The annual fee is $0.

Looking For Something Else?

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Sara Rathner

Senior Writer/Spokesperson