Forming an LLC in Illinois: A Step-by-Step Guide

Setting up an LLC in Illinois? Our guide covers the steps and what you need to know to operate an LLC in the state.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Running a small business comes with dozens of legal requirements. At the outset, you’ll need to decide which type of business entity is best for your company — and business-friendly LLCs are a popular choice.

If you want to know how to set up an LLC in Illinois, this guide has got you covered.

Forming an LLC in Illinois

Forming an LLC in Illinois can be accomplished through the Illinois Secretary of State. Before your LLC can start operating, you have to register with the Secretary of State and pay LLC formation fees. The Secretary of State also regulates naming conventions for LLCs and enforces other rules that you have to follow.

Step 1: Choose a name for your Illinois LLC

When forming an LLC in Illinois, the first step is to choose a business name. Under Illinois law, the name of a new LLC must be different from the names of other LLCs or corporations that have registered with the Secretary of State. This requirement prevents confusion among the public. For example, you can’t select the name “Mister Baker, LLC” if there’s already a “Mr. Baker, LLC” or “Mr. Baker, Inc.” registered to operate in Illinois.

Under Illinois law, the name of your Illinois LLC must end with one of the following words: Limited Liability Company, L.L.C., or LLC. Businesses that require professional certification, such as doctors and lawyers, must have Professional Limited Liability Company, P.L.L.C. or PLLC at the end of their company name. You can find out if you’re in a professionally regulated industry by visiting the Illinois Department of Financial and Professional Regulation.

Unlike most states, Illinois doesn’t allow the use of “Ltd.” or “Co.” as abbreviations in the name of an LLC. The business name cannot contain the words “corporation,” “corp.”, “incorporated,” “LP,” or “limited partnership.” The name also can’t contain words associated with insurance or banking without special permission from the state.

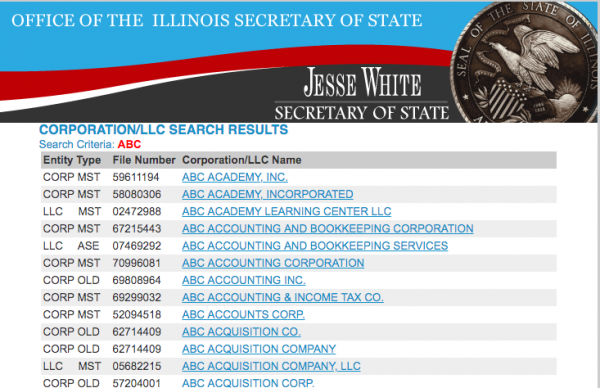

You can do a preliminary check for business name availability on the Illinois Business Search website. This tool will tell you whether any LLC or corporation in Illinois is already using the name you have in mind. You can also email or phone the Secretary of State to check name availability. Be prepared to have two or three alternative names to choose from.

If the preliminary name check shows that the name is available, you have the option to reserve the name for up to 90 days by paying a fee of $25. To reserve a name, submit Form LLC-1.15 by mail. It’s optional to reserve a name, but doing so prevents other businesses from claiming the name until you file your articles of organization.

Keep in mind that even if the Illinois Secretary of State reserves your business name, there’s no guarantee that the name complies with trademark laws. It’s ultimately up to you and your business attorney to understand the naming requirements and choose a name for your LLC that complies with state and federal laws.

Step 2: Appoint an Illinois registered agent

Every LLC that’s authorized to operate in Illinois must designate a registered agent. A registered agent is an individual or company that accepts legal documents on your business’s behalf. Government entities and legal claimants will send official correspondence to the registered agent, who is then responsible for forwarding the documents to you.

For an Illinois LLC, an individual can serve as the registered agent if they are at least 18 years old and an Illinois resident. A company can act as the registered agent if it is authorized to do business in Illinois and has an office address in Illinois (P.O. boxes are insufficient). Should your registered agent change, you should file Form LLC-1.36/1.37with the Secretary of State right away.

In Illinois, you may designate yourself or another owner of the LLC as the registered agent. However, you might not be able to fulfill the duties of a registered agent when you’re on vacation or out sick. A more convenient option is to sign up for a registered agent service. An online legal services company like Incfile can serve as your registered agent.

» MORE: Best LLC business loans

Step 3: Check if you need an Illinois business license

The state of Illinois, as well as local governments in Illinois, might require you to obtain a business license because you start operating your company. Business licenses can regulate business formation, advertising, signs, parking and many other aspects of running a business. The state has information about business licenses for a variety of industries. The city of Chicago also has a detailed webpage outlining which industries need licenses.

The Illinois Department of Financial and Professional Regulations issues professional licenses. If your LLC is in a professional industry, such as a doctor’s office or law firm, you’ll need to obtain a certificate of registration from that department before you can launch your business.

Retailers that sell tangible personal property or taxable services must register with the Illinois Department of Revenue. The retailer is responsible for collecting sales and use tax and reporting it to the state on a monthly basis.

Businesses that utilize trade names must apply for an assumed business name with the Secretary of State, and depending on your specific location, your county clerk’s office. You can file for an assumed name with the Secretary of State by filing Form LLC-1.20. An assumed name, also known as a fictitious business name or ‘doing business as’ name, is a name other than the legal name of your business. For example, if Joan and Day LLC wants to brand itself as “Joan’s Contracting,” then you need to register an assumed name.

Step 4: File articles of organization

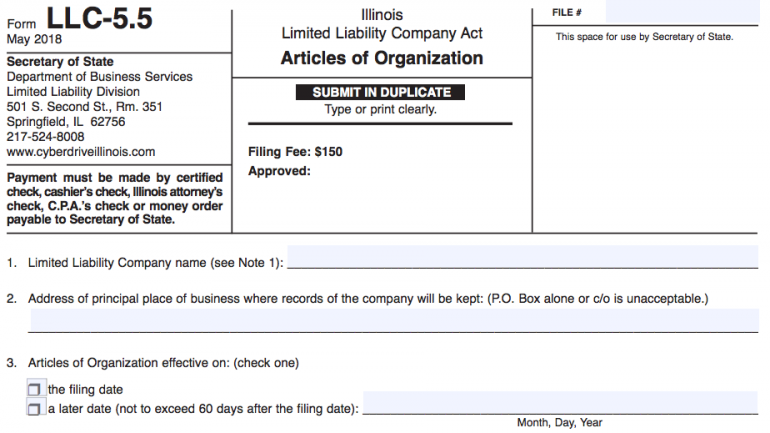

The most important step for forming an LLC in Illinois is to file articles of organization with the Illinois Secretary of State. You can either file your articles online for faster processing or mail in Form LLC-5.5. The filing fee is $150. Although Illinois recently reduced its business filing fees, this is still higher than several other states.

Illinois allows businesses to form series LLCs. In a series LLC, different divisions of a company can operate as separate entities, with separation of membership interests, assets and operations. A business that dabbles in products and services that have different income streams might choose to form a series LLC. To form a series LLC, file Form LLC-5.5(S). This form has a higher filing fee of $400.

For LLCs in Illinois, the articles of organization must include the following:

- Name of your Illinois LLC.

- LLC’s principal place of business in Illinois.

- Effective date of the LLC (can’t be more than 60 days after filing articles).

- Name and Illinois address of the registered agent.

- Purpose of the LLC.

- Dissolution date, if the LLC operating agreement specifies one.

- Optional: other provisions for the LLC’s regulation (you can leave this blank and list other regulations in the operating agreement).

- Name and address of the LLC’s manager if the LLC is manager-managed.

- Name and address of the organizer who is filling out the form.

If your business is organized under the laws of another state, and you’re seeking approval to operate in Illinois, then you’d file an Application for Admission to Transact Business with the Secretary of State. The filing fee for this application is $150, just like the fee to file articles of organization. Your application must be accompanied by a certificate of good standing from the state in which your company is organized.

Once you submit your articles of organization, the state will process them in about one week to 10 days. For an additional fee, you can request expedited filing. If the state accepts your articles, you'll receive a stamped copy to store with your business records.

Need help filing your articles of organization? An online legal service like Incfile will file your articles of organization for you. It also will include one year of free registered agent service.

Step 5: Draft an LLC operating agreement

The state of Illinois doesn’t require LLCs to have an LLC operating agreement, but it’s highly recommended. The operating agreement is a legally binding document that breaks down the management structure of the LLC and each owner’s duties and profit share.

At a minimum, the LLC operating agreement should contain the following information:

- The purpose of the LLC, including products or services offered.

- Each member’s name and address.

- The manager’s name and address if the LLC is manager-managed.

- Each member’s financial contributions to the business.

- Each member’s ownership stake in the company, division of profits and losses and voting rights.

- Procedure for admitting new members.

- Procedure for electing a manager if the LLC is manager-managed.

- Exit strategy when a member leaves the business.

- Meeting schedule.

- Dissolution procedures.

All members of the LLC should have the opportunity to review and sign the operating agreement. You won’t file your operating agreement with the state, but you should store it with other important business documents. An online legal service can help you create a custom LLC operating agreement.

Step 6: Comply With Employer Obligations

Illinois LLCs with employees have to meet additional obligations. Employers must do all of the following:

- Employee reporting: Report new employees to the Illinois Department of Employment Security within 20 days of hiring or rehiring. This is mandatory under federal and state law.

- Purchase workers' compensation insurance: Illinois businesses must purchase workers’ compensation insurance as soon as they hire their first employee. (Make sure you know about other types of LLC insurance you might need, too.)

- Pay unemployment taxes: Employers must start paying unemployment taxes as soon as they pay more than $1,500 in wages in a quarter or employed one or more individuals for more than 20 weeks in a given year.

For more information, business owners can visit the Illinois Department of Labor.

Step 7: Pay Illinois business taxes

In all states, including Illinois, LLCs are regarded as pass-through entities for tax purposes. This means that the LLC itself does not pay income taxes. Instead, business profits and losses pass through to each owner’s personal tax return. Each owner is taxed at their federal and state personal tax rate on their share of the profits.

Illinois also has a separate tax on LLCs called personal property replacement tax. The current tax rate is 1.5% of the LLC’s income, and it’s due once per year. Single-member LLCs are exempt from paying the personal property replacement tax.

LLCs can elect to be taxed as a C-corporation or S-corporation by filing paperwork with the Internal Revenue Service (IRS) and state government. S-corps are pass-through entities, similar to the default tax treatment for LLCs. However, if the LLC elects to be taxed as a C-corporation, then the LLC will pay Illinois corporate tax and federal corporate tax. In addition, the corporation will pay a higher personal property replacement tax.

Illinois LLCs with employees must withhold payroll taxes from their employees’ wages and pay the employer share of payroll taxes. A portion of these taxes goes to the federal government, and a portion goes to the state.

Along with paying required taxes, Illinois LLCs have to file an annual report with the Secretary of State each year. The annual report contains similar information to the articles of organization, and it can be filed online or by mail through Form LLC-50.1. The filing fee is currently $75. The annual report is due before the first day of the LLC’s anniversary month. For instance, if you organized your LLC on Sept. 23, your annual report is due by Aug. 31 of every year.

Step 8: Comply with federal requirements

The last thing to remember when setting up an Illinois LLC is to comply with federal requirements. For instance, you’ll need a federal employer identification number (EIN) if your LLC has employees, multiple owners or elects to be taxed as a corporation.

Owners in an LLC are responsible for paying federal self-employment taxes to cover Social Security and Medicare obligations. If you have employees, you must also withhold Social Security and Medicare taxes from your employees’ wages and pay the employer share of these taxes.

LLCs with employees have to pay federal unemployment taxes under the Federal Unemployment Tax Act (FUTA tax). The good news is that paying state unemployment taxes on time offsets your federal obligations.

Benefits and drawbacks of forming an Illinois LLC

An LLC is just one of many business entity structures you can choose from. Small-business owners like LLCs because LLCs offer tax and operational flexibility and have fewer compliance requirements than corporations. However, there are also disadvantages to watch out for.

Benefits

- Owners aren’t personally liable for business debts and lawsuits.

- LLCs have fewer compliance requirements than corporations.

- LLC earnings aren’t subject to double taxation in the way that C-corporation income is.

- LLCs can choose to be taxed as a pass-through entity or corporation.

- Illinois LLCs pay a lower personal property replacement tax than corporations.

Drawbacks

- Illinois LLC formation fees are on the high end compared to other states, particularly for series LLCs.

- All LLC earnings are subject to self-employment taxes, which isn’t the case with corporations.

- You can’t issue stock with an LLC, making it harder to raise money from investors.

Other business structures might be better suited for your company. It’s easiest and least expensive to start a sole proprietorship or general partnership, but you’re also opening yourself up to liability for business debts. C-corporation or S-corporation are best for raising money from investors. We recommend working with a business lawyer if you have questions about business entity choice.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles