Guide to American Airlines Travel Insurance

If you book using a travel credit card with insurance coverage, you can probably skip American's travel insurance.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Travel insurance can be one of the most confusing parts of booking a trip. Since many credit cards already include travel insurance, the question of whether to buy airline insurance can make sense.

Why would you pay twice for the same benefits? But, that’s the thing: Not every type of credit card covers the same travel insurance perks.

You’ll want to check if the card you use to book a flight covers a cancellation, lost baggage or an abrupt change to your travel plans — perhaps due to a medical emergency. Being prepared can save you a lot of money in the long run.

This is especially true if you cannot take a trip, which would mean forfeiting the money you spent on nonrefundable flights and hotels.

If you want maximum protection, consider your credit card insurance with an airline’s policy like from American Airlines travel insurance.

Understanding the American Airlines insurance policies can protect you on your next trip with the carrier.

American Airlines trip insurance plans

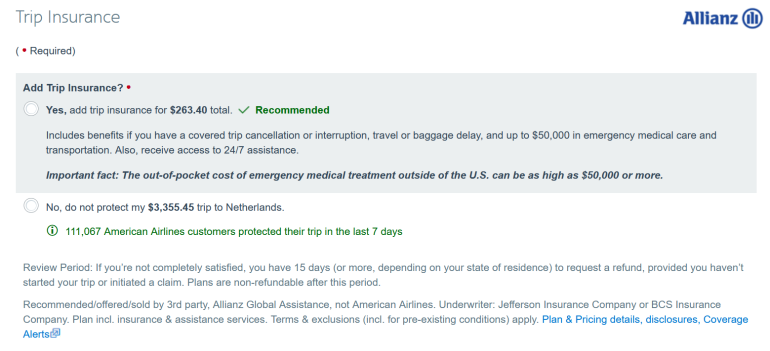

American has plans for international and domestic trips you book with the carrier, and the services are administered by Allianz Global Assistance. You’ll see the offer when completing a flight reservation on the website.

When you qualify, the policy can refund part of an itinerary or the entire purchase based on any travel costs or emergency medical expenses in case of a disruption or delay. The promotional offer you receive when booking a ticket is based on the cost of your flight. It is valid for that trip only, unlike annual or multi-trip plans that you would buy from Allianz directly.

Often, you won’t see the trip insurance policy on your American reservation, as it's sold by a third party. But keep a record of the policy information.

» Learn more: What to know before buying travel insurance

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

What does American Airlines travel insurance cover?

When you buy American Airlines travel insurance, you will be eligible for coverage for various travel issues like delayed or lost bags, medical expenses during the trip or if you have to cancel the trip altogether.

Some features of travel insurance can vary depending on where you live, so be sure to read the fine print.

This is what the flight insurance from American Airlines covers:

- Trip cancellation and trip interruption costs. If you paid for any nonrefundable expenses and have to cancel or change your trip due to reasons like illness or injury, you’ll receive a refund for those costs. This can be especially valuable for bucket-list trips like cruise or safari vacations where you spend a lot of money. Each U.S. state sets a limit for the refund amount, so be sure to review those details.

- Emergency medical transportation. If you need to be airlifted or driven a long distance to the nearest appropriate hospital or urgent care center, this would be covered by insurance. This can be pretty expensive in some remote locations, and insurance can cover the cost of a helicopter airlift if needed. The American travel insurance benefit for emergency medical transportation is as much as $50,000.

- Emergency medical and dental protection. While at the hospital or urgent care facility, you may need immediate care. American Airlines trip insurance would cover up to $10,000 in medical and dental expenses for an eligible occurrence.

- Travel delay. This is a valuable benefit, one covered by many credit cards. If you encounter a trip delay of at least six consecutive hours, this insurance will provide meal and accommodation reimbursements. The maximum coverage limits vary by U.S. state. Airlines have their own policies in these situations, and if traveling from the European Union or on an E.U.-based carrier to Europe, you may also be covered for additional compensation.

- Lost or damaged baggage. If your baggage is lost, damaged or stolen, American Airlines travel insurance reimburses you up to $500 for your personal items.

- Baggage delay. This protection covers the contents of your bag if your baggage was delayed for more than 24 hours. You’ll want to keep eligible receipts of your purchase to submit a reimbursement claim, typically up to $100 per person.

- 24-hour assistance. This policy would provide you with direct access to someone who can assist you with any travel-related emergencies.

- Rental car collision and damage. You would be eligible for primary coverage without a deductible.

» Learn more: Best credit cards for travel insurance benefits

What isn't covered by American Airlines travel insurance?

Remember that airlines like American receive a percentage of the sale of travel insurance, so they are eager to promote it. But not all circumstances are covered. This means it is important to review the exclusions.

These are some of the situations that wouldn't be eligible for reimbursement or assistance.

- Losses due to government restrictions, travel advisories or warnings (For example: If the U.S. government issues a warning not to travel somewhere).

- Losses due to known, foreseeable and expected events (like a hurricane where advance warnings are available).

- Epidemics, natural disasters, pollution leading to flight disruption and war.

- Preexisting medical conditions.

- Pregnancy, fertility treatment and childbirth.

- Health issues related to alcohol or drug use.

- Injury during professional or amateur sports training.

American Airlines international travel insurance cost

The cost will vary depending on where you are going, often based on the total nonrefundable trip cost and the state where you reside.

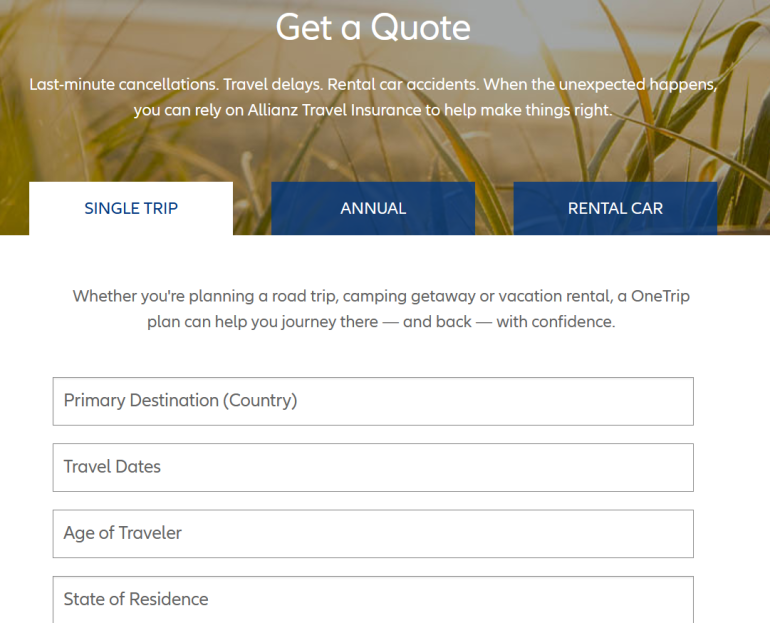

To get a more detailed idea of an American Airlines travel insurance plan, an online form calculates your trip details to give an approximate cost. After purchasing it, you have 15 days to change your mind and request a refund as long as your trip hasn't started or you haven't filed a claim.

» Learn more: The best travel insurance companies

Frequently Asked Questions

What does American Airlines trip protection mean?

This travel protection plan offers insurance for just one trip itinerary unless you buy an annual plan. A single trip insurance plan otherwise does not cover additional trips or mishaps that happen before or after your flight journey. It comes with protections for lost bags or emergency medical assistance, which can be helpful — especially if you don’t use a credit card to pay for the trip that has its own insurance protections. Other benefits can include trip interruption or cancellation, emergency dental care, rental car insurance and baggage delay.

You can pay for this when you purchase a flight on American’s website or any time after you buy a ticket on the Allianz website.

What insurance does American Airlines use?

American travel insurance plans come underwritten by Jefferson Insurance Company or BCS Insurance Company. They use AGA Service Company as the licensed producer. These plans are recommended and sold by Allianz Global Assistance, not American Airlines.

Is American Airline trip protection refundable?

Yes, if canceled within 15 days of purchase and your trip has not begun. If you have filed a claim, then you would not be able to cancel.

Is American Airlines travel insurance worth it?

This will come down to your own personal risk tolerance, but with so many exclusions on the list, it may not be. That’s because you are already protected by your credit card in many instances.

If you use a card like the American Express Platinum Card® or the Chase Sapphire Reserve® to pay for your trip, you may end up paying again on certain benefits when buying flight insurance from American.

Be sure to compare the benefits, as the amount of lost baggage or emergency medical coverage can be different for each credit card or airline.

» Learn more: The best travel credit cards right now

Buying a nonrefundable flight ticket may be one of the top reasons to consider this flight insurance, but make sure that the exclusions don’t apply to you. Also, you will want to consider your finances if you are required to cover the cost of lost bags or flights.

If not, the small added cost of insurance could be decent protection in the long run if something were to go wrong during the journey.

(Top photo courtesy of American Airlines)

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles