3 Reasons the IHG One Rewards Premier Credit Card Deserves a Spot in My Wallet

By Erin Hurd

As a credit card and travel rewards expert, I’ve been known to carry several cards at any given moment.

Some cards have come and gone from my wallet over time.

But one powerhouse hotel credit card has been a long-held mainstay for me.

That’s because the value I get from this card far outweighs the price of its annual fee – year after year.

🏨 It helps me get free hotel nights…

💳 Earns a boatload of points when I pay cash for my stays at its 20 hotel brands…

🎩 Makes me feel fancy with automatic elite status…

🤑 Saves me from costly fees when I travel overseas…

🔐 Insures my trips…

😎 and much more.

And, if you open one for yourself today, you’ll earn this bonus:

Earn 175,000 Bonus Points after spending $5,000 on purchases in the first 3 months from account opening.

Here’s why I love the IHG One Rewards Premier Credit Card.

1. It gives a free room night every single year

The headline benefit of the IHG One Rewards Premier Credit Card is the anniversary free night (up to 40,000 points) that cardholders get each and every calendar year.

NerdWallet pegs the value of IHG One Rewards points at 0.6 cent a piece. That means this free anniversary night is worth around $240 – more than double the card’s $99 annual fee!

And that free night isn’t limited to a small handful of properties.

The IHG network includes more than 6,000 hotels with 20 brands around the world. You’ll find everything from luxury to budget and everything in between.

There’s no blackout dates, long list of excluded hotels or fine print of hoops you’ll have to jump through.

In fact, the fine print of this benefit actually makes it even more valuable!

Here’s what I mean…

If you look closely at the terms of the anniversary free night benefit (hey, as a credit card expert I do this all the time so you don’t have to 😃), you’ll see this sentence:

“You can also use existing points from your IHG One Rewards account to redeem your Anniversary Night at hotels above the 40,000 point redemption level.”

That means you can easily use your annual free night award to book even more valuable rooms!

Let’s say you find the perfect IHG hotel for your anniversary getaway.

When you check the date you want, you see the room will cost 50,000 points.

Rather than being out of luck to redeem your free night certificate (as you might be with other hotel programs) – this fine print lets you add IHG points from your account to the value of the certificate.

With a few clicks, you can book the hotel you want, on the night you want, and use your free night certificate – plus some of your points.

And remember, taking advantage of this limited-time offer now will earn a boatload of points for your stash:

Earn 175,000 Bonus Points after spending $5,000 on purchases in the first 3 months from account opening.

2. You can get unlimited free nights on longer points stays

This little-known perk – one you can only access if you hold an IHG credit card – can really save you a bundle. Even if you only use it on one trip a year!

(But the more you use it, the more you save!)

If you hold the IHG One Rewards Premier Credit Card, you’ll get the 4th night free when you pay with points for a stay of four nights or more (terms apply).

Yes, that means you’ll only pay the points for 3 nights and you’ll get the 4th night totally free!

It's an easy, automatic perk. You don't have to remember to check a special box or jump through hoops to activate.

Better yet, there’s no limit to how many times you can claim your 4th free night.

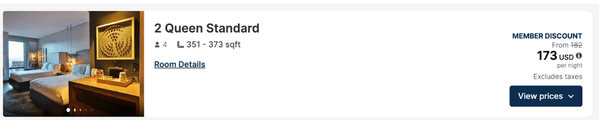

🏔️ Let’s say you want to shred some Colorado mountain snow in the winter. You could book the Hotel Indigo Silverthorne, nestled in snowcapped mountains at the basin of beautiful Buffalo Mountain.

Image courtesy of IHG

You could use your IHG points to book an extra long weekend getaway, in peak winter season.

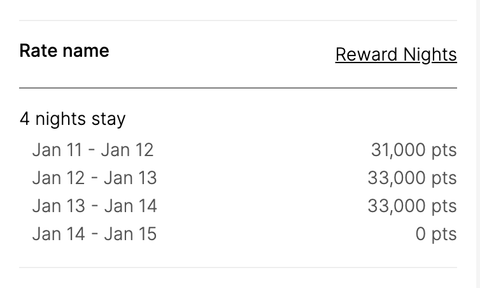

You’d pay an average of 32,000 IHG points per night, for a room with two queens –big enough to fit your whole family of 4.

And, because you hold the IHG One Rewards Premier Credit Card, you’d get the 4th night free.

Here’s what that would look like:

That same room would cost $173 per night if you paid cash.

So, the automatic 4th free night perk would save you $173 on this trip (not to mention the money you save by paying for the stay with points instead of cash!).

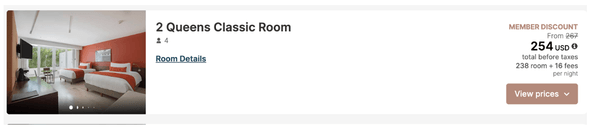

🏖️ Now, let’s say a few months later you decide to visit Cancun for Spring Break.

You decide to book the incredible InterContinental Presidente Cancun Resort, a five-star luxury resort located on the best beach in Cancun.

Image courtesy of IHG

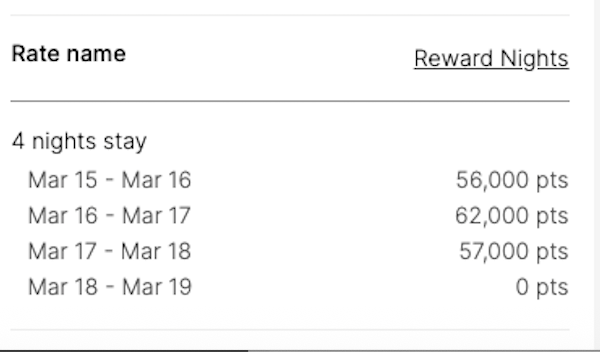

You could score a room big enough for your whole family of 4 and pay an average of 58,000 points per night.

And you could still take advantage of the automatic 4th night free perk - even if you already took advantage of a 4th night free earlier in the year on your ski trip.

In case you’re wondering, this particular room is going for an average of $254 per night for a cash stay on those same dates.

So, your 4th night free IHG One Rewards Premier Credit Card-holder perk would save you $254 on this trip (plus the $173 you saved on your ski trip!)

That's the equivalent of $427 saved from just two stays!

Plus, you don’t have to stay exactly 4 nights. If your trip was 5 nights, you’d pay for 4 nights and get 1 free.

There’s no limit to the amount of times you can take advantage of this 4th night free benefit, when you book the first 3 nights with points!

Traveling to visit family for a week over the holidays? Use that 4th night free perk again. You get the idea.

3. Spending on the card is super rewarding (even for more than hotel stays)

You’ll earn an eye-popping 26 total points per $1 spent when you use the IHG One Rewards Premier Credit Card at IHG hotels.

Here’s how that breaks down:

10 points for paying with the IHG One Rewards Premier Credit Card.

10 points from your free IHG One Rewards membership. You'll be automatically enrolled when you're approved for the card if you previously weren't a member.

6 points from Platinum Elite status, an automatic benefit of IHG One Rewards Premier Credit Card ownership.

A two-night stay at a $200-per-night hotel means earning 10,000 points.

And yes, room redemptions start at 10,000 points. By paying with this card, you don’t have to work too hard to start earning yourself free nights.

And, unlike some travel cards, you’ll continue to earn solid rewards when you use the IHG One Rewards Premier Credit Card on everyday spending, too.

The IHG One Rewards Premier Credit Card earns 5 points per $1 spent on travel, gas stations and restaurants and 3 points per $1 spent on all other purchases.

Plus, big spending earns even more rewards!

When you spend at least $20,000 in purchases in a calendar year, you’ll get a $100 statement credit plus 10,000 bonus points!

10,000 bonus IHG points are worth around $60, according to NerdWallet valuations.

That’s another potential $160 in value back from a card with a $99 annual fee!

Not to mention, the other valuable benefits and perks the IHG One Rewards Premier Credit Card gives, including:

✅ Automatic Platinum Elite status, which gives perks like priority check-in, 2 pm late checkout (when available), complimentary internet access, complimentary room upgrades (when available) and a dedicated customer service phone line.

✅ Up to a $120 credit toward an application for travel timesavers Global Entry, TSA PreCheck or Nexus (once every 4 years).

✅ No foreign transaction fees. This saves around 3% on every purchase you make outside the U.S. – fees that can really add up for travelers.

✅ Up to $50 United® Airlines TravelBank Cash each calendar year when you register.

✅ Tons of travel protections, including:

Trip cancellation and interruption.

Travel accident insurance.

Travel and emergency assistance services.

Lost luggage reimbursement.

Baggage delay insurance.

Auto rental collision damage waiver.

That level of protection could potentially save you thousands of dollars.

For example, if your trip is canceled or cut short by covered situations including sickness or severe weather, you can be reimbursed up to $5,000 per person and $10,000 per trip for prepaid, nonrefundable travel expenses, like tours or hotel rooms.

Also, if you or an immediate family member checks luggage that's damaged or lost by the carrier, you’re covered up to $3,000 per passenger.

The bottom line

Credit card points, miles and free night certificates can be incredibly valuable in helping to offset travel costs.

The IHG One Rewards Premier Credit Card's multitude of perks, credits and protections make holding the card a no-brainer for me, and many other travelers.

I'm happy to pay its relatively low $99 annual fee for the value the IHG One Rewards Premier Credit Card brings to my travels each year.

The current bonus is one you don’t want to miss out on: Earn 175,000 Bonus Points after spending $5,000 on purchases in the first 3 months from account opening.

Apply today to earn a nearly-free vacation later this year.

3x-26x

Points175,000

Points