The Guide to American Airlines Credit Card Benefits

American Airlines credit cards offer free checked bags, AAdvantage mile and Loyalty Point earning, and more.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

If you travel on American Airlines regularly, getting one of the airline's credit cards can prove extremely valuable.

Not only will you earn extra AAdvantage miles on your spending, but the cards also come with additional benefits to improve your flight experience, reach elite status faster and save money.

The American Airlines credit cards include:

Here's what to know about their benefits.

» Learn more: The best travel credit cards right now

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

AAdvantage miles earned on spending

One of the basic benefits of an American Airlines credit card is the ability to earn AAdvantage miles on your spending. With each card, you'll earn rewards on all purchases. You'll get extra miles on American Airlines purchases and bonus categories.

You can also earn miles on purchases your authorized users make on your account. Except for the Citi® / AAdvantage® Executive World Elite Mastercard®, each card offers free authorized user or employee cards. With the Citi® / AAdvantage® Executive World Elite Mastercard® that comes with Admirals Club lounge access, you can add up to three authorized users for $175 per year, then $175 annually for each additional user. These users will have access to Admirals Clubs, even if you're not present.

American Airlines personal cards

Annual fee

$0.

$99, waived for the first 12 months.

$350.

$595.

Welcome offer

Earn 15,000 American Airlines AAdvantage® bonus miles after making $1,000 in purchases within the first 3 months of account opening.

Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

For a limited time, earn 90,000 American Airlines AAdvantage® bonus miles after $5,000 in purchases within the first 4 months of account opening.

For a limited time, earn 100,000 American Airlines AAdvantage® bonus miles after spending $10,000 within the first 3 months of account opening.

Earn rate

• 2 miles per $1 at grocery stores, including grocery delivery services, and on eligible American Airlines purchases.

• 1 mile per $1 spent on other purchases.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 2 miles per $1 at gas stations and restaurants, and on eligible American Airlines purchases.

• 1 mile per $1 spent on other purchases.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 6 miles per $1 on eligible AAdvantage Hotels bookings.

• 3 miles per $1 on eligible American Airlines purchases.

• 2 miles per $1 at restaurants, including takeout and delivery, and on eligible Rides and Rails purchases, including taxis, rideshares and public transit.

• 1 mile per $1 on everything else.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

• 10 miles per $1 on eligible car rentals and hotels booked through AA.

• 4 miles per $1 on eligible American Airlines purchases (5 miles per $1 after spending $150,000 total on the card in a calendar year).

• 1 mile per $1 on everything else.

• 1 Loyalty Point per 1 eligible AAdvantage® mile earned from purchases.

Learn more

» Learn more: The best American Airlines credit cards

Discount on American Airlines flights

When you spend $20,000 in an anniversary year on the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, you'll receive a voucher for a $125 American Airlines flight discount after renewing your card.

If you travel with a companion, the Citi® / AAdvantage® Globe™ Mastercard® offers a companion certificate each year, starting after your first card renewal. That certificate allows you to bring a companion with you on a domestic round-trip itinerary for just $99 plus taxes and fees.

Free checked bags

If you wait to add on checked bags until you're at the airport rather than booking in advance, American Airlines charges $40 for the first checked bag when traveling domestically or to Puerto Rico and the U.S. Virgin Islands. Getting free checked bags can save $320 on a round-trip flight for a family of four.

You'll get the first checked bag free for yourself and up to four companions if you have the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. With the premium Citi® / AAdvantage® Executive World Elite Mastercard® and the Citi® / AAdvantage® Globe™ Mastercard®, this benefit extends to eight travel companions. The $0-annual-fee American Airlines AAdvantage® MileUp® doesn't offer this perk.

Early boarding

Getting on the plane early allows you priority access to the overhead bins and more time to get comfortable ahead of your flight. Citi® / AAdvantage® Executive World Elite Mastercard® cardholders get to board in Group 4, while all other AAdvantage cardholders (except the American Airlines AAdvantage® MileUp®) board in Group 5. American Airlines AAdvantage® MileUp® does not offer early boarding benefits.

» Learn more: American Airlines' boarding process explained

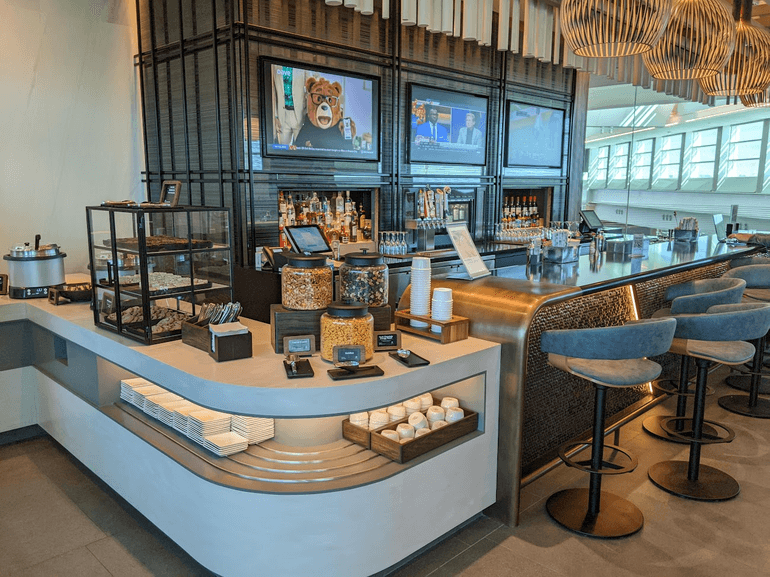

Lounge access

Only one of the American Airlines credit cards includes unlimited Admirals Club lounge access. The Citi® / AAdvantage® Executive World Elite Mastercard® comes with a complimentary Admirals Club membership where cardholders can enter the lounge for free whenever they're flying on American Airlines or an eligible partner airline. Cardholders can also bring immediate family members (spouse, domestic partner and children up to age 18) or up to two guests in for free.

While it costs extra to add authorized users on this card, they'll also have access to the Admirals Club even if you're not traveling with them. However, they won't be able to bring guests into the lounge for free.

If you don't need unlimited complimentary access, the Citi® / AAdvantage® Globe™ Mastercard® comes with four Admirals Club passes a year, with the ability to bring up to three children under 18. These passes are valid for 24 hours and can be used at multiple Admirals Club locations.

TSA PreCheck or Global Entry credit

TSA PreCheck and Global Entry expedite your wait at the airport when going through airport security and U.S. customs, respectively. The Citi® / AAdvantage® Executive World Elite Mastercard® and the Citi® / AAdvantage® Globe™ Mastercard® are the only cards from American Airlines that include reimbursement for these application fees up to $120 every four years.

In-flight savings

Save money on your in-flight purchases of food and beverages when using your American Airlines credit card. American Airlines AAdvantage credit cards provide a 25% statement credit for all inflight purchases.

This doesn't apply to the Citi® / AAdvantage® Globe™ Mastercard®. Instead, cardholders get up to $100 in statement credits on in-flight purchases when flying on eligible domestic flights.

Faster path to elite status

American Airlines elite status offers numerous perks for travelers, including complimentary upgrades, waived fees, priority standby and more. You can accelerate your path to elite status using American Airlines credit cards.

Earn Loyalty Points on purchases

Not only will you earn AAdvantage airline miles on every dollar you spend on your American Airlines credit cards, but you'll also earn one Loyalty Point on each dollar spent. This allows cardholders to earn points toward elite status based solely on their spending — or in conjunction with flying and other qualifying activities.

🤓 Nerdy Tip

You will not earn bonus Loyalty Points on spending categories with higher earning rates. For example, even though the Citi® / AAdvantage® Platinum Select® World Elite Mastercard® earns 2 AAdvantage miles per $1 spent on gas and restaurants, you'll earn only 1 Loyalty Point per $1 for those purchases. Bonus Loyalty Points

With the Citi® / AAdvantage® Executive World Elite Mastercard®, you'll receive up to 20,000 bonus Loyalty Points per year to boost your elite status. The first 10,000 points are earned by reaching 50,000 Loyalty Points in a status qualification year. A second 10,000 points (for a total of 20,000) are earned when you reach 90,000 Loyalty Points.

If you hold the Citi® / AAdvantage® Globe™ Mastercard®, you can earn more Loyalty Points through the Flight Streak bonus. For every four eligible paid flights you take on American, you earn 5,000 Loyalty Points (up to 15,000 Loyalty Points a year).

No foreign transaction fees

All of the American Airlines credit cards, except the American Airlines AAdvantage® MileUp®, waive foreign transaction fees. The American Airlines AAdvantage® MileUp® charges a 3% fee on international purchases.

Travel insurance and assistance

Unfortunately, not all American Airlines credit cards include travel insurance or assistance benefits. But the premium Citi® / AAdvantage® Executive World Elite Mastercard® and the Citi® / AAdvantage® Globe™ Mastercard® come with travel insurance benefits, including trip cancellation/interruption protection, trip delay protection, lost baggage protection and worldwide rental car insurance. Learn more about Citi cards' travel insurance benefits.

Travel and dining credits

Some of the benefits for the Citi® / AAdvantage® Executive World Elite Mastercard® are travel and dining credits. Cardholders can earn:

- Up to $120 annually in Lyft credits: After three eligible Lyft rides in a calendar month, cardholders can receive a $10 Lyft credit.

- Up to $120 annually on Grubhub purchases: Cardholders earn one $10 statement credit per monthly billing statement when making an eligible Grubhub order.

- Up to $120 annually Avis and Budget car rentals: For every dollar spent on eligible Avis and Budget car rentals, cardholders receive a $1 statement credit up to the annual maximum of $120.

The Citi® / AAdvantage® Globe™ Mastercard® also offers credits for cardholders, such as:

- Up to $100 annually in splurge credits: Cardholders can earn statement credits on purchases with up to two of the following merchants: eligible AAdvantage Hotels bookings, 1stDibs, Future Personal Training and Live Nation.

- Up to $240 annually on Turo purchases: Cardholders earn up to $30 credited for each eligible completed trip with the car-sharing service.

» Learn more: Is the Citi® / AAdvantage® Globe™ Mastercard® worth it?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles