When to Use Airline Miles Instead of Paying

Should I use points or cash for flight? It's a good question, and we'll help you make the right plan of (payment) action.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Using points for airline travel is always tempting, especially if you’ve been steadily adding to your travel reward coffers over time. But it might not always the best decision depending on your specific circumstances.

While we’re all about getting the most out of your hard-earned points by taking that next trip, sometimes the smartest thing you can do with your points is to save them for another time. Here are some instances in which paying cash may actually be better than using airline points or miles.

If the cash cost of a fare is low

In some cases, the flight you want to purchase might have a low cash price. In this situation, it may not make sense to use miles to buy the flight, even if you have them.

Before cashing in your miles for a flight, do a little math to determine how the cost of the flight looks compares in miles versus cash. Once you have both figures, divide the cost of the flight in cash by the number of miles you’d have to spend, accounting for any taxes and fees. That will give you the cent-per-mile ratio, which is an important number in the world of airline miles.

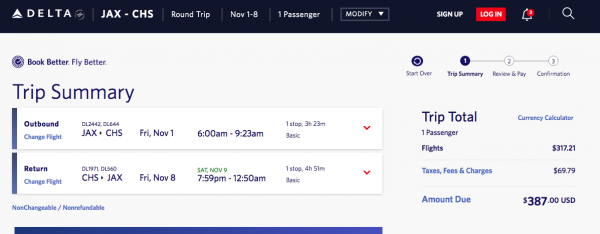

For example, let’s say you want to travel from Jacksonville, Florida to Charleston, South Carolina, for a weekend full of Southern charm. We found a round-trip ticket on Delta that costs $387, including taxes and fees.

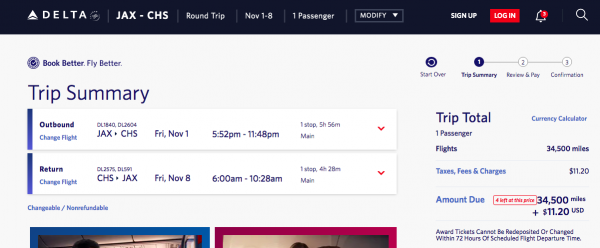

Or, you could spend 34,500 miles plus $11.20 in taxes and fees for the same travel dates, also on Delta.

While that doesn’t seem like a lot of miles at face value, some simple math will show you the cent per mile ratio:

($387 - $70) / 34,500 = 0.9 cent per mile

This isn’t a great value, especially considering NerdWallet currently values Delta miles at 1.2 cents each for domestic flights. So in this case, if you’re looking to maximize value, it could make more sense to pay cash for this flight and save the miles for a better deal.

Note that flights at this price point, or even cheaper, don't necessarily represent a bad value. It's always worth checking on a case-by-case basis.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

When the flight is short (or domestic)

If you’re an airline miles connoisseur, you likely weigh the pros and cons of using miles for every flight you take. After all, who doesn't love free stuff?

But the key to using your airline miles or points effectively is to use them on the flights where they’ll make a difference, which can mean longer and/or international itineraries. That’s because the cost of short or domestic flights purchased with miles can often be comparable to that of international or longer flights.

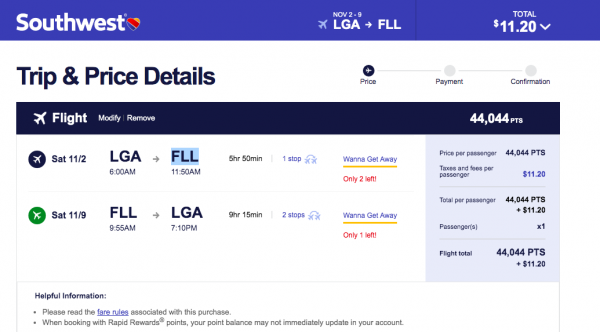

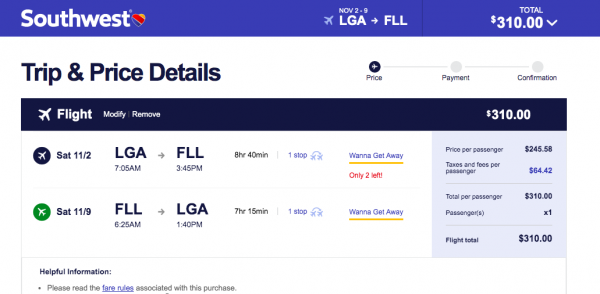

Here’s an example. Let’s say you’re craving a little sunshine before the holiday season kicks off. You could fly this itinerary on Southwest from New York City’s LaGuardia airport to Fort Lauderdale, Florida for a week of sun, sand and surf for around 44,000 miles plus $11.20 in taxes and fees.

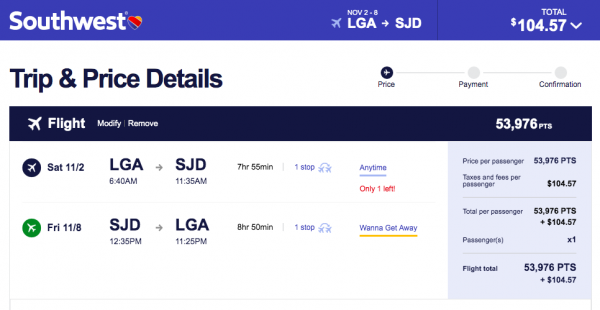

But you could also spend about 10,000 miles more (plus about $90 in extra fees) and jet off to Cabo San Lucas, Mexico.

Given the option, you may want to save your miles on the Florida trip and pay cash instead (this flight is $310).

You could also choose to take the longer international trip to use those incremental miles for something that feels more “worth it” to you, like a beach vacation in beautiful Mexico.

When you have big future travel plans

Some of the best points redemption stories are those that fund dream trips abroad.

For example, my husband and I recently used points to pay for nearly all of an offseason international trip to London.

If you have the itch to travel overseas on points, it may make sense for you to save your miles rather than using them to fund a trip to your hometown or a weekend getaway with friends.

Of course, you’ll need to weigh the cash costs of say, two cheaper flights you could pay for on points versus the cost of a more expensive international flight. But who knows? You may even have enough points to bump your tickets up to business class, making your international trip that much more memorable.

» Learn more: Credit card tips for traveling overseas

When you’re trying to earn status

Airline status is one of the best perks you can earn by being a frequent flyer. After all, it often comes with access to preferred seating, complimentary upgrades and even early boarding. But to earn status with an airline, you’ll need to fly a certain amount each year — which doesn’t usually include flights booked by redeeming points — or earn miles through spending

For example, you can earn status with American Airlines by earning 40,000 Loyalty Points to get access to perks like a free checked bag and preferred seating. But if you book an award ticket, that flight won’t earn Loyalty Points.

And that’s just one example of an elite status program. So if you’re close to earning status with your favorite airline, it may make sense to save your miles and pay cash instead. After all, what’s one free flight compared to a year’s worth of perks?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles