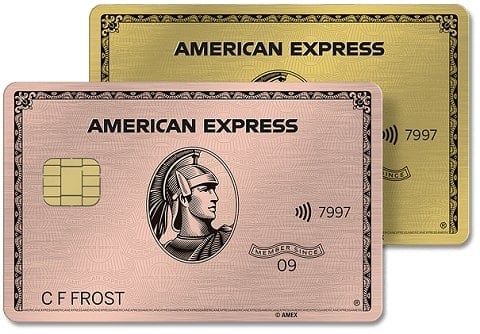

AmEx Gold vs. Platinum: Platinum Takes the Prize for Perks

Those with a serious case of wanderlust should opt for the AmEx Platinum — and maybe go for the Gold, too.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

A comparison between two standout travel cards, the American Express® Gold Card and the American Express Platinum Card®, is the rare case where it’s hard to pick a clear winner. If you're more interested in the perks, the Platinum is a dream for the high roller who wants to travel in style. But the Gold is a better earner and worthy travel companion, too, offering 4x points on dining worldwide (and at U.S. supermarkets). Terms apply.

Here’s a guide to help you decide what card to get — and when it makes sense to get both.

on American Express' website

on American Express' website

You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply.

4 points per dollar spent at restaurants worldwide, on up to $50,000 in annual spending.

4 points per $1 at U.S. supermarkets, on up to $25,000 in purchases.

3 points per $1 on airfare on a scheduled flight charged directly with passenger airlines and charged directly through American Express.

2 points per $1 on prepaid hotels and other eligible travel booked through American Express.

1 point per dollar on other purchases.

Terms apply.

5 points per dollar spent on flights booked directly with airlines or through American Express, on up to $500,000 in such purchases per calendar year.

5 points per $1 on prepaid hotels booked through American Express.

1 point per $1 on other purchases.

Terms apply.

$120 a year in dining credits at select restaurants. Enrollment required.

Up to $120 a year in Uber Cash ($10 per month), good toward U.S. Uber Eats orders or Uber rides, when you add your card to your Uber account and pay with an AmEx card. Enrollment required.

Up to $100 a year in Resy credit; $50 semi-annually. Enrollment required.

$84 credit ($7 a month) for purchases at U.S. Dunkin locations. Enrollment required.

Terms apply.

$600 hotel credit. Enrollment required.

Up to $300 a year in digital entertainment credit. Enrollment required.

$12.95 a month credit for Walmart+ when you pay for a membership with your card. Enrollment required.

$200 airline incidental fee credit. Enrollment required.*

$200 Uber Cash credit; $15 per month plus ($35 in December), when you pay with your card. Enrollment required.

$120 Uber One membership credit. Enrollment required.

$300 Equinox credit. Enrollment required.

$400 Resy credit. Enrollment required.

$300 Lululemon credit. Enrollment required.

$209 CLEAR+ credit. Enrollment required.

$120 credit for Global Entry every four years, or up to $85 for TSA PreCheck every four years.

Up to $100 in Saks Fifth Avenue credit; $50 semi-annually. Enrollment required.

$200 Oura ring credit. Enrollment required.

$300 SoulCycle at-home bike credit. Enrollment required.

Terms apply.

Why you’d want the American Express Platinum Card®

The Platinum is a bonafide premium travel card for the bonafide traveler. Its annual fee is among the highest compared to cards in its class, but in exchange, cardholders receive several superior travel perks that make flights, stays and car rentals a luxe experience.

Airport lounge access

Don't want to wait at the gate with the masses? The American Express Platinum Card® has you covered. Cardholders can enjoy complimentary snacks, drinks, Wi-Fi and even a hot shower with access to more than 1,400 airport lounges around the world. That includes the exclusive American Express Centurion lounges, which only Platinum and Black card holders can enter. The American Express® Gold Card, on the other hand, won’t grant entry into any lounge.

Unlike the American Express® Gold Card, the American Express Platinum Card® offers cell phone protection up to $800 per claim, or $1,600 (two claims) per 12-month period when you charge the bill on your card and pay a $50 deductible. (Insurance is underwritten by New Hampshire Insurance Company, an AIG Company. Eligibility and benefit level varies by card. Terms, conditions and limitations apply.)

Automatic status

Nothing says traveling in luxury like room upgrades, VIP treatment and the ability to skip the line. The American Express Platinum Card® gives its cardholders these automatic status boosts:

Marriott Gold Elite: 25% more points, potential room upgrades and late checkout.

Hilton Honors™ Gold Status: 80% more points, daily food and beverage credit and possible room upgrades.

Leading Hotels of the World: Free complimentary breakfast for two, early check-in and late checkout when available.

Avis Preferred Plus: Free one-class car upgrades, expedited service.

Hertz President's Circle: Guaranteed upgrades, dedicated customer service.

National Executive Elite: Guaranteed free upgrade when you rent at the midsize rate, guaranteed car within 24-hour notice and private airport delivery.

A bevy of credits

There’s no denying that the Platinum is leaning hard into the coupon book trend. To justify the card’s $895 annual fee, cardholders receive more than a dozen credits ranging from a $600 hotel credit to a $300 credit for Lululemon purchases. If the credits align with your spending habits, and you have the wherewithal to understand their terms and conditions, it’s possible to use those credits to offset the card’s annual fee.

Concierge services

Help scoring tickets to world-class sporting events, reservations at posh restaurants and seats at the hottest concerts can be yours with the American Express Platinum Card®. Just call the number on the back of your card to connect with a Platinum Concierge, who can help with everything from sending flowers to navigating travel disruptions. Access to such in-demand experiences pairs nicely with the card’s Platinum Travel Service that can create custom trip itineraries.

Why you’d want the American Express® Gold Card

Smaller annual fee

The American Express® Gold Card costs significantly less in annual fees than the American Express Platinum Card®. Sure, the Gold still isn’t cheap, but it can pack tremendous value.

For example, both cards have Uber Cash credits. The Gold’s is worth up to $120 (doled out in monthly increments of $10) while the Platinum’s is up to $200. But, if you’re able to get the full value of the American Express® Gold Card's Uber credit — which you can do pretty easily by calling an Uber or ordering from Uber Eats every month — you’ll make a sizable dent in the Gold’s annual fee.

To get the credits, the Gold card must be added as a payment method in the Uber app, and credits are only awarded for U.S. Uber rides and Uber Eats orders. Terms apply.

Superior rewards-earnings

The American Express® Gold Card is a rewards powerhouse — not just compared to the American Express Platinum Card®, which earns a paltry 1x points on most purchases, but compared to many other rewards cards. It boasts a whopping 4x rewards rates on the popular spending categories of restaurants (up to $50,000 per year; 1x thereafter) and U.S. supermarkets (up to $25,000 per year; 1x thereafter). It ranks on NerdWallet’s lists of best credit cards for groceries and restaurants. Terms apply.

If your household spends $12,000 a year on groceries and dining, you’d earn 48,000 Membership Rewards by putting all of those expenses on the Gold card. If you're willing to put in a little effort to transfer and redeem points with travel partners rather than with American Express directly, you can reap outsized value. NerdWallet values American Express Membership Rewards at 1.6 cents each when transferred to partners to book travel.

Simpler experience

As noted earlier, the Platinum offers more than a dozen credits, each with its own terms that you must abide by if you want to use it. If that feels overwhelming to you, the Gold with just four credits is the least mentally taxing choice.

Why you’d get both

If you can afford two high annual fees, consider getting the American Express® Gold Card and the American Express Platinum Card®. For the dedicated traveler, they make a perfect pairing. You’ll get all of the travel perks from the Platinum and big rewards rates on everyday spending categories with the Gold. Ultimately, the Gold can help you rack up Membership Rewards to pay for travel, while the Platinum can make the actual travel experience more enjoyable.

To view rates and fees of the American Express Platinum Card®, see this page. To view rates and fees of the American Express® Gold Card, see this page.

*More from American Express

American Express relies on airlines to submit the correct information on airline transactions to identify incidental fee purchases. If you do not see a credit for a qualifying incidental purchase on your eligible Card after 8 weeks, simply call the number on the back of your Card. Qualifying airlines are subject to change. See terms & conditions for more details

Insurance Benefit: Cell Phone Protection

Coverage for a Stolen or damaged Eligible Cellular Wireless Telephone is subject to the terms, conditions, exclusions and limits of liability of this benefit. The maximum liability is $800, per claim, per Eligible Card Account. Each claim is subject to a $50 deductible. Coverage is limited to two (2) claims per Eligible Card Account per 12 month period.

Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

Please visit americanexpress.com/benefitsguide for more details.

Underwritten by New Hampshire Insurance Company, an AIG Company.

Capital One Venture Rewards Credit Card

Travel

For a limited time, the Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.