Avis vs. Budget: Which Is Best?

Budget is more affordable but has lackluster loyalty. Avis is pricier but has better loyalty and upgrade potential.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Unlike airline and hotel companies, car rental brands sometimes blur together, leaving travelers wondering what their differences are. While they may seem similar, there are notable differences between brands like Avis and Budget.

They have different rates, fleets of cars, locations, loyalty programs and services. Plus, if you have car rental elite status, the perks can vary, too.

But, you may not realize that Avis and Budget are under the same parent company: Avis Budget Group. Avis tends to offer a higher standard of cars and service with Budget taking up the economy sector. The Avis Budget Group is the second largest of the major car rental companies, coming in behind Enterprise and ahead of Hertz Global Holdings.

Let’s examine Budget versus Avis and how knowing the difference between them can benefit you.

By signing up, you will receive newsletters and promotional content and agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Fleet and availability

Winner: Avis

Together, both companies have more than 435,000 cars in their fleet. No matter where you rent a car, they have locations at airports, in city centers and available on-call. Avis has more than 5,500 locations in 165 countries. It’s also known for having a more comprehensive selection of cars, especially in the luxury category.

Budget has a smaller fleet than Avis and about half as many locations — about 2,700 in more than 120 countries. Both brands have a wide array of cars from electric vehicles and convertibles to SUVs and standard sedans.

» Learn more: Rental car insurance: Do you need it?

Rates

Winner: Budget

Both Avis and Budget compete for the same business, but Budget often has cheaper rates, as its name suggests. Let’s compare the cost of a one-day rental from an Avis versus Budget car rental in Tampa and San Francisco to see which brand is cheaper.

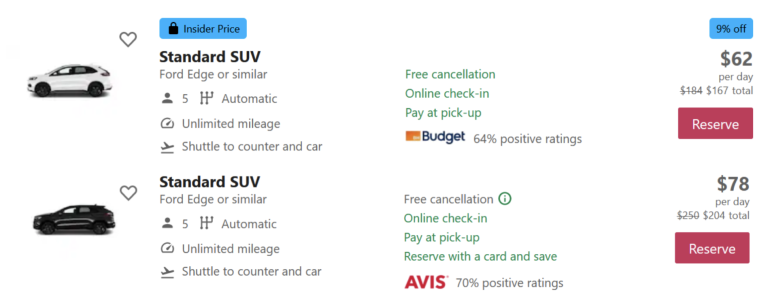

First we looked at rentals from Tampa International Airport. A standard SUV from Budget costs $167, while Avis charges $204 for the same vehicle class. Both have similar restrictions like free cancellation and the ability to pay upon check-in. They also have an unlimited mileage allowance.

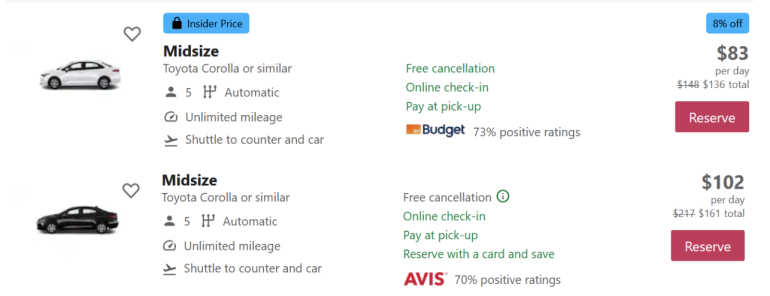

The below rates are from San Francisco International Airport for similar rentals on the same date. A midsize car costs $136 from Budget and $161 through Avis. That’s more than 15% cheaper when booking a rental car from Budget versus Avis.

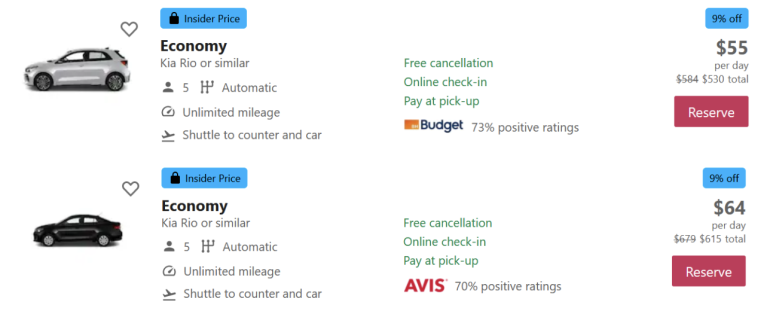

Now, let’s look at a longer seven-day rental in October 2024 at San Francisco International Airport. An economy car is notably cheaper when booking with Budget than when making a reservation with Avis — $530 for Budget versus Avis’ rate of $615.

When comparing the prices of rentals at Tampa and San Francisco airports, Budget proved to be cheaper at both locations. Despite the price difference, Budget's car rental offers all the same amenities as Avis' — from unlimited mileage to the ability to take a free shuttle from the airport counter to the car.

» Learn more: Where to find rental car discounts

Service

Winner: Tie

When it comes to Avis and Budget reviews, service can vary by location, but a professional survey shows where the brands stand: right in the middle of the pack.

According to rankings from a recent J.D. Power 2023 North America Rental Car Satisfaction Study, both brands ranked just below the study average, with Avis edging Budget by a hair. The study results come from feedback from over 8,000 travelers who rented cars at an airport location between August 2022 and August 2023.

But, what about when you’re renting a car outside of an airport? Some Avis locations will offer to drive the rental car to you or pick you up within a five-mile radius of the pickup counter. Be sure to provide 24-hour notice if you need this service. Budget offers a similar service at select locations.

» Learn more: The best apps for renting a car

Loyalty program

Winner: Avis

When comparing Avis and Budget rewards, consumers tend to like the Avis Preferred loyalty program best.

The entry-level perks of Avis elite status include bypassing the rental counter and going straight to the car. When you reach Avis Preferred Plus status, you qualify for a car upgrade.

Avis President’s Club offers a double upgrade, and the invitation-only Chairman’s Club membership adds its own perks, like complimentary car delivery within 25 miles of any Avis location. Typically, to achieve President’s Club status, members need to make 20 car rentals or spend $6,000 with Avis during a calendar year.

Budget has its own program, called FastBreak, but it doesn’t have elite status tiers or provide extra perks to frequent renters. Another downside is that it doesn’t award points that can later be redeemed for free rentals.

It’s simply a membership that expedites the path to the driver’s seat. This is why it falls behind Avis, which has a more robust program with loyalty tiers and benefits for the most frequent renters.

Remember there are also many credit cards that come with complimentary car rental elite status perks just by linking your accounts. While Budget doesn’t have elite status tiers, these cards can help catapult you to higher Avis elite status or provide extra perks.

Cards with Avis benefits

Annual fee

$895.

$695.

$695.

Welcome offer

You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply.

Earn 90,000 bonus miles after you spend $5,000 on purchases in the first 3 months from account opening.

Earn 100,000 bonus miles + 2,000 Premier qualifying points after you spend $5,000 on purchases in the first 3 months your account is open.

Still not sure?

It’s not just credit cards that deliver the goods. If you have United Premier Platinum status or higher, you’re eligible for President’s Club status. If you have United Premier Silver or Gold status, you earn Preferred Plus status.

» Learn more: The best travel credit cards right now

Avis vs. Budget recapped

Budget is typically cheaper than Avis, but it has a smaller fleet and no meaningful loyalty program. Avis, meanwhile, has a more rewarding loyalty program that can deliver perks if you rent frequently or have a credit card that provides access to elite status.

Either brand, however, is respectable and worth considering, especially since they’re owned by the same parent company. Your experience will vary by location, but if you’re hoping for car upgrades or a free rental, Avis is the way to go.

The information related to United Club℠ Business Card credit card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

To view rates and fees of the American Express Platinum Card®, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles