The Complete Guide to the American Airlines AAdvantage Program

Here's what you need to know about AAdvantage, including earning, redeeming, partners and elite status.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

On this page

AAdvantage is the loyalty program for American Airlines, one of the largest airlines in the U.S. The Fort Worth, Texas-based airline operates a robust domestic network and flies to destinations around the world.

As an AAdvantage member, you can earn miles from flying on American and its partners or by spending on its credit cards. Those miles can, in turn, be redeemed for flights within its network and that of its Oneworld alliance partners.

Unlike with other major U.S. airline loyalty programs, American miles expire after 24 months of inactivity. However, American’s loyalty program offers several attractive flight redemption options, so it can be lucrative to maintain and grow a healthy stash of miles in your AAdvantage account.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

How to join American Airlines AAdvantage

To earn AAdvantage miles, you’ll need to sign up for an account on American’s website. It's free to join.

How much are American Airlines miles worth?

Based on NerdWallet’s most recent analysis, American Airlines miles are worth 1.3 cents apiece, a solid value when compared with many of the airline's competitors. To determine the value of award miles, we compared cash prices and award redemptions for economy round-trip routes across several destinations and dates.

We divided the cost of the cash ticket by the cost of the award ticket to determine a “cent per mile” value for each flight, then averaged this value across several flights and dates. Read more about how we arrived at these figures.

You can use our American AAdvantage calculator to determine how much your miles are worth based on our valuations.

American Airlines vs. competitors

American Airlines came in second place among overall airlines in NerdWallet’s most recent analysis of the best airlines.

Its rewards program, AAdvantage, also came in second place in a second analysis of the best airline loyalty programs.

Here's a closer look at how American competed across subcategories:

- Third in rewards rate.

- Seventh in operations.

- First in elite status benefits.

- Fourth in terms of lowest fees.

How to earn AAdvantage miles

There are plenty of ways to earn AAdvantage miles, with the most obvious being flights on American or its partner airlines. Additional ways to earn miles include spending with American’s credit cards or booking hotel stays, car rentals, vacations and cruises or attending concerts or theater performances through American.

The airline also has a dining program and a shopping portal that allows you to earn additional miles on your purchases. You can even buy American miles, although we typically don’t recommend doing so.

Unlike Delta Air Lines and United Airlines, AAdvantage miles carry an expiration date if 24 months pass without earning or redeeming activity in your account. (This doesn’t apply to AAdvantage members under 21 or those who are a primary cardholder of an American Airlines credit card.)

» Learn more: The best airline credit cards

Earning AAdvantage miles when you fly

You’ll earn miles each time you fly on American or its partners and credit that flight to your AAdvantage account. However, the amount you earn may differ based on which airline markets the flight you’re on.

You can identify the marketing carrier based on the flight number on your itinerary. For example, AA123 is an American Airlines-marketed flight, while JL123 is a Japan Airlines-marketed flight.

Earning on American and select partners: The number of miles you earn is determined by how much you spent on the ticket, excluding taxes and government fees. This includes flights marketed by the following airlines:

- American Airlines.

- Aer Lingus.

- British Airways.

- Fiji Airways.

- Iberia.

- JetSMART.

- Oman Air.

If you have AAdvantage elite status, you will earn additional bonus miles for your trip.

| Status level | Miles earned | Status bonus |

|---|---|---|

| Member (basic) | 5 miles per $1 spent. | None. |

| Gold | 7 miles per $1 spent. | 40% bonus. |

| Platinum | 8 miles per $1 spent. | 60% bonus. |

| Platinum Pro | 9 miles per $1 spent. | 80% bonus. |

| Executive Platinum | 11 miles per $1 spent. | 120% bonus. |

Note, you earn miles only on airfare and airline fees. Government-imposed taxes and fees do not earn miles. There are some exceptions, such as purchasing a basic economy fare on American, which will earn 2 miles per $1 spent for tickets purchased on or before December 16, 2025. Any basic economy tickets purchased after that date will not earn miles or Loyalty Points. Status bonuses still apply to basic economy purchases.

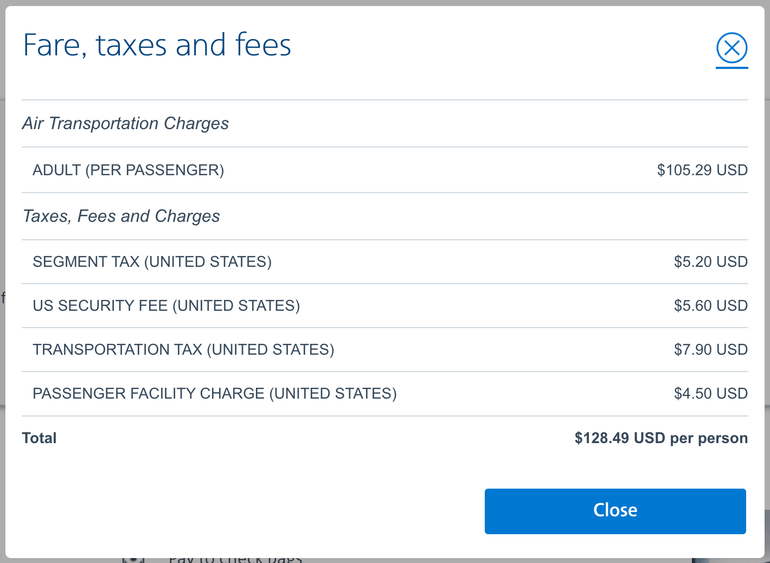

The easiest way to determine qualifying spend is by clicking on the “Price and tax information” link while booking your ticket. This will show you an itemized breakdown of the charges.

For example, a one-way flight to Miami costs $128.49, but you won’t earn miles on that amount. Instead, you’ll earn miles based on the $105.29 you spent on the fare, multiplied by the number determined by your AAdvantage status level.

Earning on other airlines: If your flight is marketed by a Oneworld partner, you’ll generally earn miles based on the distance flown and the fare class your flight is booked in. The cheapest economy tickets may not earn any miles, while others may earn only 25% to 50% of flown miles, while premium economy, business class and first class tickets can earn 50% to 100% base miles and a cabin bonus between 10% and 200%.

American also has partnerships with non-alliance airlines. You’ll need to check American’s website to see the earning rules for those. Sometimes, you can only earn miles if the flight is marketed by American and operated by the partner, while other partners like Etihad Airways allow you to earn on partner-marketed flights.

Additionally, not all routes or flights may qualify. If you buy a flight on a booking code not listed as eligible for awards, you will not earn any award miles for your flight. Also, some routes or affiliate airlines may not earn miles.

Visit the American website to better understand how many miles you could earn with American’s airline partners.

Claiming missing American Airlines miles: If you forget to attach your AAdvantage frequent flyer number to your booking on American or one of its partners, you won’t automatically get your miles credited to your account. However, there is a process to retroactively request missing mileage credit for American Airlines.

You’ll need to go to American’s dedicated page for requesting mileage credit. Fill out your AAdvantage number and your ticket number, which is a 13-digit number printed on your boarding pass or included in your booking confirmation email. Generally, it’s a good habit to keep your physical boarding pass (or at least take a picture of it) until your miles have been posted to your frequent flyer account.

You can submit your mileage claim as long as it has been at least three days from the completed flight. It can take up to 10 days to credit the miles for an American Airlines flight. Mileage credit for partner airline flights can take up to 30 days to appear.

If you run into any issues, you can also call AAdvantage for assistance. Sometimes, you may need to ask an agent to process your request, such as with partners.

Earning AAdvantage miles with a credit card

American Airlines offers credit cards through Citi and Barclays, though its partnership with Barclays will end in 2026.

NerdWallet's favorite credit card for the AAdvantage program is the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®. It gives you 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases.

You also get a great sign-up bonus to start: Earn 50,000 American Airlines AAdvantage® bonus miles after spending $2,500 in purchases within the first 3 months of account opening.

The annual fee is $99, waived for the first 12 months — but the checked bag benefit on this card can make up for it rather quickly. The first checked bag is free for you and up to four others traveling on your reservation. You also get preferred boarding, so you can get on the plane relatively early and find space for your carry-on.

Another option to consider is Citi's Strata-branded card offerings. Holders of the Citi Strata Elite℠ Card and the Citi Strata Premier® Card can transfer their Citi ThankYou points to AAdvantage miles at a 1:1 ratio. (Some Citi cards also allow transfers to American at a lower 1:0.7 ratio.) These cards typically offer better earning rates on everyday spending, so they can offer richer rewards. However, they won't come with certain perks that you might get with American Airlines credit cards, such as the ability to earn Loyalty Points toward elite status for your eligible spending.

Earning AAdvantage miles through partners

- Hotels: You can earn AAdvantage miles at most major hotel chains. In some cases, you earn 1 or 2 miles per dollar spent; in others, you earn a flat number of miles per stay. See partner hotels and earning rules.

- Dining: Register a credit card with AAdvantage Dining, and every time you use that card at a participating restaurant, club or bar, you'll earn 1 to 5 miles per dollar spent. There are thousands of participating locations.

- Auto rentals: Car rental agencies Avis and Budget offer an option to earn AAdvantage miles. See the rules here.

- Fuel: Via a partnership with Shell's Fuel Rewards program, AAdvantage members earn 3 miles for every gallon of gas bought at Shell stations, instead of the cash discount they would typically receive. Members also get 250 miles on their first fill-up after linking their AAdvantage account to Fuel Rewards.

- Shopping: When you shop online through the AAdvantage eShopping mall, you earn miles for every dollar you spend at more than 1,200 retailers. For Mastercard holders, you can also activate offers at select merchants through the SimplyMiles program to earn additional miles on your purchases.

- Vacations: When booking a flight and hotel through American Airlines Vacations, you could earn extra miles.

- Cruises: Earn 2 miles per $1 spent on 2026 sailings through AAdvantage Cruises.

Buying AAdvantage miles

In most cases, we recommend you stay away from buying miles, as it's an expensive way to accrue them.

Even with any discounts, purchasing miles should be a last resort (e.g., only do this to top up your account for an award redemption or to keep miles from expiring).

How to redeem AAdvantage miles

You can redeem American Airlines miles for award flights, upgrades, car rentals, hotel stays, vacations, Admirals Club airport lounge access, physical merchandise and much more. To get the most value from your American miles, NerdWallet recommends using them to book award flights.

AAdvantage miles are redeemable for flights through American Airlines and its partners in the Oneworld alliance. In most cases, you can redeem by booking through American’s website.

Award flight redemptions

American Airlines now has a fully dynamic award chart for its own flights, with pricing varied based on demand. Even so, American has published an "award chart" showing what you can expect to pay at the minimum by region and fare class. This is a helpful way to determine whether you’re getting the cheapest award prices, but keep in mind that you won’t always see these prices when you go to redeem your miles.

Because of dynamic pricing, there are some instances where you might find award prices to be even cheaper than what’s listed as the “starting at” price on this chart.

Other ways to find excellent value from your AAdvantage miles include booking flights on American’s partners, whether in economy or business class. American uses an award chart for those redemptions, although availability will be more scarce on partners than on American’s own flights.

Bad redemption options

Generally, redeeming your AAdvantage miles for anything other than flights will yield a low value. Keep in mind that NerdWallet values AAdvantage miles at 1.3 cents each, so you should aim to get at least that much in value from your points.

For example, in one search for a hotel in Miami, the value of using American miles for a hotel room was around 0.8 cent per mile, which is lower than our valuation. Even though AAdvantage credit cardholders and AAdvantage elite status members receive a discount up to 30% when they log in to their account, a better bet would be to use hotel points or rewards earned from a cash back credit card for hotel bookings.

American Airlines partners

American Airlines partners with airlines all around the world, opening opportunities to earn and redeem AAdvantage miles on non-American Airlines flights. Plus, if you hold American Airlines elite status, you can sometimes get similar elite status benefits on those partner airlines, too.

Oneworld alliance members

American Airlines is a founding member of the Oneworld alliance.

Oneworld member airlines

- Alaska Airlines.

- American Airlines.

- British Airways.

- Cathay Pacific.

- Fiji Airways.

- Finnair.

- Iberia.

- Japan Airlines.

- Malaysia Airlines.

- Oman Air.

- Qantas.

- Qatar Airways.

- Royal Air Maroc.

- Royal Jordanian.

- Sri Lankan Airlines.

Other partner airlines

On airline partners outside the Oneworld alliance, your ability to earn or redeem miles is more limited. You may be able to earn miles but not redeem them, for example, or you may be able to redeem only for certain flights. Sometimes, you can book an award with a partner only over the phone.

American Airlines partners

- Aer Lingus.

- Air Tahiti Nui.

- Cape Air.

- China Southern Airlines.

- Etihad Airways.

- GOL Airlines.

- Hawaiian Airlines.

- IndiGo.

- JetSMART.

- LEVEL.

- Porter Airlines.

AAdvantage program elite status

While it’s free to join the AAdvantage program, frequent flyers start to see real perks beyond earning and redeeming miles once they achieve elite status with American.

There are four levels of elite status in the AAdvantage program with published earning requirements:

- AAdvantage Gold.

- AAdvantage Platinum.

- AAdvantage Platinum Pro.

AAdvantage elite levels and benefits

| Gold | Platinum | Platinum Pro | Executive Platinum | |

|---|---|---|---|---|

| Mileage bonus | 40%. | 60%. | 80%. | 120%. |

| Boarding | Group 4. | Group 3. | Group 2. | Group 1. |

| Upgrade eligibility | Complimentary upgrades on certain American and Alaska Airlines flights. | Complimentary upgrades on certain American and Alaska Airlines flights. | Complimentary upgrades on certain American and Alaska Airlines flights. | Complimentary upgrades on certain American and Alaska Airlines flights. |

| When upgrades confirmed | 24 hours before departure. | 48 hours before departure. | 72 hours before departure. | 100 hours before departure. |

| Priority seating perks | Free Preferred seats at booking or Main Cabin Extra seats at check-in. | Free Main Cabin Extra and Preferred seats on select flights at booking. | Free Main Cabin Extra and Preferred seats on select flights at booking. | Free Main Cabin Extra and Preferred seats on select flights at booking. |

| Free checked bags per flight | 1. | 2. | 3. | 3. |

As an AAdvantage elite member, you’re eligible for getting upgrades on American Airlines as well as its partner Alaska Airlines. Eligible routes for complimentary upgrades include flights within North America, such as domestic, Caribbean and Central American flights. You can get upgraded on paid or award tickets, although Saver fares on Alaska are ineligible for complimentary upgrades.

Your position on the upgrade list is generally determined by your elite status level — the higher your status, the higher up you are on the list. For Alaska flights, you will generally be prioritized after Alaska’s elites with the equivalent status tier in the Atmos Rewards program. AAdvantage Executive Platinum members are prioritized after Atmos Platinum members.

Other Oneworld partners may also offer some benefits to American elite status members.

How to earn elite status in AAdvantage

American AAdvantage members earn status by accumulating Loyalty Points. You can earn them by flying on American or its partners, using an AAdvantage credit card or spending with one of American’s non-flight partners.

Unlike other airline loyalty programs, the AAdvantage qualification period starts March 1 of each year and goes through the end of February the following year. The elite status that you earn is good through the end of March of the next full year.

For example, let’s say you qualify for AAdvantage Platinum status in December 2025. Your status won’t expire until March 31, 2027.

Each eligible mile earned equals 1 Loyalty Point. There are three ways to earn Loyalty Points:

- Traveling on American Airlines, Oneworld or any other partner airline.

- Making purchases on American Airlines AAdvantage credit cards.

- Shopping, dining and spending money with American’s partners, including AAdvantage eShopping, AAdvantage Dining and SimplyMiles.

American typically refers to eligible miles as base miles. Meanwhile, bonus miles don’t earn additional Loyalty Points. For example, if you earn a sign-up bonus on an AAdvantage credit card, you’ll earn bonus miles, not base miles. Those can be redeemed for flights, but they will not count toward elite status.

Another example is purchasing American flights using your AAdvantage credit card. You may earn 2 AAdvantage miles per $1 spent, but one of those is a base mile, while the other is a bonus mile. You’ll still earn 2 AAdvantage miles but only 1 Loyalty Point.

How many Loyalty Points do you need to earn status with American Airlines?

| Elite status level | Loyalty Points |

|---|---|

| Gold | 40,000 points. |

| Platinum | 75,000 points. |

| Platinum Pro | 125,000 points. |

| Executive Platinum | 200,000 points. |

Since there are so many more ways to earn status (without even stepping foot on a plane), the number of points needed to reach the top status levels is high.

You may also be able to earn AAdvantage elite status through a status match, which is where American will grant you elite status if you show proof of your elite status with a different airline or hotel.

Hyatt and American offer reciprocal status to their elite members, if they choose it as one of their milestone perks.

» Learn more: Guide to American Airlines elite status

Loyalty Point Rewards

Loyalty Points aren’t just for earning elite status. You can also get perks, also known as Loyalty Point Rewards, for meeting certain thresholds.

You can earn your first perk at 15,000 Loyalty Points, even before you reach the AAdvantage Gold qualification threshold. You can earn additional rewards as you work your way to Executive Platinum status and beyond, with the final reward offered when you accumulate 5 million Loyalty Points.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles