Venmo Credit Card Review: Cash-Back Rewards Get Personal, and Automated

The Bottom Line

3.4

There’s no need to track rewards categories or activate bonuses, offering a simpler way to optimize rewards. But the sign-up bonus is a bit of a moving target, and you must use the Venmo app to get the card.

Rates, fees and offers

Rates, fees and offers

Annual fee

$0

Rewards rate

1%-3%

Bonus offer

None

Intro APR

N/A

Ongoing APR

APR: 19.49%-31.49% Variable

Cash Advance APR: 31.49%, Variable

Foreign transaction fee

0%

More details from Synchrony Bank

More details from Synchrony Bank

- Earn up to 3% cash back on your top spend category, 2% on the next, and 1% on the rest.

- No annual fee.

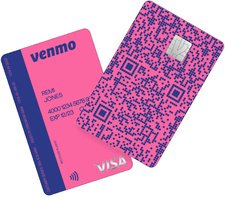

- Your card comes with your own unique QR code on the front, so it’s a snap to Venmo friends. When they scan your code, up pops your Venmo profile to pay or get paid.

- Keep tabs on card activity in the app, right with all your Venmo spending.

- Use the Venmo app to disable a lost or stolen physical card.

Pros and Cons

Pros

No annual fee

Bonus categories

Cons

No 0% intro APR

Requires good/excellent credit

Detailed Review

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

• • •

The Venmo Credit Card, issued by Synchrony Bank, breaks away from one-size-fits-all rewards cards, offering extra cash back where you spend the most each month with no need to strategize. Just use the card as you normally would to make purchases, and you’ll automatically earn a higher cash-back rate on your top two spending categories (from a list of eight).

The card also stays true to Venmo’s roots as an app that makes it easy to split costs between friends. Its design features a QR code that others can scan with their phones, so when you front the cost of a restaurant meal with your card, you won’t need to chase anyone down to get paid back.

Of course, if you aren't interested in actually using Venmo, the Venmo Credit Card is not for you. It's also worth noting that the card tends to change its sign-up bonus quite often (assuming it happens to be offering one at all).

Eligible Venmo customers can apply for the card through the Venmo app, but you must have had a Venmo account for 30 days first.

» MORE: What is Venmo?

Venmo Credit Card: The basics

Card type: Cash back.

Annual fee: $0.

Sign-up bonus: This card occasionally offers bonuses for new applicants that may change over time.

Rewards:

3% cash back in your top spending category for the month (from one of eight possible categories).

2% back in your second-place spending category for the month (from one of the remaining seven possible categories).

1% back on all other purchases, including any purchase that doesn’t fall into one of the spending categories listed below.

Spending categories that are eligible for 3% or 2% cash back

Grocery: This includes grocery stores and wholesale clubs.

Bills and utilities: Phone and internet service providers, streaming services, magazine and newspaper subscriptions, electricity, gas, water, trash disposal and other utilities.

Health and beauty: Drugstores, cosmetic stores, health clubs and other membership facilities like tennis, golf and swimming clubs.

Gas: Purchases at service stations that sell fuel.

Entertainment: Movie theaters, theatrical and concert promoters, video rental and game stores, books and newsstands, amusement parks, music stores, and toy and hobby stores.

Dining and nightlife: Dine-in, takeout and delivery from restaurants and fast-food establishments. Bars also are included.

Transportation: Rental cars, cabs and ridesharing services, limos, buses, trains, tolls, parking meters and garage parking.

Travel: Airlines, hotels and vacation rentals. Also includes resorts, bed and breakfasts, cabins, hostels and timeshares.

Interest rate: The ongoing APR is 19.49%-31.49% Variable.

Foreign transaction fees: None.

Minimum redemption requirement: None.

Compare to Other Cards

Benefits and Perks

Personalized rewards across a broad range of categories

The Venmo Credit Card doesn't require opting in or activating bonus categories. You don't really even need to "track" anything. For each monthly billing cycle, you'll simply earn bonus rewards in the top two categories you spend the most on (from the above list), and 1% back on other spending. Once the billing cycle ends, your earning opportunities reset.

Here’s how this could work: Let’s say you booked a trip this month requiring plane tickets and a hotel booking, so you spent the most on travel and would earn 3% cash back on those expenses. Your next highest spending was on bills and utilities, so that earns 2% back. The next month, you go on your trip and dine out often, turning that activity into your 3% cash-back category.

Some business and consumer credit cards also offer this automated personalization. The HMBradley credit card features it, but you must open an HMBradley deposit account first. The Citi Custom Cash® Card earns 5% cash back on up to $500 in spending each billing cycle in your highest eligible spending category (1% back after that), and 1% on other purchases.

Easy redemptions

Any cash back you earn will appear in your Venmo balance after your statement closes. From there, you can apply the money toward a credit card bill (much like a statement credit), make purchases from a merchant that accepts Venmo, send money to someone else through the Venmo app or transfer it to a linked bank account or debit card.

Use rewards to buy crypto

In August 2021, Venmo Credit Card’s reward redemption options expanded to include cryptocurrency.

You need to opt-in to enable the auto-purchase feature of the Cash Back to Crypto option, and you won't incur an additional transaction fee. But a cryptocurrency conversion spread will be built into each monthly transaction. That means Venmo will charge a small margin between the crypto market price and the current exchange rate.

If you’ve opted in and you have a cash back balance greater than $1, any cash back in your account will automatically be used to purchase the cryptocurrency of your choice. As of August 2022, you can buy one of four cryptocurrencies: Bitcoin, Ethereum, Bitcoin Cash and Litecoin. Venmo charges a fee when you buy or sell, which varies according to the value of the cryptocurrency.

» MORE: Best crypto credit cards

Unique card design that makes splitting costs simple

Each physical card features its own QR code on the front, which comes in handy when you’re splitting a purchase with another person. They can scan the QR code from the Venmo app and be brought to your Venmo profile. From there, they can send money, or request money from you. Keep in mind that paying a friend over Venmo using the Venmo Credit Card means you’ll pay a 3% fee, which is the same as using any other credit card for peer-to-peer transactions.

Instant access upon approval

While your physical card is in the mail, you can begin making purchases with the virtual version of the card, which lives within the Venmo app and can also be added to digital wallets. Once the physical card arrives, you can activate it by scanning the QR code.

Manage the card on the Venmo app

If you need to pay your balance, see your rewards activity, change notifications, set up autopay, or track your spending trends or transactions, you can do so through the Venmo app. If your physical card is lost or stolen, you can disable it in the app and continue to shop with the virtual card. There’s no separate website to log into. (For some, this may count as a drawback; see below.)

MORE NERDY PERSPECTIVE

| I’m a big Venmo user, so on many levels this card would be easy for me to integrate. It’s instantly added to your Venmo app after approval, and it automatically earns bonus rewards in your top two spending categories, so it’s not complicated to manage like other rotating bonus category cards. Plus, the 2% and 3% categories are broad and useful — things like groceries and dining, which I already spend heavily on. My only hesitation is that although the card’s rewards are decent, there are better cash back options out there that out-earn it. Additionally, if I’m going to opt for a card right now, I want a good sign-up bonus — the one here is always changing and sometimes lackluster. Funto Omojola, writer, credit cards |

Drawbacks and Considerations

Welcome bonus is a moving target

The Venmo Credit Card currently offers bonuses on a limited-time basis. So if you want the bonus, you'll have to time your application carefully. Other cards consistently sweeten the deal with welcome offers worth $150 or more, which can help offset the annual fee some of them charge. One example is the Blue Cash Preferred® Card from American Express, which offers this welcome bonus: Earn a $250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months. Terms Apply. The card also earns generous cash-back rates in several common spending categories. It charges a $0 intro annual fee for the first year, then $95. If that's too high, consider its sibling card, the $0-annual-fee Blue Cash Everyday® Card from American Express. Its rewards are also useful, though less robust. Terms apply (see rates and fees for the Preferred version; see rates and fees for the Everyday).

Many spending categories earn only 1% back

You earn 3% or 2% cash back in only two spending categories per month. Any other spending earns only 1%. If you have a month where you spend a lot at a home improvement store, for example, other cards will reward you more handsomely. However, you could pair the Venmo Credit Card with a flat-rate card like the Citi Double Cash® Card, which earns 2% cash back on all purchases: 1% when you buy, 1% when you pay it back.

Not a starter credit card

While Venmo’s audience skews younger, the Venmo Credit Card requires good to excellent credit to qualify (corresponding to a FICO score of at least 690). A seasoned Venmo user who is still new to building credit may need to set their sights on a starter credit card for now.

You must use it with the Venmo app

There’s no Venmo Credit Card without Venmo. If you have no desire to use the Venmo app and would prefer a more traditional credit card experience, there are other cash-back credit cards that would be a better fit.

How To Decide If It's Right For You

If you already use Venmo and you want an easy-to-manage card with decent ongoing rewards, the Venmo Credit Card could certainly be a contender. The card’s seamless user experience makes it feel like the future of credit cards.

But if you’re after a lucrative sign-up bonus, you have less-than-ideal credit or you have no desire to use Venmo as a payment tool, you'll want to look elsewhere.

See how this card stacks up with NerdWallet's best credit cards to get.

To view rates and fees of the Blue Cash Everyday® Card from American Express, see this page.

To view rates and fees of the Blue Cash Preferred® Card from American Express, see this page.

The information related to the Citi Custom Cash® Card has been collected by NerdWallet and has not been reviewed or provided by the issuer or provider of this product or service.

Earn more in popular categories

Earn 6% cash back at U.S. supermarkets on up to $6,000 in spending per year, 6% cash back on select U.S. streaming services, 3% cash back at U.S. gas stations and on transit, and 1% back everywhere else. There's a $0 intro annual fee for the first year, then $95. Terms apply.

Looking For Something Else?

Methodology

NerdWallet reviews credit cards with an eye toward both the quantitative and qualitative features of a card. Quantitative features are those that boil down to dollars and cents, such as fees, interest rates, rewards (including earning rates and redemption values) and the cash value of benefits and perks. Qualitative factors are those that affect how easy or difficult it is for a typical cardholder to get good value from the card. They include such things as the ease of application, simplicity of the rewards structure, the likelihood of using certain features, and whether a card is well-suited to everyday use or is best reserved for specific purchases. Our star ratings serve as a general gauge of how each card compares with others in its class, but star ratings are intended to be just one consideration when a consumer is choosing a credit card. Learn how NerdWallet rates credit cards.

About the author

Sara Rathner

Senior Writer/Spokesperson