6 SEC-Approved XRP ETFs (Fees and Promotions Included)

The SEC has approved six spot XRP ETFs. Here's what to know about them.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Suppose you’re interested in cryptocurrency — and willing to tolerate the higher level of volatility that comes with it — but you don’t want to mess with manually buying crypto yourself. If that sounds like you, spot crypto ETFs may be worth checking out.

Back in 2024, the first spot Bitcoin ETFs and Ethereum ETFs launched, giving investors a way to get exposure to those cryptocurrencies in almost any brokerage account.

Since then, a number of other cryptocurrencies have started to be tracked by ETFs. One of the most recent is XRP, also known as Ripple — the fifth-largest cryptocurrency by market cap.

Ripple is a crypto payments company whose founders created XRP, its native token. XRP and the blockchain it runs on, the XRP Ledger, are billed as a better way to send money across borders. While the traditional process of sending and receiving money can take days to complete, XRP international transactions can be settled in seconds — and usually for a fraction of the cost.

XRP became more widely available to U.S. consumers following the partial resolution of a lawsuit filed against the company by the U.S. Securities and Exchange Commission. A federal judge ruled in July of 2023 that Ripple's sale of XRP on crypto exchanges was not an unregistered sale of securities. And then in Aug. 2025, the SEC dropped its case against Ripple completely, paving the way for the ETFs that are now trading.

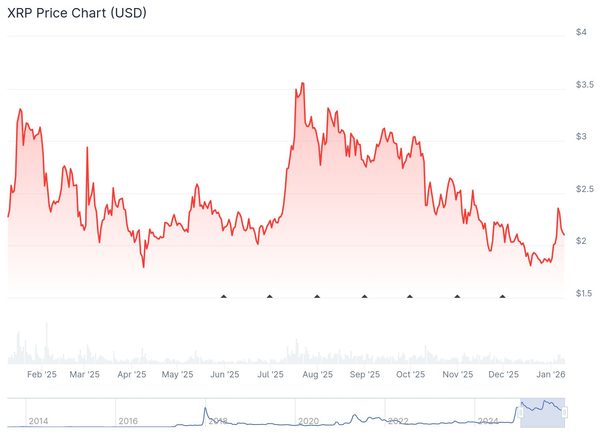

Following larger crypto trends, XRP is down around 11% in the last year, despite the surge following the SEC's entire dismissal of the case in August 2025. Source: CoinGecko.

What is a spot XRP ETF?

A spot XRP ETF is an exchange-traded fund that invests directly in XRP, similar to how a spot gold ETF invests directly in gold on behalf of its shareholders. The fifth-largest cryptocurrency had a volatile 2025: It traded as low as $1.79 in April, and as high as $3.56 in July. It didn’t fare so well in the second half of last year, but it is already up almost 20% in 2026.

Before the SEC approved the first spot XRP ETFs in November 2025, the only ways to get XRP exposure were through crypto exchanges, or through certain XRP-related ETFs that attempt (often imperfectly) to track the price of the cryptocurrency by investing in derivatives such as futures. But now, a half-dozen funds allow investors to buy XRP in ETF form via any brokerage that offers ETFs.

Here are all of the XRP ETFs currently listed, and their fees and promotions

We've listed these XRP ETFs from lowest to highest fees. A few funds are currently waiving their fees for a few months in 2026.

Symbol | Fund name | Fee |

|---|---|---|

XRPZ | Franklin Templeton XRP ETF | 0.19% (waived through May 31, 2026) |

TOXR | 21Shares XRP ETF | 0.30% |

XRP | Bitwise XRP ETF | 0.34% |

GXRP | Grayscale XRP Trust ETF | 0.35% (waived through Feb. 24, 2026) |

XRPC | Canary XRP ETF | 0.50% |

XRPR | Rex-Osprey XRP ETF | 0.75% |

Source: Fund websites. Data is current as of Jan. 7, 2026, and is intended for informational purposes only.

What to know about XRP ETFs

More XRP ETFs may launch in the future: A couple of other ETF issuers, such as CoinShares and WisdomTree, have filed paperwork with the SEC for a spot XRP ETF but have not launched them yet.

Fees may change: As new funds come online, they may announce fee waivers like those offered by Franklin Templeton and Grayscale, which may create competitive pressure for other issuers to waive their fees. Conversely, the fee waivers from Franklin Templeton and Grayscale are only effective for a few months, and may not apply anymore if you wait a while to buy those funds.

More access but less control than actual XRP: Spot XRP ETFs allow investors who don’t have an account with a crypto exchange to profit from the price movements of the world’s fourth-largest cryptocurrency, but the tradeoff is that XRP ETFs offer investors less control over their crypto investment than owning XRP tokens themselves. You can’t send your XRP elsewhere or lend it for a return if you own it indirectly through an ETF — for those features, you’ll need to buy the cryptocurrency itself.

» MORE: Best crypto exchanges

Neither the author nor editor owned positions in the aforementioned investments at the time of publication.